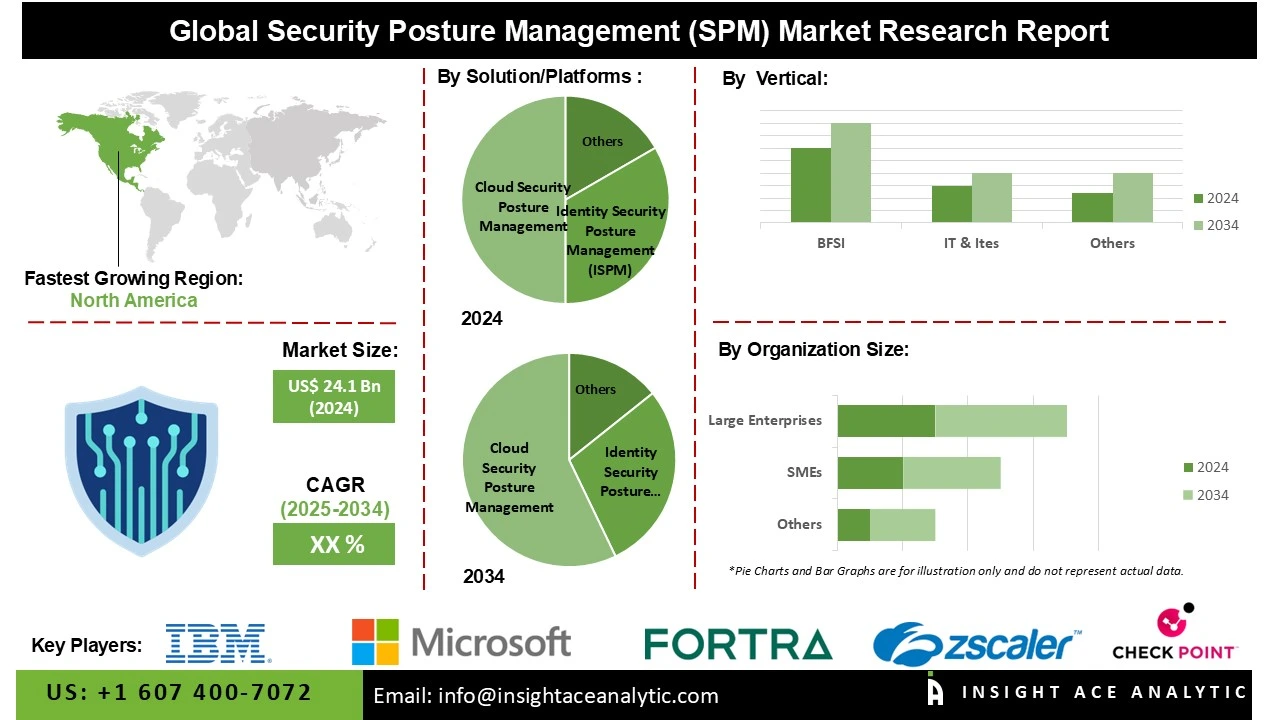

Security Posture Management (SPM) Market Size is valued at US$ 24.1 Bn in 2024 and is predicted to reach US$ 112.3 Bn by the year 2034 at an 17.2% CAGR during the forecast period for 2025-2034.

Security posture management (SPM) is the continuous evaluation and improvement of an organization's cloud and on-premises resource security by identifying vulnerabilities, ensuring compliance, and implementing configuration best practices. A robust security posture is now essential for modern businesses, as the rapid digital transformation and widespread cloud adoption increase their vulnerability to threats. The security posture management market is expected to grow during the projected period due to the growing demand for proactive posture management tools and services driven by an increase in cyber attacks across industries.

The growing use of cloud and hybrid environments is driving the security posture management market since it has made continuous monitoring and risk management across complex infrastructures imperative. Additionally, as companies shift from traditional perimeter security models to continuous verification and adaptive access controls, the market is expanding due to the widespread adoption of zero-trust and risk-based frameworks. However, integrating cutting-edge platforms with outdated IT systems is a significant barrier to the security posture management market. Visibility and security gaps result from many organizations' continued reliance on antiquated infrastructure incompatible with contemporary SPM solutions.

