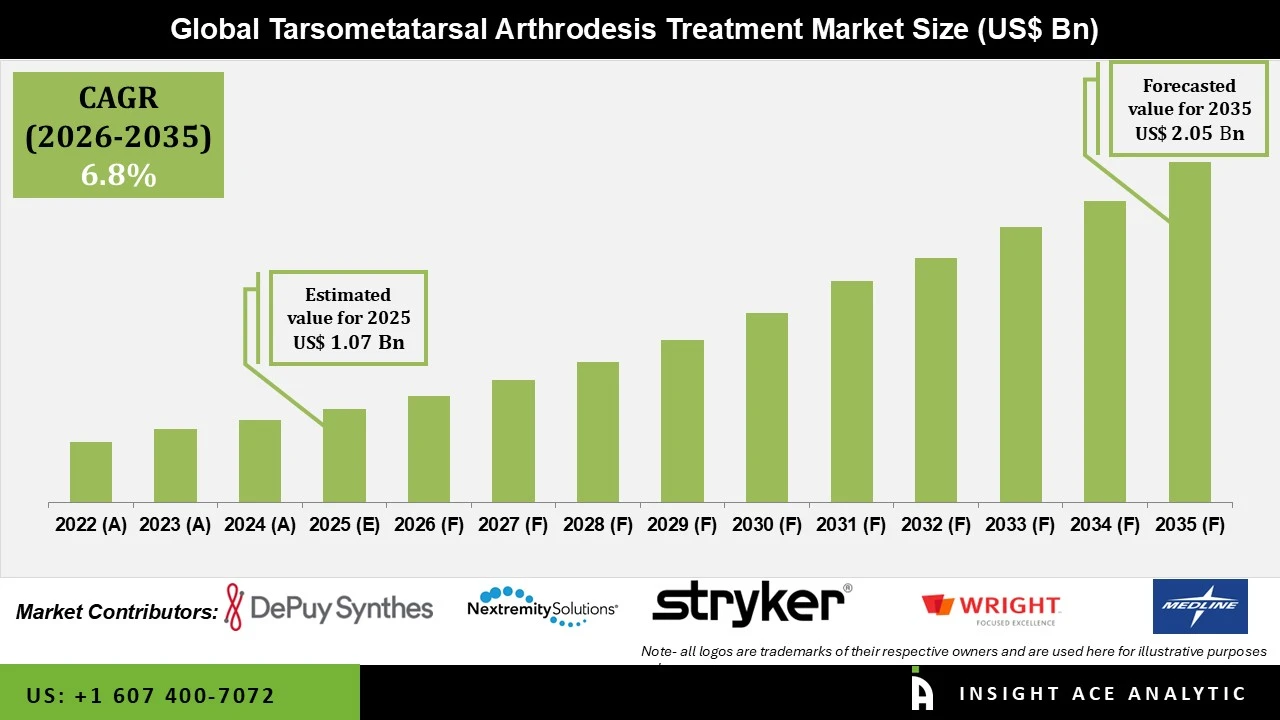

Tarsometatarsal Arthrodesis Treatment Market Size is valued at USD 1.07 Bn in 2025 and is predicted to reach USD 2.05 Bn by the year 2035 at a 6.8% CAGR during the forecast period for 2026 to 2035.

