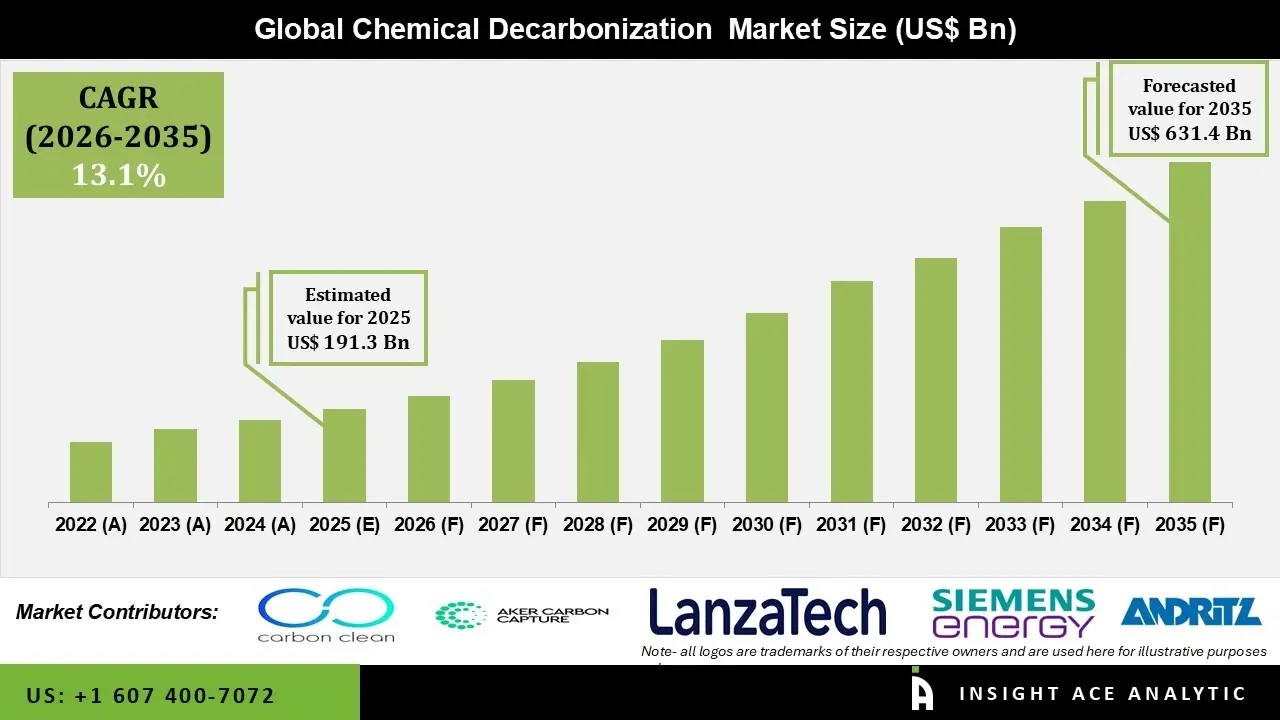

Chemical Decarbonization Market Size is valued at USD 191.3 Bn in 2025 and is predicted to reach USD 631.4 Bn by the year 2035 at a 13.1% CAGR during the forecast period for 2026 to 2035.