Some of the Key Players in Security Posture Management (SPM) Market:

· Palo Alto Networks

· CrowdStrike

· Netskope

· Trend Micro

· Cloudflare

· Fortinet

· Check Point

· Zscaler

· Fortra

· Optiv Security

· IBM

· Microsoft

· Orca Security

· Aqua Security

· Sophos

· Wipro

· Qualys

· Sysdig

· Oracle

· Wiz.io

· Tenable

· SentinelOne

· Lumos

· Spin.AI

· Permiso Security

· Firemon

· Cyscale

· Valence Security

· Push Security

· AppOmni

· JuipterOne

· Veza

· Grip Security

· Proofpoint

· Strac.io

· Authmind

· Forcepoint

· Thales

· Varonis

· Cequence Security

· BeyondTrust

· Okta

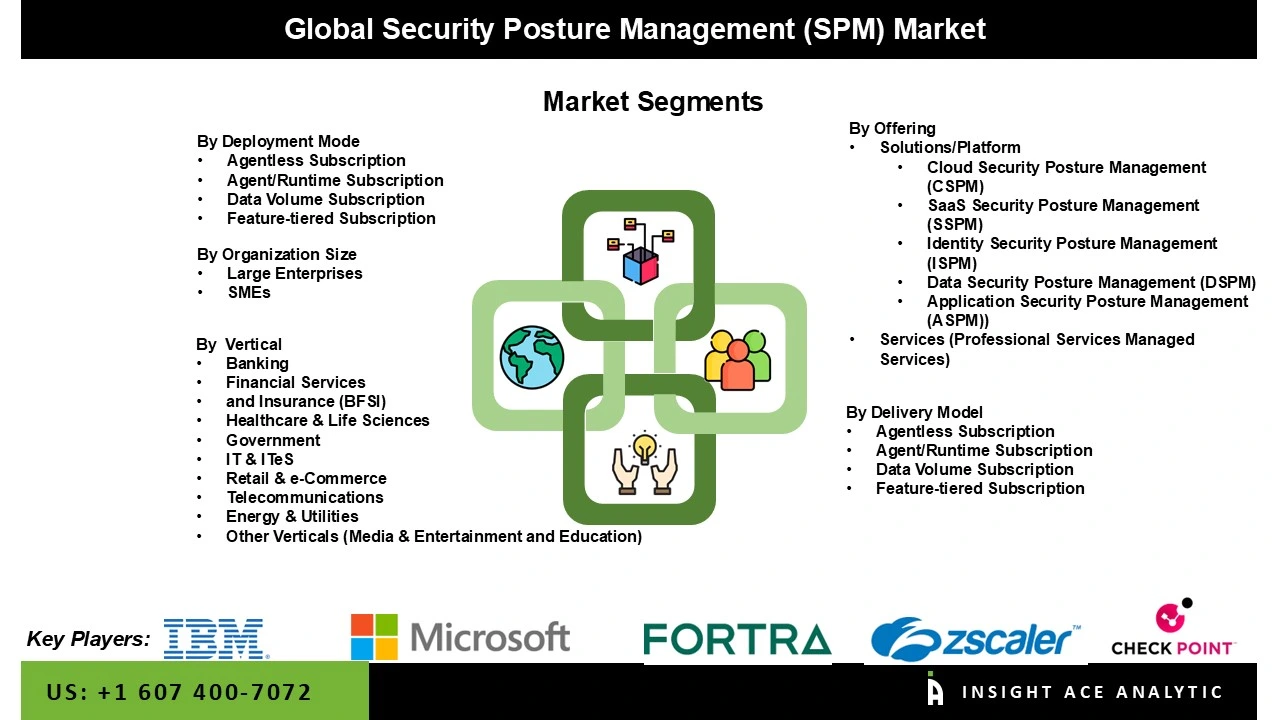

The security posture management (spm) market is segmented by offering, delivery model, deployment mode, organization size, and application. By offering, the market is segmented into saas security posture management (SSPM), solutions/platform (cloud security posture management (SPM), identity security posture management (ISPM), application security posture management (ASPM)), data security posture management (DSPM), and services (professional services and managed services).

By delivery model, the market is segmented into agent/runtime subscription, agentless subscription, feature-tiered subscription, and data volume subscription. By deployment mode, the market is segmented into cloud, on-premises, and hybrid. By organization size, the market is segmented into large enterprises and smes. By application, the market is segmented into it & ites, banking financial services and insurance (bfsi), telecommunications, government, healthcare & life sciences, retail & e-commerce, energy & utilities, and other verticals (media & entertainment and education).

