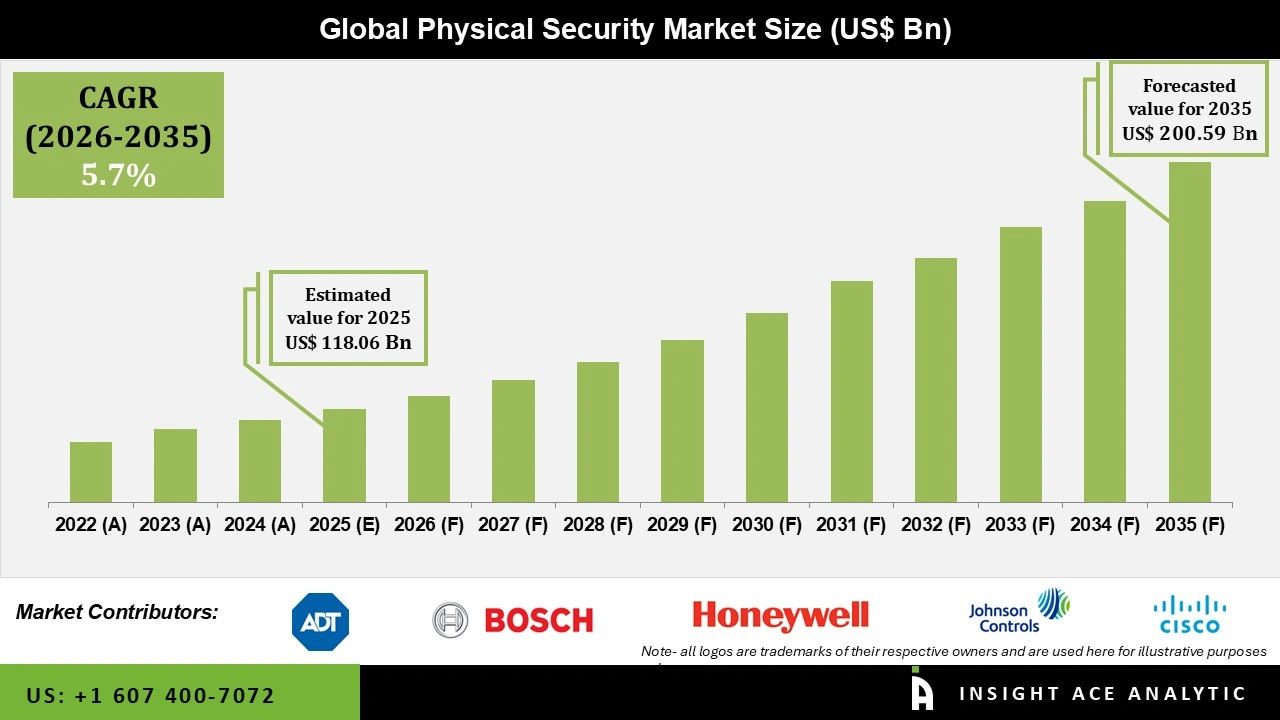

Global Physical Security Market Size is valued at USD 118.06 Bn in 2025 and is predicted to reach USD 200.59 Bn by the year 2035 at a 5.70% CAGR during the forecast period for 2026 to 2035.

