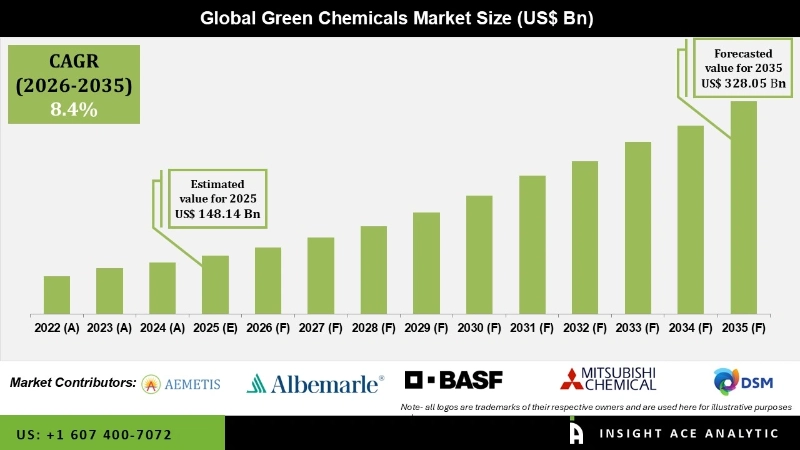

Green Chemicals Market Size is valued at 148.14 billion in 2025 and is predicted to reach 328.05 billion by the year 2035 at a 8.4% CAGR during the forecast period for 2026 to 2035.

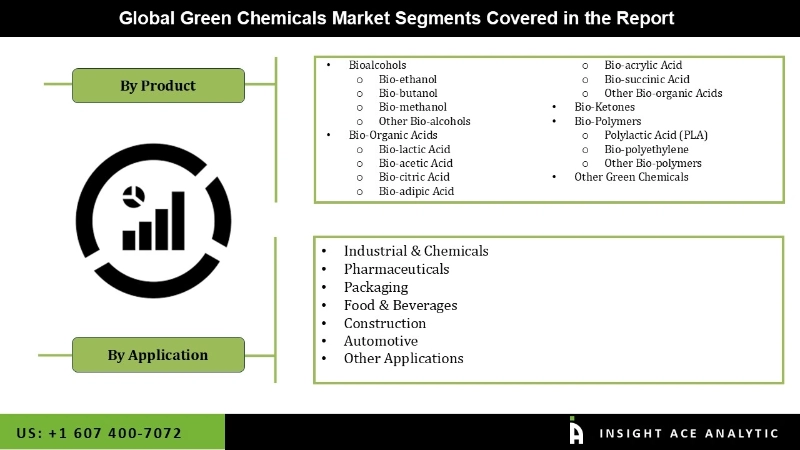

Green Chemicals Market Size, Share & Trends Analysis Report By Type (Bio-alcohols, Bio-polymers, Bio-organic acids, Bio-ketones), Application (Industrial & Chemical, Food & Beverages, Pharmaceuticals, Packaging, Construction, Automotive), By Region, And Segment Forecasts, 2026 to 2035.

Green chemicals are essential as they are intended to limit or eliminate the use or generation of hazardous compounds. Other chemical goods are being commercialized as a result of rising demand for greener products, a growing need for cost-effective processing, lower feedstocks, and new product channels.

Recently, the growing acceptability of packaging materials derived from renewable sources, such as animal and plant waste, has resulted in a significant expansion in the business. This has much to do with the environmental benefits of bio-based packaging, such as non-toxicity, the use of fewer raw materials in manufacturing, cheap production costs, and proper disposal.

However, the outbreak of COVID-19 in 2020 had a negative influence on the area market. Nonetheless, the start of vaccination programs resulted in a drop in COVID-19 infections in H3 2021. As a result, the region's lockdown limitations were lifted, and business operations resumed. Throughout the projected period, such factors are expected to drive the regional green chemicals market.

The green chemicals market is segmented on the basis of product and application. Based on product, the market is further segmented as alcohols, bio-organic acids, bio-ketones, bio-polymers, and other green chemicals. The alcohol segment includes bio-ethanol, bio-butanol, bio-methanol, and other bio-alcohols. By bio-organic acids, the market is segmented into bio-lactic acid, bio-acetic acid, bio-citric acid, bio-adipic acid, bio-acrylic acid, bio-succinic acid, and other bio-organic acids. The bio-polymers segment includes polylactic acid (PLA), bio-polyethylene, and other bio-polymers. The applications segment includes industrial & chemicals, pharmaceuticals, packaging, food & beverages, construction, automotive, and other applications.

