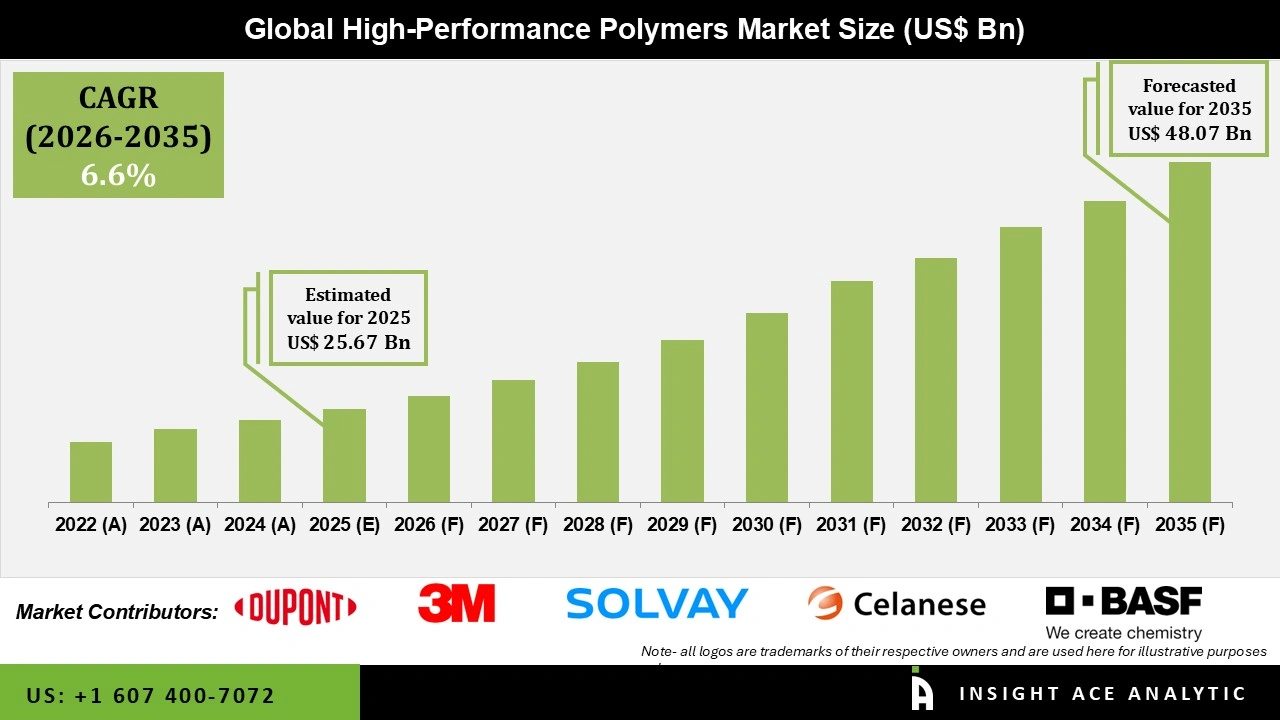

Global High-Performance Polymers Market Size is valued at USD 25.67 billion in 2025 and is predicted to reach USD 48.07 billion by the year 2035 at a 6.6% CAGR during the forecast period for 2026 to 2035.

