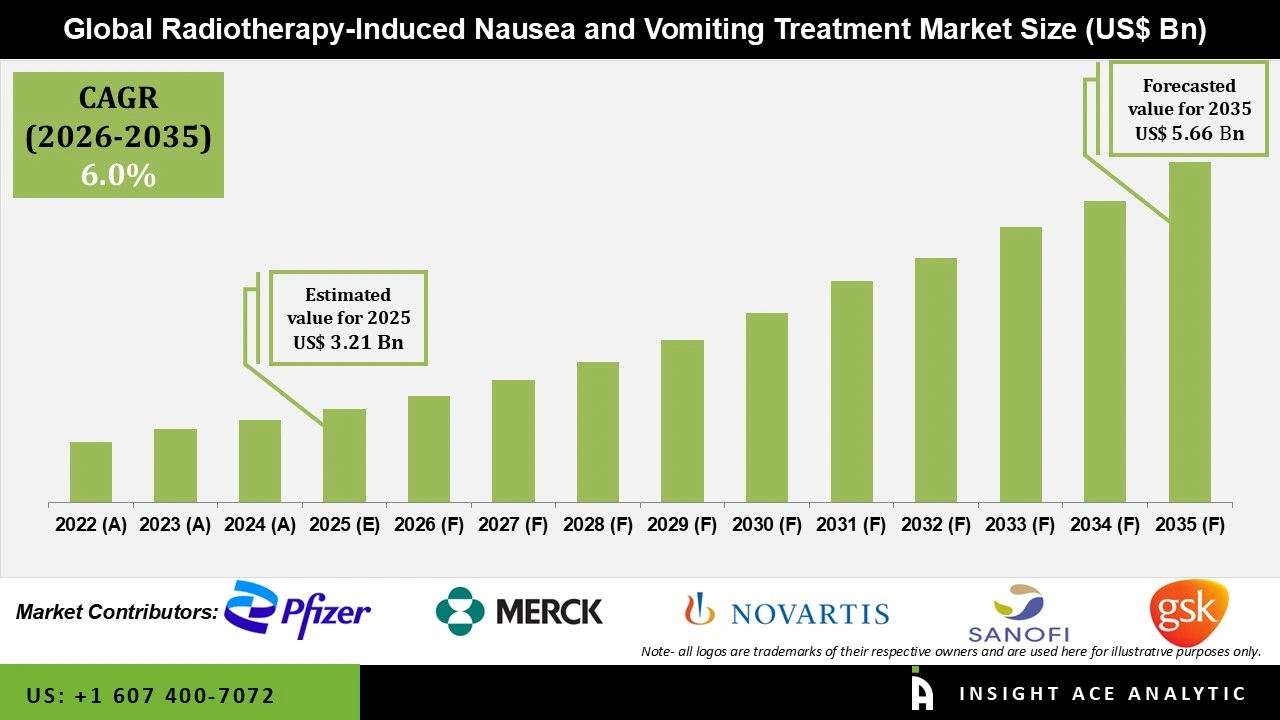

Global Radiotherapy-Induced Nausea and Vomiting Treatment Market Size is valued at USD 3.21 Bn in 2025 and is predicted to reach USD 5.66 Bn by the year 2035 at a 6.0% CAGR during the forecast period for 2026 to 2035.

