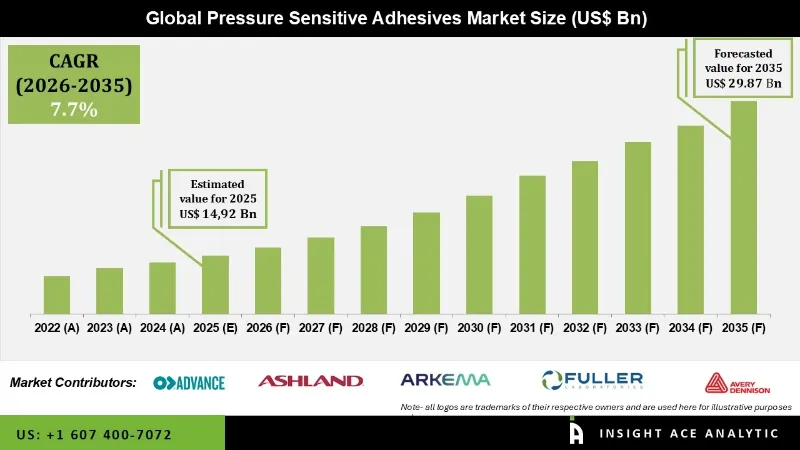

Pressure Sensitive Adhesives Market Size is valued at 14.92 billion in 2025 and is predicted to reach 29.87 billion by the year 2035 at a 7.7% CAGR during the forecast period for 2026 to 2035.

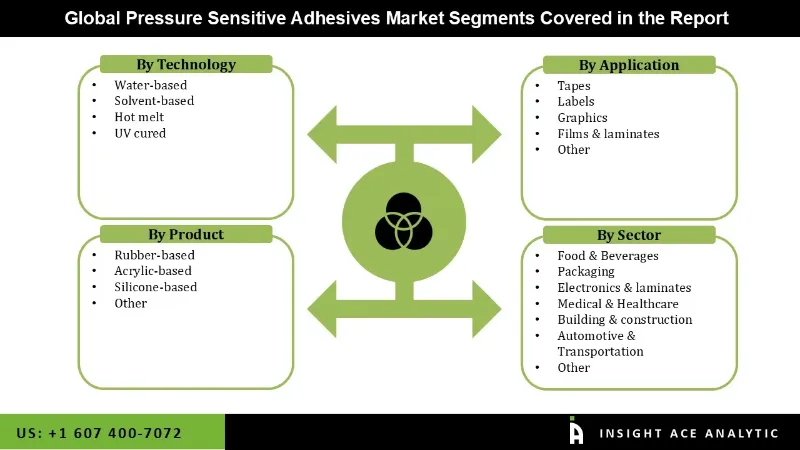

Pressure Sensitive Adhesives Market Size, Share & Trends Analysis Report By Chemistry (Acrylic, Rubber, Silicone), Technology (Water-based, Solvent-based, Hot Melt), Application (Labels, Tapes, Graphics), End-Use Industry (Packaging, Automotive, Healthcare), By Region, And Segment Forecasts, 2026 to 2035

Pressure Sensitive Adhesives, often known as self-stick adhesives, bind two similar or dissimilar surfaces together when pressure is applied. These adhesives do not require heat, solvent, or water activation to deliver holding force to a variety of materials. They can match a wide range of substrates and are either removable or permanent. Due to their reassurance of use and low cost, pressure-sensitive adhesives are expected to stimulate the demand for the miniaturization of electronic devices such as smartphones, PCs, and tablets. As a result of rising disposable income, the popularity and demand for such technological devices are propelling pressure adhesives market expansion.

However, the COVID-19 epidemic had a negative impact on the pressure-sensitive adhesives business. Automotive, electronics, building and construction, consumer goods, and other industries are major users of pressure-sensitive adhesives. The demand for PSAs from the automotive sector has decreased due to the detrimental impact on the industry. Disruption in value chain analysis, for example, has impacted large-scale businesses in the automobile sector.

The pressure-sensitive adhesives market is segmented on the basis of technology, product, application, and sector. Based on technology, the market is categorized as water-based, solvent-based, hot melt, and UV cured. The products segment includes rubber-based, acrylic-based, silicone-based, and other. By application, the market is categorized into tapes, labels, graphics, films & laminates, and others. The applications segment includes food & beverage, packaging, electronics & laminates, medical & healthcare, building & construction, automotive & transportation, and other.