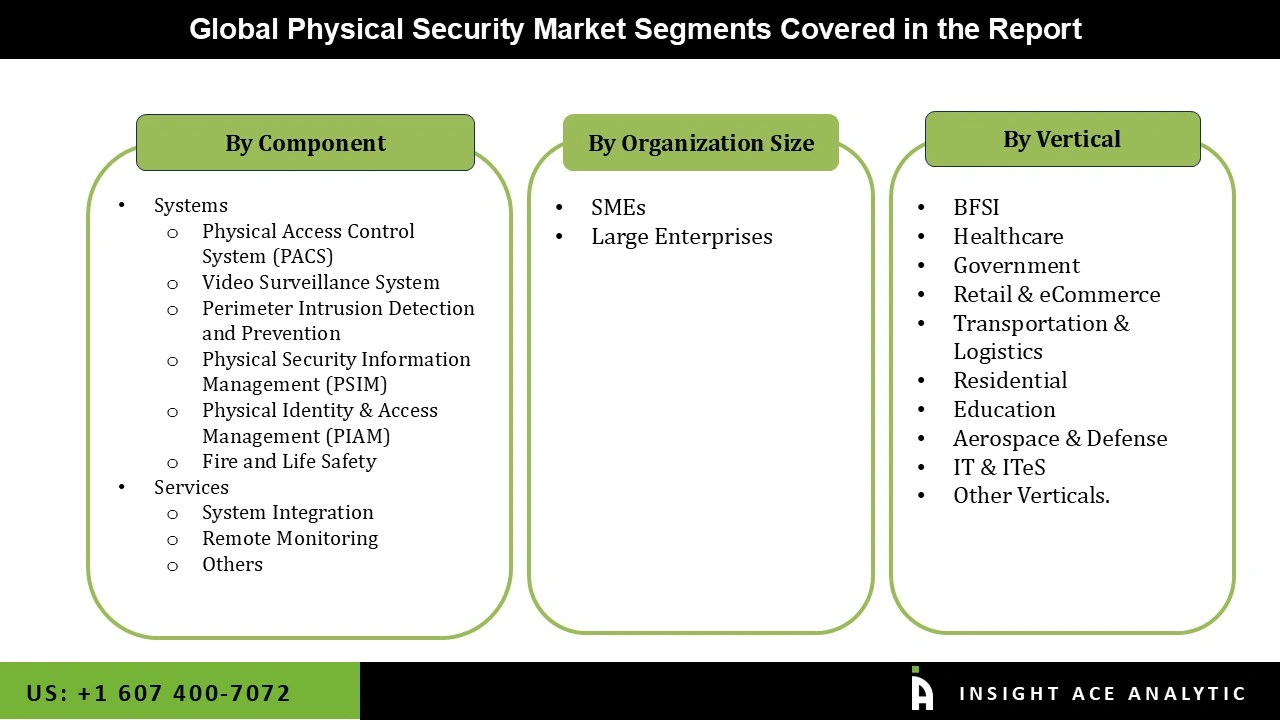

Physical Security Market Size, Share & Trends Analysis Report By Component (System, Service), By System, By Services (Professional Services, Managed Services), By Organization Size (SMEs, Large Enterprises), By Organization Size, By Vertical, By Region, And By Segment Forecasts, 2026 to 2035.

Key Industry Insights & Findings from the Report:

Physical security refers to the measures, policies, and practices to protect physical assets, people, and resources from unauthorized access, damage, theft, or harm. It encompasses various security measures to safeguard physical locations, assets, and information. Physical security is a significant component of overall security strategies and is essential in various settings, including businesses, government facilities, residential areas, and critical infrastructure.

It protects against natural disasters, fire, robbery, vandalism, and terrorism. The increases in the number of terror incidents and the increase in awareness drive the growth of the worldwide physical security industry. Furthermore, technological improvements have a beneficial impact on the growth of the physical security industry. However, privacy issues and a lack of physical and logical security integration are impeding the growth of the physical security sector. On the contrary, increased demand for physical security in smart cities will likely provide lucrative prospects for market advancement throughout the forecast period.

However, the COVID-19 epidemic has harmed the worldwide Physical Security market. Physical security is commonly utilized in oilfield services and pipeline management because it can detect many flaws and abnormalities that might cause system failures. Due to the pandemic, oilfield services and pipeline management encountered financial issues, resulting in the suspension of many new projects, which directly influenced the sales of physical security utilized in oilfield services and pipeline management. As a result, the worldwide Physical Security industry grew slowly during the pandemic.

The Physical Security Market consists of component, organization size, and vertical. According to components, the market is segmented as system and service. The system segment includes a physical access control system, video surveillance system, perimeter intrusion detection & prevention, physical security information management, physical identity & access management, security scanning, imaging, and metal detection, fire & life security. Services segment includes System Integration, Remote Monitoring. The organization size segment comprises large enterprises and SMEs. By vertical, the market is further segmented into healthcare, BFSI, government, Retail & eCommerce, transportation & logistics, residential, education, aerospace & defence, IT & ITeS, and other verticals.

The Retail and e-commerce category is expected to hold a major share in the global Physical Security Market in 2022. Retail and e-commerce are sectors of the country's economy that deal with selling things to customers via various shops, small grocery stores, supermarkets, major department stores, or the Internet. Previously, CCTV surveillance was an important security feature in retail businesses, but it was solely utilized for video surveillance to prevent theft. However, the surveillance system is currently being integrated with powerful systems. People can be counted, and heat maps can be generated using modern video analytics. These maps will assist in determining which areas of the shop receive the greatest foot traffic. This is likely to drive category growth over the forecast period.

The large enterprise segment is likely to grow at a rapid rate in the global Physical Security Market. The segment is driven by factors such as increased infrastructure to defend, extremely sensitive information to safeguard, and increased revenue to invest. As a result, they are among the early users of physical security. Furthermore, safeguarding their data from theft, hacking, and unauthorized access allows the industry to gravitate toward physical security solutions.

