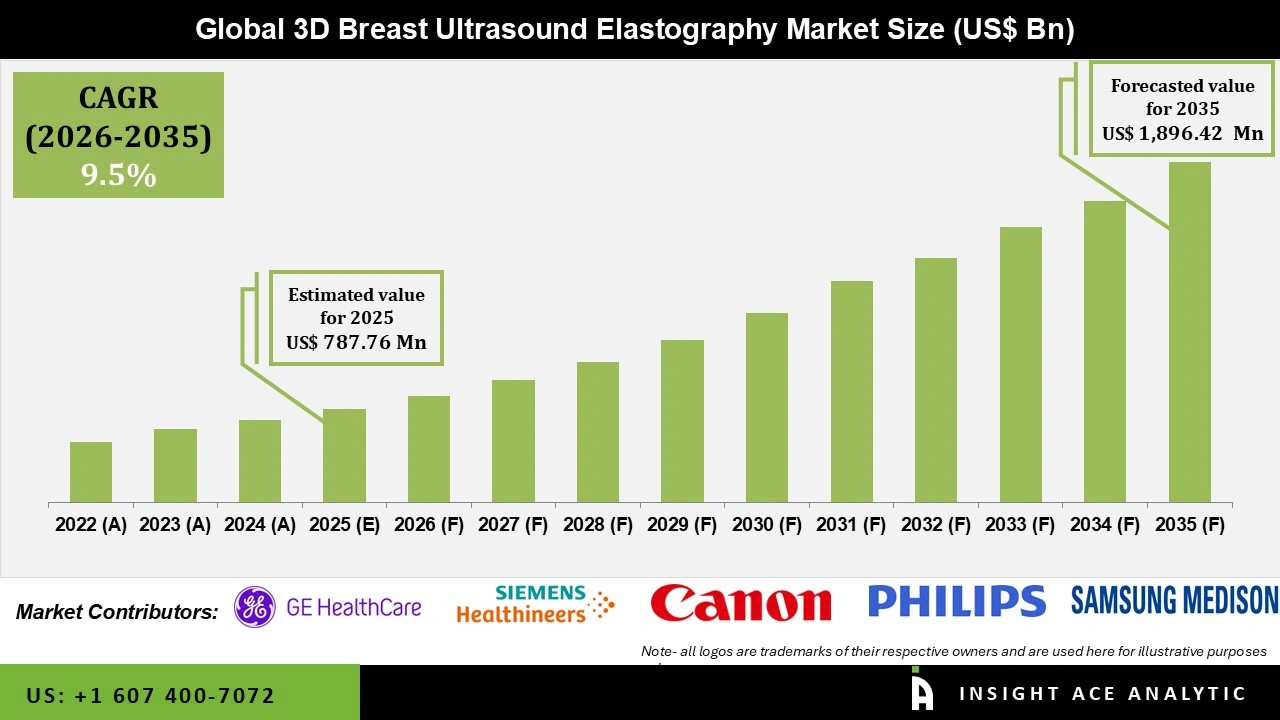

Global 3D Breast Ultrasound Elastography Market Size is valued at USD 787.76 Mn in 2025 and is predicted to reach USD 1,896.42 Mn by the year 2035 at a 9.5% CAGR during the forecast period for 2026 to 2035.