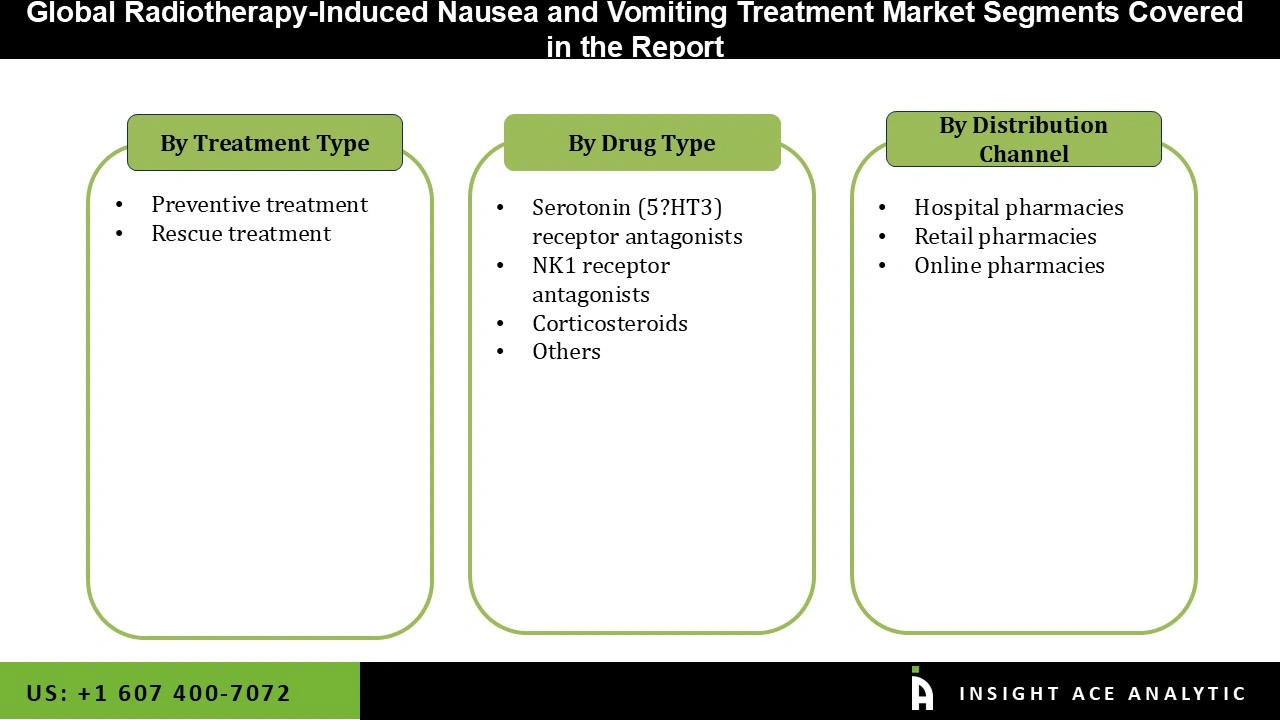

Radiotherapy-Induced Nausea and Vomiting Treatment Market Size, Share & Trends Analysis Distribution by Drug Type (Corticosteroids, Serotonin (5-HT3) Receptor Antagonists, NK1 Receptor Antagonists, and Others), Treatment Type (Preventive Treatment and Rescue Treatment), Distribution Channel (Hospital Pharmacies, Online Pharmacies, and Retail Pharmacies), By Region and Segment Forecasts, 2026 to 2035.

The medical management of nausea and vomiting that arise as side effects of radiation therapy used to treat cancer is known as "radiotherapy-induced nausea and vomiting" (RINV). Since radiation can irritate the gastrointestinal system or activate the brain's vomiting center, these symptoms are most prevalent in patients undergoing radiation therapy to the abdomen, pelvis, brain, or entire body. Antiemetic drugs are used therapeutically and prophylactically as the mainstay of treatment to prevent and manage symptoms. Longer radiation treatment courses, an increase in the use of supportive care drugs to enhance treatment compliance and patient quality of life, and an increase in the prevalence of cancer worldwide are all factors driving the radiotherapy-induced nausea and vomiting treatment market expansion.

The need for efficient antiemetic treatments is growing since nausea and vomiting are experienced by a considerable percentage of patients undergoing abdominal, pelvic, or total body irradiation. The radiotherapy-induced nausea and vomiting treatment market is growing as the use of sophisticated antiemetic medications such as corticosteroids, NK1 receptor antagonists, and 5-HT3 receptor antagonists increases, enhancing patient comfort and treatment compliance. Additionally, the market is expanding more rapidly due to factors such as improved healthcare infrastructure, greater awareness of the importance of managing radiation-related side effects, and a growing emphasis on supportive oncology care. This is especially true in emerging economies, where access to cancer treatment is improving.

In addition, the radiotherapy-induced nausea and vomiting treatment market is anticipated to gain from ongoing developments in radiation therapy and pharmaceutical technology that aims to improve effectiveness and lessen side effects. Furthermore, favorable reimbursement policies in developed nations and regulatory support for comprehensive cancer care are having a positive impact on market dynamics. Additionally, manufacturers are focusing more on long-acting formulations and combination medicines suited to certain patient risk profiles, reflecting a move toward individualized supportive care. However, the radiotherapy-induced nausea and vomiting treatment market is constrained by factors such as the low prevalence of severe side effects brought on by precision radiation procedures, the availability of generic antiemetic medications, and financial strains on healthcare systems.

