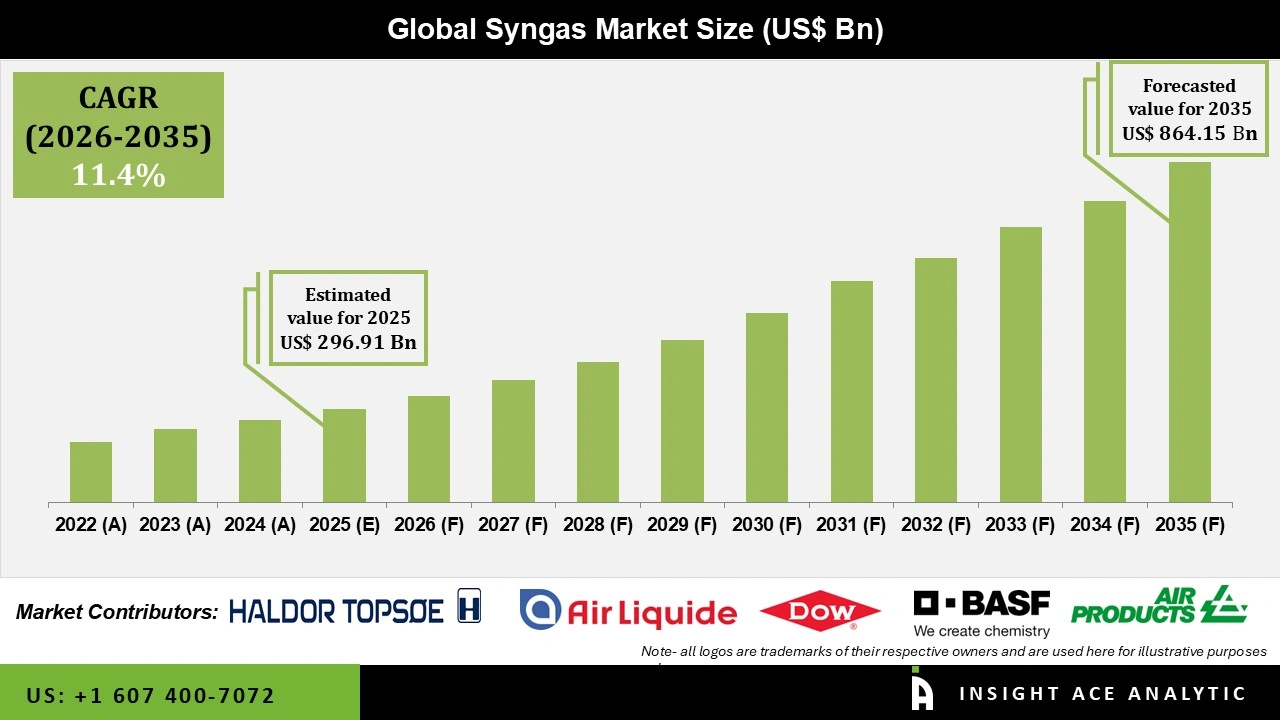

Global Syngas Market Size is recorded at 296.91 (mm nm³/h) in 2025 and is predicted to reach 864.15 (mm nm³/h) by the year 2035 at a 11.40% CAGR during the forecast period for 2026 to 2035.