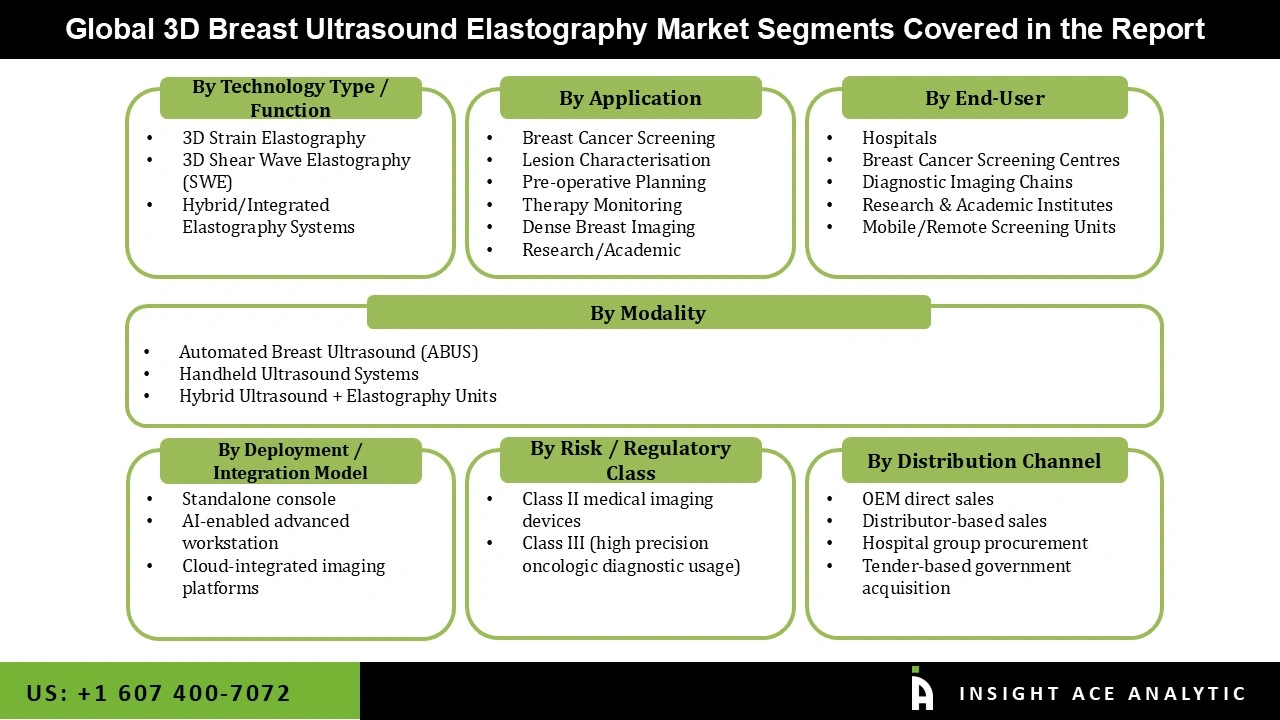

3D Breast Ultrasound Elastography Market Size, Share & Trends Analysis Distribution by Modality (Handheld Ultrasound Systems, Automated Breast Ultrasound (ABUS), and Hybrid Ultrasound + Elastography Units), By Deployment Model )Standalone Console, Cloud-integrated Imaging Platforms, and AI-enabled Advanced Workstation), By Risk Class (Class II Medical Imaging Devices and Class III (High Precision Oncologic Diagnostic Usage)), By Application (Breast Cancer Screening, Therapy Monitoring, Pre-operative Planning, Lesion Characterisation, Research/Academic, and Dense Breast Imaging), By Technology (3D Shear Wave Elastography (SWE), 3D Strain Elastography, and Hybrid/Integrated Elastography Systems), By End-user (Hospitals, Diagnostic Imaging Chains, Mobile/Remote Screening Units, Breast Cancer Screening Centres, and Research & Academic Institutes), By Distribution Channel (OEM Direct Sales, Hospital Group Procurement, Distributor-based Sales, and Tender-based Government Acquisition), By Region and Segment Forecasts, 2026 to 2035.

3D breast ultrasound elastography is an advanced diagnostic imaging modality that integrates three-dimensional ultrasound acquisition with elastography techniques to evaluate the mechanical stiffness of breast tissue across multiple planes. The method quantifies tissue elasticity either qualitatively and semi-quantitatively through strain elastography (based on tissue deformation under light external compression) or quantitatively through shear-wave elastography. By generating volumetric datasets and multiplanar reconstructions including the clinically useful coronal plane 3D elastography provides superior visualisation of lesion stiffness, margin characteristics, internal heterogeneity, and architectural distortion compared with conventional two-dimensional ultrasound or 2D elastography alone.

One of the main factors propelling the 3D breast ultrasound elastography market is the rising incidence of breast cancer worldwide and the growing emphasis on early and precise diagnosis. Because of the limits of traditional mammography, especially in women with dense breast tissue, medical professionals are gravitating toward sophisticated imaging modalities that enhance diagnostic confidence and lesion definition. By combining tissue stiffness measurement and volumetric imaging, 3D breast ultrasound elastography improves visibility and makes it easier to distinguish between benign and malignant tumours. Furthermore, its adoption in hospitals and diagnostic facilities is speeding up due to the growing demand for non-invasive and radiation-free diagnostic methods. Additional factors driving the 3D breast ultrasound elastography market expansion include raising patient awareness, enhancing healthcare infrastructure, and expanding screening programs, particularly in emerging nations.

