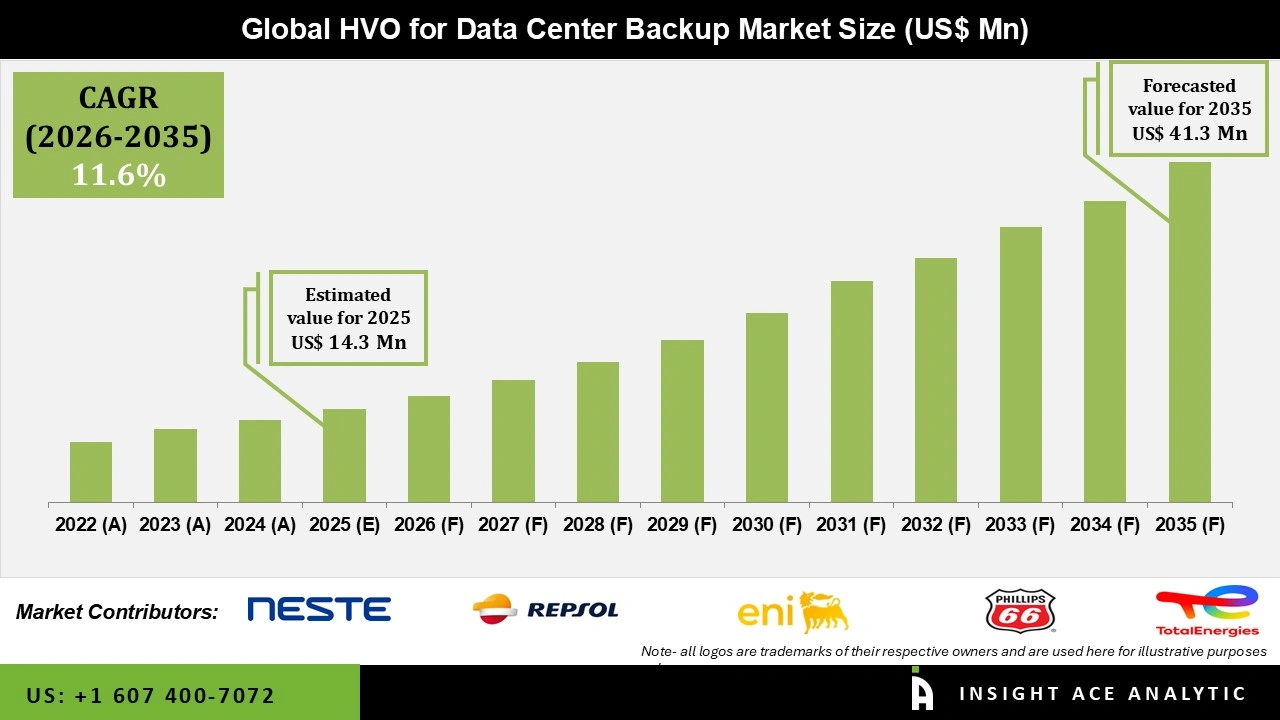

Global HVO for Data Center Backup Market Size is valued at USD 14.3 Mn in 2025 and is predicted to reach USD 41.3 Bn by the year 2035 at a 11.6% CAGR during the forecast period for 2026 to 2035.