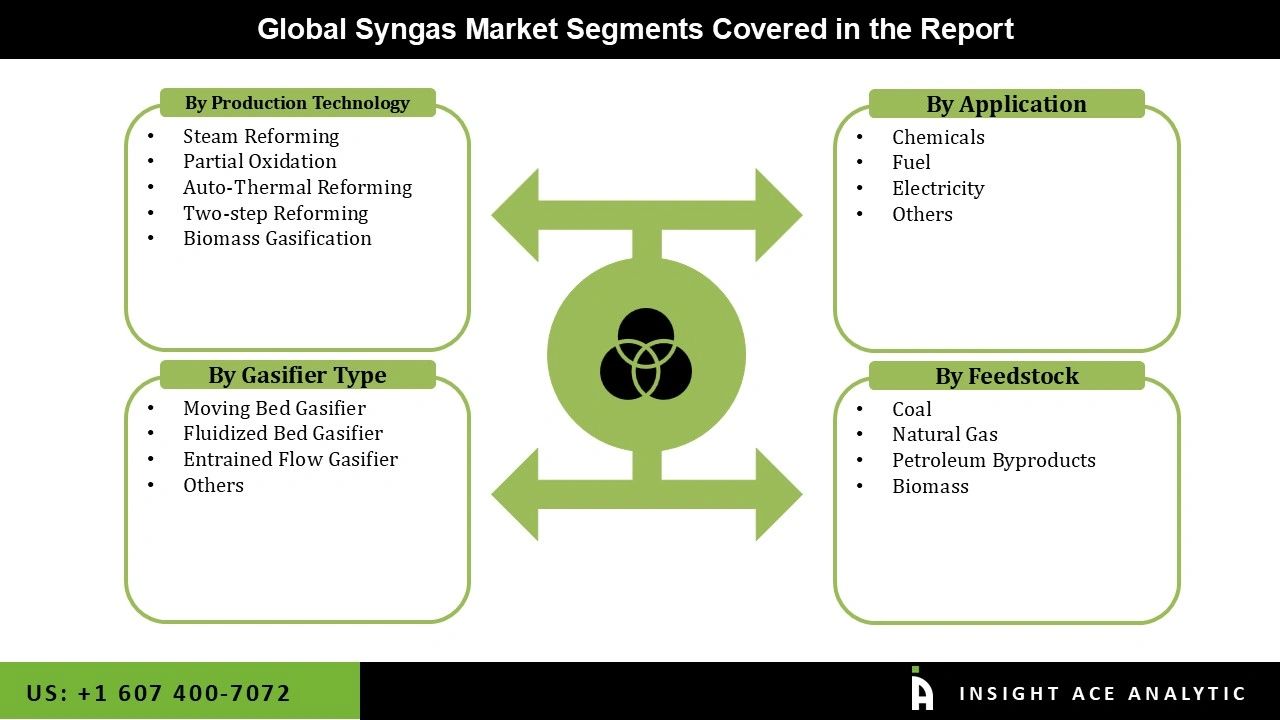

Syngas Market Size, Share & Trends Analysis Report By Production Technology (Steam Reforming, Partial Oxidation, Auto-Thermal Reforming, Two-Step Reforming And Biomass Gasification), Gasifier Type (Moving Bed Gasifier, Fluidized Bed Gasifier, Entrained Flow Gasifier), Feedstock And Application, By Region, And Segment Forecasts, 2026 to 2035.

Key Industry Insights & Findings from the Report:

Hydrogen, carbon monoxide, and carbon dioxide are all components of syngas. Gasification is typically how the Syngas is created. Its primary use is for electricity production, and it has some heating benefits. It serves as a versatile intermediary in manufacturing methanol, methanol, and SNG. In between generating petroleum to use as a lubricator and to make other chemicals, there is Syngas. The constantly rising demand for syngas from the global chemical industry is one of the main factors boosting the market for syngas.

Additionally, the advancement of the underground mine gasification (UGC) method is enhancing the market outlook. It makes it easier to finish the in-situ gasification process, which turns coal into Syngas. Since less feedstock needs to be transported to combustion plants, considerable cost savings drive the market's expansion. Increasing environmental awareness and strict government rules surrounding the use of clean fuels are other major drivers of industry expansion. Due to the existence of significant companies on a global scale, the syngas business is predicted to expand quickly.

The market is anticipated to increase due to rising environmental consciousness and government laws regarding the use of bioethanol, as well as rising hydrogen demand for fertilizers and the expanding requirement for Syngas from the electrical and chemical industries. On the other hand, setting up a syngas production plant involves significant finance and capital. The market's expansion is anticipated to be hampered by this aspect.

The syngas market is segmented based on production technology, feedstock, gasifier type and application. Based on production technology, the market is segmented as steam reforming, partial oxidation, auto-thermal reforming, two-step reforming and biomass gasification. Based on gasifier type market is segmented as moving bed gasifier, fluidized bed gasifier, entrained flow gasifier and others. By feedstock, the market is segmented into coal, natural gas, petroleum byproducts and biomass. Based on Application, the market is segmented into chemicals, fuel, electricity and others.

The fluidized bed gasifier category held a major share of the global syngas market in 2021. A fluidized bed gasifier is frequently used to increase turbulence for more thorough combustion of low-responsiveness feedstocks. Additionally, compared to pressurized gasifiers, it has superior cold gas efficiency. Furthermore, the fluidized bed gasifier is one of the most important designs for biomass gasification, largely because it can be used for intermediate processes. Additionally, crucial benefits, including high efficiency, adaptable feedstock, and reduced pollution, are anticipated to boost demand for fluidized bed gasifiers.

The coal segment is projected to grow rapidly in the global Syngas market. This rise can be attributed mostly to the natural abundance of coal for the generation of electricity as well as to its outstanding compatibility as a source of cutting-edge technology for the manufacture of synthetic gas. The production of coal-based Syngas is also significantly influenced by important markets like China and India. This may help the coal segment's global industrial growth during the forecast year.