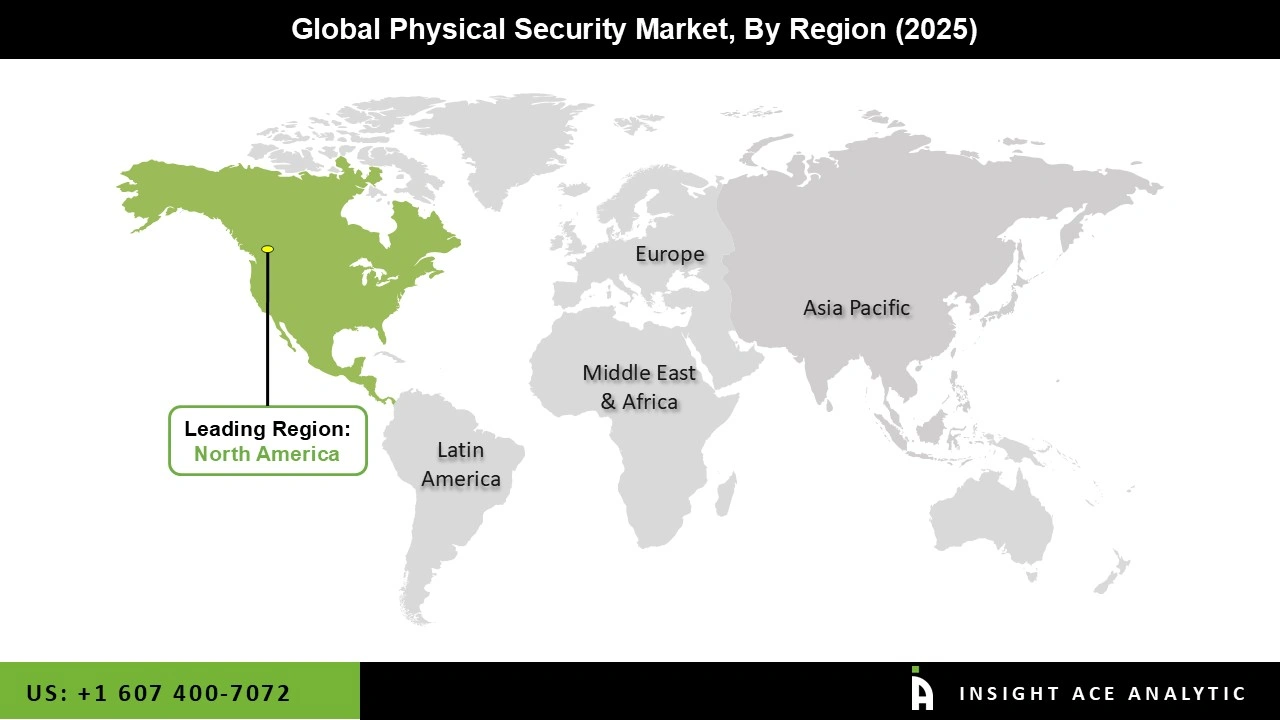

The North America Physical Security Market is expected to record the major market share in revenue in the near future. This pattern is predicted to persist throughout the forecast period. North America has the highest rate of adoption of modern physical security measures. Strong economic growth, regulatory reforms, and increased SME investments in physical security systems are driving the regional market.

Furthermore, a number of public facilities and transport systems, including airports, seaports, trains, and bus stations, are focusing on securing their infrastructure through security layers. Asia Pacific is estimated to grow firmly during the forecast period. The increased demand for smart security systems in India and China is to blame for this expansion. The Chinese government's significant investments in safe city initiatives, especially focusing on city surveillance and traffic monitoring, are expected to drive market growth.

| Report Attribute | Specifications |

| Market Size Value In 2025 | USD 118.06 Bn |

| Revenue Forecast In 2035 | USD 200.59 Bn |

| Growth Rate CAGR | CAGR of 5.70% from 2026 to 2035 |

| Quantitative Units | Representation of revenue in US$ Bn and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2025 |

| Forecast Year | 2026-2035 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | Component, Organization Size, and Verticals |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; Japan; Brazil; Mexico; The UK; France; Italy; Spain; India |

| Competitive Landscape | Johnson Controls (Ireland), Bosch Building Technology (Germany), Honeywell (US), ADT (US), Cisco (US), Telus (Canada), Wesco (US), Genetec (Canada), HID Global (US), Pelco (US), Hikvision (China), Gallagher (New Zealand), Secom (Japan), Allied Universal (US), Zhejiang Dahua Technology (China), Axis communications (Sweden), Hanwha Vision America (US), Teledyne FLIR (US), Hexagon AB (Sweden), General Dynamics (US), BAE Systems (UK), Huawei (China), NEC (Japan), Qognify (US), SmartCone Technology (Canada), Verkada (US), IOTAS (US), Cloudastructure (US). |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing And Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.