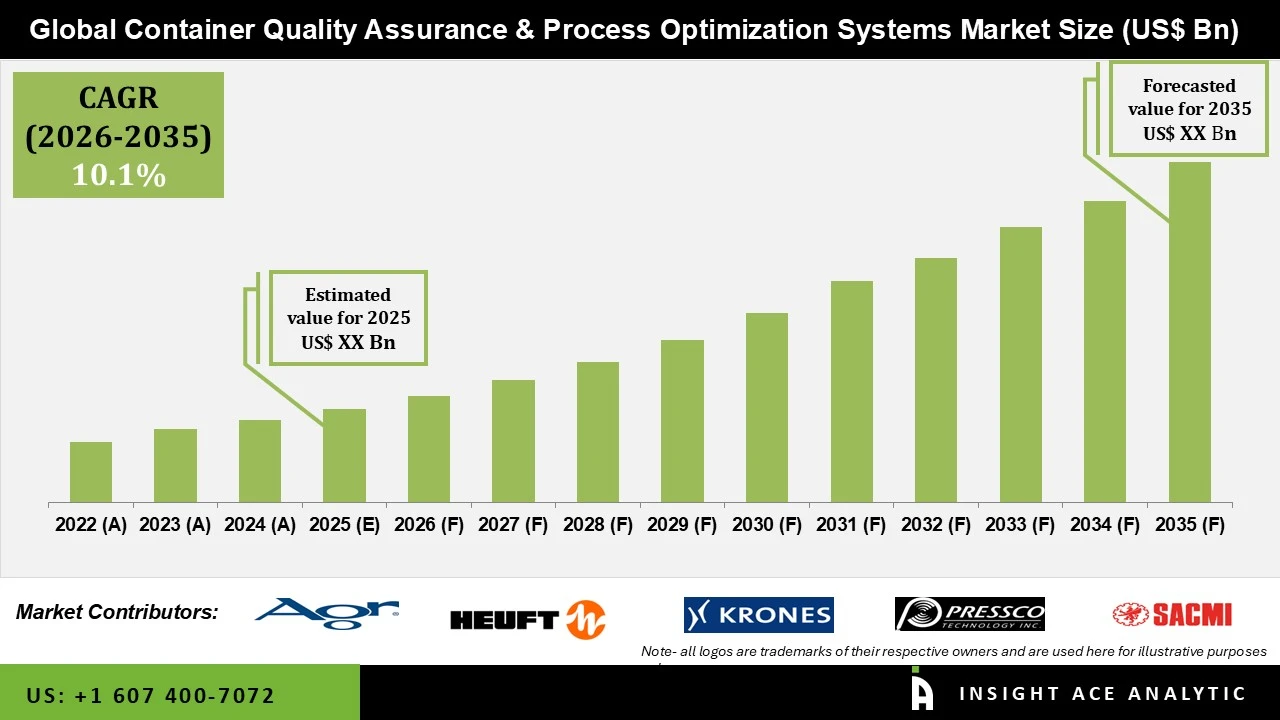

Container Quality Assurance & Process Optimization Systems Market Size is predicted to develop a 10.1% CAGR during the forecast period for 2026 to 2035.

Container Quality Assurance & Process Optimization Systems Market Size, Share & Trends Analysis Distribution by Solution Category (Inline / On-Line Container QA Systems, Container Performance Testing Systems (At-Line / Laboratory), Process Optimization & Closed-Loop Control Systems, Quality Data & Digital QA Software, Services), By Container Material (PET Bottles, HDPE / PP Rigid Plastic Containers, Glass Containers, Metal Cans, Multilayer (COEX) Containers), By End-Use Industry (Food & Beverage, Pharmaceuticals, Cosmetics & Personal Care, Chemicals & Industrial, Household & Home Care), By Automation Level (Standalone Measurement/Test Equipment, Inline Automated QA Stations, Closed-Loop Autonomous Control Systems, Plant-Wide Digital QA Systems), By Offering Type (Hardware Equipment, Software Platforms, Service & Aftermarket, Spare Parts & Consumables) and Segment Forecasts, 2026 to 2035

Container quality assurance & process optimization systems encompass the full range of technologies, equipment, software, and services used to ensure the integrity, safety, and performance of packaging containers across manufacturing lines. This market includes inline and on-line inspection systems for leak detection, dimensional accuracy, wall thickness, and visual defects; at-line and laboratory testing equipment for container strength and performance validation and process optimization solutions such as closed-loop control systems and digital quality management platforms. Together, these solutions help manufacturers maintain consistent packaging quality while minimizing waste, downtime, and compliance risks across high-speed production environments.