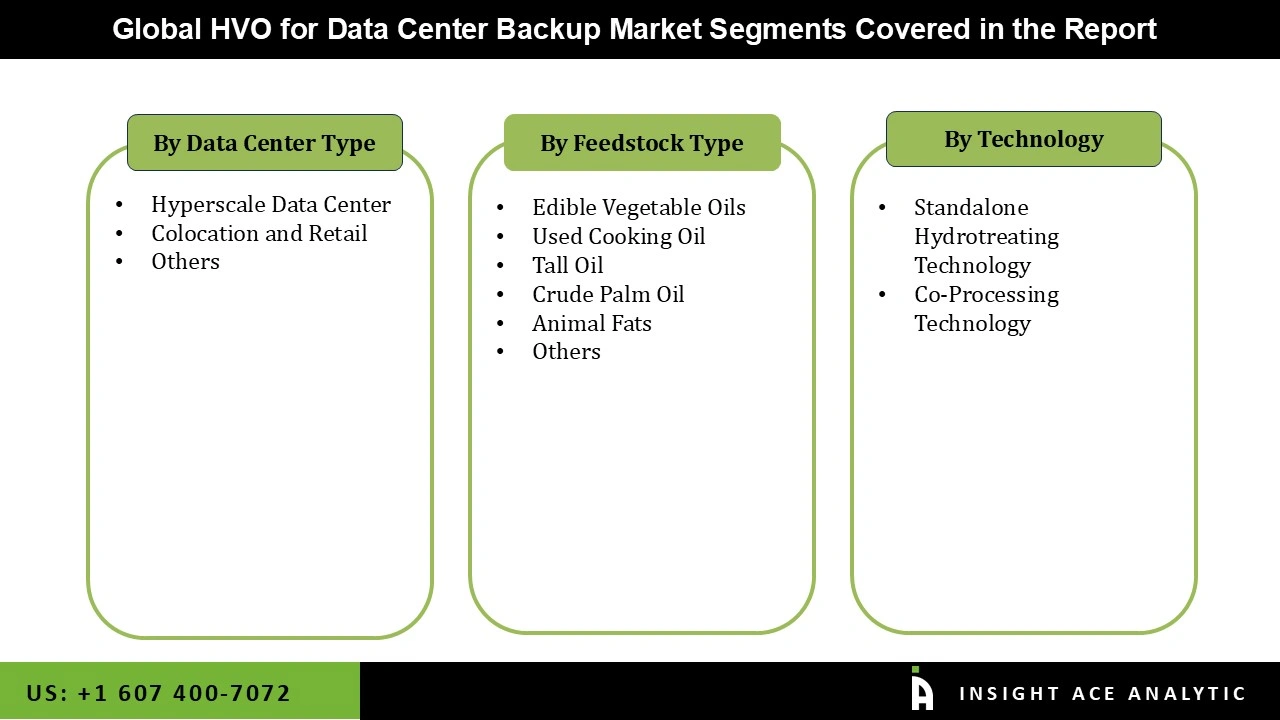

HVO for Data Center Backup Market Size, Share & Trends Analysis Distribution by Data Center Type (Hyperscale Data Center, Colocation and Retail, Others), By Feedstock Type (Edible Vegetable Oils, Used Cooking Oil, Tall Oil, Crude Palm Oil, Animal Fats, and Others), By Technology (Standalone Hydrotreating Technology and Co-Processing Technology), By Region and Segment Forecasts, 2026 to 2035

HVO (Hydrotreated Vegetable Oil) is a renewable diesel fuel made from waste oils, fats, and plant-based feedstocks. It works exactly like regular diesel and can be used directly in existing backup generators without any changes. In data centers, HVO powers emergency generators to keep everything running during power outages. It burns much cleaner than normal diesel, cutting carbon emissions by up to 90% over its full lifecycle and producing fewer harmful pollutants. The main reasons data centers are switching to HVO are stricter carbon reduction goals, the huge increase in data center power needs, and the desire for greener backup power without losing reliability.

The HVO for the data centre backup market is steadily increasing as the critical infrastructure sector begins to demonstrate a greater concern for the factors of sustainability, reduced carbon emissions, and guaranteed power availability. Data center facilities are increasingly reliant on HVO as a more sustainable alternative to classic diesel fuels to maintain constant operations in the event of a grid shutdown. Additionally, the power demand is rising substantially because of the higher usage of cloud computing, artificial intelligence, and hyperscale facilities. The rising interest from consumers to enhance the ESG profile and the increasing need to comply with the tightened regulations associated with the current higher concern against pollution are encouraging data center to adopt new fuels such as HVO.

Moreover, the fact that HVO can be integrated easily with the existing diesel generator base without the need for major modifications to the equipment adds to the market's growth. It finds particular applications as a data center backup power source owing to the high storage life, fuel stability, and reliability exhibited by the product when the power goes out. As a result of the support offered by the government in the form of sustainable regulations, the use of renewable fuels has started gaining momentum at a faster pace. However, there are some challenges that the market for HVO for data center backup power sources needs to face, including higher fuel prices compared to conventional diesel oil, along with limited accessibility.

Driver

Growing Pressure on Data Centers to Lower Their Carbon Impact and Improve Sustainability

The HVO for data center backup market is expanding dramatically due to growing pressure on data centers to lower their carbon impact and improve sustainability. In many areas and nations, the practice of obtaining renewable energy to power data centers is expanding. Data centers account for 1-3% of global energy use, making them among the biggest power consumers. Additionally, the operators of data centers, including Google, Microsoft, Meta (Facebook), and Amazon Web Services, have pledged to reach net-zero carbon emissions. Additionally, the need for cloud computing is driving the development of huge data centers across the globe. The HVO for data center backup market is expanding due to the rising need for enormous amounts of power.

Restrain/Challenge

High Capital Expenditure Needed for Data Center Backup Installation

One of the primary obstacles to the HVO for data center backup market's expansion is the substantial capital expenditure needed for data center backup installation and upkeep. To provide redundancy, large-scale data centers frequently require several high-capacity units, which greatly increases upfront expenses. The total cost of ownership is also increased by continuing maintenance, fuel costs, and compliance testing. These costs may be prohibitive for small and medium-sized businesses. Additionally, the requirement for qualified specialists and ongoing oversight raises operating expenses even more. Sustaining the HVO for data center backup market growth requires addressing these cost-related issues through service-based models, fuel-efficient technology, and modular designs.

The Colocation and Retail category held the largest share in the HVO for Data Center Backup market in 2025 since data centers need dependable and sustainable power solutions to run continuously. This rise is being driven by the increasing demand across industries for high-performance computing, cloud computing, and data storage. Furthermore, the efficiency and sustainability of backup power solutions are being improved by developments in HVO technologies, energy storage options, and power management systems, making them perfect for retail data centers and colocation.

