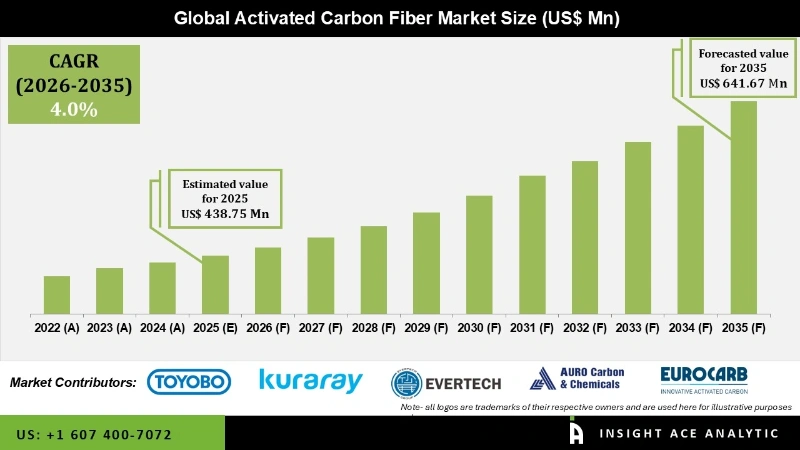

Global Activated Carbon Fiber Market Size is valued at USD 438.75 Mn in 2025 and is predicted to reach USD 641.67 Mn by the year 2035 at a 4.00% CAGR during the forecast period for 2026 to 2035.

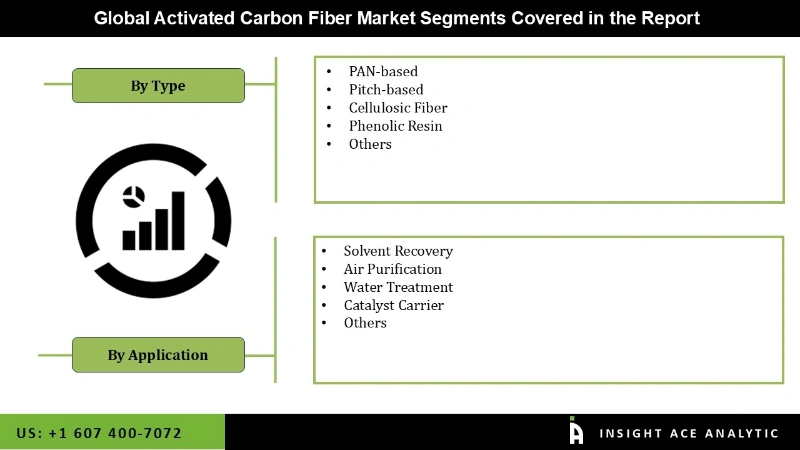

Activated Carbon Fiber Market Size, Share & Trends Analysis Report By Type (PAN-based, Pitch-based, Cellulosic Fiber, Phenolic Resin), Application (Solvent Recovery, Air Purification, Water Treatment, Catalyst Carrier), By Region, And Segment Forecasts, 2026 to 2035.

The market for high-performance adsorption and filtration materials derived from carbon fibers that have been treated to boost their adsorption capacity is known as the activated carbon fiber (ACF) market. The activated carbon fiber market expansion is expected to rise in the forthcoming years due to the increasing demand for high-performance filtration and adsorption materials in various industries, such as water treatment, air purification, and food and beverage. The activated carbon fiber market demand is also driven by the growth of the end-use industries, technological advancements, and increasing environmental concerns.

ACF is favored over traditional activated carbon due to its high surface area, good adsorption capacity, and low-pressure drop. Due to stringent government regulations and rising public awareness of health issues, ACF applications for water treatment will greatly increase demand. The development of innovative fibers and the application of ACF filters in new water purifiers are expected to accelerate the activated carbon fiber industry growth. However, high production costs and obstacles to environment-friendly production of ACF are some challenges that restrict the activated carbon fiber market growth.

The activated carbon fiber market is segmented based on type and application. Based on type, the market is segmented as PAN-based, Pitch-based, cellulose fiber, phenolic Resin and others. By application, the market is segmented into solvent recovery, air purification, water treatment, catalyst carrier and others.

