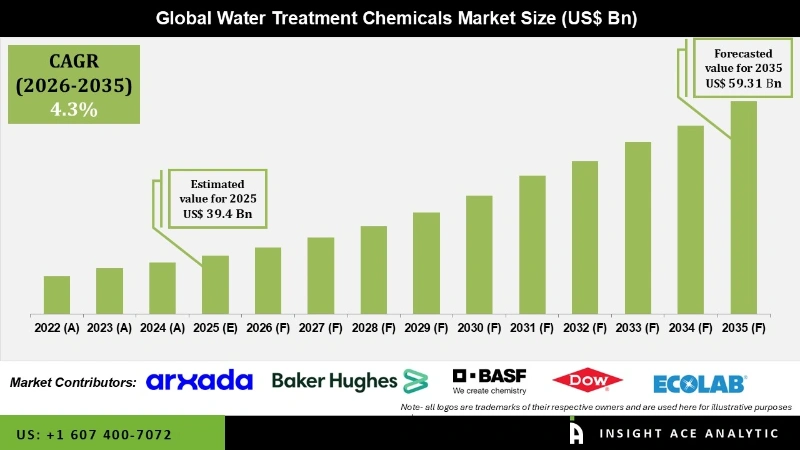

Global Water Treatment Chemicals Market Size is valued at USD 39.4 Bn in 2025 and is predicted to reach USD 59.31 Bn by the year 2035 at a 4.3% CAGR during the forecast period for 2026 to 2035.

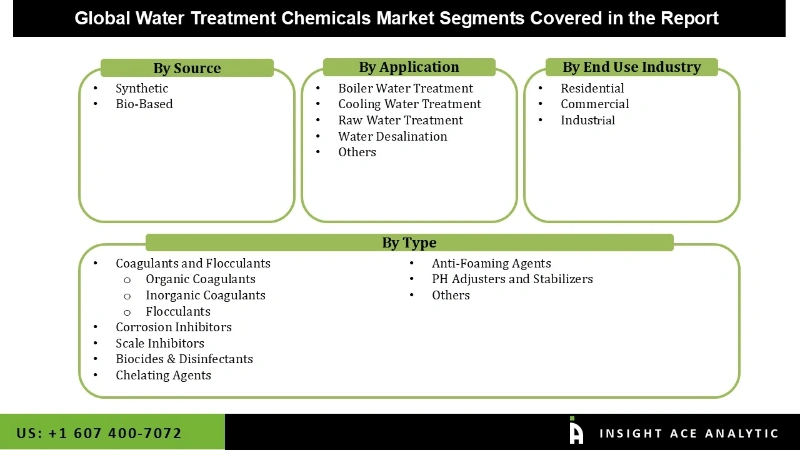

Water Treatment Chemicals Market Size, Share & Trends Analysis Report By Type (Corrosion Inhibitors, Scale Inhibitors, Biocides & Disinfectants, Coagulants & Flocculants, Chelating Agents, Anti-Foaming Agents, PH Adjusters, Stabilizers), Application, End-Use Industry, And Source, By Region, And Segment Forecasts, 2026 to 2035.

Key Industry Insights & Findings from the Report:

The water treatment chemicals industry is a rapidly growing industry that provides a range of products and services to improve water quality and safety for various applications, including drinking water, industrial processes, and wastewater treatment.

Growing demand for sustainable and innovative water treatment solutions, rising demand for natural and bio-based water treatment chemicals as consumers seek safer and eco-friendly alternatives to synthetic chemicals, and increasing adoption of advanced water treatment technologies such as membrane filtration, reverse osmosis, and ultraviolet (UV) are the major drivers of the water treatment chemicals market expansion.

However, stringent regulations and compliance requirements, increasing competition from alternative water treatment technologies, fluctuating raw material prices and supply chain disruptions, growing concerns over the environmental impact of water treatment chemicals, and limited adoption in developing regions due to high costs and lack of infrastructure are some of the major restraints that are limiting the water treatment chemicals market growth.

The water treatment chemicals market is segmented based on type, application, end-use industry, and source. On the basis of type, the market is categorized into corrosion inhibitors, scale inhibitors, biocides & disinfectants, coagulants & flocculants, chelating agents, anti-foaming agents, PH adjusters and stabilizers and others. Based on application, the market is categorized into boiler water treatment, cooling water treatment, raw water treatment, water desalination and others. Based on the end-use industry, the market is segmented into residential, commercial and industrial. Based on source, the market is categorized into synthetic and bio-based.