Furthermore, the 3D breast ultrasound elastography market's competitive environment is being shaped by continuous technological developments in ultrasound systems, such as enhanced picture resolution, real-time elastography capabilities, and integration with AI-based diagnostic tools. The adoption is also being aided by attractive reimbursement policies in developed regions and regulatory support for early breast cancer screening. As a result of manufacturers' emphasis on clinical precision and innovation, the market is gradually moving toward specialized and high-performance imaging platforms designed for breast applications. However, expensive equipment prices, a shortage of qualified personnel, and competition from other imaging modalities like digital mammography and MRI are limiting the 3D breast ultrasound elastography market's growth over the forecast period.

Driver

Rising Incidence of Breast Cancer Worldwide

The rising incidence of breast cancer worldwide and the increased focus on early detection are two of the major factors propelling the 3D breast ultrasound elastography market. About 12.5% of all cancer cases each year are breast cancer, making it the most commonly diagnosed disease in the world. Over 339,000 new cases were reported in the United States in the same year, according to the American Cancer Society, making it the second most common cause of cancer-related death for women. Healthcare systems around the world are placing a higher priority on better screening and diagnosis accuracy because breast cancer is still one of the top causes of cancer-related deaths among women. Additionally, mammography and other traditional imaging methods can have drawbacks, especially in women with dense breast tissue where tumors may be hard to find. By assessing tissue stiffness, 3D breast ultrasound elastography improves lesion definition and gives clinicians more confidence when distinguishing benign from malignant tumours. Furthermore, the need for this technology is strengthened by patients' and doctors' growing awareness of cutting-edge, radiation-free diagnostic solutions.

Restrain/Challenge

High Price of Sophisticated Imaging Systems

The expense of maintaining sophisticated 3D breast ultrasound elastography devices is a significant market barrier. Due to the need for specialized software, complex hardware, and frequent calibration, these systems are substantially more costly than traditional ultrasound equipment. It might be a costly upfront expenditure for smaller hospitals, diagnostic clinics, and healthcare facilities in underdeveloped nations. Additionally, operating costs are increased by educating medical personnel to perform and interpret elastography appropriately. The adoption is further constrained by some nations' inadequate reimbursement rules for sophisticated imaging techniques. Therefore, even with its clinical benefits, cost sensitivity is still a major obstacle to the widespread use of 3D breast ultrasound elastography technology.

The Automated Breast Ultrasound (ABUS) category held the largest share in the 3D Breast Ultrasound Elastography market in 2025 because it can produce imaging that is standardized, repeatable, and operator-independent. In contrast to portable ultrasonography, ABUS devices automatically take volumetric, high-resolution pictures of the entire breast, which lowers variability and boosts workflow effectiveness in hectic diagnostic environments. The demand for ABUS technology is also being driven by the rising prevalence of dense breast tissue in women and the increasing statutory requirements for additional screening in several countries. Additionally, the rise of this category is supported by growing screening programs, increasing physician knowledge, and technological breakthroughs in image processing and automation.

In 2025, the Breast Cancer Screening category dominated the 3D Breast Ultrasound Elastography market because of the growing focus on healthcare prevention and early detection. A growing number of women are being encouraged to get frequent screenings by government-sponsored screening programs, rising awareness efforts, and recommendations for routine breast exams. Additionally, 3D ultrasound elastography is becoming more popular as a useful supplement to traditional mammography, especially for women with dense breast tissue for whom standard imaging may not be as successful. Evaluating tissue stiffness and improving lesion characterisation increases screening diagnostic accuracy and lowers false positives and needless biopsies.

