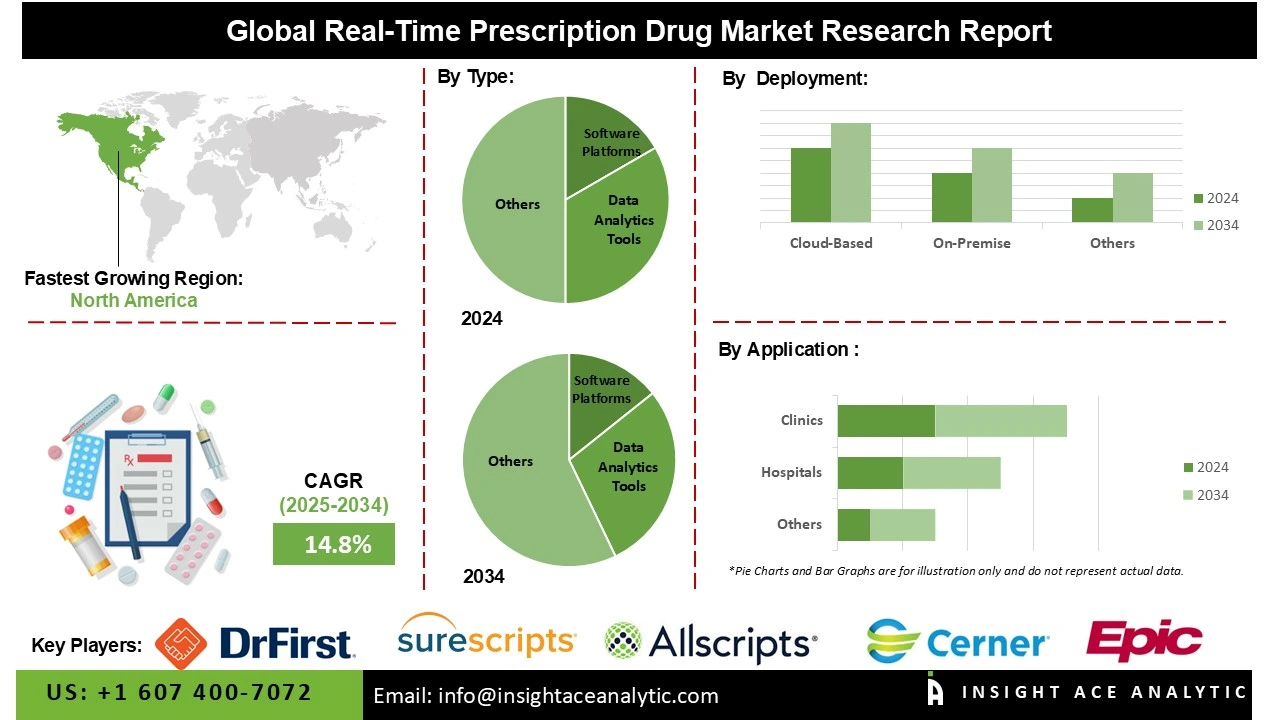

Global Real-Time Prescription Drug Market Size is predicted to grow at an 14.8% CAGR during the forecast period for 2025 to 2034.

