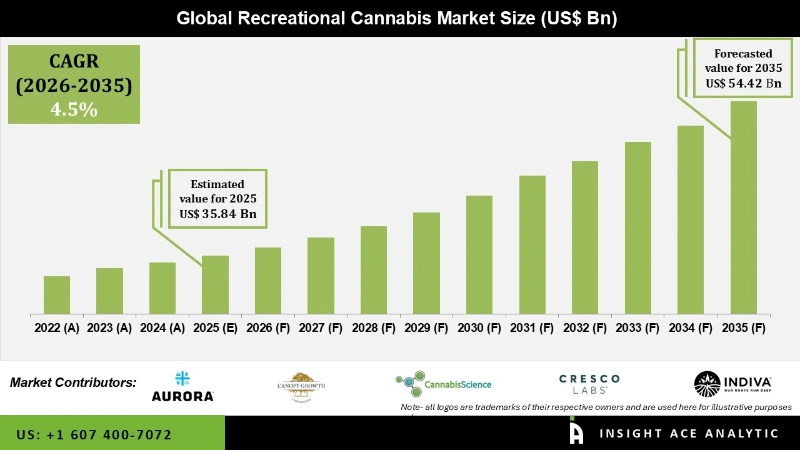

Recreational Cannabis Market Size is valued at USD 35.84 billion in 2025 and is predicted to reach USD 54.42 billion by the year 2035 at a 4.5% CAGR during the forecast period for 2026 to 2035.

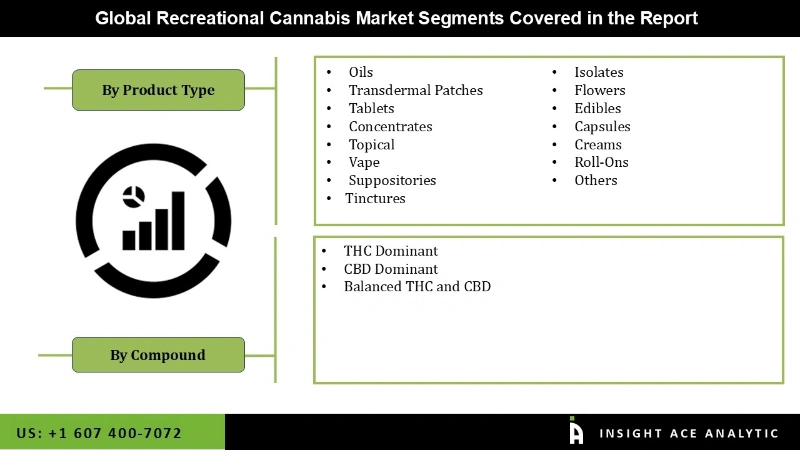

Recreational Cannabis Market Size, Share & Trends Analysis Report by Product Type (Oils, Transdermal Patches, Tablets, Concentrates, Topical, Vape, Suppositories, Tinctures, Isolates, Flowers, Edibles, Capsules, Creams, Roll-Ons and Others), Compound (THC Dominant, CBD Dominant and Balanced THC and CBD), Region And Segment Forecasts, 2026 to 2035.

Cannabis, sometimes known as marijuana, is a herbal treatment derived from Cannabis plants that are used to treat various symptoms and ailments, including cancer, chronic pain, and mental disorders. CBD and THS are the two major cannabinoids generated from this plant that have medical potential. Marijuana is also the most commonly used narcotic that affects consciousness.

Recreational marijuana is commonly smoked as a dry, shredded mixture of green and brown flowers, stems, seeds, and leaves. Marijuana can be taken recreationally as a blunt, pipe or bong, or cigarette (joint). People can now consume medicines without fear of harm and benefit from their medicinal advantages thanks to the legalization of cannabis. As a result, many governments are increasingly legalizing cannabis use. At the same time, it remains illegal in the majority of countries.

Cannabis use for recreational purposes has grown in popularity around the world as the regulations controlling its use and sale have become more relaxed over time. This has aided the overall growth of the recreational cannabis market. This market category is already surpassing all others because of the high demand for cannabis for recreational uses. If recreational cannabis becomes legal, the market for it may expand dramatically.