Driver

Rising Incidence of Cancer Worldwide

The radiotherapy-induced nausea and vomiting treatment market is significantly influenced by the rising incidence of cancer worldwide. According to the Cancer Research UK, there were 18.1 million new instances of cancer worldwide in 2020, and by 2040, that number is expected to increase to 28 million. This rising incidence calls for more frequent and expensive cancer treatments, such as radiation therapy, which is known to frequently cause nausea and vomiting as side effects. Additionally, the need for efficient RINV management is anticipated to rise as cancer incidence rates rise, especially among these younger populations. In order to address the side effects of cancer therapies, such as radiation therapy, which is still a mainstay of cancer treatment, it is imperative that treatment alternatives continue to evolve. Therefore, the need for efficient radiotherapy-induced nausea and vomiting treatment to control these side effects and guarantee patient comfort and adherence to life-saving radiation procedures is growing along with the increase of cancer patients.

Restrain/Challenge

Negative Side Effects of Antiemetic Medications

The negative side effects of antiemetic medications provide a serious obstacle to the radiotherapy-induced nausea and vomiting treatment market expansion. These medications, which are mostly 5-HT3 receptor antagonists like granisetron and ondansetron, are frequently used to treat radiation-induced nausea and vomiting. Even while these medications are good at reducing vomiting, they can cause headaches, constipation, and exhaustion, which can have a negative impact on patient comfort and compliance. The side effects of antiemetic medications frequently result in other issues such as electrolyte imbalances and dehydration, which makes treating these symptoms especially difficult. Additionally, the high frequency of nausea and the possibility of serious side effects from the therapies highlight the need for improvements in RINV management techniques that can provide relief with fewer negative consequences. This requirement has a direct effect on the market since it restricts the use of currently available therapies and emphasizes the need for new therapeutic approaches.

The Serotonin (5-HT3) receptor antagonists category held the largest share in the radiotherapy-induced nausea and vomiting treatment market in 2025. Serotonin-mediated transmission from the gastrointestinal tract to the central nervous system is blocked by drugs such as ondansetron, granisetron, tropisetron, and palonosetron. This is a crucial mechanism in chemotherapy and radiation-induced vomiting. These medications are far more successful than metoclopramide or phenothiazines in clinical trials for RINV; some studies have reported perfect control of vomiting after fractionated abdominal irradiation of up to 97%. Additionally, 5 HT3 receptor antagonists are consistently recommended by worldwide guidelines as first-line prophylactics for moderate and high-risk radiation regimens, sometimes in conjunction with dexamethasone, guaranteeing their widespread usage in both hospital and outpatient settings.

In 2025, the hospitals category dominated the radiotherapy-induced nausea and vomiting treatment market because hospitals continue to be the principal location for cancer patients undergoing radiation treatment. The rise in cancer diagnoses and radiotherapy treatments administered in hospital settings is the primary driver of this trend, as it increases the need for antiemetic drug stocking and dispensing on-site. Integrated care pathways that prioritize prompt management of treatment-related side effects are advantageous to hospital pharmacists because they let doctors to promptly access and administer the proper RINV treatments. Further encouraging expansion is the fact that hospitals frequently have stronger reimbursement policies and more purchasing power for more recent and combination antiemetic medications.

