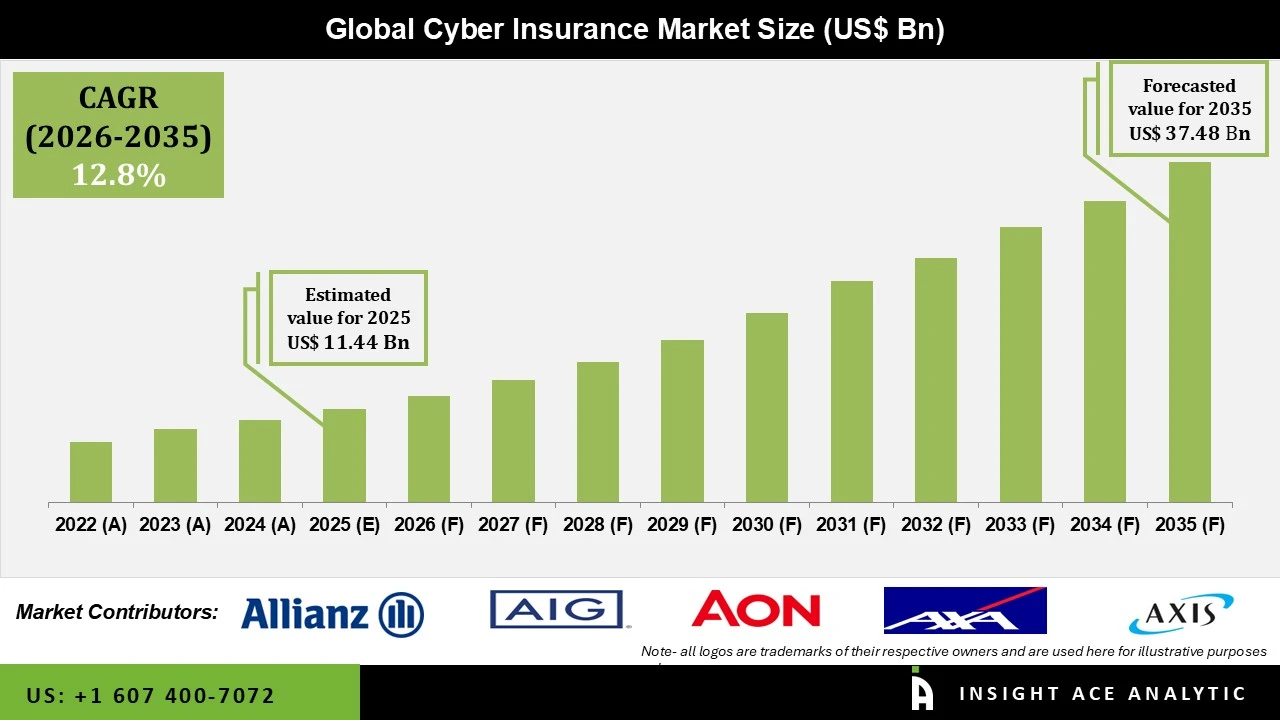

Cyber Insurance Market Size is valued at USD 11.44 Billion in 2025 and is predicted to reach USD 37.48 Billion by the year 2035 at a 12.89% CAGR during the forecast period for 2026 to 2035.

Cyber Insurance Market Size, Share & Trends Analysis Report By Company Size (Large Companies and Small & Medium-sized Companies) and Industry Vertical (BFSI, IT & Telecom, Retail & E-commerce, Healthcare, Manufacturing, Government & Public Sector), By Region, And Segment Forecasts, 2026 to 2035

Key Industry Insights & Findings from the Report:

Cyber insurance is a specialized insurance product that protects against the financial risks of cybersecurity threats. It offers coverage for various crimes, including ransom, data loss, hacking, theft, disruption of service, and other online crimes. Organizations are more susceptible to electronic warfare and data breaches as the number of electronic devices used to store data increases.

One of the latest technologies that are evolving the fastest is cloud computing. It dismantles previous barriers in IT, creates new markets, encourages the mobility trend, and makes unified communications breakthroughs possible. Several IT stakeholders and businesses are turning to novel insurance models to evaluate the risks related to retaining sensitive data in the current cybersecurity climate.

Additionally, two of the newest and most promising technologies are blockchain and artificial intelligence (AI) technology, which are anticipated to offer risk analytics solutions and generate new business opportunities for the cyber insurance market growth.

However, as cloud computing is a frequent target of cyberattacks, there is a greater need for cybersecurity insurance. Insurers will take a wider variety of security measures and solutions into account as the cyber insurance market expands. The importance of the data and an organization's capacity to appropriately protect it will be essential factors in assessing overall risk and influencing the adoption of new technologies.

