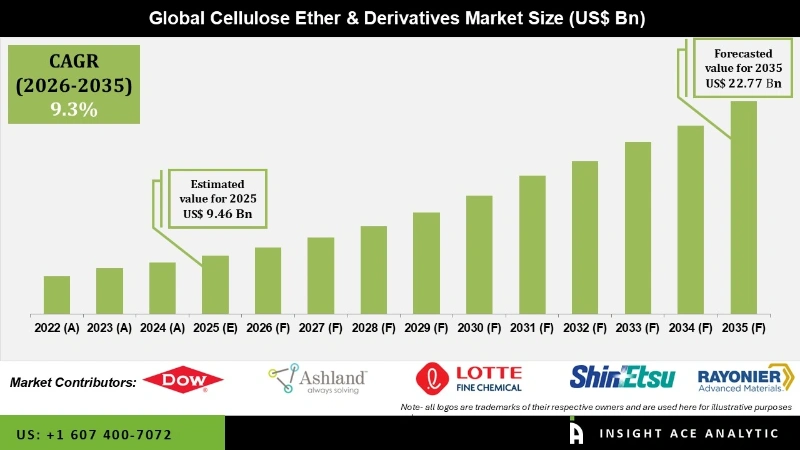

Cellulose Ether and Derivatives Market Size is valued at USD 9.46 Bn in 2025 and is predicted to reach USD 22.77 Bn by the year 2035 at a 9.3% CAGR during the forecast period for 2026 to 2035.

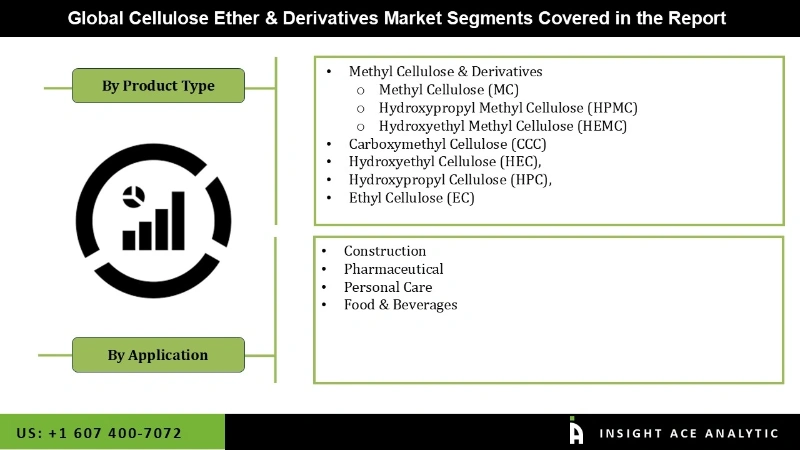

Cellulose Ether and Derivatives Market Size, Share & Trends Analysis Report By Product Type (Methyl Cellulose & Derivatives, Carboxymethyl Cellulose (CCC), Hydroxyethyl Cellulose (HEC), Hydroxypropyl Cellulose (HPC), Ethyl Cellulose (EC)), By Application, By Region, And by Segment Forecasts, 2026 to 2035.

Cellulose ether and its derivatives are a group of compounds derived from cellulose, which is a naturally occurring polymer found in the cell walls of plants. These compounds are widely used in various industries due to their significant properties and versatile applications. Cellulose ethers are water-soluble polymers that can be modified to obtain specific properties, making them valuable in industries like pharmaceuticals, food, construction, and more.

Over an extended period, these substances have held a significant role across diverse sectors, including construction, paints and chemicals, food and beverage, cosmetics, and healthcare. The demand for cellulose ether and derivatives has recently surged considerably, primarily due to their heightened utilization within the chemical industry. This increased demand is driven by their efficacy in tasks like thickening, emulsification, water retention, and enhanced stability, rendering them valuable additives in this sector. Furthermore, prominent players within the chemical industry are strategizing to invest in expansion endeavours, venturing into new domains to escalate cellulose production. This approach addresses the escalating demand for cellulose ether and its derivatives.

The Cellulose ether & derivatives market is segmented based on Product Type and Application. Based on product Type, the Cellulose Ether and derivatives market is segmented as Methyl Cellulose and derivatives having Methyl Cellulose (MC), Hydroxypropyl Methyl Cellulose (HPMC), Hydroxyethyl Methyl Cellulose (HEMC) as a sub segments. Also, Carboxymethyl Cellulose (CCC), Hydroxyethyl Cellulose (HEC), Hydroxypropyl Cellulose (HPC), Ethyl Cellulose (EC)). The application segment is divided into construction, pharmaceutical, personal care, and food & beverages.