However, marijuana usage behaviors may not be substantially disturbed over protracted periods of social isolation during the COVID-19 pandemic epidemic, resulting in its continued demand throughout the pandemic. Many states have deemed medicinal marijuana used to be legal, and medical marijuana shops have been designated as important companies.

The Recreational Cannabis Market is segmented on the basis of product and compound. Product segment includes Oils, Transdermal Patches, Tablets, Concentrates, Topical, Vape, Suppositories, Tinctures, Isolates, Flowers, Edibles, Capsules, Creams, Roll-Ons and Others, organic acids and other products. The compound segment includes THC dominant, CBD dominant, and balanced THC and CBD.

The flowers category is expected to hold a major share of the global recreational cannabis market in 2022. Marijuana flower, or "bud," is the most widely consumed product in the world. A "bud" typically contains 15% to 30% THC, 0.1% to 1% CBD, and negligible quantities of other cannabinoids. Cannabinoids have boiling temperatures that are lower than the temperature at which flower burns; this is the principle used in vaporizers, which are rapidly gaining popularity; complex vaporizers are being created to maintain temperatures that target the activation of certain cannabinoids.

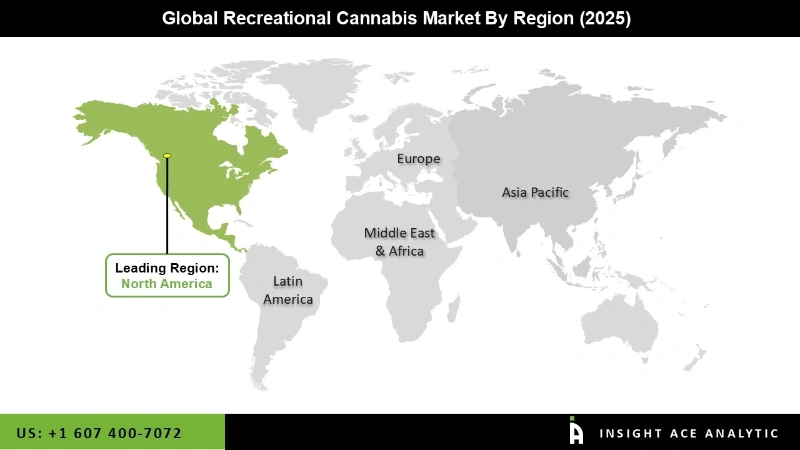

The North America Recreational Cannabis Market is expected to report the highest market share in terms of revenue in the near future. Its cultivators in the United States have risen dramatically, fuelling its consumption and applications. This is expected to boost sales and open new revenue streams for regional companies. Because of the expanding usage of medical cannabis and progressive regulations, Europe is the second-largest market. Medical marijuana has been shown in trials to be useful in treating illnesses ranging from cancer to appetite stimulants in individuals with AIDS-related sickness in European countries.

Furthermore, due to changes in government policy, the product's demand is predicted to skyrocket. Many countries' applicable law is new; the Greek government legalized medical marijuana in 2018, the same year as the United Kingdom. As a result, rising therapeutic use of the substance in countries is likely to improve regional sales.

| Report Attribute | Specifications |

| Market size value in 2025 | USD 35.84 Bn |

| Revenue Forecast in 2035 | USD 54.42 Bn |

| Growth rate CAGR | CAGR of 4.5% from 2026 to 2035 |

| Quantitative units | Representation of revenue in US$ Billion, and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2025 |

| Forecast Year | 2026-2035 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market statistics, growth prospects, and trends |

| Segments Covered | Product, Compound And Application |

| Regional scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; The UK; France; Italy; Spain; South Korea; Southeast Asia |

| Competitive Landscape | AURORA CANNABIS INC., Cannabis Science Inc., Canopy Growth Corporation, Cresco Labs, INDIVA, Medical Marijuana, Inc., Organigrams Holding Inc., STENOCARE A/S, The Cronos Group, Trulieve. |

| Customization scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing and available payment methods | Explore pricing alternatives that are customized to your particular study requirements. |

Recreational Cannabis Market By Product Type-

Recreational Cannabis Market By Compound-

Recreational Cannabis Market By Region-

North America

Europe

Asia Pacific

Latin America

Middle East & Africa

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.