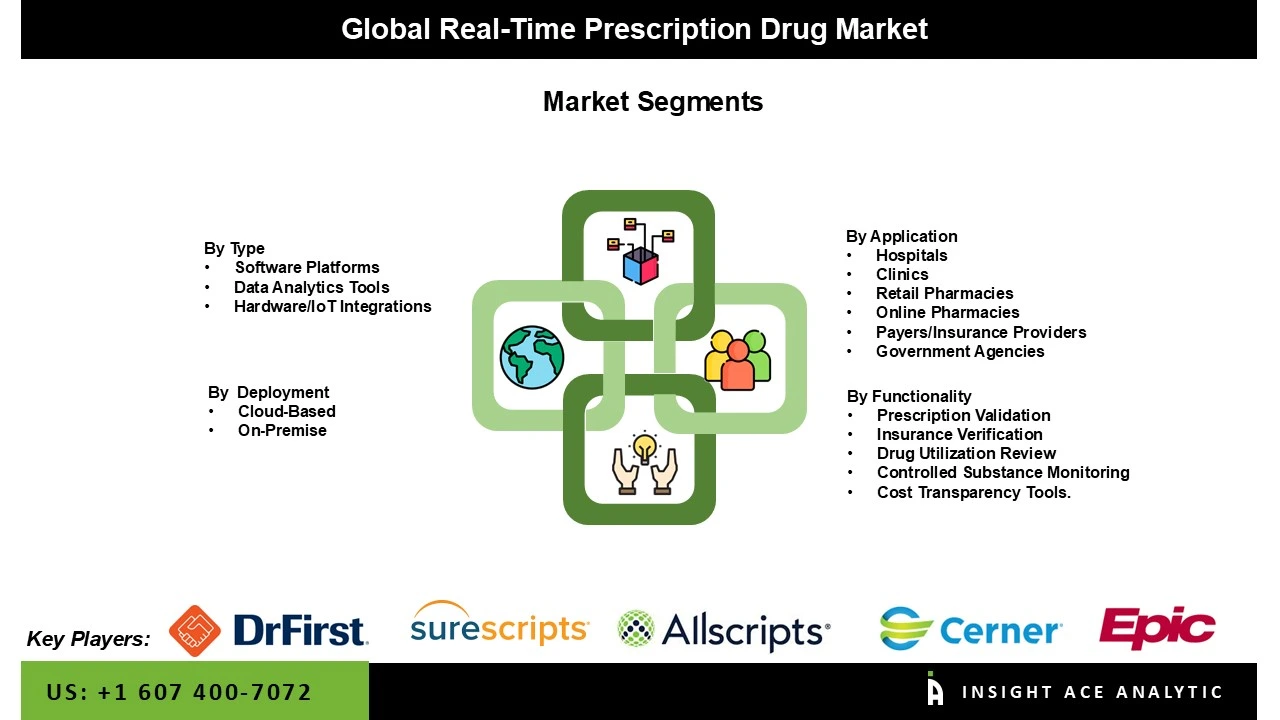

Real-Time Prescription Drug Market Size, Share & Trends Analysis Distribution by Type (Software Platforms, Data Analytics Tools, and Hardware/IoT Integrations), by Application (Hospitals, Clinics, Retail Pharmacies, Online Pharmacies, Payers/Insurance Providers, and Government Agencies), by Functionality (Prescription Validation, Insurance Verification, Drug Utilization Review, Controlled Substance Monitoring, and Cost Transparency Tools), by Deployment Mode (Cloud-Based and On-Premises), and Segment Forecasts, 2025 to 2034

With integrated Digital networks linking doctors, pharmacists, insurers, and patients, prescriptions are recorded, validated, and monitored promptly. This revolutionary idea in healthcare is known as "real-time prescription drug. Real-time prescription monitoring minimises the risk of overprescribing, fraudulent activity, and misuse of opioids by allowing immediate assessment of the availability of the drug, appropriate dosage, eligibility for insurance coverage, and patient eligibility, particularly compared with traditional systems that involve delays, duplications, or abuse.

At the point of care, it also delivers decision-support tools for clinicians that assess the likelihood of drug interactions and detect adherence issues, while adding transparency for all stakeholders. The global market for real-time prescription drugs is expanding due to the rising incidence of chronic diseases, increasing demand for cost transparency, the significant adoption of electronic prescribing, and technological advances that enable real-time access to prescription information for improved patient care.

The rising incidence of chronic disease is another element propelling the real-time prescription drug market. The rising incidence of chronic diseases increases the need for continuous medication management, adherence monitoring, and cost transparency, driving demand for real-time prescription drug systems that optimise prescribing decisions and improve patient outcomes. However, interoperability challenges with existing EHR and pharmacy systems, along with high implementation costs are some of the obstacles hindering the growth of the real-time prescription drug sector. Over the course of the forecast period, specific advancements in AI, cloud computing, and analytics are expected to create opportunities for the real-time prescription drug market, enabling innovative and cost-effective medication management solutions.

