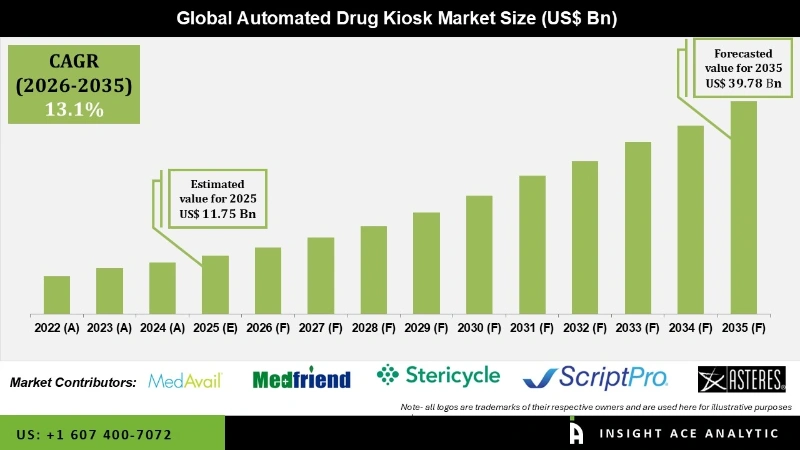

Automated Drug Kiosk Market Size is valued at USD 11.75 Bn in 2025 and is predicted to reach USD 39.78 Bn by the year 2035 at a 13.1% CAGR during the forecast period for 2026 to 2035.

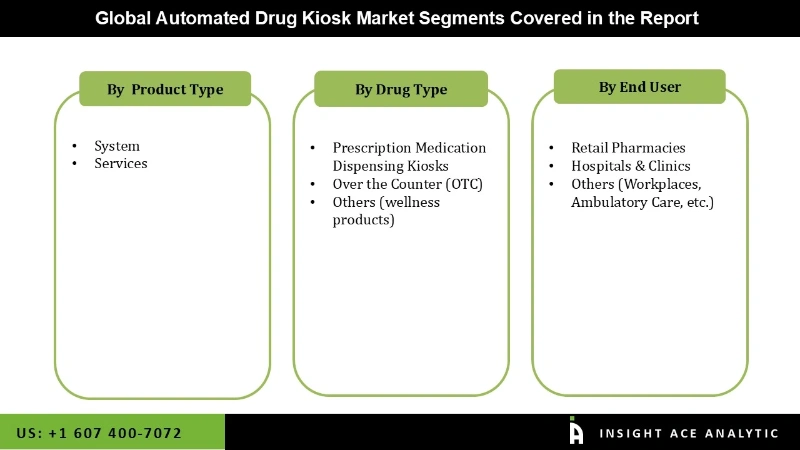

Automated Drug Kiosk Market Size, Share & Trends Analysis Report By Product Type (System, Services), By Drug Type (Prescription Medication Dispensing Kiosks, Over-the-Counter (OTC), Others (wellness products)), By End-User (Retail Pharmacies, Hospitals & Clinics, Others (workplaces, ambulatory care, etc.)), By Region, And By Segment Forecasts, 2026 to 2035

Automated drug kiosks are a novel method of updating the pharmacy experience, providing advantages in terms of accessibility, efficiency, and patient contentment. With the progression of technology, it is probable that these kiosks will become more prevalent, leading to a greater alteration of the pharmaceutical dispensing environment. The development of the global automated drug kiosk market is projected to be propelled by the compelling economics of these systems. They offer heightened efficiency in medication dispensing, significantly saving pharmacists' time and thus fostering demand for automated drug kiosks in the foreseeable future. Also, these systems are Equipped with features such as facial recognition, medication image capture, biometrics, and barcode readers. These systems offer automated functionalities like insurance verification, prescription validation, remote insurance processing, labelling, vial capping, and backend data collection.

Additionally, the incorporation of these features enhances efficiency while substantially reducing reimbursement fraud and medication errors. These advantages are anticipated to impact the global automated drug kiosk market favourably. Moreover, the proliferation of automated drug kiosks may need more support from traditional brick-and-mortar pharmacies, which view these kiosks as potential competitors. Established pharmacies may lobby against the expansion of automated drug kiosks, leading to regulatory challenges and market entry barriers for kiosk operators.