The water treatment segment dominates the activated carbon fiber (ACF) market, and it is projected to expand. A possible method of treating sewage is the aerated bioreactor. Recently, concerns about activated carbon fibers (ACF), a biomembrane carrier used in wastewater disposal, have grown significantly. ACF made of high modulus polyacrylonitrile (PAN) is frequently utilized as a biomembrane carrier to discharge industrial organic wastewater treatment that is difficult to biodegrade. Using ACF filters in new water purifiers and creating novel fibers will contribute to expanding the activated carbon fiber market in the wastewater treatment industry. However, existing activated carbon fiber (ACF) water purifier filter elements could be more effective because of an unqualified pH increase.

The market for polyacrylonitrile (PAN)-based materials is expected to be worth over due to its favorable characteristics, such as quick pyrolysis, a higher melting point, and simple raw material accessibility. Additionally, the growing usage of PAN-based precursors in the ACF industry is expected to boost significantly segment expansion because of their high carbon yield and good tensile strength.

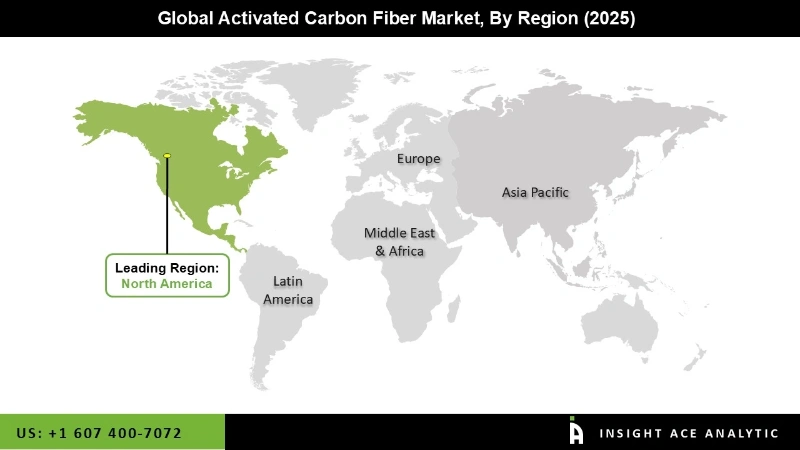

APAC is anticipated to account for a sizeable portion of the global activated carbon fiber market in the upcoming years. APAC comprises the following nations: China, Japan, India, Indonesia, South Korea, and the rest of the region. The economic boom in the area, fueled by factors like the affordable supply of labor and materials as well as other advancements and new technology, can be linked to regional growth. In addition, the region is experiencing significant air pollution brought on by the presence of several manufacturing facilities in China and Japan, which has a detrimental effect on human health by increasing the risk of illnesses like bronchitis and asthma, among others. These elements are thus driving the regional market's upward trend. Moreover, the North America activated carbon fiber market is expected to record the highest market share in revenue shortly.

The demand for activated carbon fiber in North America is anticipated to gain more market share. Throughout the analysis, it is anticipated that the expansion of the local chemical sector will be the primary driver of ACF use. The expanding domestic petroleum industry and the rising demand for chemical and solvent recovery equipment are projected to propel regional market statistics further.

| Report Attribute | Specifications |

| Market size value in 2025 | USD 438.75 Mn |

| Revenue forecast in 2035 | USD 641.67 Mn |

| Growth rate CAGR | CAGR of 4.00% from 2026 to 2035 |

| Quantitative units | Representation of revenue in US$ Mn, and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2025 |

| Forecast Year | 2026-2035 |

| Report coverage | The forecast of revenue, the position of the company, the competitive market statistics, growth prospects, and trends |

| Segments covered | Type And Application |

| Regional scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; The UK; France; Italy; Spain; China; Japan; India; South Korea; Southeast Asia; South Korea; Southeast Asia |

| Competitive Landscape | Toyobo Co., Ltd. (Japan), Kuraray Co., Ltd. (Japan), Unitika Ltd. (Japan), Gun Ei Chemical Industry Co., Ltd. (Japan), Evertech Envisafe Ecology Co., Ltd. (Taiwan), AWA Paper & Technology Company, Inc (Japan), Taiwan Carbon Technology Co., Ltd (Taiwan), Daigas Group (Japan), Auro Carbon & Chemicals (India), Hangzhou Nature Technology Co.Ltd. (China), Eurocarb Products Technology Co., Ltd (Taiwan), Ceram=Materials (US), and HPMS Graphite (US). |

| Customization scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing and available payment methods | Explore pricing alternatives that are customized to your particular study requirements. |

Activated Carbon Fiber Market By Type-

Activated Carbon Fiber Market By Application-

Activated Carbon Fiber Market By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.