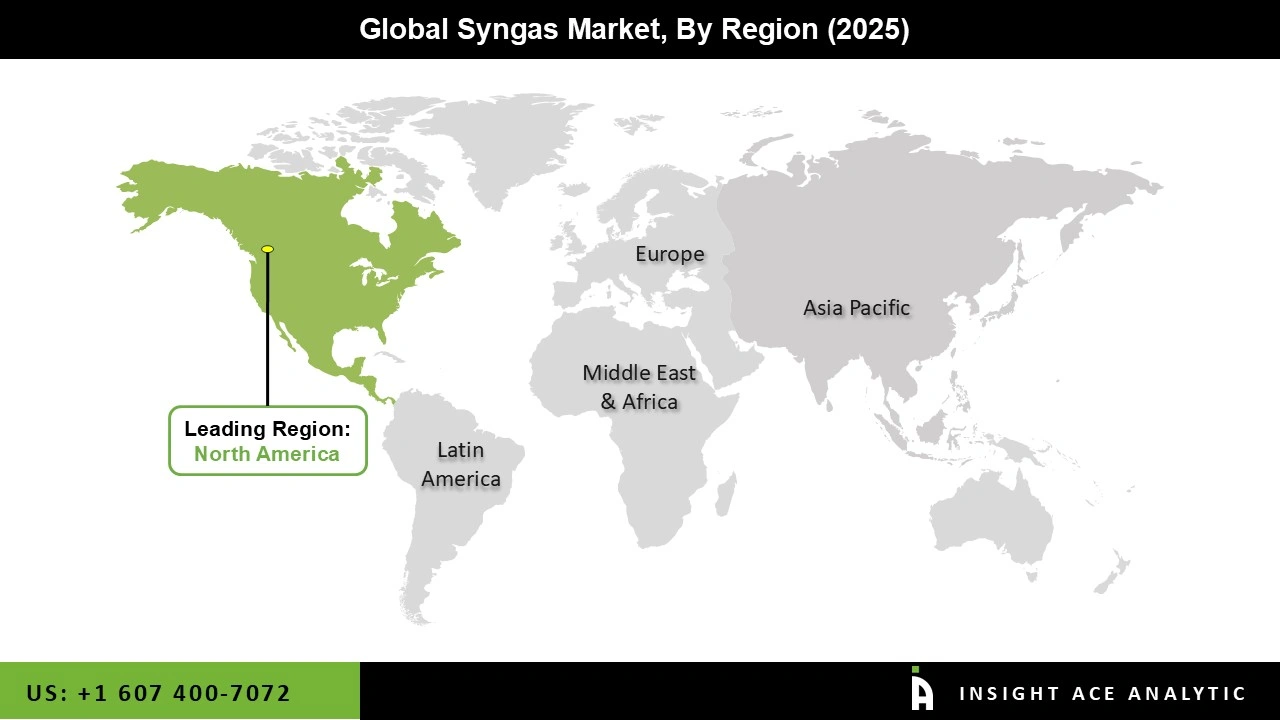

The North America syngas market is expected to register the highest market share in revenue shortly. This can be attributed to the region's strong focus on the environment, with the increasing adoption of Syngas in different industries, including food & beverages, personal care, packaging, automotive, and others. In addition, the chemical industry in the region is focusing on the production of Syngas to develop sustainable and environmental-friendly solutions.

Growing demand for bio-based components across industries and widespread adoption of Syngas in the production of intermediate chemicals in the region are factors increasing the growth of the target market in the region. In addition, the Asia Pacific region is projected to grow rapidly in the global Syngas market. The Asia-Pacific area is anticipated to expand quickly over the forecast period due to the growing market for Syngas across numerous industries, including fuel, chemicals, and power. Additionally, the expanding industrialization in Asian countries like Japan and Australia would help expand the Asia Pacific synthesis gas market.

| Report Attribute | Specifications |

| Market size value in 2025 | 296.91 (mm nm³/h) |

| Volume forecast in 2035 | 864.15 (mm nm³/h) |

| Growth rate CAGR | CAGR of 11.40% from 2026 to 2035 |

| Quantitative units | Representation of Volume in MWth, and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2025 |

| Forecast Year | 2026-2035 |

| Report coverage | The forecast of Volume, the position of the company, the competitive market statistics, growth prospects, and trends |

| Segments covered | Production Technology, Feedstock, Gasifier Type And Application |

| Regional scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; The UK; France; Italy; Spain; China; Japan; India; South Korea; Southeast Asia; South Korea; Southeast Asia |

| Competitive Landscape | Air Products Inc., KBC Inc., Siemers, Haldor Topsoe A/S, Air Liquide, BASF S, Synthesis Energy Systems, Inc., Dow Inc. andSasol Limited |

| Customization scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing and available payment methods | Explore pricing alternatives that are customized to your particular study requirements. |

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.