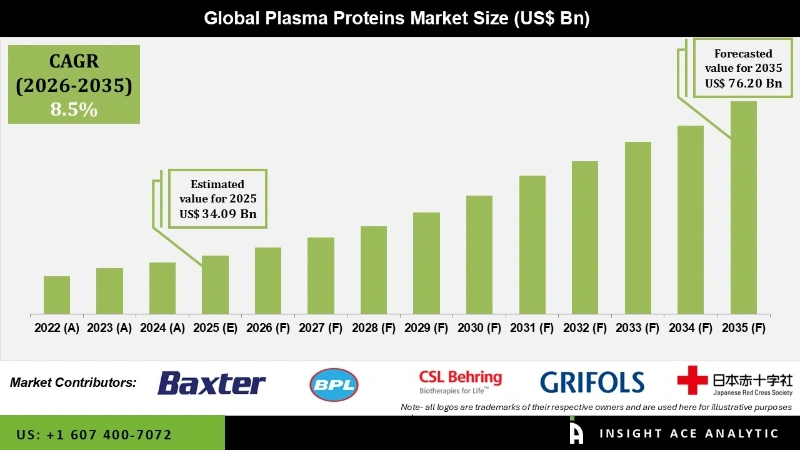

Plasma Proteins Market Size is valued at 34.09 Billion in 2025 and is predicted to reach 76.20 Billion by the year 2035 at an 8.5% CAGR during the forecast period for 2026 to 2035.

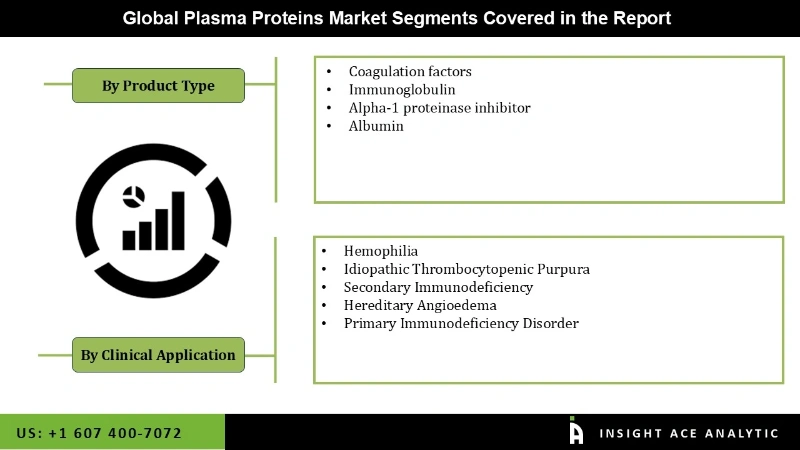

Plasma Proteins Market Size, Share & Trends Analysis Report By Product Type (Coagulation Factors, Immunoglobulin, Alpha-1 Proteinase Inhibitor, and Albumin), By Clinical Application, Region And Segment Forecasts, 2026 to 2035.

It is expected to shwo a CAGR of 8.4% during a forecast period of 2022-2030. Plasma is defined as a part of blood, which is a clear, straw-colored fluid residue after red platelets, white blood cells, blood cells, and other cellular components got eliminated. Human blood consists of various proteins. A mixture of lipoproteins, simple proteins, glycoproteins, and other conjugated proteins are called plasma proteins. By replacing the deficient or missing proteins in plasma, Plasma protein therapies are used to treat the well-defined medical condition. Plasma protein therapeutics include biological medicines, which are either infused or injected to treat life-threatening, chronic and genetic diseases. This plasma protein plays a vital role in blood clotting and also provides immunity against diseases.

Increasing usage of the plasma protein derived medicines worldwide; the introduction of new plasma-derived therapies is the major driving factors of the global plasma protein market. The market is also driven by a host of other factors, including the rising prevalence of life-threatening diseases of immune or neurological systems and infectious diseases like Rabies, Tetanus, Hepatitis A&B, and varicella. On the contrary, there are a few restraints for the market, which include stringent government policies, issues pertaining to reimbursement, complexity in manufacturing biologics, which may limit the growth of the market. With the technological advancements, the process involving fractionating the protein from plasma has become high-cost saving and efficient, which is also supposed to boost the global plasma protein therapeutics market. With increasing awareness among people about blood donations and government initiatives, the plasma-derived medicine market is expected to grow in the coming years at a significant rate.

