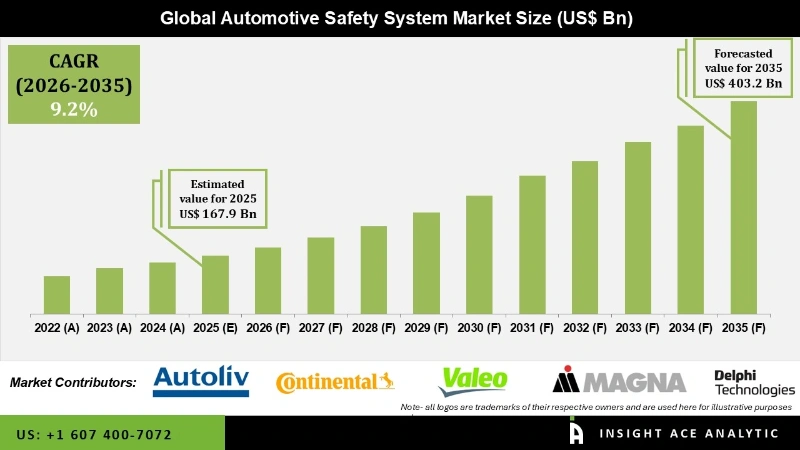

Global Automotive Safety System Market Size is valued at USD 167.9 Bn in 2025 and is predicted to reach USD 403.2 Bn by the year 2035 at an 9.2% CAGR during the forecast period for 2026 to 2035.

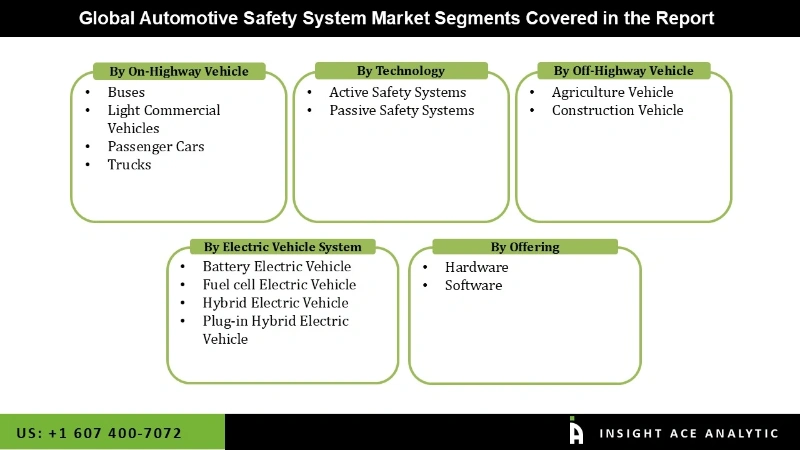

Automotive Safety System Market Size, Share & Trends Analysis Report By Technology (Active (ABS, ESC, BSD, LDWS, TPMS) and Passive (Airbag, Pedestrian and Whiplash Protection)), On-highway (PC, LCV, Buses, Trucks), Off-highway (Agriculture & Construction Vehicles), Electric Vehicles (Battery EV, Fuel Cell EV, Hybrid EV, and Plug-In Hybrid EV), Offering (Hardware, Software), By Region, And Segment Forecasts, 2026 to 2035.

Key Industry Insights & Findings from the Report:

The equipment installed into a vehicle to lessen the likelihood and severity of traffic collisions is referred to as an automotive safety system. The vehicle safety system is a critical component in the automobile manufacturing industry. Safety systems are employed in the automotive industry to ensure the safeness and security of automobiles and passengers.

Seatbelts, airbags, antilock braking systems, electronic traction, stability control systems, lane departure warning, blind-spot recognition, and driver monitoring are all utilized to ensure the safety of passengers. Vehicle demand is being driven by rising population, per capita income, and favorable foreign direct investment. With increased vehicle demand, demand for higher road safety regulations rises, boosting the automotive safety system market expansion soon.

However, the global market for car safety systems has been poorly disrupted by the COVID-19 pandemic. The COVID-19 pandemic slowed economic growth in nearly all major countries, altering consumer purchasing patterns.

National and international travel have been hampered due to the lockdown applied in many nations, which has dramatically disrupted the supply chain of numerous sectors worldwide, consequently increasing the supply-demand gap. As a result, a lack of raw material supply is likely to slow the manufacturing rate of automobile safety systems, severely impacting the automotive safety system market growth.