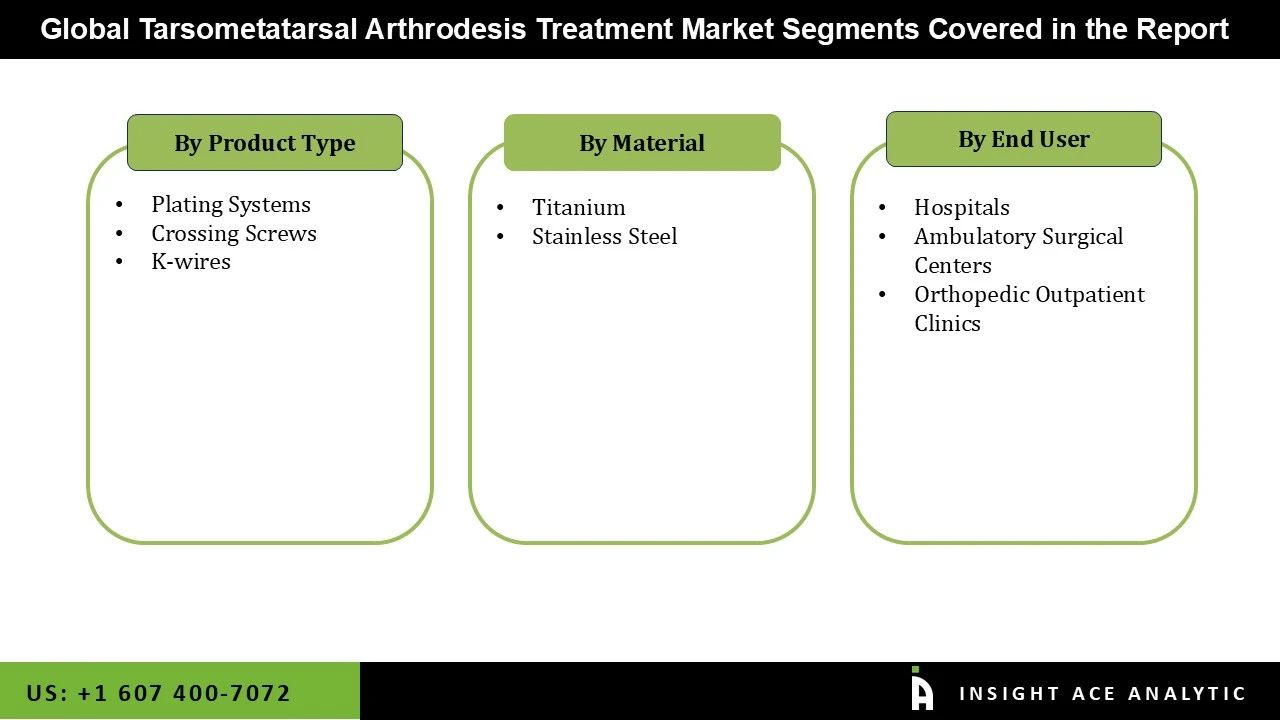

Tarsometatarsal Arthrodesis Treatment Market Size, Share & Trends Analysis Distribution by Type (Plating Systems, K-wires, and Crossing Screws), Material (Stainless Steel and Titanium), End-user (Hospitals, Orthopedic Outpatient Clinics, and Ambulatory Surgical Centers), and Segment Forecasts, 2026 to 2035

In recent decades, the shift toward precision and minimally invasive techniques has quietly become one of the most important advances in modern foot and ankle surgery. Tarsometatarsal arthrodesis (TMT fusion) exemplifies this evolution: by permanently stabilizing the midfoot joints between the tarsal and metatarsal bones, the procedure eliminates painful motion while restoring alignment and load-bearing capacity. It is now a standard intervention for severe midfoot arthritis, post-traumatic instability, progressive deformities, and chronic joint pain refractory to non-operative care. Surgeons remove damaged cartilage, realign the bony surfaces, and achieve rigid fixation with screws, plates, or staples, typically resulting in reliable pain relief and improved function at the cost of some midfoot flexibility. The procedure’s growing role reflects an aging population with more degenerative joint disease, increasing sports-related midfoot trauma, and greater recognition of the TMT complex as a frequent source of disabling foot pain.

One of the main drivers of the tarsometatarsal arthrodesis treatment market's expansion is the rising need for minimally invasive procedures. This can be attributed to the less invasive nature of tarsometatarsal arthrodesis treatment. Additionally, the industry is also experiencing significant expansion due to the increased knowledge of the advantages of tarsometatarsal arthrodesis treatment. This is because the treatment of foot and ankle injuries with Tarsometatarsal Arthrodesis is quite successful. The demand for efficient treatments is anticipated to grow as the population ages and lifestyle-related illnesses become more common, resulting in a healthy business climate. Moreover, there are opportunities for expansion due to continuous research and development initiatives targeted at improving surgical methods and post-operative care.