Some of the Key Players in Real-Time Prescription Drug Market:

· Surescripts

· Express Scripts

· CVS Caremark

· OptumRx

· Prime Therapeutics

· Molina Healthcare

· Dosespot

· Arrive Health

· CenterX

· McKesson

· Capital Rx

· eHealth NSW

· Bp Software

· Best Practice Software

· everyLIFE Technologies

The real-time prescription drug market is segmented by type, application, functionality, and deployment mode. By type, the market is segmented into software platforms, data analytics tools, and hardware/iot integrations. By application, the market is segmented into hospitals, clinics, retail pharmacies, online pharmacies, payers/insurance providers, and government agencies. By functionality, the market is segmented into prescription validation, insurance verification, drug utilization review, controlled substance monitoring, and cost transparency tools. By deployment mode, the market is segmented into cloud-based and on-premises.

In 2024, software platforms lead the real-time prescription medicine market. This convergence is driven by their ability to deliver comprehensive, scalable solutions for managing prescription drugs. These platforms interact seamlessly with electronic health records (EHRs), pharmacy systems, and payer networks, giving users real-time access to coverage, formulary, and pricing information. They also assist clinicians in making informed prescribing decisions, reducing errors and improving medication adherence.

The most significant and fastest-growing application is in hospitals, where managing enormous patient numbers involves making quick and precise prescription decisions. RTPD systems enable hospital physicians to collect patient-specific formulary and coverage data, optimize treatment regimens, and eliminate prescription errors. Furthermore, these technologies enhance operational efficiency by streamlining inventory management, billing, and prior authorisation processes. Hospitals are increasingly turning to software-integrated solutions to improve patient outcomes, safety, and adherence, especially in inpatient and outpatient settings. RTPD technologies are frequently utilised in hospital settings due to the increasing complexity of chronic disease management and regulatory pressure to deliver high-quality, cost-effective care.

North America dominated the real-time prescription drug market in 2024. The United States is at the forefront of this expansion. This is due to the robust healthcare infrastructure, high adoption of electronic health records, and the presence of significant market players. Other factors supporting further uptake include an increase in chronic diseases, governmental initiatives to promote electronic prescribing, and value-based care models. High levels of patient awareness, regulatory approval, and the readiness of technological solutions contribute to this region's leadership in utilizing real-time solutions for electronic prescribing.

Moreover, the increasing digitisation of healthcare, rising adoption of electronic prescribing, and growing awareness of cost-effective medication management in the Asia-Pacific region mean that the real-time prescription drug market is expanding at the strongest and fastest rate in this region. Additionally, the expansion of healthcare infrastructure in countries such as China, India, and Japan, coupled with government initiatives that support digital health solutions, drives market growth. The rising prevalence of chronic diseases, increasing patient demand for transparent medication costs, and the entry of global and regional players offering real-time prescription tools further accelerate adoption across the region.

Real-Time Prescription Drug Market by Type-

· Software Platforms

· Data Analytics Tools

· Hardware/IoT Integrations

Real-Time Prescription Drug Market by Application-

· Hospitals

· Clinics

· Retail Pharmacies

· Online Pharmacies

· Payers/Insurance Providers

· Government Agencies

Real-Time Prescription Drug Market by Functionality-

· Prescription Validation

· Insurance Verification

· Drug Utilization Review

· Controlled Substance Monitoring

· Cost Transparency Tools

Real-Time Prescription Drug Market by Deployment Mode-

· Cloud-Based

· On-Premises

Real-Time Prescription Drug Market by Region-

North America-

· The US

· Canada

Europe-

· Germany

· The UK

· France

· Italy

· Spain

· Rest of Europe

Asia-Pacific-

· China

· Japan

· India

· South Korea

· Southeast Asia

· Rest of Asia Pacific

Latin America-

· Brazil

· Argentina

· Mexico

· Rest of Latin America

Middle East & Africa-

· GCC Countries

· South Africa

· Rest of the Middle East and Africa

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.