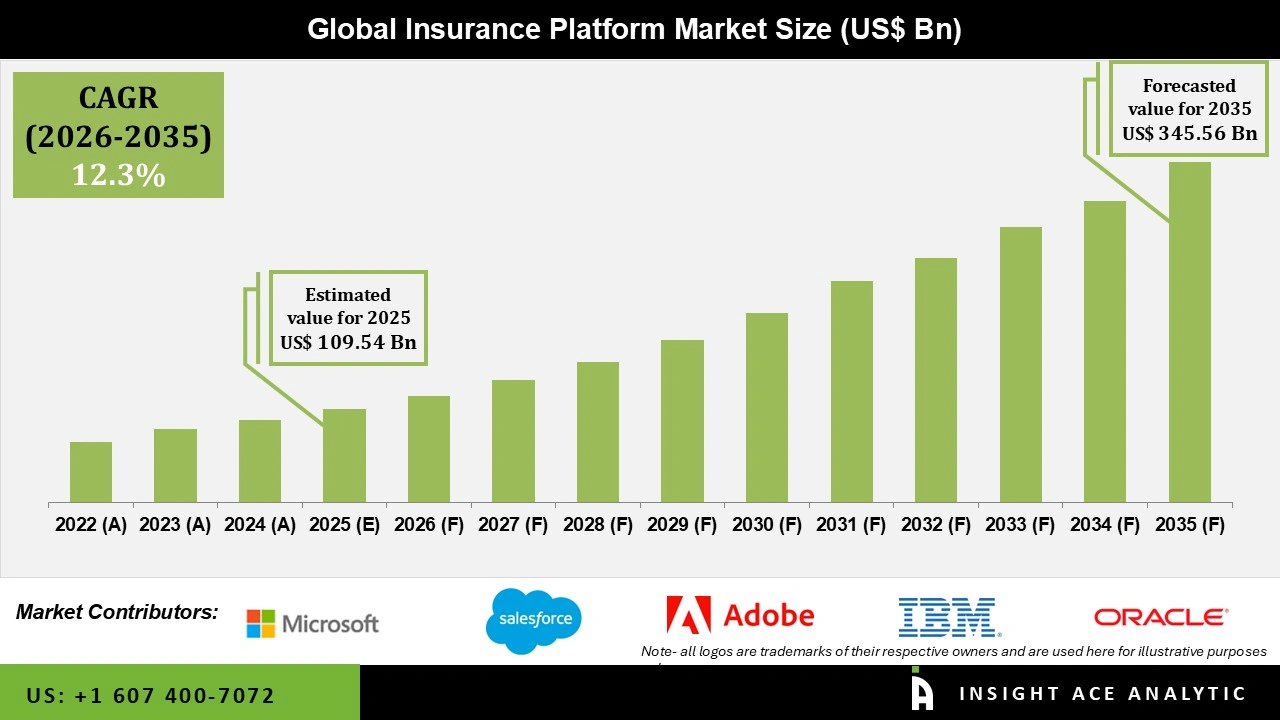

Global Insurance Platform Market Size is valued at USD 109.54 Bn in 2025 and is predicted to reach USD 345.56 Bn by the year 2035 at a 12.3% CAGR during the forecast period for 2026 to 2035.