The synthetic segment category is expected to hold a major share of the global water treatment chemicals market. Synthetic water treatment chemicals are manufactured through chemical synthesis and used in various water treatment applications. These chemicals are preferred over natural water treatment chemicals due to their higher effectiveness, purity, and consistency in performance. Synthetic water treatment chemicals such as coagulants, flocculants, biocides, and disinfectants are widely used in various end-use industries, including municipal, power, oil & gas, and mining. The growing demand for clean water from these industries is expected to drive the growth of the synthetic water treatment chemicals market. Additionally, the development of innovative and sustainable synthetic water treatment chemicals by key players is expected to further boost the growth of this segment in the coming years.

The raw water treatment segment is expected to grow rapidly in the water treatment chemicals market due to increasing demand for clean and safe water from various end-use industries such as municipal, power, oil & gas, and mining. Raw water treatment involves the removal of impurities such as suspended solids, bacteria, viruses, and dissolved minerals from the water before it is used for various applications. The use of water treatment chemicals such as coagulants, flocculants, and disinfectants is crucial in achieving effective raw water treatment. With the growing demand for water treatment chemicals in the raw water treatment segment, key players are investing in developing innovative and sustainable products to cater to the increasing demand. Additionally, stringent government regulations related to water quality and safety are expected to drive the growth of the raw water treatment segment in the water treatment chemicals market.

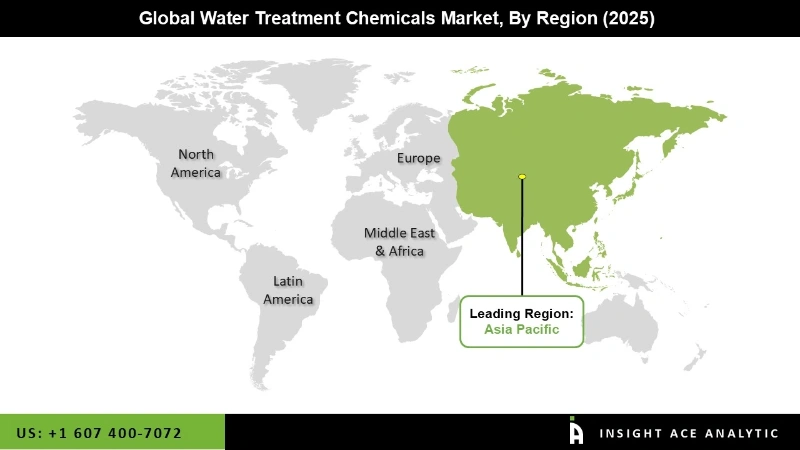

Asia Pacific region is expected to dominate the water treatment chemicals market position in the forthcoming years, driven by rapid industrialization, increasing population, and growing demand for clean water. The region is home to some of the world's most dense countries, including China and India, experiencing high demand for water treatment chemicals to address water pollution and ensure safe drinking water. Additionally, many key regional players are expected to drive market growth. Other factors contributing to the Asia Pacific water treatment chemicals market growth include government initiatives to promote water conservation and the development of innovative and sustainable water treatment technologies.

In addition, the largest market share belonged to North America. In North America's North Dakota and West Texas regions, technological advancement in hydraulic fracturing has led to increased production output of unconventional sources, including shale gas and tight oil. As a result, water treatment facilities are now more prevalent in the upstream oil and gas sector, which is anticipated to have a significant positive impact on the water treatment chemicals market demand throughout the forecast period.

| Report Attribute | Specifications |

| Market size value in 2025 | USD 39.4 Bn |

| Revenue forecast in 2035 | USD 59.31 Bn |

| Growth rate CAGR | CAGR of 4.3% from 2026 to 2035 |

| Quantitative units | Representation of revenue in US$ Bn, and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2025 |

| Forecast Year | 2026-2035 |

| Report coverage | The forecast of revenue, the position of the company, the competitive market statistics, growth prospects, and trends |

| Segments covered | Type, Application, End-Use Industry, And Source |

| Regional scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; The UK; France; Italy; Spain; China; Japan; India; South Korea; Southeast Asia; South Korea; Southeast Asia |

| Competitive Landscape | BASF SE, Kemira Oyj, Ecolab Inc., Dow Inc., Solenis LLC, SNF Floerger, Nouryon, Baker Hughes, Kurita Water Industries Ltd, Veolia, and Arxada. |

| Customization scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing and available payment methods | Explore pricing alternatives that are customized to your particular study requirements. |

Water Treatment Chemicals Market By Type-

Water Treatment Chemicals Market By Application-

Water Treatment Chemicals Market By End Use Industry-

Water Treatment Chemicals Market Based On Source-

By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.