Moreover, better fusion rates and fewer problems are anticipated as a result of this individualized method becoming commonplace. A significant trend that aims to reduce patient morbidity and do away with the requirement for hardware removal surgery is the development of bioabsorbable fixation devices. Furthermore, the advanced surgical techniques are also becoming more accessible due to significant investments made by both public and private organizations in enhancing healthcare infrastructure and accessibility. Thus, this is anticipated to boost the tarsometatarsal arthrodesis treatment market growth over the forecast period.

• DePuySynthes

• Medline Industries Inc.

• Acumed LLC

• Stryker GmbH

• Biomet Trauma

• Nextremity Solutions Inc.

• Wright Medical Technology Inc.

• Integra Lifesciences Corporation

• Novastep Inc.

• Paragon 28 Inc.

• Orthofix Medical Inc.

• Others

The growing prevalence of traumatic injuries and midfoot disorders, especially Lisfranc injury and degenerative osteoarthritis, is one of the main factors propelling the tarsometatarsal arthrodesis treatment market. The number of patients needing surgery for persistent midfoot pain and instability has increased due in large part to age-related joint degradation, increased involvement in sports, and traffic accidents. Furthermore, the demand for corrective and pain-relieving surgical operations has been further spurred by the global increase in the senior population, who are more susceptible to structural foot abnormalities and arthritis. Improved surgical methods, better fixation devices, and better postoperative results have also boosted patient acceptability and physician confidence, which has supported the tarsometatarsal arthrodesis treatment market growth.

The high procedure cost and related postoperative recovery burden are a significant barrier to the tarsometatarsal arthrodesis treatment market. The procedure calls for specialist implants like plates and screws, sophisticated imaging guidance, and knowledgeable orthopedic surgeons, all of which raise the total cost of care. Limited reimbursement coverage and high out-of-pocket expenses limit patient access to the surgery in many developing and cost-sensitive nations. Additionally, when conservative treatment alternatives are still available, the risk of complications such as infection, nonunion, hardware irritation, and protracted immobilization can deter patients and healthcare professionals from choosing surgical fusion.

The plating systems category held the largest share in the tarsometatarsal arthrodesis treatment market in 2025 as a result of surgeons' growing predilection for strict internal fixation techniques that offer better stability and fusion results. Plate systems provide more biomechanical support than individual screws, especially in cases of revision surgery, multi-joint fusions, and complex midfoot abnormalities. Orthopedic surgeons have turned to them because of their ability to preserve exact anatomical alignment while lowering the possibility of hardware failure or nonunion. Additional technological developments that have increased procedural success rates and decreased postoperative problems include locking plate designs, low-profile anatomical plates, and better biocompatible materials.

In 2025, the hospitals category dominated the tarsometatarsal arthrodesis treatment market as a result of the growing demand for sophisticated surgical environments with specialist orthopedic infrastructure. Hospitals are usually the main locations for complicated foot and ankle surgeries because they provide access to skilled orthopedic surgeons, cutting-edge imaging equipment, and extensive postoperative care settings. In addition to improving surgical results and patient safety, the availability of multidisciplinary teams that include anesthesiologists and rehabilitation specialists encourages more patients to seek treatment in hospitals. Furthermore, the increasing incidence of hospitalizations for age-related degenerative diseases, sports-related midfoot fractures, and traumatic injuries supports procedural volumes.

