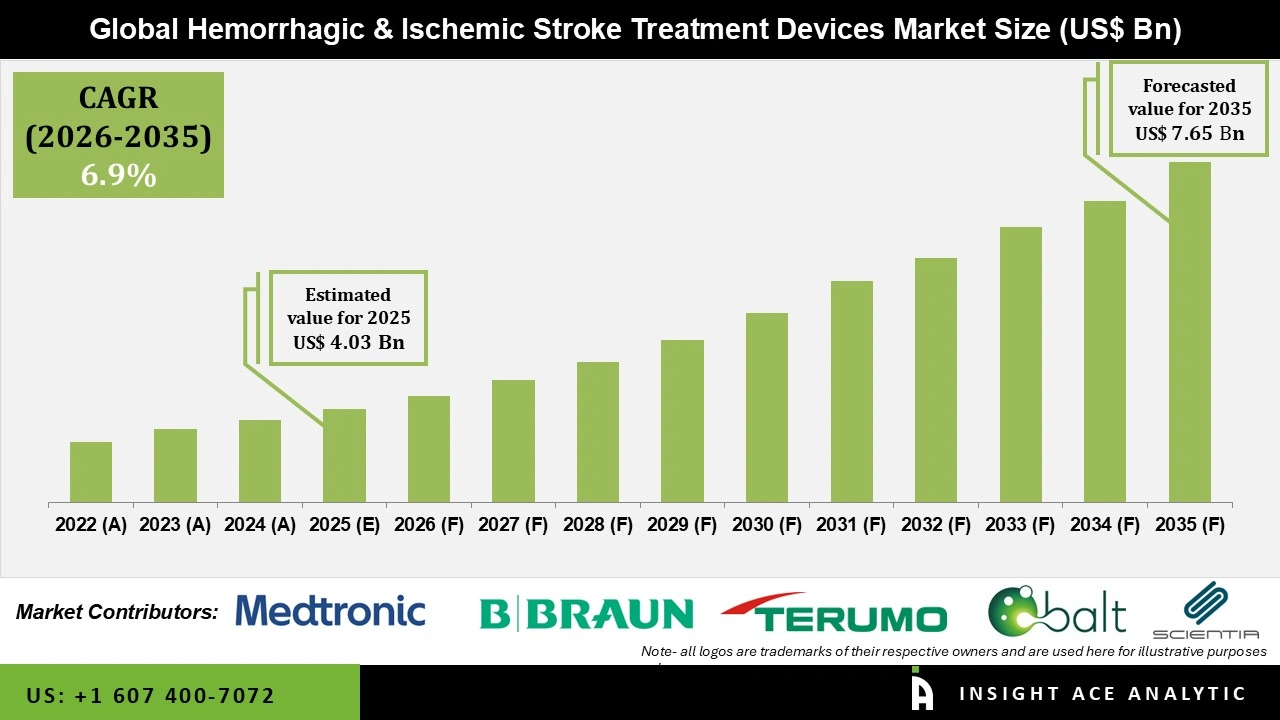

Global Hemorrhagic and Ischemic Stroke Treatment Devices Market Size is valued at USD 4.03 Bn in 2025 and is predicted to reach USD 7.65 Bn by the year 2035 at a 6.8% CAGR during the forecast period for 2026 to 2035.