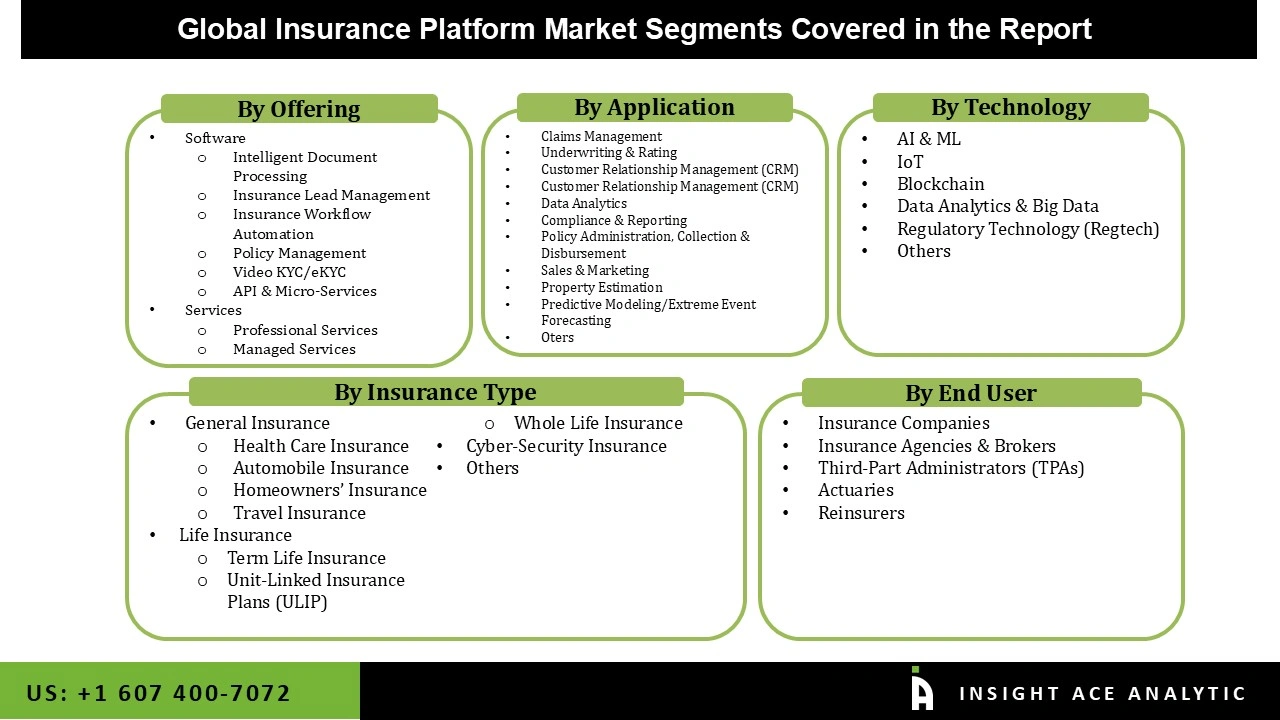

Insurance Platform Market Size, Share & Trends Analysis Report By Offering (Software, Services), By Application, By Insurance Type, By Technology, By End-User, By Region, and By Segment Forecasts, 2026 to 2035

The insurance platform is a set of websites that offer information on insurance products as well as other pertinent information. The Digital insurance platform, in particular, is designed to assist consumers in preparing for the problems provided by rapidly growing technology as it enters the insurance sector. A digital insurance platform is software or technology that helps companies monitor, create, manage, and regulate the digital insurance ecosystem. It helps firms integrate digitization into the insurance process. The growing deployment of IoT products is driving the digital insurance platform industry. The increased use of underwater acoustic modems in naval defence is a major factor driving market expansion. The shifting focus of insurers from product-based to consumer-centric strategies is increasing demand for digital insurance platform equipment.

However, the COVID-19 pandemic had a tremendous impact on the insurance business, notably insurance platforms, due to changes in consumer behaviour, economic constraints, and the need for creative solutions to handle emerging risks. Insurance platforms encountered difficulties resolving these claims, resulting in legal conflicts and discussions over policy wordings relating to pandemic-related losses.

The Insurance Platform Market is segmented on the basis of offering application. Insurance type, technology, and end-user. According to offering segment, the market is divided into software and services. Based on software segment, the market is segmented as intelligent document processing, insurance lead management, insurance workflow automation, policy management, Video KYC/eKYC, API & micro-services, and others. As per the services, the market is segmented as professional services and managed services.

The application segment includes claims management, underwriting & rating, customer relationship management (CRM), billing & payments, data analytics, Compliance & reporting, policy administration, collection & disbursement, sales & marketing, property estimation, predictive modelling/extreme event forecasting, and others. By insurance type, the market is segmented into general insurance, life insurance, cyber-security insurance, and others. The technology segment includes AI & ML, IoT, blockchain, data analytics & big data, regulatory technology (regtech), and others. By end-user, the market is segmented into insurance companies, insurance agencies & brokers, third-party administrators (TPAs), actuaries, and reinsurers.

The software category will hold a major share of the global Insurance Platform Market in 2024. The insurance platform market's software segment contains a variety of software solutions that cater to the needs of the insurance business. These solutions are intended to simplify and automate many operations, resulting in enhanced efficiency, lower costs, and higher customer satisfaction. It includes a variety of critical processes that are essential to the operations of an insurance company. Policy issuance and renewal are fundamental to policy administration. This entails creating and maintaining insurance policies for customers. It ensures that policies are issued accurately and renewed seamlessly, facilitating smooth interactions with policyholders.

The actuaries segment is projected to grow at a rapid rate in the global Insurance Platform Market. Actuaries are an important end-user group in the insurance platform market. Actuaries play an important role in the insurance sector by analyzing and managing risk, defining price structures, and assuring an insurance company's financial viability.

Insurance platforms provide advanced tools and data analytics capabilities to actuaries, allowing them to generate precise risk evaluations and model numerous scenarios. As the insurance landscape changes due to shifting rules and developing hazards, actuaries rely on modern platforms to negotiate complexities, optimize financial performance, and ensure insurance carriers' long-term survival.

