Global Plastic Chemical Recycling Market Size is valued at 10.1 Bn in 2023 and is predicted to reach 66.0 Bn by the year 2031 at an 27.4% CAGR during the forecast period for 2024 to 2031.

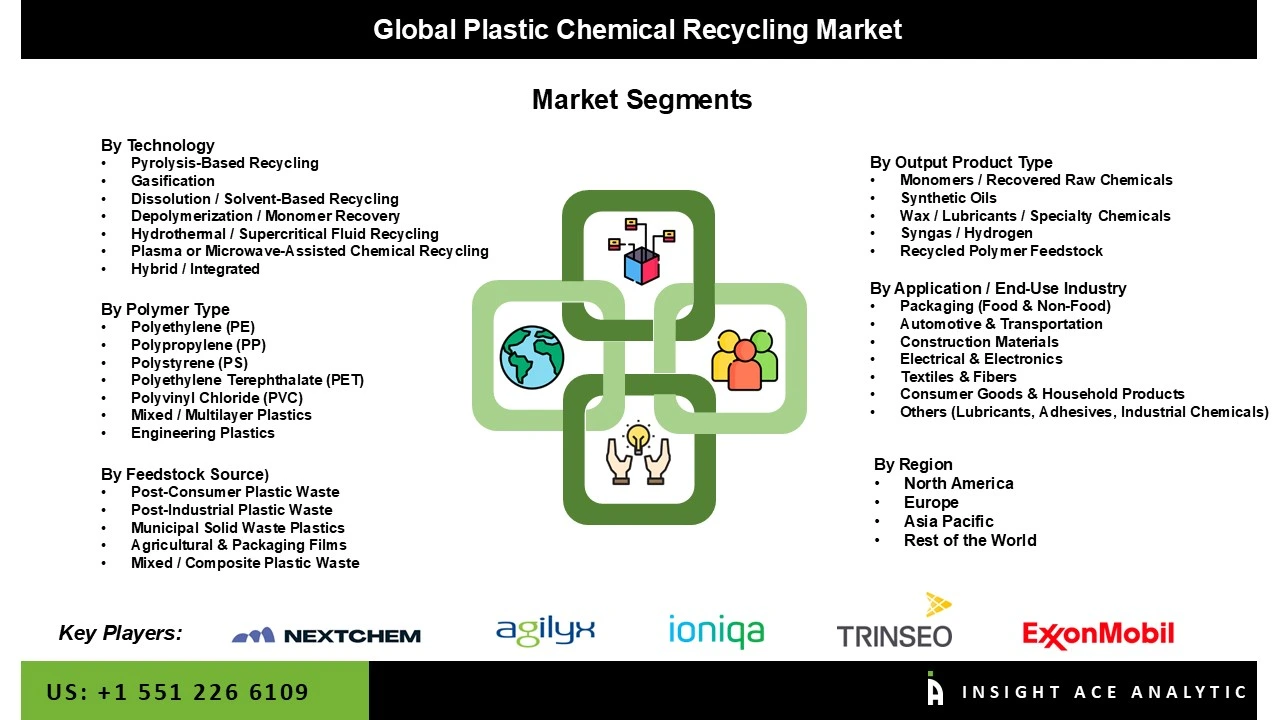

Plastic Chemical Recycling Market Size, Share & Trends Analysis Distribution by Type (Pyrolysis, Gasification, Dissolution, Depolymerization) and Segment Forecasts, 2024 to 2031

Plastic chemical recycling refers to a range of technologies that decompose plastic waste into its fundamental chemical components through methods such as pyrolysis, gasification, and depolymerization. These processes transform hard-to-recycle plastics into usable raw materials by altering their molecular structure, allowing for a broader array of plastic types to be recycled compared to conventional methods.