The Automated drug kiosk market is segmented on the basis of product and application. Based on product, the automated drug kiosk market is segmented as Systems and Services. By drug type, the market is segmented into prescription medication dispensing kiosks, Over-the-counter (OTC), and other applications; the market is segmented into hospitals, retail pharmacies, and others.

It is anticipated that the service sector will command a substantial portion of the global Automated Drug Kiosk market in 2022. Service providers play a significant role by offering consulting services aimed at assisting healthcare facilities in evaluating their medication dispensing requirements and tailoring automated drug kiosk solutions accordingly. This involves conducting site assessments, identifying workflow needs, and suggesting the most suitable kiosk configurations. Through close collaboration with clients, service providers customize solutions to align with operational objectives and improve efficiency. By delivering consulting and customization services, service providers distinguish themselves in the market and capture a larger portion of the revenue.

The hospital's care segment is projected to grow at a rapid rate in the global Automated drug kiosk market. Hospitals are often busy environments where healthcare professionals need to prioritize patient care. Automated drug kiosks help streamline the medication dispensing process, allowing hospital staff to focus on other critical tasks while patients can independently collect their medications. Automated drug kiosks provide a convenient way for patients to access medications without having to wait in long lines at the hospital pharmacy. This is especially beneficial for patients who are discharged and need to quickly obtain their prescribed medications before leaving the hospital.

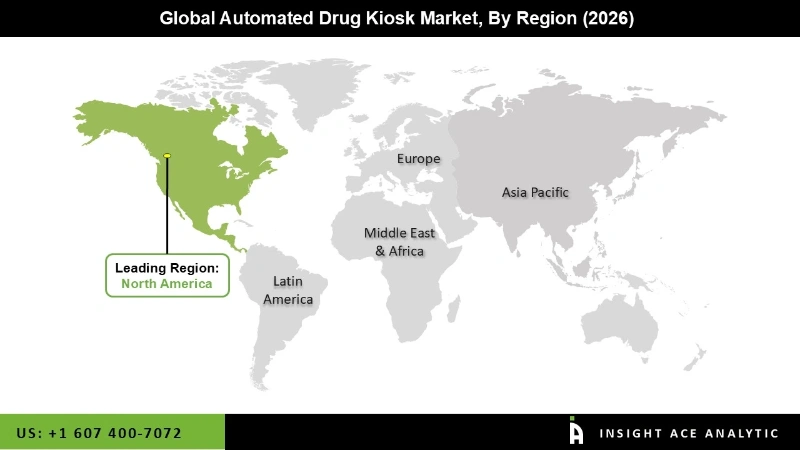

The North American automated drug kiosk market is expected to record a large market revenue share in terms of revenue in the near future. The increasing cost of healthcare in North America has led to a growing emphasis on cost containment and efficiency improvement measures. Automated drug kiosks offer a cost-effective solution for medication dispensing, reducing the need for manual labour and streamlining the workflow process.

In addition, the Asia Pacific regional market is estimated to expand at a rapid rate in the global Automated drug kiosk market. Emerging economies in Asia-Pacific, including China and India, present significant opportunities for automated drug kiosk manufacturers. These countries are witnessing the rapid development of healthcare systems and the rising adoption of digital health technologies, creating a favourable market environment for automated drug kiosk deployment.

| Report Attribute | Specifications |

| Market Size Value In 2025 | USD 11.75 Bn |

| Revenue Forecast In 2035 | USD 39.78 Bn |

| Growth Rate CAGR | CAGR of 13.1% from 2026 to 2035 |

| Quantitative Units | Representation of revenue in US$ Bn and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2024 |

| Forecast Year | 2026 to 2035 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Product Type, Drug Type And End-User |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; France; Italy; Spain; Southeast Asia; South Korea |

| Competitive Landscape | MedAvail Technoogies Inc., MedfriendRx, Stericycle Inc., ScriptPro LLC, Howell LL, Smart RX Systems, PickPoint, MC HealthGrid Pvt Ltd., Asteres Inc., Distributed Delivery Networks Corp., TES America LLC, Amerisource Bergen Corporation, Accu Chart Plus Healthcare Systems, Inc., Omnicell, Inc. and other market players |

| Customization Scope | Free customization report with the procurement of the report and modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing And Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

Automated Drug Kiosk Market By Product Type-

Automated Drug Kiosk Market By Drug Type

Automated Drug Kiosk Market By End-User-

Automated Drug Kiosk Market By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.