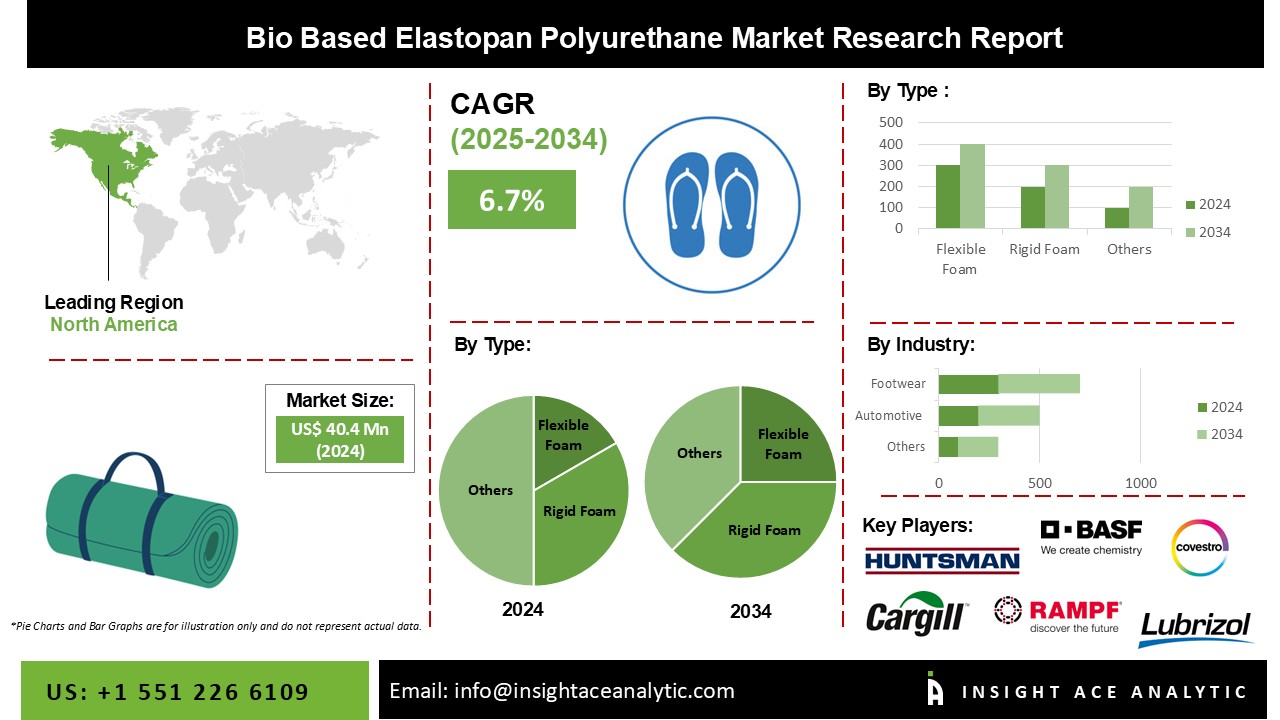

Bio-Based Elastopan Polyurethane Market Size is valued at 40.4 million in 2024 and is predicted to reach 76.8 million by the year 2034 at an 6.7% CAGR during the forecast period for 2025-2034.

The development of bio-based polymers like polyurethane has been fueled by growing worries about the hazardous effects of petrochemicals and declining crude oil sources (PU). During the forecast period, regulations established by most countries that limit the use of plastics derived from petroleum in specific applications, such as medical equipment, are anticipated to further encourage bio-based polyurethane manufacturing.

Major players focus on increasing their production capacity to increase their market share and meet the rising demand. The increase in partnerships and collaborations among major players that want to strengthen their position in the market is projected to support market expansion. The industry's growth projections are further backed by the ongoing commercial development projects, which include multinational offices, resort & spas, outdoor recreational areas, and shopping structures.urthermore, the desire for long-lasting and recyclable goods has increased due to technological developments and rising EV sales. Over the forecast period, an increase in EVs on the road is anticipated to fuel market expansion positively.

The bio-based elastomer polyurethane market is segmented based on type and industry. Based on type, the market is segmented as rigid foam, flexible foam, coatings, adhesives, & sealants. The market is segmented by industry: automotive, building & construction, consumer goods, electrical & electronics, and packaging.

The flexible foam category is expected to hold a major share of the global bio-based elastomer polyurethane market in 2021. Flexible foam composed of bio-based polyurethane is strong, light, supportive, and comfy, despite growing worries about its toxicity. Various business and consumer products employ polymer cushioning, including carpet underlay, vehicle upholstery, equipment, containers, bedding, chairs, and specialty items. The fact that this material can be extremely stiff, soft, or even viscoelastic accounts for its popularity. Flexible foam can be created in practically any form and stiffness level. It is specifically molded for usage in the automobile sector, primarily for car seats. Cushions for office equipment and leisure automobiles are two more common uses.

The packaging segment is projected to grow at a rapid rate in the global bio-based elastomer due to the manufacturer's shock-absorbing qualities, which make it perfect for storing and transporting products, including electrical equipment, consumer items, wineries, pharmaceutical and & healthcare products; it is frequently used in packing applications. Other characteristics of polyurethane, like moisture resistance and thermal insulation, aid in preserving the safety of perishable goods like seafood, vegetables, and fruits. These elements influence the packaging end-use segment's need for it., especially in countries such as the US, Germany, the UK, China, and India.

The North American bio-based elastomer polyurethane market is expected to register the highest market share in revenue soon. The area is home to a sizable number of producers of bio-based elastomers. Likewise, the region's growing need for electric automobile charging cables is anticipated to expand due to federal regulations that encourage it. This could have a favorable impact on the use of bio-based elastomers in cable jackets. In addition, the Asia Pacific region is projected to grow rapidly in the global bio-based elastomer polyurethane market. This is due to the rising demand for this material from the worldwide packaging, consumer goods, automotive, and construction industries. In addition, the expansion of business construction companies, such as professional commercial properties, hotels & resorts, outdoor recreation areas, and retail structures, enhance the industry's growth prospects.

| Report Attribute | Specifications |

| Market size value in 2023 | USD 38.43 million |

| Revenue forecast in 2031 | USD 63.91 million |

| Growth rate CAGR | CAGR of 6.75% from 2024 to 2031 |

| Quantitative units | Representation of revenue in US$ Million, Volume in Tons and CAGR from 2024 to 2031 |

| Historic Year | 2019 to 2023 |

| Forecast Year | 2024-2031 |

| Report coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments covered | Type, End-user Industry |

| Regional scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; The UK; France; Italy; Spain; China; Japan; India; South Korea; Southeast Asia; South Korea; South East Asia |

| Competitive Landscape | BASF SE, Mitsui Chemicals Inc., Covestro AG, Huntsman International LLC, Lubrizol Corporation, Woodbridge Foam Corporation, Rhino Linings Corporation, Malama Composites Inc., SK pucore, RAMPF Group, Cargill, Incorporated, Weylchem International GmbH |

| Customization scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing and available payment methods | Explore pricing alternatives that are customized to your particular study requirements. |

Bio-Based Elastane Polyurethane Market By Type:

Bio-Based Elastane Polyurethane Market By Industry:

Bio-Based Elastane Polyurethane Market By Region:

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.