The identity security posture management (ISPM) category held the largest share in the market because businesses are realizing how important it is to safeguard digital identities and access rights in intricate IT environments. Through ISPM solutions, enterprises can identify excessive permissions, continuously monitor entitlements, and address identity-related issues that may lead to data breaches. Data-sensitive and regulated businesses are adopting ISPM at a faster rate as identification emerges as the new security perimeter.

In 2025, the large enterprises category held the largest market share and dominated the security posture management market. They are most vulnerable to security and compliance issues due to their costly, complex IT stacks spanning multiple cloud platforms. Large enterprises can employ sophisticated SPM solutions that provide continuous visibility, automated threat detection, real-time remediation, and alerting, as they typically have greater resources and specialized security teams.

North America led the security posture management market in 2024 due to its robust cybersecurity infrastructure, high cloud adoption rates, strict regulations, and a strong vendor base, including leading cloud service providers. The Health Insurance Portability and Accountability Act (HIPAA) security compliance procedures and other strict data protection laws in the area further support this business. In addition, significant expenditures in automation, AI, and machine learning have also been key factors in the growth of security posture management products.

The market for security posture management in the Asia Pacific region is expected to grow at the fastest rate during the forecast period due to rapid digital expansion, rising cyber threats, and a wave of institutional and regulatory reforms. This pace is set by nations such as China, Japan, Singapore, India, and Australia, which have stringent compliance regulations, national cybersecurity plans, and focused investments. Additionally, the importance of real-time monitoring, configuration management, and prompt threat detection has increased as the government, financial, healthcare, and energy sectors have come to rely more on digital infrastructure.

| Report Attribute | Specifications |

| Market Size Value In 2024 | USD 24.1 Bn |

| Revenue Forecast In 2034 | USD 112.3 Bn |

| Growth Rate CAGR | CAGR of 17.2% from 2025 to 2034 |

| Quantitative Units | Representation of revenue in US$ Bn and CAGR from 2025 to 2034 |

| Historic Year | 2021 to 2024 |

| Forecast Year | 2025-2034 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Offering, By Delivery Model, By Deployment Mode, By Organization Size, By Application |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; Germany; The UK; France; Italy; Spain; Rest of Europe; China; Japan; India; South Korea; Southeast Asia; Rest of Asia Pacific; Brazil; Argentina; Mexico; Rest of Latin America; GCC Countries; South Africa; Rest of the Middle East and Africa |

| Competitive Landscape | Palo Alto Networks, CrowdStrike, Netskope, Trend Micro, Cloudflare, Fortinet, Check Point, Zscaler, Fortra, Optiv Security, IBM, Microsoft, Orca Security, Aqua Security, Sophos, Wipro, Qualys, Sysdig, Oracle, Wiz.io, Tenable, SentinelOne, Lumos, Spin.AI, Permiso Security, Firemon, Cyscale, Valence Security, Push Security, AppOmni, JuipterOne, Veza, Grip Security, Proofpoint, Strac.io, Authmind, Forcepoint, Thales, Varonis, Cequence Security, BeyondTrust, and Okta |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Geographic competitive landscape. |

| Pricing and Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

Security Posture Management (SPM) Market by Offering-

· Solution/Platforms

o SaaS Security Posture Management (SSPM)

o Cloud Security Posture Management (CSPM)

o Identity Security Posture Management (ISPM)

o Application Security Posture Management (ASPM))

o Data Security Posture Management (DSPM)

· Services (Professional Services and Managed Services)

Security Posture Management (SPM) Market by Delivery Model -

· Agent/Runtime Subscription

· Agentless Subscription

· Feature-tiered Subscription

· Data Volume Subscription

Security Posture Management (SPM) Market by Deployment Mode-

· Cloud

· On-premises

· Hybrid

Security Posture Management (SPM) Market by Organization Size-

· Large Enterprises

· SMEs

Security Posture Management (SPM) Market by Application-

· IT & ITes

· Banking Financial Services and Insurance (BFSI)

· Telecommunications

· Government

· Healthcare & Life Sciences

· Retail & e-Commerce

· Energy & Utilities

· Other Verticals (Media & Entertainment and Education)

Security Posture Management (SPM) Market by Region-

North America-

· The US

· Canada

Europe-

· Germany

· The UK

· France

· Italy

· Spain

· Rest of Europe

Asia-Pacific-

· China

· Japan

· India

· South Korea

· Southeast Asia

· Rest of Asia Pacific

Latin America-

· Brazil

· Argentina

· Mexico

· Rest of Latin America

Middle East & Africa-

· GCC Countries

· South Africa

· Rest of the Middle East and Africa

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.