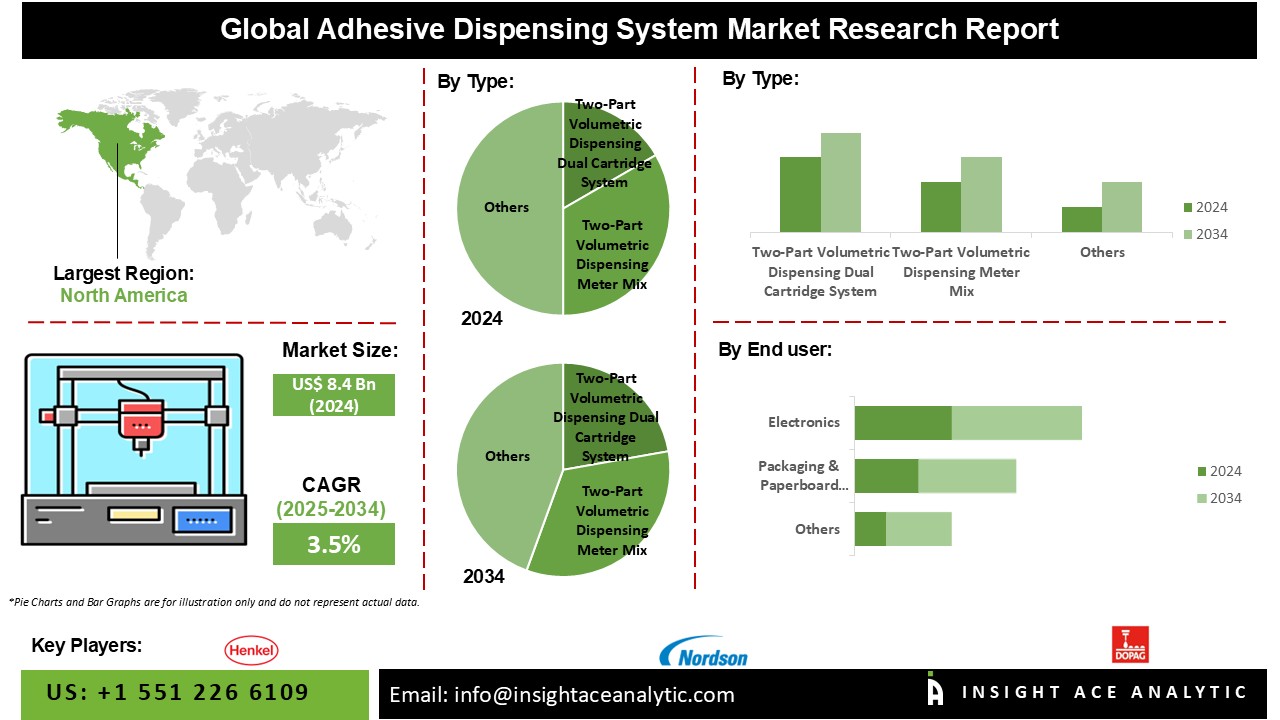

Adhesive Dispensing Equipment Market Size is valued at USD 8.4 Bn in 2024 and is predicted to reach USD 11.7 Bn by the year 2034 at a 3.5% CAGR during the forecast period for 2025-2034.

Adhesive dispensing equipment refers to machinery used for the precise application of adhesives. It finds extensive utility across diverse industries, including electronics, construction, automotive, packaging, industrial manufacturing, lamination, leather & footwear production, woodworking, and transportation. The market for adhesive dispensing equipment has been experiencing growth, primarily driven by heightened demand emanating from various end-use sectors. This upswing can be attributed to technological advancements and the increasing disposable income levels in developing nations. Several factors contribute to the expansion of this market. These include a rising demand for adhesive dispensing applications in electronics, construction, automotive, and packaging industries.

Additionally, manufacturers are becoming increasingly aware of automation's cost-saving benefits, which fuels adoption. Reduced labour costs propel the pursuit of automated systems. Moreover, the availability of cost-effective manual adhesives contributes to a more affordable price point for these machines.

The adhesive dispensing equipment market is segmented based on type and end users. The market is segmented based on type as a part volumetric dispensing dual cartridge system, two-part volumetric dispensing meter mix, and hand-held hot melt applicators and applications. By application, the adhesive Dispensing Equipment market is segmented into Packaging paper board Packaging, electronics, industrial and institutional construction and others.

The electronics category will hold a major share of the global adhesive dispensing equipment market. Adhesive dispensing machinery finds widespread utilization within the electronics sector, serving multiple functions. Notable applications encompass component attachment, product sealing and potting, and Conformal Coating. Adopting such equipment enhances the caliber and dependability of electronic gadgets while simultaneously reducing manufacturing expenses and boosting production efficiency. This expansion is a consequence of the rising global appetite for cutting-edge electronic devices.

The two-part volumetric dual cartridge system segment is projected to grow rapidly in the global Adhesive Dispensing Equipment market. The dual cartridge system minimizes waste by mixing only the required adhesive. This reduces material costs and environmental impact, making it an attractive choice for companies striving for sustainability. The system streamlines the adhesive dispensing process, reducing downtime. Operators can work more efficiently as they don't need to manually mix adhesives, which can be time-consuming and prone to errors.

The North American adhesive dispensing equipment market is expected to register a tremendous market share in revenue shortly. The market is experiencing growth during the forecast period due to several factors, including an increasing desire for lighter-weight vehicles, heightened construction activities, and the expanding use of adhesives across various applications.

Additionally, the European adhesive dispensing equipment market is expected to benefit from rising government investments in initiatives to reduce road vehicle weight, which will significantly shape the market landscape in the next five years.

However, Asia Pacific is projected to grow rapidly in the global adhesive dispensing equipment market. The expansion witnessed in these areas can be credited to the rising needs of the construction and automotive sectors. Furthermore, the escalating demand for adhesives across various end-use applications like electronics, packaging, lamination, woodworking, and transportation also significantly propels the adhesive dispensing equipment market's growth in these regions.

| Report Attribute | Specifications |

| Market Size Value In 2024 | USD 8.4 Bn |

| Revenue Forecast In 2034 | USD 11.7 Bn |

| Growth Rate CAGR | CAGR of 3.5% from 2025 to 2034 |

| Quantitative Units | Representation of revenue in US$ Bn and CAGR from 2025 to 2034 |

| Historic Year | 2021 to 2024 |

| Forecast Year | 2025-2034 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Type, By End-User |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico ;The UK; France; Italy; Spain; South Korea; South East Asia |

| Competitive Landscape | Valco Melton, Henkel Adhesives Technologies India, Nordson Sealant Equipment, Glue Machinery Corporation, Hernon Equipment, Kirkco Corporation, EXACT DISPENSING SYSTEMS, Adhesive Systems Technology Corporation, Dymax Corporation, Ashby Cross Company, Dopag Group (Switzerland), Nordon Corporation (U.S.) |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing And Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

Adhesive Dispensing Equipment Market By Type-

Adhesive Dispensing Equipment Market By End-User-

Adhesive Dispensing Equipment Market By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.