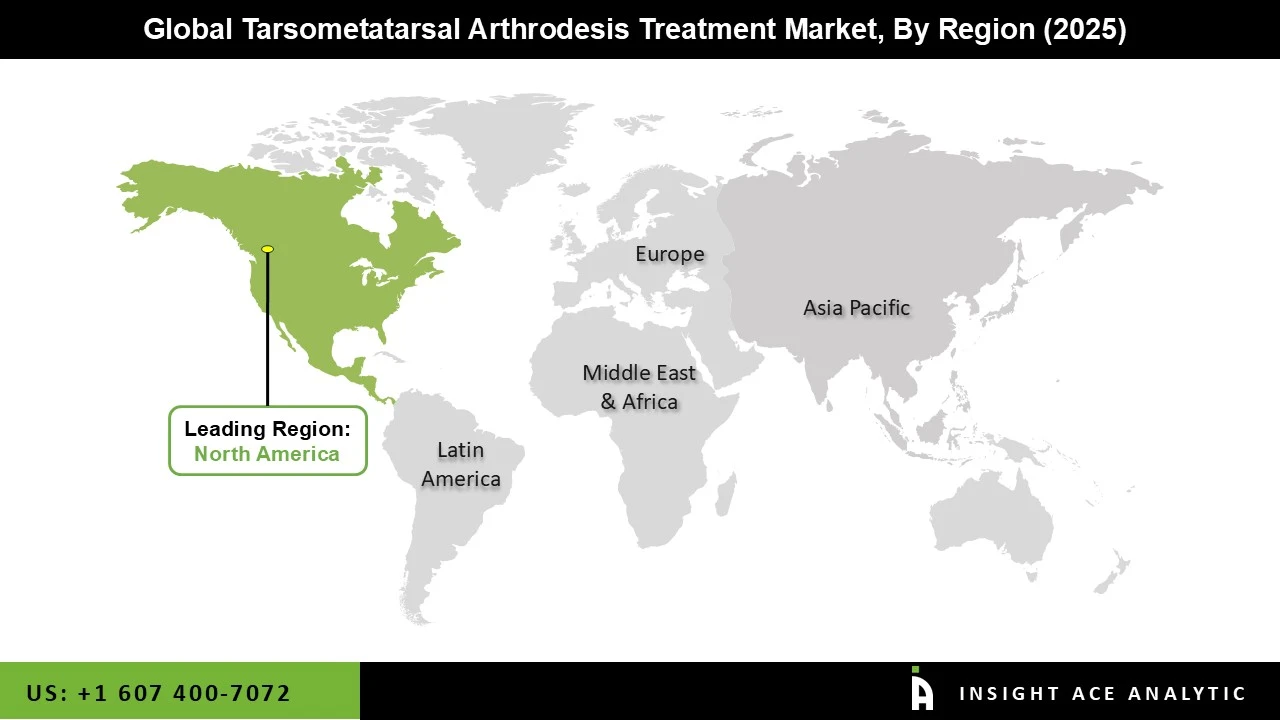

The tarsometatarsal arthrodesis treatment market was dominated by North America region in 2025 driven by a high rate of foot abnormalities, arthritis, and sophisticated medical facilities. Due to their well-established orthopedic care systems, extensive network of specialist surgical centers, and robust reimbursement structures that promote the use of arthrodesis treatments, the United States and Canada lead the world in procedure volumes. The advanced fixation systems are becoming more and more popular among clinicians due to technological advancements such as bioabsorbable materials, optimized implant designs, and minimally invasive surgical methods that improve patient outcomes. Furthermore, the need for corrective arthrodesis surgery is growing as individuals and medical professionals become more aware of foot and ankle conditions. North America's supremacy is further cemented by high healthcare costs and continuous R&D investments by significant medical device makers.

| Report Attribute | Specifications |

| Market size value in 2025 | USD 1.07 Bn |

| Revenue forecast in 2035 | USD 2.05 Bn |

| Growth Rate CAGR | CAGR of 6.8% from 2026 to 2035 |

| Quantitative Units | Representation of revenue in US$ Bn and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2025 |

| Forecast Year | 2026-2035 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | Type, Material, Treatment Duration, End-user, Distribution Channel, and By Region |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; France; Italy; Spain; South Korea; Southeast Asia |

| Competitive Landscape | DePuySynthes, Medline Industries Inc., Acumed LLC, Stryker GmbH, Biomet Trauma, Nextremity Solutions Inc., Wright Medical Technology Inc., Integra Lifesciences Corporation, Novastep Inc., Paragon 28 Inc., Orthofix Medical Inc., and Others |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Geographic competitive landscape. |

| Pricing and Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

• Plating Systems

• K-wires

• Crossing Screws

• Stainless Steel

• Titanium

• Hospitals

• Orthopedic Outpatient Clinics

• Ambulatory Surgical Centers

North America-

• The US

• Canada

Europe-

• Germany

• The UK

• France

• Italy

• Spain

• Rest of Europe

Asia-Pacific-

• China

• Japan

• India

• South Korea

• South East Asia

• Rest of Asia Pacific

Latin America-

• Brazil

• Argentina

• Mexico

• Rest of Latin America

Middle East & Africa-

• GCC Countries

• South Africa

• Rest of Middle East and Africa

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.