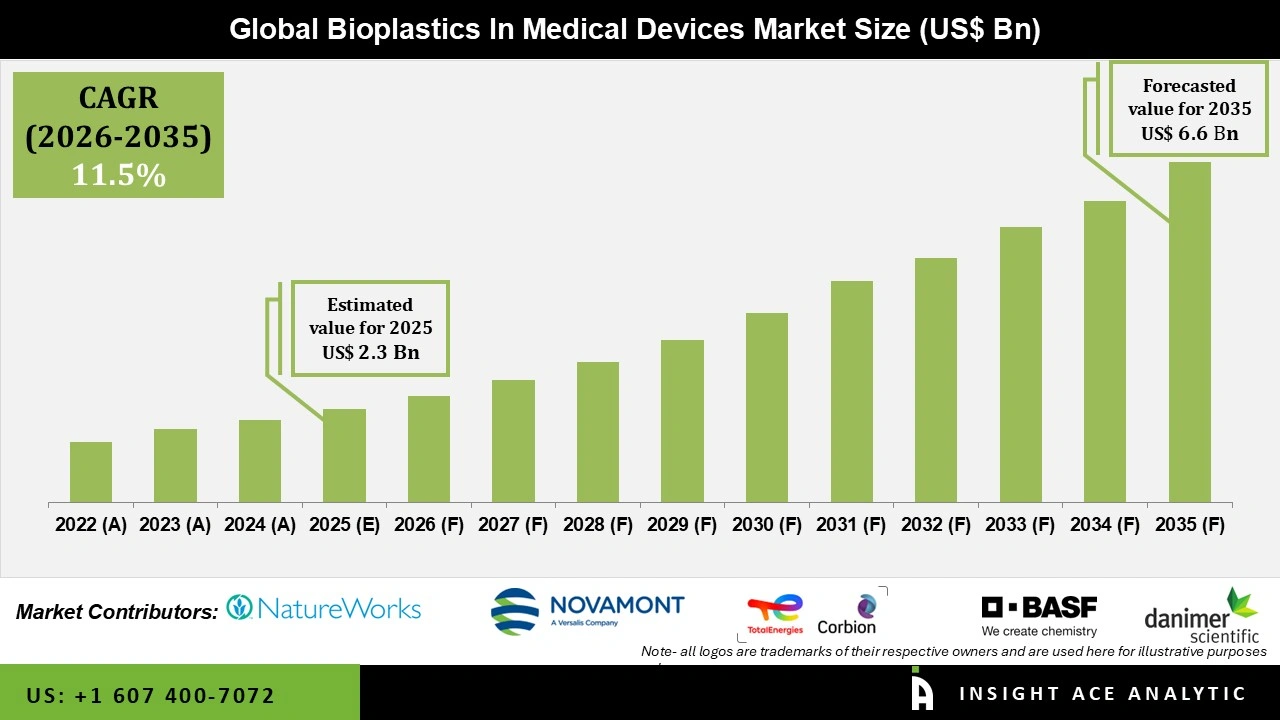

Global Bioplastics in Medical Devices Market Size is valued at USD 2.3 Bn in 2025 and is predicted to reach USD 6.6 Bn by the year 2035 at a 11.5% CAGR during the forecast period for 2026 to 2035.