These systems are widely used across food & beverage, pharmaceuticals, cosmetics, chemicals, and household care industries to prevent product loss, extend shelf life, and ensure regulatory compliance. Market growth is being driven by increasing demand for high-speed automated packaging lines, stricter quality and safety standards, and rising emphasis on operational efficiency and cost control. Manufacturers are also adopting digital QA software and data-driven optimization tools to enable real-time monitoring, predictive maintenance, and continuous improvement. However, market expansion is partially constrained by the high upfront cost of advanced inspection and automation systems, particularly for small and mid-sized manufacturers, as well as the complexity of integrating new QA technologies into existing production lines. Despite these challenges, container quality assurance and process optimization systems remain essential for manufacturers seeking consistent quality, reduced risk, and long-term production efficiency.

• AGR International, Inc.

• HEUFT Systemtechnik GmbH

• Krones AG

• Pressco Technology

• Sacmi

• Bucher Emhart Glass

• Sidel

• KHS GmbH

• XPAR Vision

• IRIS Inspection Machines

• Stevanato Group

• Wilco AG

• Packaging Technologies & Inspection

• Teledyne TapTone

• Marposs

• Precitec

• Kistler Group

• Container Automation Systems

• GP Resources

• Others

The container quality assurance & process optimization systems market is being most strongly driven by the rapid shift toward high-speed, fully automated packaging operations. As manufacturers scale up production to meet growing demand, packaging lines are running faster and with tighter tolerances, leaving little room for errors or defects. Even small quality issues can quickly lead to product loss, recalls, or costly line stoppages, making real-time inspection and process control a business necessity rather than a quality add-on. To keep pace with these high-speed environments, manufacturers are increasingly investing in inline QA systems and closed-loop optimization tools that monitor container performance continuously and adjust processes automatically.

These solutions help maintain consistent quality without slowing production, while also reducing waste, improving efficiency, and protecting brand reputation. As automation becomes central to modern packaging operations, quality assurance and process optimization systems are playing a critical role in enabling reliable, scalable, and cost-effective manufacturing.

The main restraint for the container quality assurance & process optimization systems market is the high cost and complexity involved in integrating these systems into existing production environments. Many manufacturing lines were not originally designed to support advanced inspection, automation, or digital QA technologies, making upgrades both time-consuming and technically demanding. Installation often requires customization, line downtime, and coordination between multiple vendors, which can disrupt operations in the short term. For small and mid-sized manufacturers, the upfront investment and longer payback period can be a major hurdle, even when the long-term benefits are clear. Concerns around training requirements, system compatibility, and ongoing maintenance further add to adoption hesitation. As a result, while these solutions offer strong value in terms of quality consistency and efficiency, integration challenges continue to slow broader market uptake, particularly among cost-sensitive and legacy manufacturing operations.

The Inline Automated QA Stations are emerging as one of the most important automation levels within the container quality assurance & process optimization systems market, as manufacturers increasingly move toward real-time, in-process quality control. Unlike standalone or at-line testing equipment, inline automated QA stations operate directly on high-speed production lines, allowing continuous inspection without slowing throughput. This makes them especially attractive for manufacturers seeking to balance quality assurance with productivity. These systems automatically inspect containers for critical parameters such as dimensional accuracy, wall thickness, defects, and closure integrity, while instantly rejecting non-conforming units.

