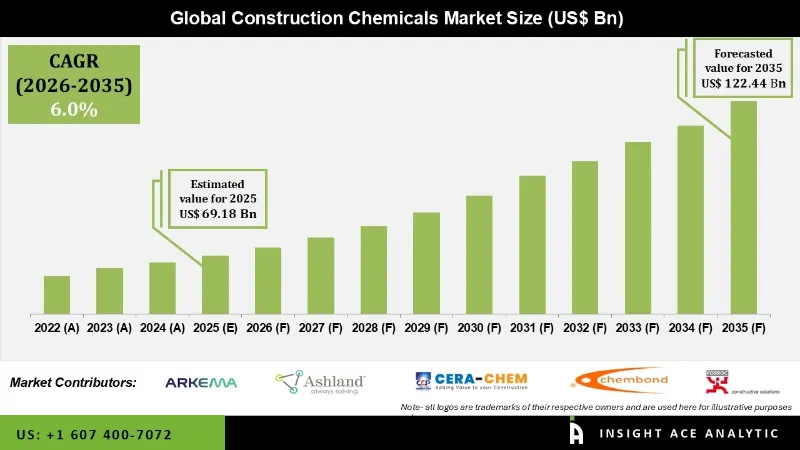

Construction Chemicals Market Size is valued at 69.18 billion in 2025 and is predicted to reach 122.44 billion by the year 2035 at a 6.0% CAGR during the forecast period for 2026 to 2035.

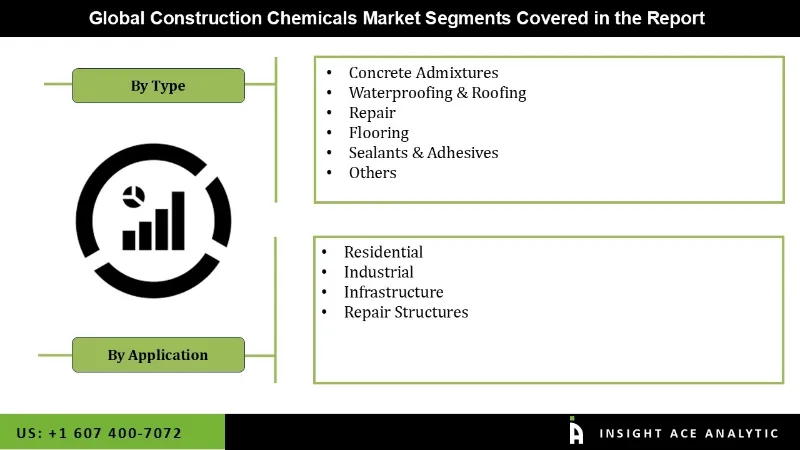

Construction Chemicals Market Size, Share & Trends Analysis Report By Type (Concrete Admixtures, Water Proofing & Roofing, Repair, Flooring, Sealants & Adhesives, Asphalt Additives, Flame-Retardants, Shrinkage Reducing Agents, Bond Breakers, And Mold Release Agents) By Application (Residential, Industrial/Commercial, Infrastructure And Repair Structures), By Region, And Segment Forecasts, 2026 to 2035.

Construction chemicals are chemicals used with cement, concrete, or other building materials to hold them all together during construction. The project will be more environmentally friendly, and the construction materials will be of higher quality. Construction chemicals are chemical substances that are used in construction projects, and they are mostly used to speed up the process and give the buildings more durability and strength.

Construction chemicals are used in various building materials to improve workability and performance, provide functionality, and preserve a structure's essential or customized characteristics while it is being built. The demand for premix admixtures prior to use in construction is increasing, fueling growth in the building chemicals sector. Furthermore, the decreased infrastructure durability caused by increased rainstorms and wet winters has increased the need for high-quality building chemicals.

However, in 2020, the COVID-19 epidemic had a negative impact on the market. Following the onset of the COVID-19 pandemic, construction work ceased worldwide, particularly in major construction hubs such as China, India, the United States, and European nations. Due to the global growth in the construction sector, the market is expected to grow steadily over the forecast period.

The Construction chemicals market is segmented on the basis of type and application. Type segment includes concrete admixtures, waterproofing & roofing, repair, flooring, sealants & adhesives, and others. By application, the market is segmented into residential, industrial, infrastructure, and repair structures.