The water-based category is expected to hold a major share of the global Pressure Sensitive Adhesives Market in 2024. This is due to the fact that water-based pressure-sensitive adhesives are made from a combination of water, polymers, and additives. It is best suited to porous and non-purpose substrates. Furthermore, several types of monomers can be utilized to obtain desired qualities such as peel strength, shear strength, and tackiness during the formation of water-based PSAs. Tapes, labels, paper, packaging, and woodworking use water-based pressure-sensitive adhesives.

The packaging care segment is projected to grow at a rapid rate in the global pressure-sensitive adhesives market since pressure-sensitive adhesives function as a catalyst for the packaging industries since they provide various benefits such as less retention time, no physical transformation or chemical reaction, and others, all of which save time and boost production.

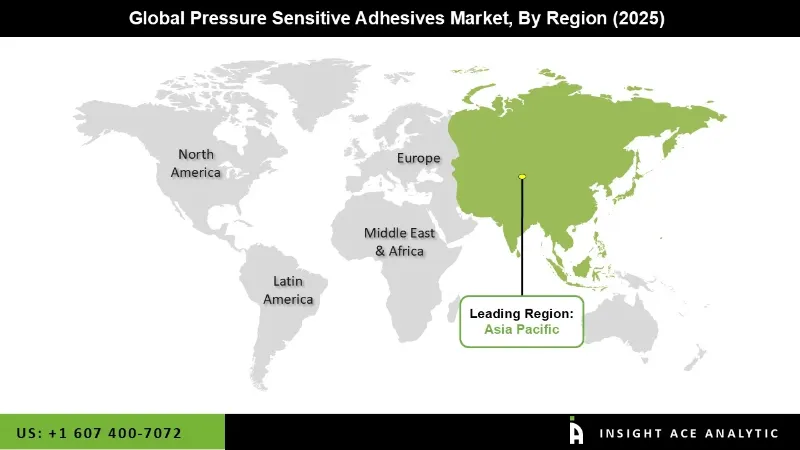

Asia Pacific Pressure Sensitive Adhesives Market is expected to register the highest market share in revenue in the near future. This is due to increased infrastructure activity in nations such as India and China. Furthermore, the demand for pressure-sensitive adhesives will increase as the need for building chemicals rises.

Again, rising demand for low volatile organic compound (VOC) content adhesives from China, Japan, and India drives demand for water-based pressure-sensitive adhesives. Adopting transparent and film labels, shrink-wrap labels for makers of fast-moving consumer goods (FMCG), flexible labels, and colorful wrap-around labels in North America is expected to boost the market. The pressure-sensitive adhesives market is yet in its earlier stages of development, and it has a greater potential for growth in the future.

| Report Attribute | Specifications |

| Market size value in 2025 | USD 14.92 Bn |

| Revenue forecast in 2035 | USD 29.87 Bn |

| Growth rate CAGR | CAGR of 7.7% from 2026 to 2035 |

| Quantitative units | Representation of revenue in US$ Million, Volume (KT), and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2024 |

| Forecast Year | 2026-2035 |

| Report coverage | The forecast of revenue, the position of the company, the competitive market statistics, growth prospects, and trends |

| Segments covered | Packaging Type, Printing Technology, Embellishing Type, And Application |

| Regional scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; The UK; France; Italy; Spain; China; Japan; India; South Korea; Southeast Asia; South Korea; Southeast Asia |

| Competitive Landscape | Avery Dennison Corporation, H. B. Fuller, Arkema Group, Henkel AG & Co. KGaA, The 3M Company, Sika AG, DowDuPont, Inc. (Dow Corning), Momentive Performance Materials, Wacker Chemie AG, LG Chem Ltd, Evonik Industries AG, Mapei SpA, Ashland, Inc, Beardow Adams (Adhesives) Limited, Franklin International, Inc, Mactac Performance Adhesive Group, and Powerband Industries Pvt. Ltd. |

| Customization scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing and available payment methods | Explore pricing alternatives that are customized to your particular study requirements. |

Pressure Sensitive Adhesives Market By Technology-

Pressure Sensitive Adhesives Market By Product-

Pressure Sensitive Adhesives Market By Application-

Pressure Sensitive Adhesives Market By Sector-

Pressure Sensitive Adhesives Market By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.