Inline automated QA stations also enable faster response to process deviations, helping reduce scrap, prevent downstream losses, and maintain consistent quality. Their ability to integrate with existing production lines and support gradual automation upgrades has made them a preferred choice across food & beverage, pharmaceutical, and personal care packaging operations. As manufacturers prioritize efficiency, compliance, and scalability, inline automated QA stations continue to gain strong adoption across global packaging facilities

The Inline / on-line container quality assurance systems form the backbone of the container quality assurance & process optimization systems market and represent the most important solution category driving adoption today. As packaging lines operate at increasingly high speeds, manufacturers need real-time visibility into container quality to avoid defects that can lead to product loss, recalls, or unplanned downtime. Inline QA systems enable continuous inspection of critical parameters such as dimensions, wall thickness, material distribution, preform quality, and closure integrity without interrupting production. These systems allow issues to be identified and corrected immediately, helping manufacturers maintain consistent quality while maximizing throughput. Industries such as food & beverage, pharmaceuticals, and personal care rely heavily on inline inspection to meet strict safety and regulatory requirements. By reducing waste, improving efficiency, and supporting stable, high-volume production, inline / on-line container QA systems have become a core investment for manufacturers seeking reliable performance and long-term operational efficiency.

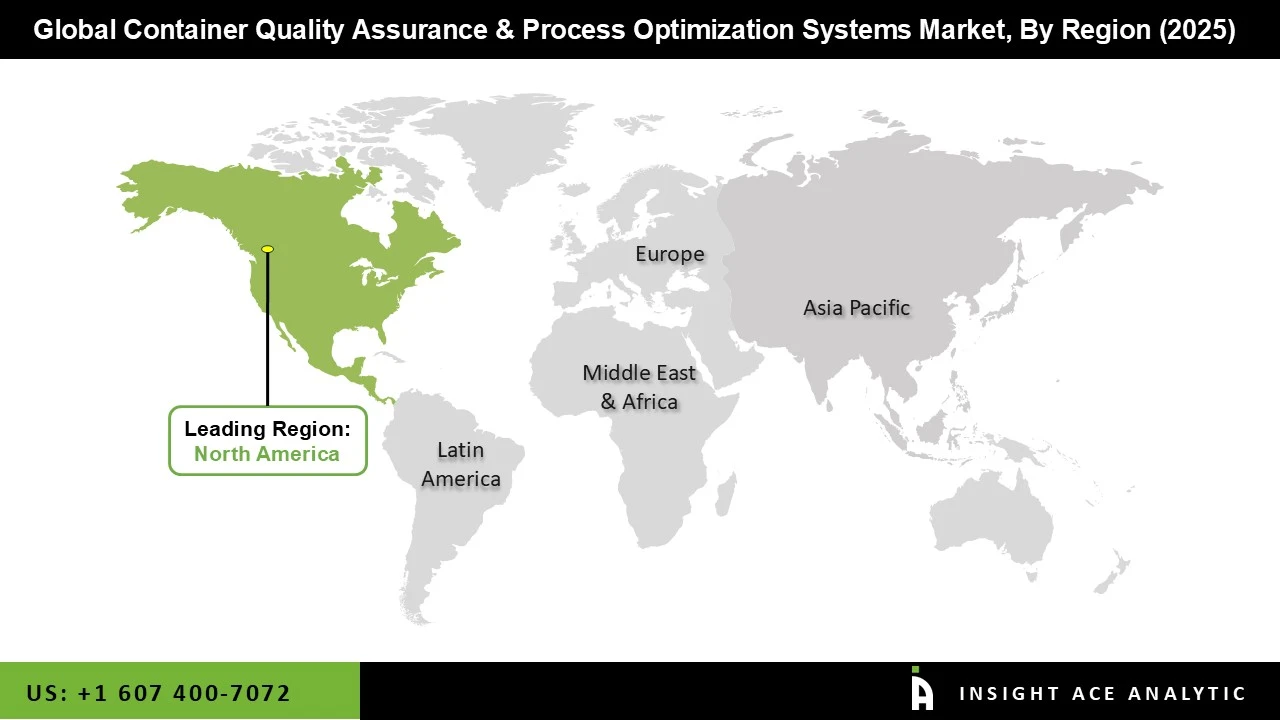

North America emerged as the leading region in the container quality assurance & process optimization systems market due to its strong manufacturing ecosystem, high level of automation, and strict focus on quality and regulatory compliance. The region is home to major food & beverage, pharmaceutical, cosmetics, and chemical manufacturers that rely on high-speed packaging lines, where maintaining container integrity is critical to avoid product recalls, compliance issues, and brand damage. Stringent regulations and safety standards have encouraged manufacturers to adopt advanced inline inspection systems, digital quality assurance platforms, and closed-loop process control solutions. In addition, North America benefits from the presence of leading technology providers and system integrators, enabling faster adoption of innovative QA and optimization tools. Strong investment in smart factories, data analytics, and operational efficiency initiatives has further reinforced North America’s leadership in this market.