The concrete admixtures category is expected to hold a major share of the global construction chemicals market in 2022. Cement is the most commonly utilized binding substance in the construction sector. Cement is combined with crushed rocks (aggregate), sand, and water to make concrete. Concrete admixtures are substances added to concrete to improve its polish and strength. Admixtures are mostly used to reduce the water content of concrete and increase its durability. Lingo-based admixtures, Sulfonated Naphthalene Formaldehyde (SNF), and Sulfonated Melamine Formaldehyde (SMF) are the most often utilized admixtures (SMF). Lingo-based admixtures were among the first to be utilized in concrete.

The infrastructure segment is projected to grow at a rapid rate in the global construction chemicals market. Infrastructure is commonly utilized for joint and crack sealing. Furthermore, sealants are utilized in proofing to protect the structure from moisture, dust, and heat. Sealants are commonly employed in a variety of commercial and residential applications. Market growth has been fueled by the expansion of ultramodern offices and workspaces, as well as rising urbanization and improved lifestyles.

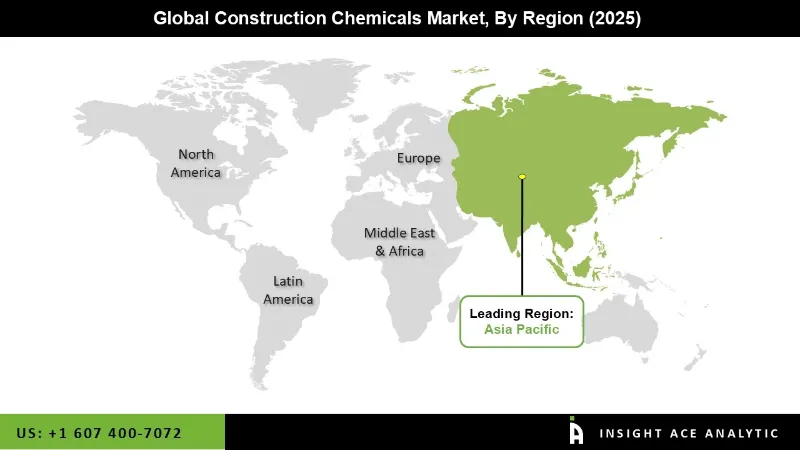

Asia Pacific's construction chemicals market is expected to register the highest market share in revenue in the near future. This can be attributed to the increasing expenditures in infrastructure development in addition to increasing consumer disposable income levels. Southeast Asian economies such as Indonesia, the Philippines, and Malaysia are experiencing significant economic growth, which is expected to benefit the building industry. These countries are seeing high demand for infrastructure projects, fueling the demand for construction chemicals in the Asia Pacific and propelling the regional market.

The expansion of the construction sector in Europe is driving construction chemicals. Western European countries, including the United Kingdom, Germany, the Netherlands, Germany, France, and others, are predicted to grow moderately during the forecast period. These countries' economic and political policies are also predicted to impact the growth of the building chemicals industry significantly.

| Report Attribute | Specifications |

| Market size value in 2025 | USD 69.18 Bn |

| Revenue forecast in 2035 | USD 122.44 Bn |

| Growth rate CAGR | CAGR of 6.0% from 2026 to 2035 |

| Quantitative units | Representation of revenue in US$ Billion, Volume (KT) and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2024 |

| Forecast Year | 2026-2035 |

| Report coverage | The forecast of revenue, the position of the company, the competitive market statistics, growth prospects, and trends |

| Segments covered | Type, And Application |

| Regional scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; The UK; France; Italy; Spain; South Korea; Southeast Asia |

| Competitive Landscape | Arkema SA, Ashland Inc., BASF SE, Fosroc International Ltd., Mapei Spa, Pidilite Industries Limited, Rpm International Inc., Sika Ag, The Dow Chemical Company, W. R. Grace & Co. |

| Customization scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing and available payment methods | Explore pricing alternatives that are customized to your particular study requirements. |

Construction Chemicals Market By Type-

Construction Chemicals Market By Application-

Construction Chemicals Market By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.