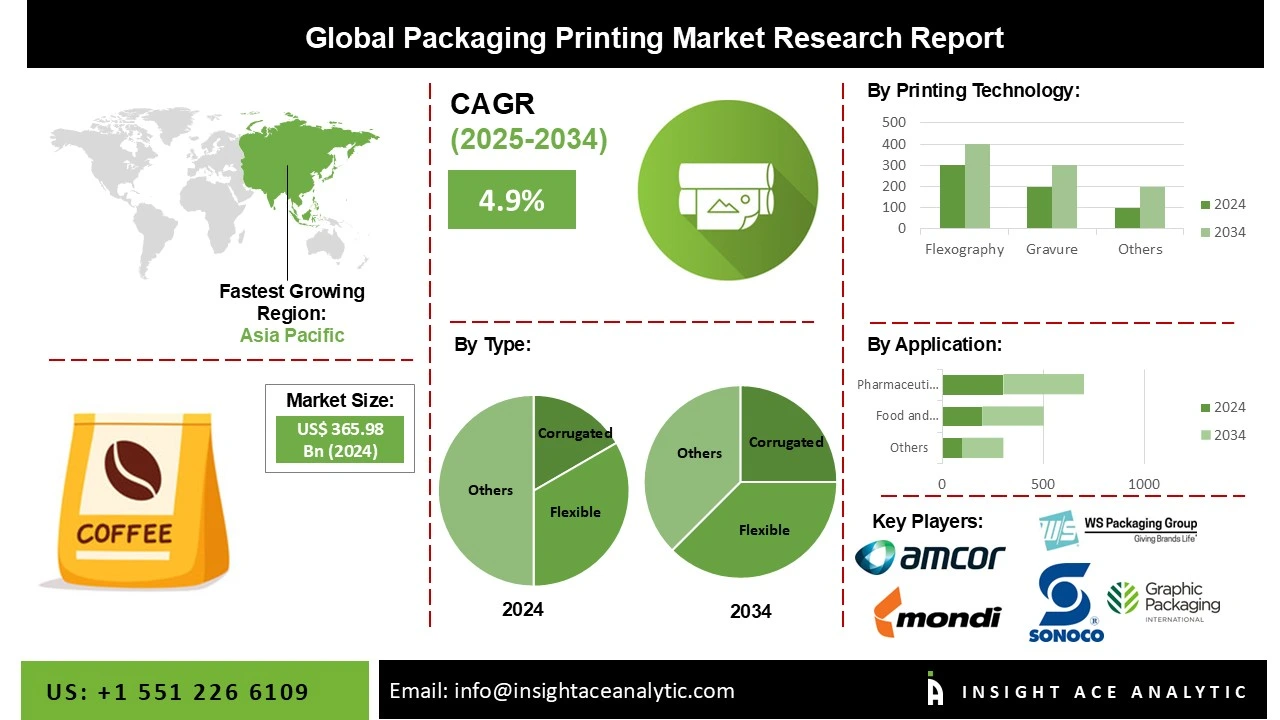

Packaging Printing Market Size is valued at 365.98 billion in 2024 and is predicted to reach 586.23 billion by the year 2034 at a 4.9% CAGR during the forecast period for 2025-2034.

Packaging printing is printing packaging materials such as glass, metal, plastic, label, paper, and paperboard, among others, utilizing various printing methods such as rotogravure, flexography, offset lithography, digital printing, and screen printing with multiple ink types. It is utilized in various applications, including food and beverage and pharmaceutical.

The Packaging printing market expansion is enhanced by the rapid emergence of digital print technology that has made the label printing industry more sophisticated and raised the acceptance of digital print labels. Its flexibility, versatility, and high graphical standards are the primary growing features. It is possible to print on metallic films, plastics, cellophane, paper, and corrugated surfaces using the flexographic process.

However, during COVID-19, as compared to other industries, fewer lockdowns were observed in the packaging industry as the packaging, food, beverage, and medical industries were considered essential. Furthermore, the massive demand for staples and medicines was due to panic-driven buying. Several supply chain constraints resulted in a mixed COVID-19 impact on the packaging printing market growth.