The bio-alcohols category is expected to hold a considerable share of the global green chemicals market in 2024, owing to its consistent performance, higher production, and enhanced sustainability. Because of the environmental impact of conventional organic acids, the demand for bio-based organic acids is gradually increasing. Organic acid is increasingly being generated from renewable sources such as feedstock to address this expanding demand. Organic acids, which typically contain at least one carboxyl group, are extremely versatile substances with several applications in industries such as consumer products, food and beverage, pharmaceuticals, and chemicals.

The packaging segment is projected to grow rapidly in the global green chemicals market. Packaging produced from renewable materials and plant byproducts such as corn flour or sugarcane is environmentally beneficial. Cornstarch-based packaging, in particular, has seen a boom in interest over the last decade, owing to its eco-friendliness and recyclable nature, which accounts for a sizable market share.

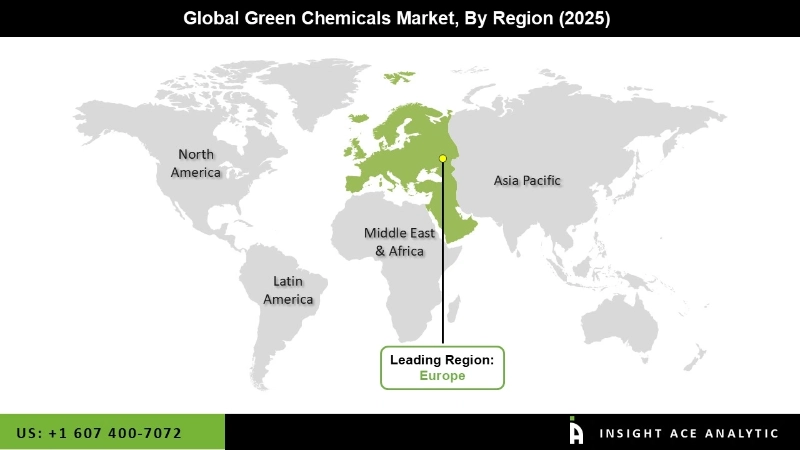

Europe's green chemicals market is expected to register the highest market share in revenue in the near future, owing to the region's growing number of thriving automotive manufacturers, which is promoting the use of green chemicals. Because of the advent of low-cost and abundant feedstock, a shift in emphasis towards the use of ecologically sustainable goods, and the execution of several government initiatives, North America is predicted to expand faster than the rest of the globe.

The EPA implemented encouraging regulations for the use of bio-based chemicals in the United States, which is projected to boost demand for bio-based chemicals in North America. Brazil is the world's second-largest producer of green chemicals after China.

| Report Attribute | Specifications |

| Market size value in 2025 | USD 148.14 Bn |

| Revenue forecast in 2035 | USD 328.05 Bn |

| Growth rate CAGR | CAGR of 8.4% from 2026 to 2035 |

| Quantitative units | Representation of revenue in US$ Billion, Volume (KT) and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2024 |

| Forecast Year | 2026-2035 |

| Report coverage | The forecast of revenue, the position of the company, the competitive market statistics, growth prospects, and trends |

| Segments covered | Product And Application |

| Regional scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; The UK; France; Italy; Spain; South Korea; Southeast Asia |

| Competitive Landscape | Cargill, Incorporated (U.S.), Mitsubishi Chemical Holdings Corporation (Japan), BASF SE (Germany), DuPont de Nemours, Inc. (U.S.), Koninklijke DSM N.V. (Netherlands), Evonik Industries AG (Germany), SECOS Group Ltd (Australia), Braskem SA (Brazil), Aemetis, Inc. (U.S.), and Albemarle Corporation (U.S.), among others. |

| Customization scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing and available payment methods | Explore pricing alternatives that are customized to your particular study requirements. |

Green Chemicals Market By Product-

Green Chemicals Market By Application-

Green Chemicals Market By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.