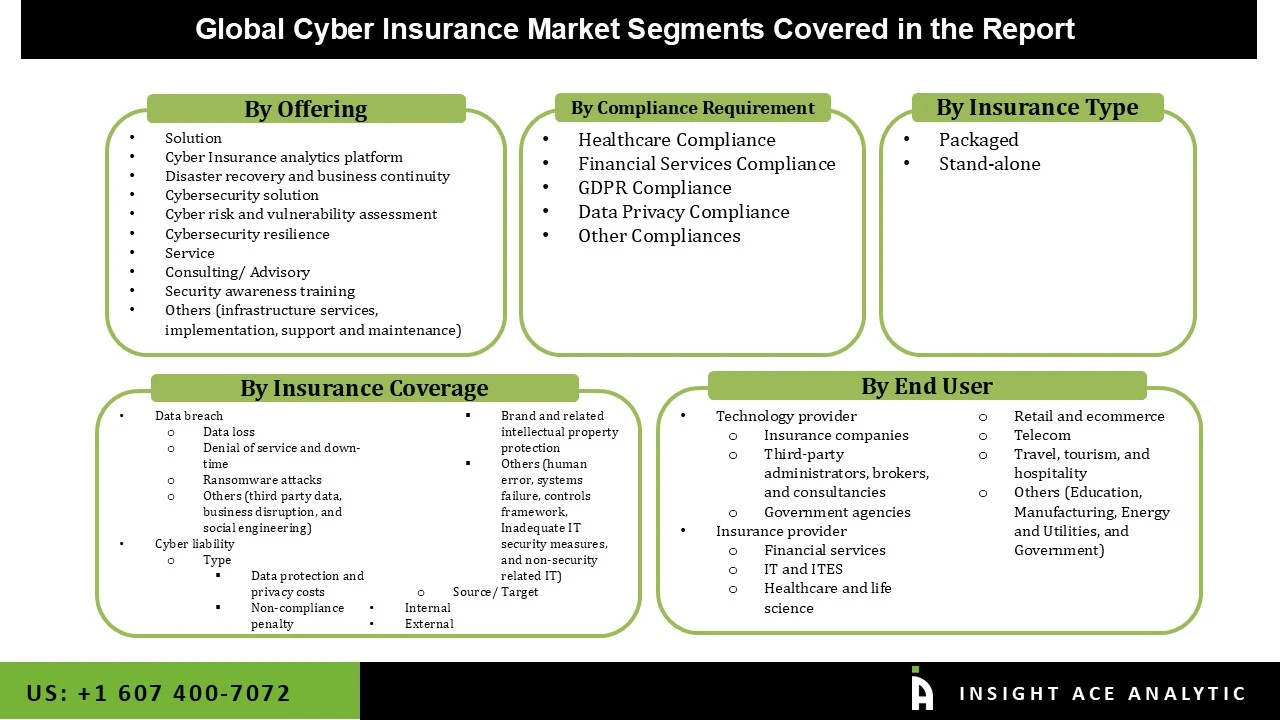

The Cyber Insurance market is segmented by offering, insurance coverage, Compliance Requirements, insurance type, end user. Based on offering, the market is segmented as solution, services. Solution is sub segmented into Cyber Insurance analytics platform, Disaster recovery and business continuity, Cybersecurity solution. Cybersecurity solution is sub segmented into Cyber risk and vulnerability assessment, Cybersecurity resilience. Service is sub segmented into Consulting/ Advisory, Security awareness training, Others (infrastructure services, implementation, and support and maintenance). The market is segmented by Insurance Coverage: Data breach and Cyber liability. Data breach is sub segmented into Data loss, Denial of service and down-time, Ransomware attacks, Others (third party data, business disruption, and social engineering). Cyber liability is sub segmented into type and source/ Target. Type is sub segmented into Data protection and privacy costs, Non-compliance penalty, Brand and related intellectual property protection, Others (human error, systems failure, controls framework, Inadequate IT security measures, and non-security related IT). Source/ Target is sub segmented into Internal, External. By Compliance Requirements market is segmented into Healthcare Compliance, Financial Services Compliance, GDPR Compliance, Data Privacy Compliance, Other Compliances. By insurance type market is segmented into Packaged and Stand-alone. By end user market is sub segmented into Technology provider and Insurance provider. Technology provider is sub segmented into Insurance companies, Third-party administrators, brokers, and consultancies, Government agencies. Insurance provider is sub segmented into financial services, IT and ITES, Healthcare and life science, Retail and ecommerce, Telecom, Travel, tourism, and hospitality, Others (Education, Manufacturing, Energy and Utilities, and Government).

Cyber risk insurance, or cyber liability insurance, helps organizations manage the financial impact of cyber-attacks, covering both first-party expenses (such as investigation costs, business losses, and extortion) and third-party claims (including legal proceedings and privacy issues). As cyber threats grow more sophisticated and regulations tighten, businesses are increasingly adopting Cyber Insurance to mitigate potential financial losses. By providing comprehensive coverage, these policies help insurers and businesses minimize the consequences of security breaches. Leading providers in the Cyber Insurance market include Allianz Group, AIG, Chubb, Aon, Zurich, AXA, and Berkshire Hathaway.

GDPR compliance is one of the most important drivers of growth in the Cyber Insurance Market because its strict data protection laws levy huge fines for non-compliance, and companies opt for insurance to cover financial losses. As data breaches become more common, organizations increasingly use cyber insurance to cover breach notification costs, legal expenses, and regulatory fines. Even though GDPR is an EU law, its international reach necessitates that multinational companies comply when processing EU citizen data, which further increases the need for Cyber Insurance protection.