In 2025, the Edible Vegetable Oils category dominated the HVO for Data Center Backup market propelled by the growing emphasis on low-carbon and sustainable fuel substitutes for vital power applications. HVO made from edible vegetable oils like soybean, rapeseed, and palm oil offers a cleaner-burning alternative to traditional diesel, and data center operators are under increasing pressure to lower carbon emissions while maintaining a steady power supply. These oils make it possible to produce high-quality HVO with superior combustion qualities, a lower sulfur content, and fewer emissions of particulate matter and NOx, which makes them appropriate for data center backup generator systems.

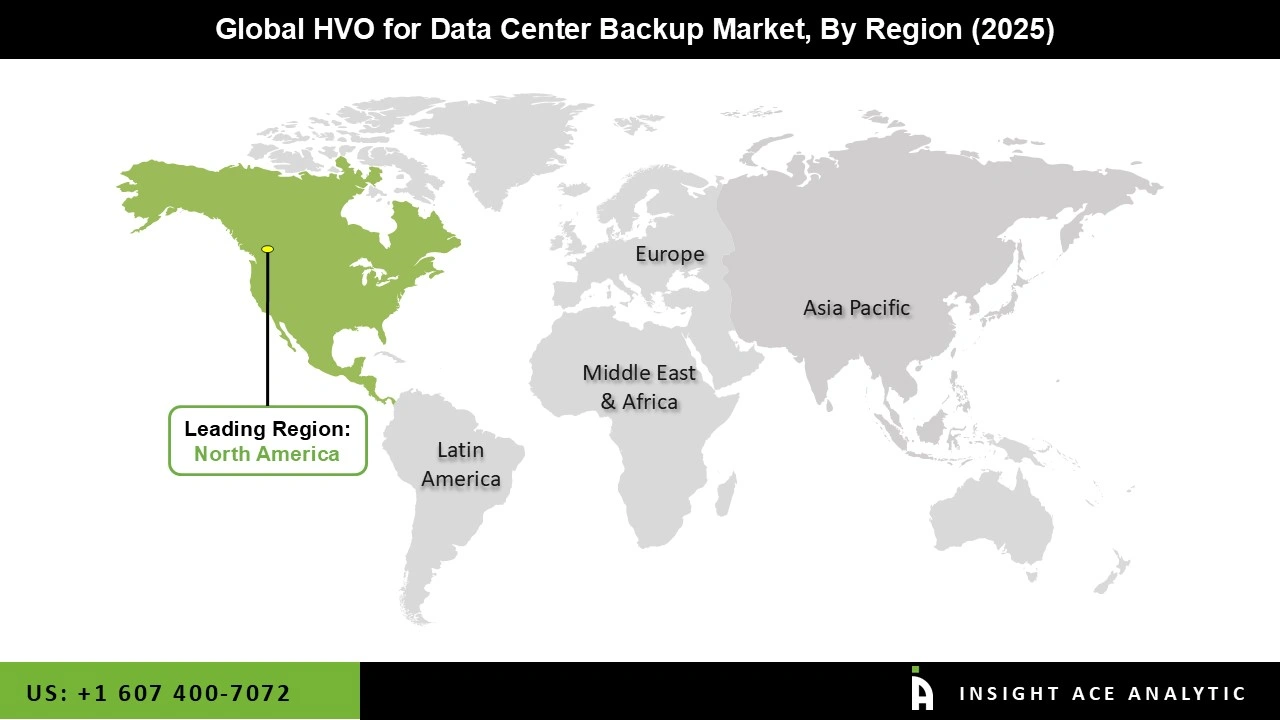

The HVO for Data Center Backup market was dominated by North America region in 2025 due to the quick growth of colocation and hyperscale data centers, as well as the growing focus on carbon reduction and sustainability. Hydrotreated vegetable oil (HVO) is becoming more popular as a greener substitute for traditional diesel fuel in backup generators since data centers need highly dependable backup power solutions to guarantee continuous operations.

Additionally, data center operators are being encouraged to switch to HVO-based backup systems by strict environmental regulations, corporate net-zero promises, and growing pressure from investors and consumers to adopt low-emission energy solutions.

| Report Attribute | Specifications |

| Market size value in 2025 | USD 14.3 Mn |

| Revenue forecast in 2035 | USD 41.3 Mn |

| Growth Rate CAGR | CAGR of 11.6 % from 2026 to 2035 |

| Quantitative Units | Representation of revenue in US$ Bn and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2024 |

| Forecast Year | 2026-2035 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | Data Center Type, Feedstock Type, Technology, and By Region |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; The UK; France; Italy; Spain; China; Japan; India; South Korea; Southeast Asia; South Korea; Southeast Asia |

| Competitive Landscape | Neste, Repsol, TotalEnergies, Phillips 66 Company, Eni S.p.A., Crown Oil Ltd, Foster Fuels Inc., Certas Energy, LubiQ HVO Fuels, Rehlko, Rolls-Royce plc, Caterpillar, Cummins Inc., and Moteurs Baudouin |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Geographic competitive landscape. |

| Pricing and Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.