The automotive safety system market is segmented on the basis of technology, on-highway vehicle, off-highway vehicle, electric vehicle, and offerings. The technology segment includes active safety systems (anti-lock braking systems, automatic emergency braking, blind spot detection, electronic brake force distribution, electronic stability control, forward-collision warning, lane departure warning systems, traction control system, and tire pressure monitoring systems), passive safety systems (occupant protection and pedestrian protection systems, whiplash protection systems).

The on-highway vehicle type include buses, light commercial vehicles, passenger cars, and trucks. For off-highway vehicles, the market is segmented into agriculture vehicles and construction vehicles. The electric vehicle segment includes battery electric vehicles, fuel cell electric vehicles, hybrid electric vehicles, and plug-in hybrid electric vehicles. By offering, the market has been segmented into hardware and software.

The passenger cars category is expected to hold a major share of the global automotive safety system market in 2024. Growing passenger car sales and production in developing nations are likely to boost segment expansion in this market. The increased use of safety features in passenger automobiles as a result of severe government safety rules is also expected to fuel market expansion in this sector.

The hardware segment is projected to grow at a rapid rate in the global automotive safety system market. The hardware safety system is adopted primarily due to its simple complexity and inexpensive installation cost. Despite being complicated, highly integrated, and expensive, the software system is significantly more precise and trustworthy in terms of safety features.

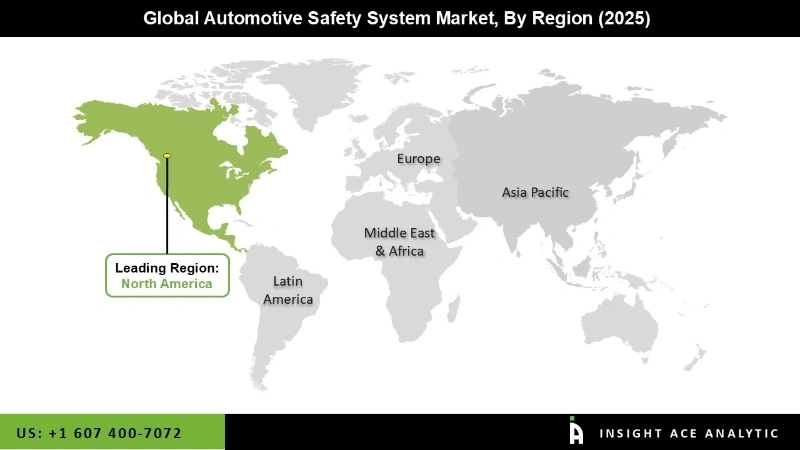

The North American automotive safety system market is expected to register the highest market share in terms of revenue in the near future. The region's rising population, combined with one of the best road infrastructures in the world, encourages automakers to create high-powered automobiles, which will drive the expansion of the automotive safety system market throughout the projection period. Because of the increasing number of automobiles manufactured and sold in Asia Pacific, the automotive safety system market is expected to increase significantly. Furthermore, the increased disposable income in developing countries is expected to drive the expansion of the automobile safety system market in the area in the coming years.

| Report Attribute | Specifications |

| Market size value in 2025 | USD 167.9 Bn |

| Revenue forecast in 2035 | USD 403.2 Bn |

| Growth rate CAGR | CAGR of 9.2% from 2026 to 2035 |

| Quantitative units | Representation of revenue in US$ Bn, and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2025 |

| Forecast Year | 2026-2035 |

| Report coverage | The forecast of revenue, the position of the company, the competitive market statistics, growth prospects, and trends |

| Segments covered | Technology, On-Highway Vehicle, Off-Highway Vehicle, Electric Vehicle, And Offerings |

| Regional scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; The UK; France; Italy; Spain; China; Japan; India; South Korea; Southeast Asia; South Korea; Southeast Asia |

| Competitive Landscape | Robert Bosch, Denso, Delphi Automotive, Infineon, ZF Friedrichshafen, Continental, Valeo, Magna, Autoliv, Mobileye, Hyundai Mobis, Takata, Knorr-Bremse. |

| Customization scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing and available payment methods | Explore pricing alternatives that are customized to your particular study requirements. |

Automotive Safety System Market By Technology-

Automotive Safety System Market By On-Highway Vehicle-

Automotive Safety System Market By Off-Highway Vehicle-

Automotive Safety System Market By Electric Vehicle System-

Automotive Safety System Market By Offering

Automotive Safety System Market By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.