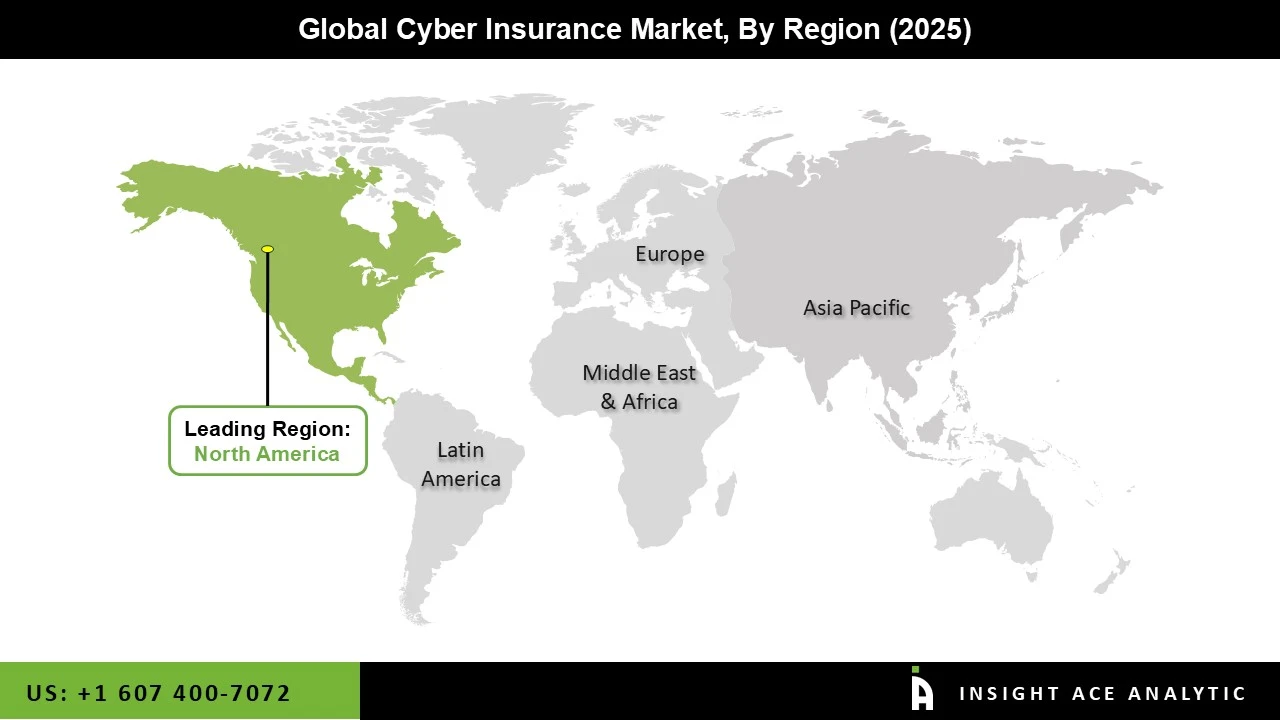

The North American Cyber Insurance Market position is expected to report the highest market share in revenue soon. The growing frequency of cyberattacks and the significant risk of data loss are likely to be attributed to the region's need for cybersecurity insurance. The United States is anticipated to undergo rapid development because of the nation's strict cybersecurity regulations and tight government supervision. Additionally, the nation's significant presence of prominent cyber insurance companies is predicted to support Cyber Insurance Market development. In addition, Asia Pacific is projected to grow at a rapid rate in the global Cyber Insurance market. Due to the growing number of international corporations, particularly in developing nations, the rise in cybercrimes across various economic sectors, and the untapped market potential given by emerging nations like India and China.

| Report Attribute | Specifications |

| Market size value in 2025 | USD 11.44 Billion |

| Revenue forecast in 2035 | USD 37.48 Billion |

| Growth rate CAGR | CAGR of 12.89% from 2026 to 2035 |

| Quantitative units | Representation of revenue in US$ Mn, and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2025 |

| Forecast Year | 2026-2035 |

| Report coverage | The forecast of revenue, the position of the company, the competitive market statistics, growth prospects, and trends |

| Segments covered | offering, insurance coverage, Compliance Requirements, insurance type, end user |

| Regional scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; France; Italy; Spain;South Korea; Southeast Asia |

| Competitive Landscape | Allianz, American International Group, Inc., Aon plc, AXA, Berkshire Hathway Inc, Lloyd’s of London Ltd, Lockton Companies, Inc, Munich Re, The Chubb Corporation, Zurich |

| Customization scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing and available payment methods | Explore pricing alternatives that are customized to your particular study requirements. |

Cyber Insurance Market By Offering:

Cyber Insurance Market By Insurance Coverage:

Cyber Insurance Market By Compliance Requirements:

Cyber Insurance Market By insurance type:

Cyber Insurance Market By End User:

Cyber Insurance Market By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.