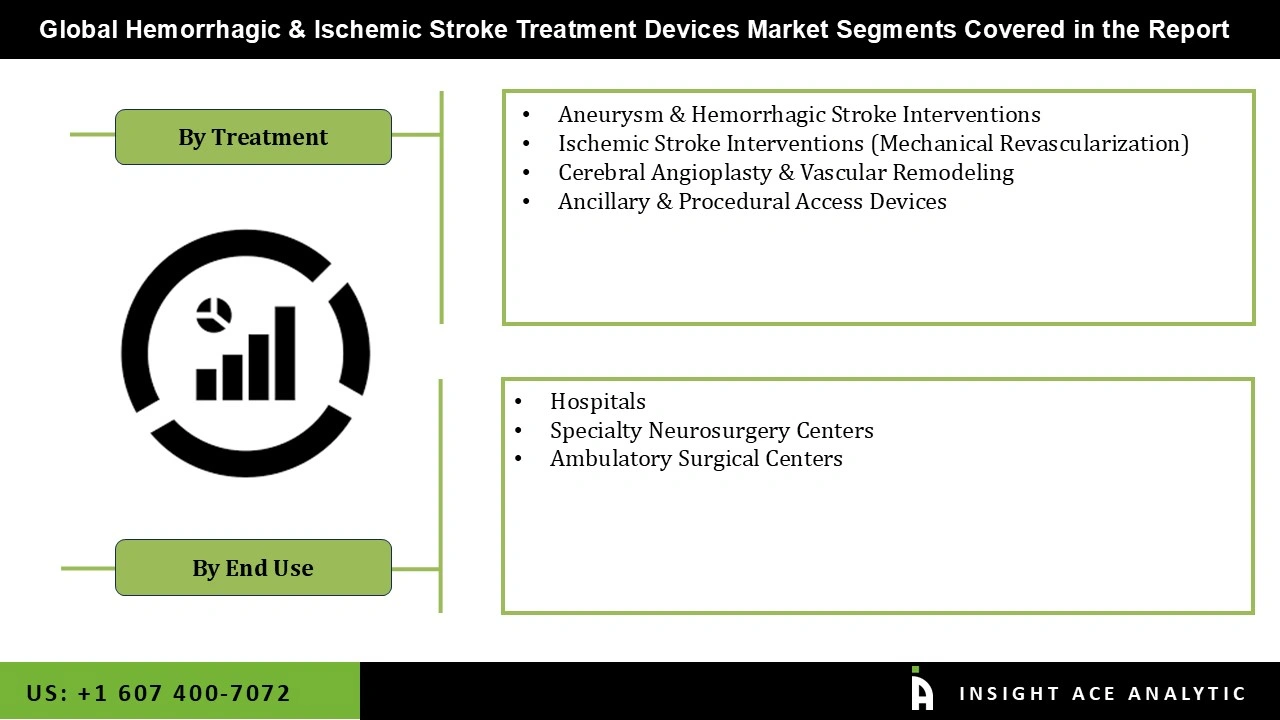

Hemorrhagic and Ischemic Stroke Treatment Devices Market Size, Share & Trends Analysis Distribution by Treatment (Aneurysm & Hemorrhagic Stroke Interventions (By Device [Embolization Coiling Systems {Coated / Bioactive Coils, Bare Platinum Coils}, Intrasaccular Flow Disruption Devices {Woven EndoBridge (WEB), Luna Aneurysm Embolization System, Contour Neurovascular System}, Flow Diversion Systems {Next-Generation / Surface-Modified Flow Diverters, Standard Flow-Diverting Stents (e.g., Pipeline)}, Liquid Embolization Agents {Adhesive Liquid Embolics (NBCA), Non-Adhesive Liquid Embolics (Onyx, Squid, PHIL)}, By Indication [Intracranial Aneurysm, AVM & AVF Embolization, cSDH (MMA Embolization)]), Cerebral Angioplasty & Vascular Remodeling (Balloon Angioplasty Systems, Coil-Assisted Adjunctive Devices (Balloon-assisted and stent-assisted), Intracranial & Carotid Stenting Systems), Ischemic Stroke Interventions (Mechanical Revascularization) (Aspiration-Based Thrombectomy Systems, Stent Retriever Systems), and Ancillary & Procedural Access Devices (Microcatheters, Guiding & Distal Access Catheters, Access Sheaths & Wires)), By End-user, By Region and Segment Forecasts, 2026 to 2035.

The hemorrhagic and ischemic stroke treatment devices are a wide range of medical devices intended to limit brain damage, control bleeding, restore blood flow, and enhance patient outcomes after various stroke types. By enabling prompt, targeted therapy, decreasing disability, and lowering mortality, these devices are essential to the care of acute stroke, and continuous technical improvements continue to enhance their accessibility, safety, and efficacy. These devices serve as the technological foundation for contemporary neurointerventional care, facilitating quicker diagnosis, accurate treatment, and better functional outcomes. The hemorrhagic & ischemic stroke treatment devices market is expanding as a result of the increased prevalence of hemorrhagic & ischemic stroke due to lifestyle-related risk factors like diabetes and hypertension, as well as the aging of the world's population.