The applications of chemically recycled plastics are extensive, spanning various industries. Recovered materials are used in high-quality food and beverage packaging, ensuring safety and sustainability; in the automotive industry for manufacturing parts that contribute to lighter and more sustainable vehicle designs; in the fashion industry for creating clothing and accessories that promote circularity; and in the construction industry for building materials that enhance sustainability.

One of the primary driving factors behind the growth of the plastic chemical recycling market is the rising public concern over the environmental impacts associated with plastic waste. As awareness of plastic pollution increases, consumers and governments are demanding more sustainable waste management solutions. This shift is prompting companies to invest in advanced recycling technologies to meet sustainability goals and comply with stricter environmental regulations. For instance, Agilyx ASA, a technology company enabling the recycling of challenging post-use plastics into high-value, virgin-equivalent products, exemplifies this trend. The company recently demonstrated its depolymerization technology at Toyo Styrene's 10-ton-per-day chemical recycling facility in Japan, showcasing the practical implementation of advanced recycling solutions in response to growing environmental concerns and regulatory pressures.

The plastic chemical recycling market is segmented by type. By type the market is segmented into pyrolysis, gasification, dissolution, depolymerization.

The depolymerization segment is driving the growth of the plastic chemical recycling market due to its ability to process a wider range of plastic waste, including mixed and contaminated plastics that conventional methods struggle with. By breaking down plastics into monomers or oligomers, depolymerization enables the recovery of high-quality feedstocks that can be repolymerized into new, virgin-equivalent plastics.

This meets the rising demand for recycled plastics across industries such as packaging, automotive, and consumer goods. Depolymerization also supports the circular economy by converting plastic waste back into monomers, reducing reliance on virgin resources, and aligning with sustainability goals. Technological advancements are further enhancing the efficiency and cost-effectiveness of depolymerization, making it a key driver of the plastic chemical recycling market.

Growing environmental concerns, proactive government initiatives, a diverse economic landscape, and technological innovations are driving the growth of plastic chemical recycling in Asia-Pacific. As the region faces significant plastic pollution, both consumers and governments are pushing for sustainable waste management. Many countries have implemented regulations like Extended Producer Responsibility (EPR) to promote recycling, fostering investment and innovation in recycling technologies. The diverse economic landscape allows for tailored approaches, with advanced economies like Japan having comprehensive recycling laws and developing economies like India rapidly building infrastructure. Significant investment in advanced recycling technologies, particularly in China and India, is enhancing recycling rates and efficiency, making chemical recycling a more viable option for managing plastic waste.

| Report Attribute | Specifications |

| Market Size Value In 2022 | USD 10.1 Bn |

| Revenue Forecast In 2031 | USD 66.0 Bn |

| Growth Rate CAGR | CAGR of 27.4 % from 2024 to 2031 |

| Quantitative Units | Representation of revenue in US$ Bn and CAGR from 2024 to 2031 |

| Historic Year | 2019 to 2023 |

| Forecast Year | 2024-2031 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Type and By Region |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; The UK; France; Italy; Spain; China; Japan; India; South Korea; Southeast Asia; South Korea; Southeast Asia |

| Competitive Landscape | Recuro, Agilyx, Plastic Energy, Quantafuel, Nexus Circular, Alterra Energy, New Hope Energy, Brightmark, Freepoint Eco-Systems, Encina, BlueAlp, OMV, Recycling Technologies, Greenback Recycling Technologies, ReOil Hungaria, Resynergi, Klean Industries, BioBTX, Plastic2Oil / JBI, ReNewlogy, Integrated Green Energy (IGE), Quantafuel Skive, Argelec, Orlen Unipetrol, Qenersys / QuantaFuel |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Geographic competitive landscape. |

| Pricing and Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

Plastic Chemical Recycling Market -By Technology :

Plastic Chemical Recycling Market -By Polymer Type:

Plastic Chemical Recycling Market -By Feedstock Source:

Plastic Chemical Recycling Market -By Output Product Type:

Plastic Chemical Recycling Market -By Application / End-Use Industry:

Plastic Chemical Recycling Market by Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.