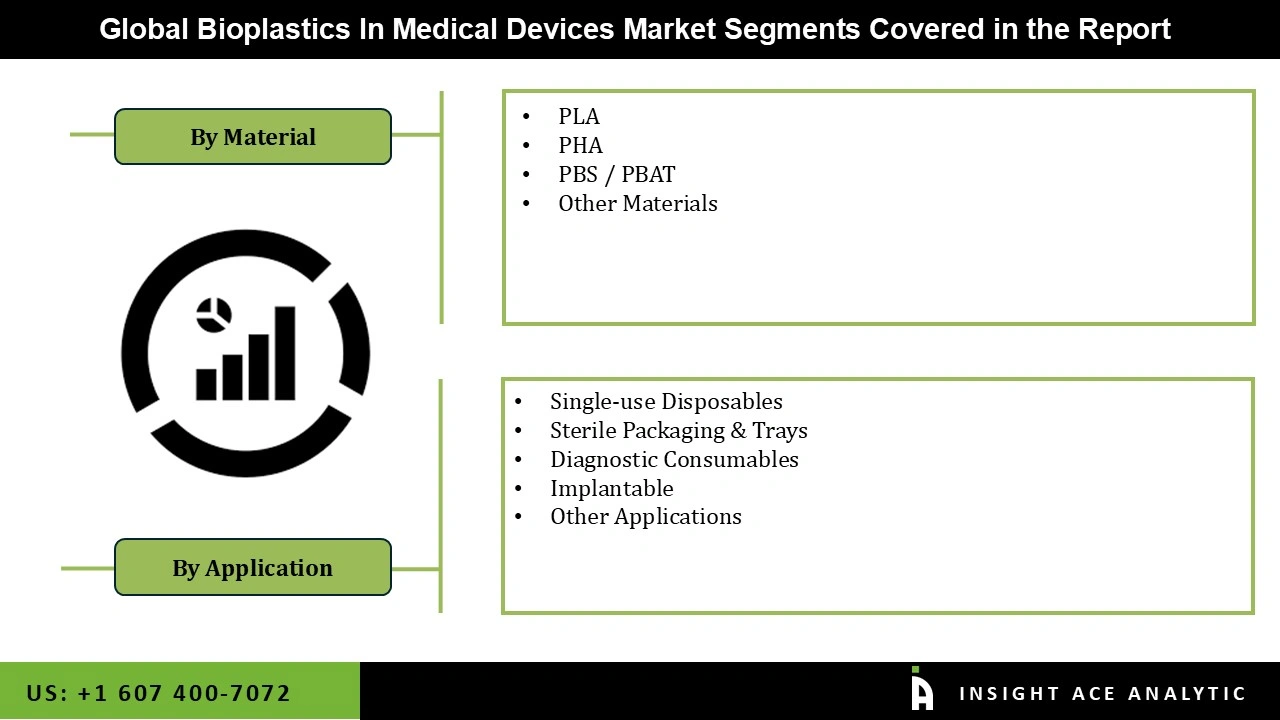

Bioplastics in Medical Devices Market Size, Share & Trends Analysis Distribution by Material (PLA, PHA, PBS / PBAT, and Others), Application (Sterile Packaging & Trays, Single-use Disposables, Implantable, Diagnostic Consumables, and Others), by Region and Segment Forecasts, 2026 to 2035

Bioplastics are plastics made partly or fully from natural, renewable sources like corn starch, sugarcane, or vegetable oils. In medical devices, they replace traditional petroleum-based plastics to make products more eco-friendly and reduce reliance on fossil fuels. They are used for items such as disposable syringes, IV bags, surgical tools, packaging, device casings, and even resorbable implants that the body can break down naturally. The market is growing because hospitals, manufacturers, and regulators want sustainable healthcare solutions that cut down on plastic waste while still meeting strict safety and performance standards for medical use.

The most recent market trend driving the usage of biodegradable plastics is growing environmental consciousness on a global scale. The focus has turned to lessening the environmental impact of medical products as a result of this increase in ecological consciousness. Moreover, the increase in local production combined with technological advancements in polymer science might stimulate market expansion. The performance and viability of biodegradable materials are improved by advancements, increasing their use in medical applications. The qualities of biodegradable polymers are improved by these technical advancements, making them an important alternative to traditional materials. Additionally, the increase in funding for research projects offers chances for innovation, which results in more economical and effective biodegradable medical solutions. Initiatives in material science that assist the rapid expansion of the bioplastics in medical devices market.