The patients and healthcare professionals are adopting more modern treatment options, including minimally invasive endovascular treatments, as a result of growing awareness of the significance of prompt diagnosis and intervention. Additionally, the broader adoption of mechanical thrombectomy systems, embolization devices, and intracranial pressure management technologies is being supported by advancements in healthcare infrastructure, growing networks of comprehensive stroke centers, and increased access to qualified neurointerventional specialists. Furthermore, hospitals can invest in cutting-edge stroke treatment equipment due to favorable reimbursement policies in a number of developed economies and growing healthcare spending, which is driving the hemorrhagic & ischemic stroke treatment devices market expansion.

In addition, because of ongoing technological developments and the creation of next-generation devices with improved safety, accuracy, and usability, the market offers substantial prospects. Clinical outcomes and procedure success rates are being improved by innovations such as enhanced imaging-guided navigation systems, flow diverters, high-efficiency aspiration catheters, and sophisticated stent retrievers. These developments create ideal conditions for long-term market expansion by enabling manufacturers to broaden their product offerings, improve their competitive posture, and meet unmet clinical needs. However, there are several obstacles that limit the hemorrhagic & ischemic stroke treatment devices market. The widespread adoption is hampered by high device and procedure costs, restricted access in low- and middle-income areas, and a lack of qualified neurointerventional specialists.

Driver

Rapidly Growing Aging Population

The hemorrhagic and ischemic stroke treatment devices market is expected to rise in the future due to an increase in hemorrhagic and ischemic stroke cases brought on by an aging population. The risk of both ischemic and hemorrhagic strokes is significantly increased in older persons due to disorders such as diabetes, hypertension, atrial fibrillation, and atherosclerosis. The demand for sophisticated treatment devices like mechanical thrombectomy systems, flow diverters, embolization coils, and intracranial pressure monitoring devices is being driven by the growing number of elderly people who require acute stroke intervention and long-term neurological care as life expectancy continues to rise globally. As a result, the hemorrhagic and ischemic stroke treatment devices market is expanding due to the aging population.

Restrain/Challenge

High Cost of Sophisticated Stroke Therapy

The high cost of sophisticated stroke therapy technologies and the infrastructure needed to employ them efficiently is a significant barrier to hemorrhagic and ischemic stroke treatment devices market. The utilization of intracranial monitoring equipment, embolization supplies, and mechanical thrombectomy systems is costly and frequently necessitates specialized facilities and highly qualified staff. Additionally, the hospitals find it challenging to invest in these technologies in many emerging and underdeveloped areas due to limited reimbursement coverage and healthcare budgets. This lowers market penetration generally and leads to unequal access to improved stroke care, especially in low- and middle-income nations where the incidence of stroke is rising quickly.

The Aneurysm & Hemorrhagic Stroke Interventions category held the largest share in the Hemorrhagic & Ischemic Stroke Treatment Devices market in 2025. The significant clinical urgency and intricacy of cerebral hemorrhage are what propel the hemorrhagic & ischemic stroke treatment devices market. Since these interventions are life-saving and necessitate specialist endovascular solutions, there is a strong demand for devices including coils, flow diverters, stents, and embolization systems, which supports segment leadership. Additionally, the segment's leading position in the market is reinforced by the increasing use of minimally invasive aneurysm repair techniques and better clinical outcomes.

In 2025, the hospitals category dominated the Hemorrhagic & Ischemic Stroke Treatment Devices market because they continue to be the major facilities for difficult surgical and endovascular procedures, advanced neuroimaging, and emergency stroke care. The rapid diagnosis and prompt treatment are essential for hemorrhagic stroke outcomes, and they are made possible by hospitals' concentration of specialized stroke units, neurosurgeons, and neurointerventional radiologists. Higher capital investment capacity, advantageous inpatient procedure reimbursement, and access to cutting-edge infrastructure have further strengthened hospitals' dominant position in comparison to other care settings.