The food & beverages category will hold a major share in the global Cellulose Ether & Derivatives market in 2022. The segment of food and beverages is projected to experience the most significant uptake of cellulose ether and its derivatives throughout the forecast period. This predominance is primarily attributed to cellulose ethers and derivatives as agents for thickening in various food and beverage items, including sauces, soups, and juices. This application serves to enhance the texture and viscosity of these products.

Moreover, they find use as emulsifiers to enhance the stability and uniformity of emulsions in diverse food and beverage offerings, such as mayonnaise and salad dressings. Furthermore, cellulose, being an inherent polymer derived from plant fibres, underpins the eco-friendliness and renewability of cellulose ethers and derivatives. This natural origin aligns well with the sustainability goals of the food and beverage industry, contributing to the industry's efforts toward environmental responsibility.

The methylcellulose (MC) segment will experience the most rapid (CAGR) throughout the forecast period. Methylcellulose is characterized by its white appearance, lack of odour or taste, and solubility in cold water, forming a gel-like substance upon heating. This distinctive property enables methylcellulose to serve as a versatile ingredient, functioning as a thickener, emulsifier, and stabilizer in various industries, including food and beverage, pharmaceuticals, cosmetics, and others. Moreover, the remarkable attribute of methylcellulose being both safe and non-toxic further bolsters its adoption. This safety profile contributes significantly to expanding the cellulose ether and derivatives market.

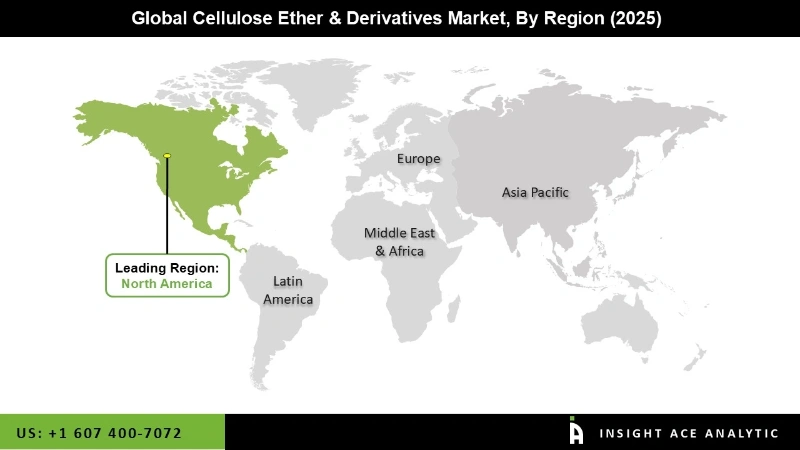

The North American cellulose ether & derivatives market is expected to register a tremendous market share in revenue soon. The resurgence of the construction sector, particularly in the United States, has increased the demand for building materials that utilize cellulose ethers, especially in cement-based products, to enhance workability, water retention, and other properties.

In addition, the Asia Pacific regional market is projected to grow rapidly in the global Cellulose Ether & Derivatives market. The Asia Pacific region was experiencing significant urbanization and infrastructure development. As a result, there was a growing demand for construction materials that utilized cellulose ethers to enhance properties such as workability, water retention, and overall performance of concrete and mortar.

| Report Attribute | Specifications |

| Market Size Value In 2025 | USD 9.46 Bn |

| Revenue Forecast In 2035 | USD 22.77 Bn |

| Growth Rate CAGR | CAGR of 9.3% from 2026 to 2035 |

| Quantitative Units | Representation of revenue in US$ Bn and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2025 |

| Forecast Year | 2026-2035 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Product Type, Application |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico ;The UK; France; Italy; Spain; South Korea; South East Asia |

| Competitive Landscape | The Dow Chemical Company (US), Ashland Global Holdings, Inc. (US), Rayonier Advanced Materials (US), Shin-Etsu Chemical Co., Ltd. (Japan), LOTTE Fine Chemicals (South Korea), DKS Co. Ltd. (Japan), Nouryon Chemical Holdings B.V. (The Netherlands), J.M. Huber Corporation (US), Shandong Head Co., Ltd. (China), Colorcon (US), FENCHEM (China), Lamberti S.p.A. (US), J. RETTENMAIER & SÖHNE GmbH + Co KG (Germany), Hebei JiaHua Cellulose Co., Ltd. (China), and Zibo Hailan Chemical Co., Ltd. (China). |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing And Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

Cellulose Ether & Derivatives Market By Product-

Cellulose Ether & Derivatives Market By Application-

Cellulose Ether & Derivatives Market By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.