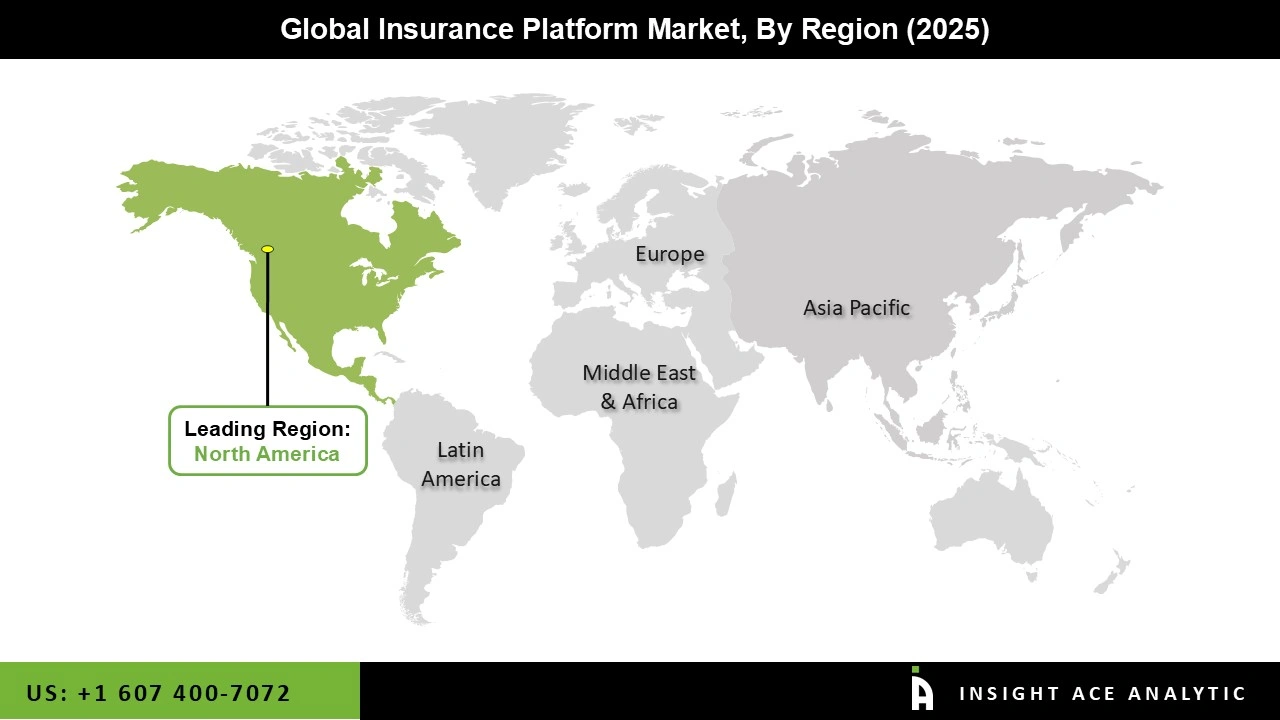

The North America Insurance Platform Market is expected to register the maximum market share in revenue in the near future. The insurance platform market in North America is at the forefront of technology innovation and transformation in the global insurance business. This region has developed as a hub for pioneering insurance technology solutions, spanning a broad and diverse geographical terrain encompassing the United States and Canada.

North America is a dynamic market where established insurers and insurtech disruptors are converging to reinvent how insurance goods and services are supplied and consumed. Asia-Pacific is predicted to grow during the projection period as commercial investment by various sectors increases.

| Report Attribute | Specifications |

| Market Size Value In 2025 | USD 109.54 Bn |

| Revenue Forecast In 2035 | USD 345.56 Bn |

| Growth Rate CAGR | CAGR of 12.3% from 2026 to 2035 |

| Quantitative Units | Representation of revenue in US$ Bn and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2024 |

| Forecast Year | 2026 to 2035 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | Offering, Application, Insurance Type, Technology, End-user |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico ; France; Italy; Spain; South Korea; South East |

| Competitive Landscape | Microsoft (US), Adobe (US), Salesforce (US), IBM (US), Oracle (US), SAP (Germany), Pegasystems (US), Accenture (Ireland), DXC Technology (US), Guidewire Software (US), Duck Creek Technologies (US), Applied Systems (US), Fineos (Ireland), Cognizant (US), Appian (US), LTIMindtree (India), Prima Solutions (France), Majesco (US), EIS Group (US), Cogitate Technology Solutions (US), Vertafore (US), Sapiens International Corporation (Israel), Bolt Insurance (US), Inzura (UK), Britecore (US), Shift Technology (France), Zipari (US), Qauntemplate (US), PerfectQuote (US), Outsystems (US), Zywave (US), Socotra (US), InsuredMine (US), InsuredHQ (New Zealand), CodeMetro (US), AgencySmart (US), and OneShield (US). |

| Customization Scope | Free customization report with the procurement of the report and modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing And Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.