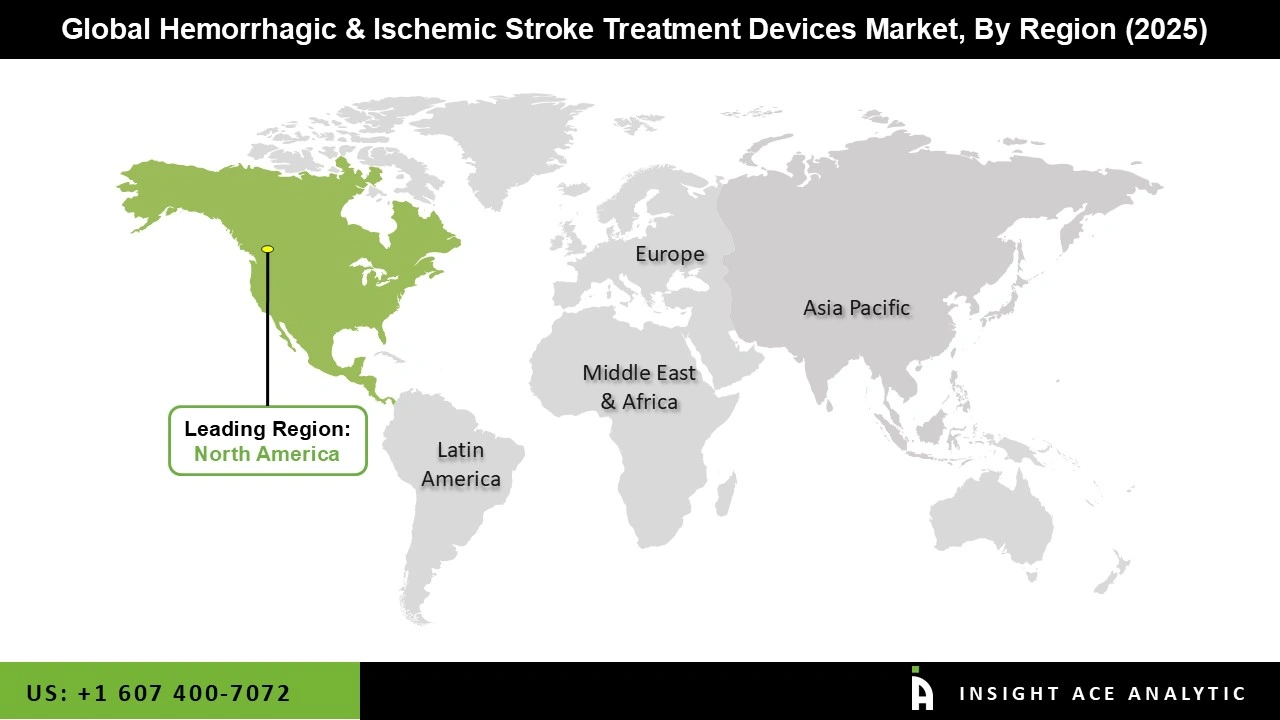

The Hemorrhagic & Ischemic Stroke Treatment Devices market was dominated by North America region in 2025, as a result of upgraded stroke care facilities using more minimally invasive and image-guided therapies. The hemorrhagic and ischemic stroke treatment devices adoption is being fueled by robust reimbursement support, a solid healthcare infrastructure, and widespread clinical approval.

Furthermore, the market expansion in the region is supported by ongoing product innovation and an increasing focus on quick, outcome-focused care. The increasing use of advanced endovascular and minimally invasive techniques in specialized stroke centers is driving the U.S. market for hemorrhagic and ischemic stroke treatment devices. Additionally, the adoption of hemorrhagic and ischemic stroke treatment devices is being accelerated in this region by cooperative clinical research and increasing investments in neurointerventional infrastructure.

| Report Attribute | Specifications |

| Market size value in 2025 | USD 4.03 Bn |

| Revenue forecast in 2035 | USD 7.65 Bn |

| Growth Rate CAGR | CAGR of 6.8% from 2026 to 2035 |

| Quantitative Units | Representation of revenue in US$ Bn and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2025 |

| Forecast Year | 2026-2035 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | Treatment, Age Group, Treatment Duration, End-user, Distribution Channel, and By Region |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; The UK; France; Italy; Spain; China; Japan; India; South Korea; Southeast Asia; South Korea; Southeast Asia |

| Competitive Landscape | Johnson & Johnson (MedTech), Medtronic, Scientia Vascular, Inc., MicroPort Scientific Corporation, phenox GmbH (Wallaby Medical), Acandis GmbH, B. Braun SE, Terumo Corporation, Balt, Integra LifeSciences, Infinity Neuro LLC, Stryker, Peter LAZIC GmbH, Vesalio Inc., Penumbra, Inc., and Boston Scientific Corporation |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Geographic competitive landscape. |

| Pricing and Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.