In addition, another significant factor in the bioplastics in medical devices market is the packaging industry's increasing product demand. Due to the growing demand for recyclable, biodegradable, and compostable materials, the packaging industry is the biggest consumer of bioplastics. The need for sustainable packaging is driving up the use of bio-PET and starch-based bioplastics. Furthermore, the growth of bioplastics in the medical devices market is being impacted by the textile industry's growing product demand, which is quickly employing bioplastics as a sustainable alternative to traditional petroleum-based materials. Numerous initiatives are underway to enhance the mechanical strength and heat resistance of fibers generated from bioplastics. However, the high production costs of bioplastics continue to be a major obstacle to the growth of bioplastics in the medical devices market, especially for smaller or new companies.

Driver

Increased Focus on Sustainability and Environmental Responsibility

The increased focus on sustainability and environmental responsibility in the healthcare industry is one of the main factors driving the bioplastics in medical devices market. Due to growing concerns about the production of medical waste and environmental pollution, hospitals, producers of medical devices, and regulatory agencies are concentrating more on lowering carbon footprints and minimizing reliance on fossil-based polymers. Bioplastics, which are made from renewable resources, are in line with corporate environmental, social, and governance (ESG) commitments and global sustainability goals. As a result, manufacturers are encouraged to incorporate bioplastics into medical devices, including non-implantable parts, packaging, and disposable instruments. Additionally, the shift to bioplastics in the medical devices market is being accelerated by government programs that support eco-friendly products and the implementation of green procurement practices in healthcare systems.

Restrain/Challenge

High Production Cost of Bioplastics

The bioplastics in medical devices market confronts substantial obstacles because of higher production costs and intricate manufacturing procedures. Manufacturing costs are significantly increased by the need for specialized machinery, regulated environmental conditions, and strict quality control procedures in the manufacturing of bioplastics. Precise temperature and humidity control are necessary for the production processes of bioplastics like polylactic acid and polyhydroxyalkanoates, which frequently call for specially designed manufacturing facilities with cutting-edge automation systems. Furthermore, the cost of raw materials for bioplastics in medical devices is still significantly greater than that of conventional plastics. Moreover, the price volatility and supply chain fluctuations are caused by the small pool of suppliers for high-purity material used for medical-grade bioplastics.

The PLA category held the largest share in the Bioplastics in Medical Devices market in 2025 because of its robust biocompatibility, biodegradability, and base of renewable raw materials. Since PLA can safely break down into lactic acid in the human body, it is widely used in medical applications such as drug delivery systems, orthopaedic implants, tissue engineering scaffolds, resorbable sutures, and disposable medical devices. The use of PLA-based materials is being further accelerated by the growing need for bioresorbable medical products and minimally invasive procedures, which do not require additional surgeries for implant removal. Additionally, PLA is being used more quickly than traditional petroleum-based polymers due to increased institutional and governmental emphasis on environmentally friendly and sustainable medical supplies.

In 2025, the Single-use Disposables category dominated the Bioplastics in Medical Devices market, driven by the growing focus in healthcare environments on patient safety, infection control, and operational effectiveness. Disposable medical supplies such as syringes, catheters, tubing, gloves, and diagnostic consumables have become increasingly popular due to rising hospital-acquired illnesses and the need to avoid cross-contamination. Additionally, as manufacturers and healthcare providers look for sustainable substitutes for traditional petroleum-based plastics without sacrificing performance or regulatory compliance, bioplastics are becoming more popular in this market.

