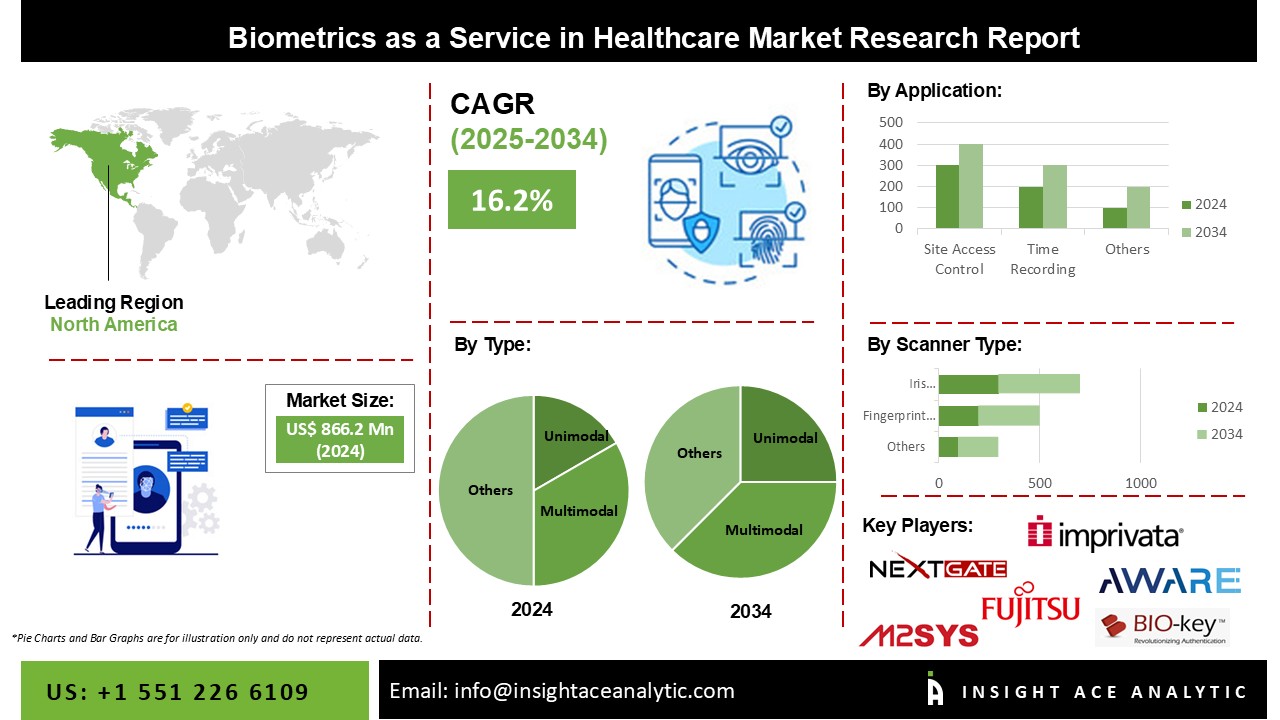

Biometrics as a Service in Healthcare Market Size is valued at USD 866.2 million in 2024 and is predicted to reach USD 3846.1 million by the year 2034 at a 16.2% CAGR during the forecast period for 2025-2034.

Key Industry Insights & Findings from the Report:

Biometrics refers to patient identification and giving users access control. Clinical trial participants' information is protected, and biometrics detects fraud. The government works to pass many pieces of legislation to maintain hospital security. Any health organization today is required to follow tight security guidelines. Government support is another aspect that stimulates the market.

The use of biometrics is necessary for certain hospital rooms. In many countries, certain hectare surety regulations are required. Government support for increased security is resulting in positive market developments. These methods have greatly decreased fraud and data threats. These important reasons will accelerate the revenue growth rates of the healthcare biometrics industry.

The highest incidences of data theft are found in the IT and healthcare sectors. As a result, biometrics in healthcare is becoming more widely used. This technique offers a variety of advantages. There are many patient records at medical facilities. However, with the aid of modern technology, all the data may be kept in one location in a secure environment. Healthcare Biometrics also enables data analysis and contactless payment processing. The healthcare biometrics industry overview shows how strongly these factors boost market value.

Biometrics as a service in the healthcare market is segmented into type, application and scanner type. Based on type, the market is divided into unimodal and multimodal. Based on application, biometrics as a service in the healthcare market is segmented into site access control, time recording, mobile application and web and workplace. Based on the scanner, the market is bifurcated into fingerprint recognition, palm recognition, facial recognition, voice recognition, iris recognition and others.

The market's leading segment is. Healthcare firms prefer multimodal biometrics over unimodal biometrics because it considerably increases the confirmation rate. In multimodal biometrics, two identity qualities are combined, like a fingertip and a picture or a palm and an iris. This improves the identification process' accuracy and efficiency.

Fingerprint recognition has the highest revenue share, and it is anticipated that it will continue to hold that position during the anticipated time. The demand for a highly reliable and accurate method for safeguarding critical healthcare data and avoiding errors that might mean the death distinction is fueling the segment's expansion. Because each person has a unique set of fingerprints, fingerprint identification is the most precise means of identifying. Hospitals can comply with laws requiring the preservation of privacy laws around the world,

North American biometrics as a service in the healthcare market is expected to register the highest market share in revenue soon. This is a result of the region's availability of additional healthcare facilities and the presence of significant key players. Additionally, the market in this region will rise due to the rising demand for biometrics brought on by the increasing number of healthcare data breaches. A potential exists for the biometrics market in healthcare because of innovative diagnostic facilities. The growing investment in the healthcare biometrics industry will lead to discoveries. Premium features will be included in the healthcare biometrics. These factors will propel North America to the top spot in the market. In addition, Asia Pacific is projected to grow rapidly in the global market. Cyber threats are becoming more frequent in the region. Cyber threats to personal confidentiality and institutional data are frequent.Additionally, the market for healthcare biometrics is very technologically advanced. Client authorization and records are handled efficiently. A staggering number of professionals are also employed to manage the biometrics system.

| Report Attribute | Specifications |

| Market size value in 2024 | USD 866.2 Mn |

| Revenue forecast in 2034 | USD 3846.1 Mn |

| Growth rate CAGR | CAGR of 16.12% from 2025 to 2034 |

| Quantitative units | Representation of revenue in US$ million and CAGR from 2025 to 2034 |

| Historic Year | 2021 to 2024 |

| Forecast Year | 2025-2034 |

| Report coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments covered | Type, Application And Scanner Type |

| Regional scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; The UK; France; Italy; Spain; China; Japan; India; South Korea; Southeast Asia; South Korea; Southeast Asia |

| Competitive Landscape | Thales, Fujitsu, Aware, Inc., BIO-key International, MorphoTrust USA, NextGate, Imprivata, Inc., Suprema, Imageware and M2SYS Technology. |

| Customization scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing and available payment methods | Explore pricing alternatives that are customized to your particular study requirements. |

Biometrics as a Service in Healthcare Market By Type

Biometrics as a Service in Healthcare Market By Application

Biometrics as a Service in Healthcare Market By Scanner Type

Biometrics as a Service in Healthcare Market By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

Rest of Middle East and Africa

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.