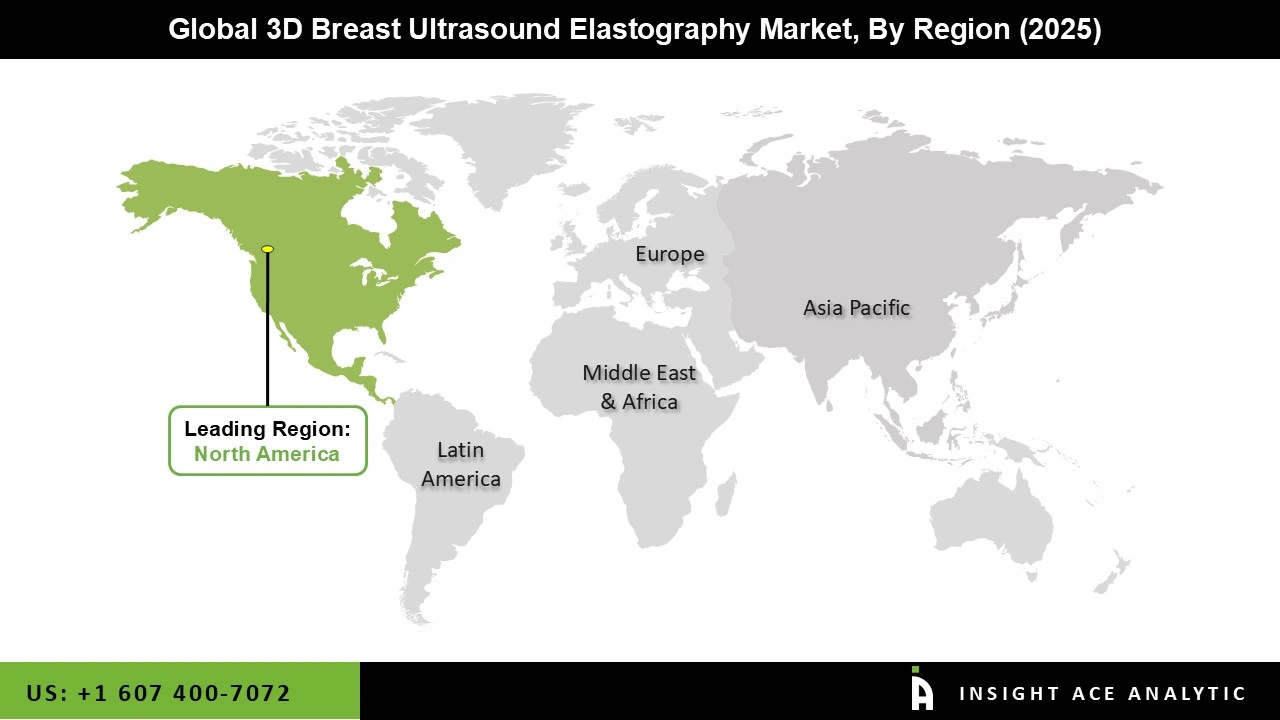

The 3D Breast Ultrasound Elastography market was dominated by the North America region in 2025 because breast cancer is quite common, early screening is widely known, and there is a sophisticated healthcare system in place. The widespread use of highly developed diagnostic imaging technology and established breast cancer screening programs are features of the region, especially the US.

Further propelling market expansion are the rising use of supplementary imaging techniques for women with dense breast tissue and the growing desire for non-invasive, radiation-free diagnostic procedures. Additionally, the regional expansion is further aided by advantageous reimbursement practices, continuing clinical research, and constant technology advancements by top medical imaging firms.

| Report Attribute | Specifications |

| Market size value in 2025 | USD 787.76 Mn |

| Revenue forecast in 2035 | USD 1,896.42 Mn |

| Growth Rate CAGR | CAGR of 9.5% from 2026 to 2035 |

| Quantitative Units | Representation of revenue in US$ Bn and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2025 |

| Forecast Year | 2026-2035 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | Modality, Deployment Model, Risk Class, End-user, Distribution Channel, and By Region |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; The UK; France; Italy; Spain; China; Japan; India; South Korea; Southeast Asia; South Korea; Southeast Asia |

| Competitive Landscape | Siemens Healthineers, Canon Medical Systems, GE HealthCare, Hitachi Medical Systems, Fujifilm Healthcare, Hologic, SonoScape, Mindray, Philips Healthcare, Samsung Medison, Esaote, Telemed Medical Systems, Butterfly Network, Regional ultrasound manufacturers, AI-based independent elastography developers, Supersonic Imagine, Seno Medical, Academic technology developers, and Others |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Geographic competitive landscape. |

| Pricing and Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.