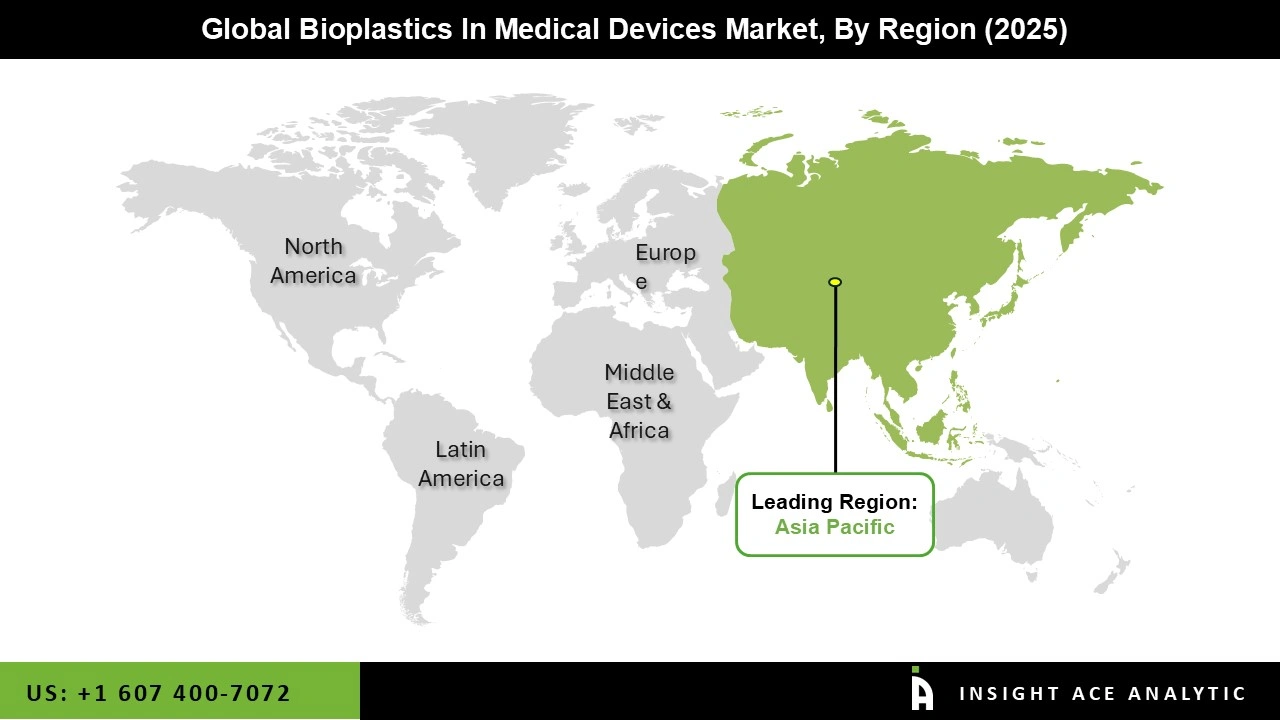

Asia-Pacific led the bioplastics in medical devices market in 2025. The region dominates due to its massive manufacturing capacity, rapid adoption of sustainable materials in healthcare products, and growing focus on environmental standards in countries like China, India, and Japan.

Governments here provide strong incentives for green innovation, such as subsidies for bio-based production and strict regulations on plastic waste. Asia-Pacific's large population, expanding healthcare systems, and low-cost supply chains make it easier to scale up bioplastics for items like disposable supplies, packaging, and implants. These factors, combined with rising investments from local and international companies, keep Asia-Pacific at the forefront of the market.

| Report Attribute | Specifications |

| Market size value in 2025 | USD 2.3 Bn |

| Revenue forecast in 2035 | USD 6.6 Bn |

| Growth Rate CAGR | CAGR of 11.5% from 2026 to 2035 |

| Quantitative Units | Representation of revenue in US$ Bn and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2024 |

| Forecast Year | 2026 to 2035 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | Material, Application, and By Region |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; The UK; France; Italy; Spain; China; Japan; India; South Korea; Southeast Asia; South Korea; Southeast Asia |

| Competitive Landscape | BASF SE, TotalEnergies Corbion, NatureWorks LLC, Danimer Scientific, FKuR Kunststoff GmbH, Biome Bioplastics Limited, Novamont S.p.A., Mitsubishi Chemical Corporation, Toray Industries, Inc., and RWDC Industries |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Geographic competitive landscape. |

| Pricing and Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.