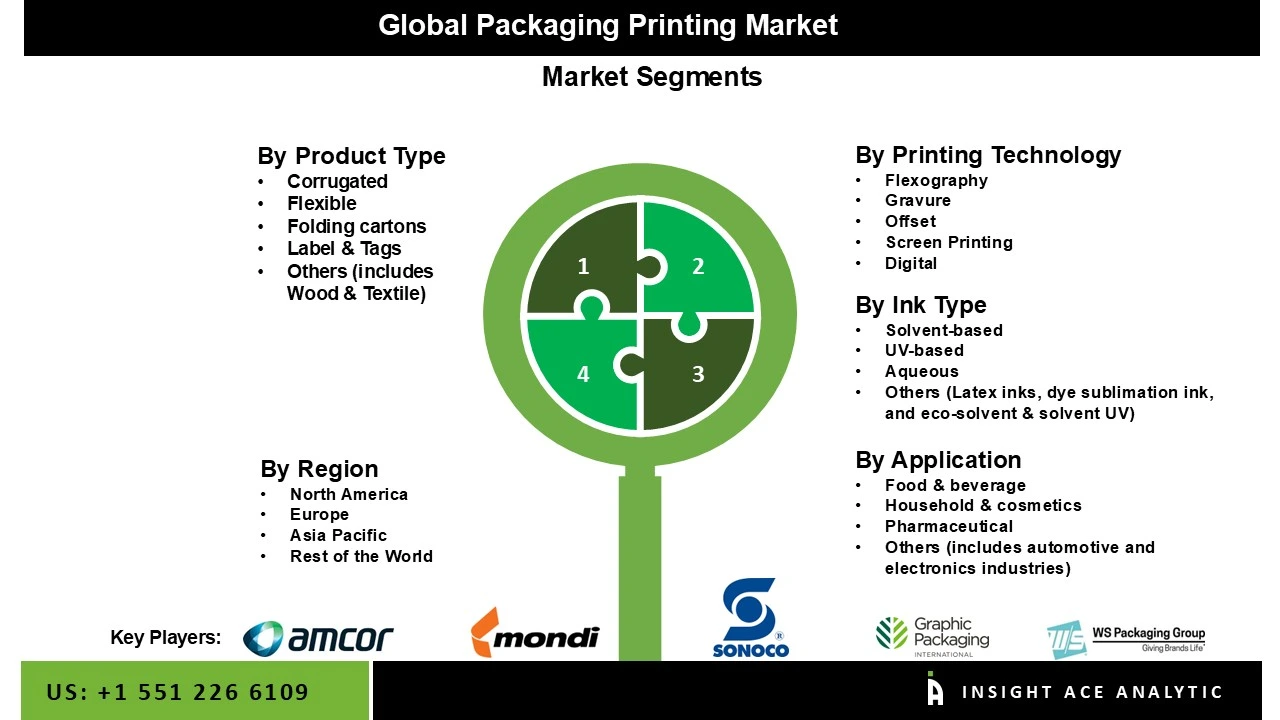

The Packaging Printing Market is segmented based on type, printing technology, printing ink, and application. Based on type, the market is segmented as corrugated, flexible, folding cartons, labels & tags, and others. The printing technology segment includes flexography, gravure, offset, screen printing, and digital. Printing ink is segmented into solvent-based, UV-based, aqueous, and others. The applications segment includes food & beverage, household & cosmetics, pharmaceutical, and others.

The labels & tags category is expected to hold a substantial share of the global packaging printing market in 2024. The rapid rise of digital print technology has aided the label market's growth by making the label printing market more sophisticated and increasing label usage. Its adaptability and versatility, as well as its high graphic standards, are key growth factors. Printing on metallic films, plastics, cellophane, paper, and corrugated surfaces is possible using the flexographic method.

The food & beverage segment is projected to grow rapidly in the global packaging printing market. The demand for printing in food packaging is expanding due to rising consumer demand for packaged products as eating habits change, and altering lifestyles may significantly impact the market. Because of the high barrier qualities, shelf life, and consumer safety, a rise in per capita disposable income and an increasing population are predicted to boost product demand. Printing on food packaging materials is used to inform and market to consumers. Printings are utilized with many different packaging materials. Direct printing is possible on plastics, paper, board, and cork.

Asia Pacific packaging printing market is expected to register the highest market share in terms of revenue in the near future. The Asia-Pacific package printing market encompasses a wide range of printing technologies and applications in a variety of sectors.

Different industries, such as food and beverage, consumer electronics, and so on, have resulted in increasing demand for packaging solutions in nations such as China, India, Japan, and South Korea. Furthermore, the packaging printing market in Europe is driven by factors such as an increased need for sustainable printing, increased demand for flexible packaging, cost-effectiveness, and decreased packaging waste. The expanding healthcare sector and the popularity of simple packaging are driving the package printing industry's growth.

Packaging Printing Market Report Scope

| Report Attribute | Specifications |

| Market size value in 2024 | USD 351.90 Bn |

| Revenue forecast in 2034 | USD 509.60 Bn |

| Growth rate CAGR | CAGR of 4.77% from 2025 to 2034 |

| Quantitative units | Representation of revenue in US$ Million, Volume (Unit) and CAGR from 2024 to 2031 |

| Historic Year | 2021 to 2024 |

| Forecast Year | 2025-2034 |

| Report coverage | The forecast of revenue, the position of the company, the competitive market statistics, growth prospects, and trends |

| Segments covered | Packaging Type, Printing Technology, Printing Ink, And Application |

| Regional scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; The UK; France; Italy; Spain; Japan; South Korea; Southeast Asia |

| Competitive Landscape | Mondi Plc, Sonoco Products Company, Graphics Packaging Holding Company, Quad/Graphics, Inc., Amcor Limited, Constantia Flexibles GMBH, Quantum Print and Packaging Ltd., WS Packaging Group, Inc., Kido Packaging Corporation, and Toppan Printing Co. Ltd. |

| Customization scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing and available payment methods | Explore pricing alternatives that are customized to your particular study requirements. |

By Packaging Type

By Printing Technology

By Ink Type

By Application

Packaging Printing Market By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.