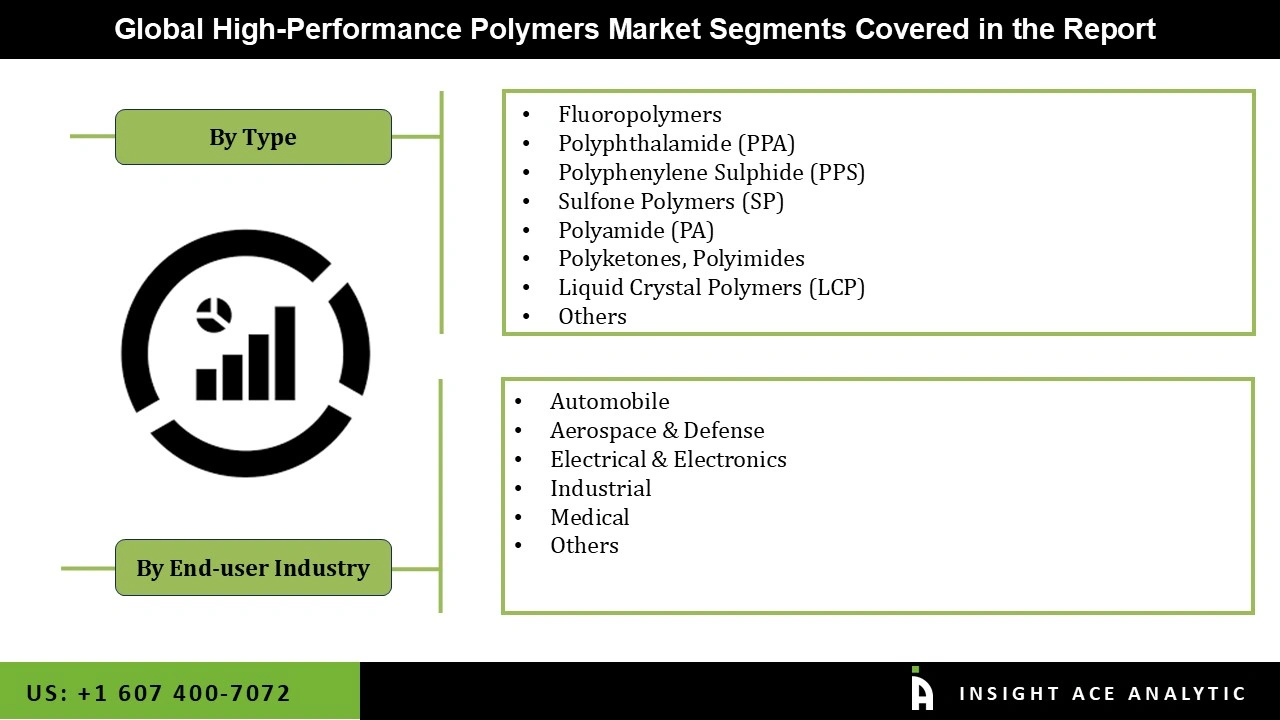

High-Performance Polymers Market Size, Share & Trends Analysis Report By Type (Fluoropolymers, Polyphthalamide (PPA), Polyphenylene Sulphide (PPS), Sulfone Polymers (SP), Polyamide (PA), Polyketones, Polyimides, Liquid Crystal Polymers (LCP)), By End-user Industry (Automobile, Aerospace & Defense, Electrical & Electronics, Industrial, Medical), By Region and Segment Forecasts, 2026 to 2035

Key Industry Insights & Findings from the Report:

High-performance polymers are a group of materials known for their exceptional mechanical, thermal, chemical, and electrical properties. Polymers are manufactured to exacting standards across a range of sectors, with the aim of outperforming generic commodity plastics in a number of targeted contexts. The high-performance polymers market is likely to be driven by the rising demand for lightweight polymers in sectors such as the automotive and aerospace industries to boost efficiency and decrease emissions.

High-performance polymers are the increasing popularity of electric vehicles, which is being encouraged by governments worldwide. Furthermore, high-performance polymers are in high demand in the medical industry because of their biocompatibility, stabilizability, and resistance to chemicals and biological fluids. Market growth opportunities for high-performance polymers generated from renewable and natural sources have increased as society shifts toward more eco-friendly and sustainable materials. The market is expected to increase throughout the forecast period because of factors such as technological innovation, urbanization, industrialization, infrastructure development, and rising per capita income.

However, the High-performance polymers market expansion is hampered by the high price of high-performance polymers compared to regular polymers and other materials like metals. COVID-19 has severely disrupted the profit margins of plastic manufacturers because of its effects on the distribution of both raw materials and final products. Once the crisis was under control, however, the government relaxed regulations to help nations advance up the economic value chain by encouraging local and small-scale enterprises to resume manufacturing. Plastic manufacturers have increased output in response to rising consumer demand. Manufacturers have begun their efforts by first taking the recommended safety precautions.

The high-performance polymers market is segmented based on type and end-user industry. Based on type, the market is segmented into fluoropolymers, polyphthalamide (PPA), polyphenylene sulphide (PPS), sulfone polymers (SP), polyamide (PA), polyketones, polyimides, liquid crystal polymers (LCP), and others. By end-user industry, the market is segmented into automobile, aerospace defense, electrical and electronics, industrial, medical, and others.

The fluoropolymers high-performance polymers category is expected to hold a significant global market share in 2022. Fluoropolymers are in high demand because of their exceptional performance. Their widespread application in fields as diverse as transportation and healthcare has contributed to the market's expansion. Fluoropolymers are the most practical non-reactive material now available and exhibit exceptional chemical properties. The most well-known types of fluoropolymers are polyvinylidene fluoride and polyvinyl fluoride. Many useful industrial products can be made with the help of fluoropolymers. Because of its high melting point, long lifespan, and resistance to chemicals, PTFE finds widespread application in cookware and non-stick coating.

The automobile segment is projected to grow rapidly in the global high-performance polymers market. The rising trend of adopting lightweight materials to improve vehicle performance is anticipated to increase sales of high-performance polymers for the automotive industry. Great-performance polymers are in great demand because of their widespread application across diverse vehicle subsystems, including structural components, frameworks, interiors, and exteriors, especially in countries like the US, Germany, the UK, China, and India.