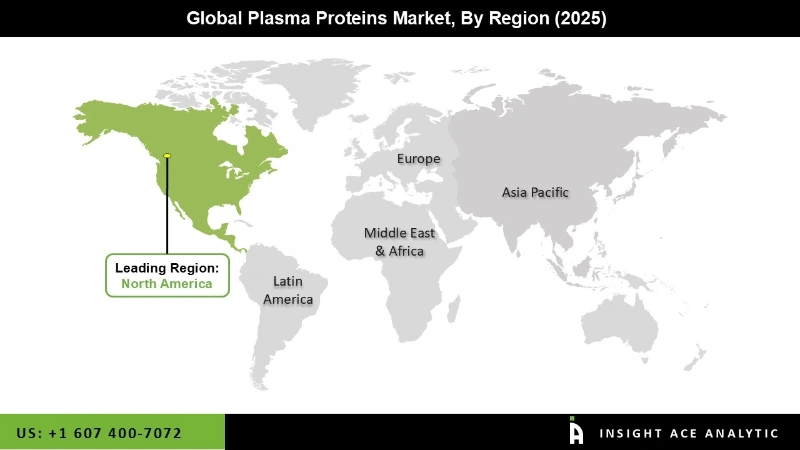

The global plasma protein market is segmented on the basis of product type, which is further divided into coagulation factors, immunoglobulin, alpha-1 proteinase inhibitor, and albumin. Based on application, plasma protein therapeutics is segmented into idiopathic thrombocytopenic purpura, secondary immunodeficiency, hemophilia, hereditary angioedema, primary immunodeficiency disorder, and other indications. Based on geographical region, the market assessment is divided into the regions of North America, Asia-Pacific, Europe, Latin America, and Middle-East & Africa.

North America stood as a developed market for plasma protein therapeutic and is going to see quick growth in the future. Europe was one of the leading regional markets, followed by North America, and is expected to show significant growth in the years to come. In Europe, plasma protein therapeutics products are considered non-prescription products that allow their widespread use. Growth in the Asia Pacific plasma protein therapeutics market was expected to be driven by the increasing awareness about blood donations. In the Middle East & Africa region, the market is likely to register a modest growth rate due to a lack of awareness. Latin America is known to be an important regional market and is expected to experience sensible growth over the forecast period. Thus, all the above-stated improvements are going to push the market growth in the future.

C1 esterase inhibitor (Ruconest), Human glucocerebrosidase (Elelyso), VEGFR Fc-fusion (Eylea), CTLA-4 Fc-fusion (Nulojix), Anti-IL-6 receptor (Actemra), Anti-CD30 (Adcetris) are some of the U.S FDA approved therapeutic proteins that are produced by using different protein engineering technologies.

| Report Attribute | Specifications |

| Market Size Value In 2025 | USD 34.09 Billion |

| Revenue Forecast In 2035 | USD 76.20 Billion |

| Growth Rate CAGR | CAGR of 8.5% from 2026 to 2035 |

| Quantitative Units | Representation of revenue in US$ Million and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2024 |

| Forecast Year | 2026-2035 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Product Type, By Clinical Application |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; Brazil; Mexico; The UK; France; Italy; Spain; China; Japan; India; South Korea; South East Asia |

| Competitive Landscape | Octapharma, LFB Group, Grifols, Baxter, CSL limited, Telecris, Kedrion, and Chengdu Inst; Japan Red Cross, BPL Group, Shanghai Blood Institute, Sanquin, and Others |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing and Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

Global Plasma Proteins Market based on Product Type

Global Plasma Proteins Market based on Clinical Application

Global Plasma Proteins Market Based on Geographical Region

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.