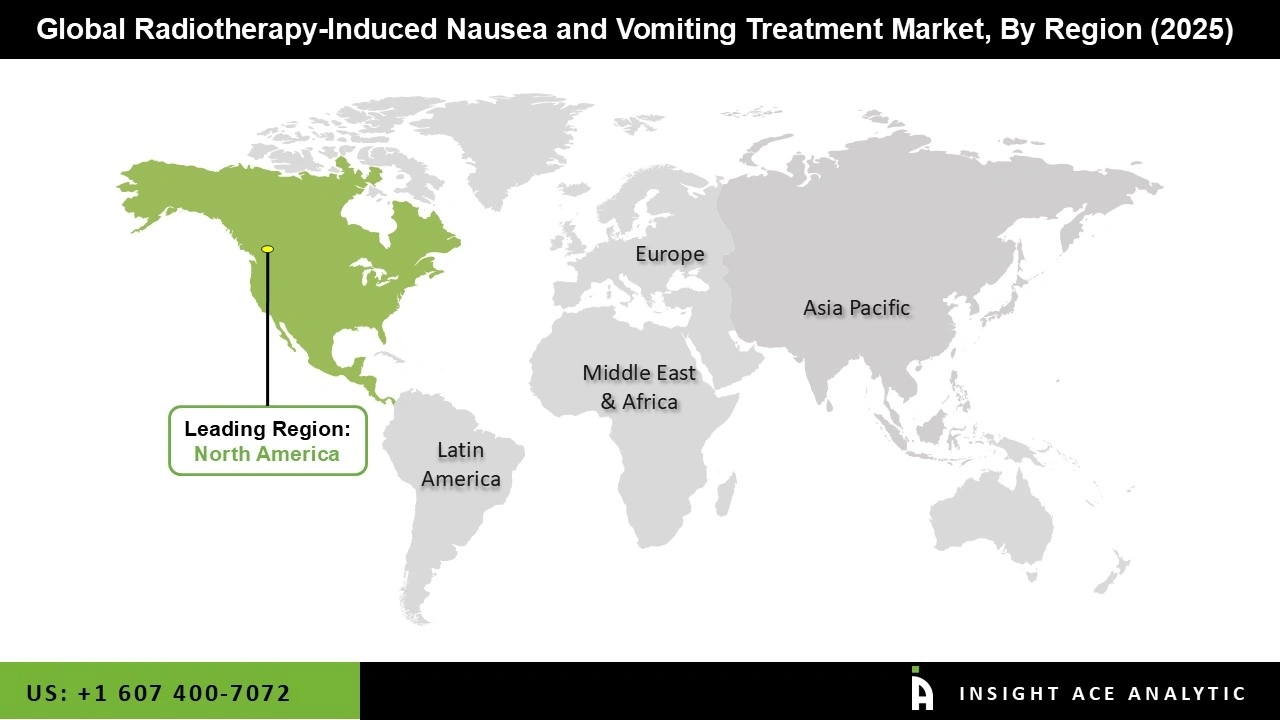

The radiotherapy-induced nausea and vomiting treatment market was dominated by North America region in 2025. Effective antiemetic treatments are in high demand in the US and Canada due to the high incidence of cancer and extensive usage of radiation. Additional factors supporting market expansion include a robust healthcare infrastructure, convenient access to cutting-edge drugs, and established clinical procedures for supportive cancer care.

Furthermore, advantageous reimbursement rules, higher provider understanding of managing treatment side effects, and continued research and development in antiemetic medications all contribute to the radiotherapy-induced nausea and vomiting treatment market penetration. Additionally, well-known American pharmaceutical companies encourage both new research and broader access to treatments that combat nausea. All of these factors work together to make North America a prominent and expanding radiotherapy-induced nausea and vomiting treatment market.

• June 2025: Zyprexa (olanzapine) in combination with standard antiemetics safely and effectively prevented radiation-induced nausea and vomiting (RINV) in patients who received abdominal or pelvic radiotherapy or concurrent chemoradiation with low emetogenic oral capecitabine, according to results from a phase 3 placebo-controlled trial presented at the 2025 ASCO Annual Meeting.

• March 2023: For about $1.35 billion, Merck announced a major acquisition of Imago BioSciences, Inc. This purchase is a component of Merck's plan to expand its pipeline, which includes cancer medicines that may be related to supportive care, such as the treatment of illnesses brought on by radiation therapy.

| Report Attribute | Specifications |

| Market size value in 2025 | USD 3.21 Bn |

| Revenue forecast in 2035 | USD 5.66 Bn |

| Growth Rate CAGR | CAGR of 6.0% from 2026 to 2035 |

| Quantitative Units | Representation of revenue in US$ Bn and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2025 |

| Forecast Year | 2026-2035 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | Drug Type, Treatment Type, Distribution Channel, and By Region |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; The UK; France; Italy; Spain; China; Japan; India; South Korea; Southeast Asia; South Korea; Southeast Asia |

| Competitive Landscape | Novartis AG, Pfizer Inc., Sanofi S.A., Teva Pharmaceutical Industries Ltd., GlaxoSmithKline plc, Unimed Pharmaceuticals (AbbVie), Merck & Co., Inc., Cipla Ltd., Mylan (Viatris), Dr. Reddy's Laboratories Ltd., Qilu Pharma, Taiji Group, Helsinn Group, Heron Therapeutics Inc., Kyowa Kirin Co., Ltd., Eisai Co., Ltd., Aurobindo, F. Hoffmann-La Roche Ltd., and Pharma Ltd. |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Geographic competitive landscape. |

| Pricing and Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.