• In September 2025, Pressco Technology introduced a redesigned vision system controller to enhance efficiency in high-speed container inspection operations. The company’s DecoSpector 360 system enables precise detection of printing and decoration defects, while upgraded INTELLISPEC™ platforms offer advanced, customizable inspection capabilities across production lines. Powered by AI-driven machine vision, these solutions help beverage manufacturers reduce spoilage, improve quality consistency, and optimize overall line performance, supporting smarter and more reliable container quality assurance processes.

| Report Attribute | Specifications |

| Growth Rate CAGR | CAGR of 10.1% from 2026 to 2035 |

| Quantitative Units | Representation of revenue in US$ Bn and CAGR from 2026 to 2035 |

| Historic Year | 2021 to 2025 |

| Forecast Year | 2026-2035 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | Solution Category, Container Material, End Use Industry, Automation level, Offering Type and By Region |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; The UK; France; Italy; Spain; China; Japan; India; South Korea; Southeast Asia; South Korea; Southeast Asia |

| Competitive Landscape | AGR International, Inc., HEUFT Systemtechnik GmbH, Krones AG, Pressco Technology, Sacmi, Bucher Emhart Glass, Sidel, KHS GmbH, XPAR Vision, IRIS Inspection Machines, Stevanato Group, Wilco AG, Packaging Technologies & Inspection, Teledyne TapTone, Marposs, Precitec, Kistler Group, Container Automation Systems, GP Resources |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Geographic competitive landscape. |

| Pricing and Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

• Inline / On-Line Container QA Systems

o Inline Dimensional Measurement Systems

o Inline Wall Thickness & Material Distribution Measurement Systems

o Hot-End Forming Process Monitoring Systems (Glass)

o Cold-End Container Inspection Systems (Glass & Rigid Plastic)

o Preform Quality Inspection Systems

o Closure Quality Inspection Systems

• Container Performance Testing Systems (At-Line / Laboratory)

o Top Load / Compression Testing Systems

o Internal Pressure / Burst Testing Systems

o Impact / Drop Testing Systems

o Thermal Shock / Heat Resistance Testing Systems

o Volume / Capacity Measurement Systems

o COEX / Barrier Layer Distribution Analysis Systems

o Fracture & Breakage Analysis Systems

• Process Optimization & Closed-Loop Control Systems

o Closed-Loop Blow Molder Control Systems (PET)

o Forming Machine Optimization Systems (Glass IS Machines)

o Recipe & Changeover Optimization Modules

o Predictive Maintenance & Process Drift Detection Systems

• Quality Data & Digital QA Software

o Quality Analytics & SPC Platforms

o Defect Data Management Systems

o Quality-Linked OEE & Loss Analysis Software

o PLC/SCADA/MES Connectivity Platforms

• Services

o Installation & Commissioning

o Calibration & Validation Services

o Preventive Maintenance Contracts

o Training & Technical Support

o Process Optimization Consulting

o Spare Parts & Consumables

• PET Bottles

• HDPE / PP Rigid Plastic Containers

• Glass Containers

• Metal Cans

• Multilayer (COEX) Containers

• Food & Beverage

• Pharmaceuticals

• Cosmetics & Personal Care

• Chemicals & Industrial

• Household & Home Care

• Standalone Measurement/Test Equipment

• Inline Automated QA Stations

• Closed-Loop Autonomous Control Systems

• Plant-Wide Digital QA Systems

• Hardware Equipment

• Software Platforms

• Service & Aftermarket

• Spare Parts & Consumables

North America-

• The US

• Canada

Europe-

• Germany

• The UK

• France

• Italy

• Spain

• Rest of Europe

Asia-Pacific-

• China

• Japan

• India

• South Korea

• South East Asia

• Rest of Asia Pacific

Latin America-

• Brazil

• Argentina

• Mexico

• Rest of Latin America

Middle East & Africa-

• GCC Countries

• South Africa

• Rest of Middle East and Africa

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.