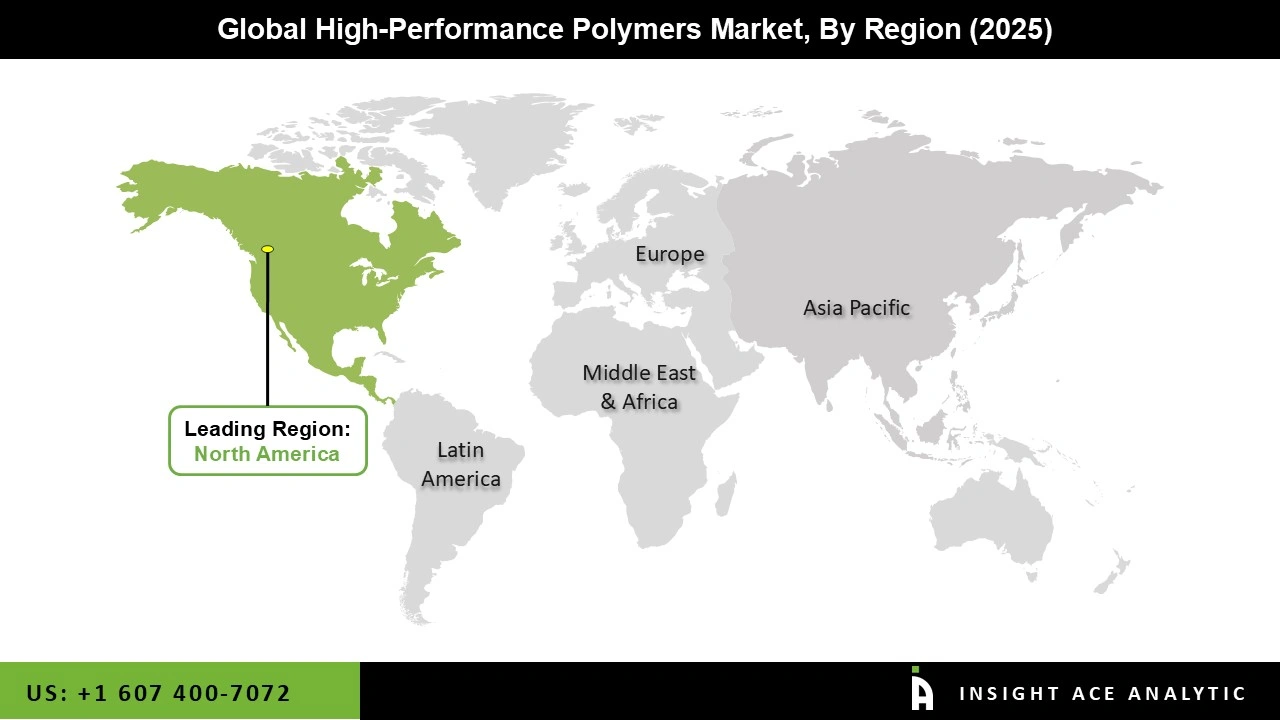

The North American high-performance polymers market is expected to report the most increased market share in revenue in the near future. It can be attributed to the fact that the automobile sector primarily drives the demand for high-performance polymers. Environmental worries and sustainable development programs are being addressed alongside a burgeoning research and development sector in polymer science and technology.

In addition, Asia Pacific is projected to overgrow in the global high-performance polymers market because High-performance polymers are becoming increasingly important as their end-use applications spread throughout the automotive, air travel, and medical sectors, not to mention the rapidly growing electrical and electronics sectors, which in turn fuels the high-performance polymers industry in this region.

| Report Attribute | Specifications |

| Market Size Value In 2025 | USD 25.67 billion |

| Revenue Forecast In 2035 | USD 48.07 billion |

| Growth Rate CAGR | CAGR of 6.6% from 2026 to 2035 |

| Quantitative Units | Representation of revenue in US$ Bn, Volume (Tons) and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2024 |

| Forecast Year | 2026-2035 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Imaging Modality, By Application, By End-Use |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; The UK; France; Italy; Spain; China; Japan; India; South Korea; Southeast Asia |

| Competitive Landscape | DuPont, 3M, Solvay, BASF SE, Celanese Corporation, DAIKIN INDUSTRIES, Ltd., Resirene, MC Polymers, Celanese, Arkema, Chevron Phillips, Victrex, Sabic Global Technologies, Arkema, I. Dupont De Nemours and Company, Evonik Industries AG, Saudi Basic Industries Corporation (SABIC), Solvay S.A., and Sumitomo Chemical Co., Ltd. |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing And Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.