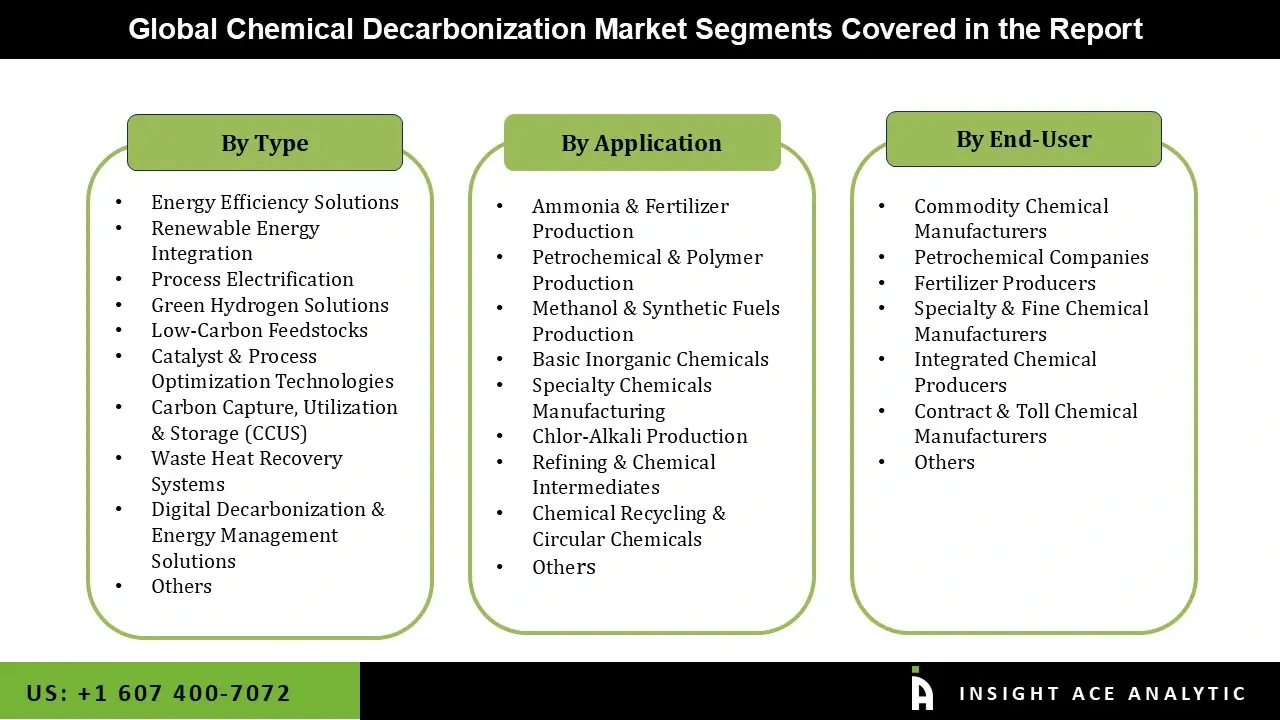

Chemical Decarbonization Market Size, Share & Trends Analysis Distribution by Type (Process Electrification, Green Hydrogen Solutions, Low-Carbon Feedstocks, Energy Efficiency Solutions, Renewable Energy Integration, Catalyst & Process Optimization Technologies, Digital Decarbonization & Energy Management Solutions, Carbon Capture, Utilization & Storage (CCUS), Waste Heat Recovery Systems, and Others), Application (Ammonia & Fertilizer Production, Chlor-Alkali Production, Refining & Chemical Intermediates, Basic Inorganic Chemicals, Specialty Chemicals Manufacturing, Petrochemical & Polymer Production, Methanol & Synthetic Fuels Production, Chemical Recycling & Circular Chemicals, and Others), End-user (Petrochemical Companies, Fertilizer Producers, Commodity Chemical Manufacturers, Integrated Chemical Producers, Contract & Toll Chemical Manufacturers, Specialty & Fine Chemical Manufacturers, and Others), and Segment Forecasts, 2026 to 2035

The methodical reduction or eradication of carbon dioxide (CO₂) and other greenhouse gas emissions produced across chemical industrial processes and value chains is referred to as chemical decarbonization. It entails switching to low-carbon substitutes such as renewable power, green hydrogen, bio-based raw materials, and recycled carbon sources from fossil fuel-based feedstocks and energy sources. Redesigning chemical routes, implementing carbon capture, utilization, and storage (CCUS), electrifying heat-intensive operations, and increasing process efficiency are important strategies for producing the same goods with noticeably fewer emissions. The stricter environmental laws, increased awareness of the social and economic advantages of chemical decarbonization, and increased international efforts to tackle climate change are driving the market.

The growing requirements and efforts from various industrial players towards reducing gas emissions and achieving net-zero targets within the industrial sectors are the primary factors contributing to the chemical decarbonization market. It has become an inevitable necessity for chemical industry players to adopt lower-carbon production methods due to stringent regulations enacted by environmental bodies and various government agencies worldwide as a result of rising global concerns regarding environmental sustainability and the impacts of industrial gas emissions on global warming and pollution levels.

Apart from that, various organizations from both the private and government sectors worldwide continue to make heavy investments in innovative decarbonization solutions such as green hydrogen, process optimization, and other innovative methods such as CCUS, due to which the adoption and use of such solutions continue to increase within various chemical industry production units, thus exponentially contributing towards the growing requirements and development of the chemical decarbonization market worldwide.

Moreover, the chemical decarbonization market is also propelled by the rising demand for ecologically friendly products from consumers, investors, and downstream industries. The chemical industry is compelled to decarbonize its operations due to the demands of low-carbon chemicals from various end-use industries like consumer products, automotive, construction, and packaging to meet its sustainability commitments.

The financial feasibility of decarbonization projects is rising due to advancements in technology and decreasing prices of hydrogen and renewable energy. Barriers like extensive infrastructure development demands, huge initial investment, and technological intricacy might have a slight inhibiting effect on the growth of the market for chemical decarbonization. Despite the barriers, the market for chemical decarbonization is witnessing steady growth due to the long-term benefits of zero emissions, regulatory support, and competitiveness.

• Carbon Clean

• Twelve

• Dioxide Materials

• Monolith Inc.

• Aker Carbon Capture

• LanzaTechlow-carbon

• Siemens Energy

• Topsoe

• Terradot

• Nextchem

• ANDRITZ

• Carbon Engineering

Rising regulatory pressure from global governments to decrease greenhouse gas emissions & address climate change is a primary reason propelling the chemical decarbonization market. To encourage industries to switch to low-carbon operations, governments are increasingly enforcing strict environmental regulations, emission limits, carbon pricarbon cing schemes, and sustainability mandates. These rules cover a wide range of industries, including manufacturing, transportation, energy, and heavy industry, making it imperative that businesses implement chemical decarbonization techniques and technologies.

The Paris Agreement and other regulatory frameworks have set aggressive goals for cutting carbon emissions worldwide, pushing nations to move more quickly toward sustainable industrial processes and greener energy sources. Apart from international accords, aggressive national and regional strategies are also emerging. In order to meet stakeholder demands and government expectations, corporations are increasingly integrating sustainability and carbon reduction objectives into their strategic priorities. The desire for a wide range of chemical decarbonization options, from enhanced carbon capture and the use of green fuels to energy-efficient equipment and electrification, is being fueled by this trend.

The substantial capital expenditure needed for the creation, implementation, and expansion of chemical decarbonization technology is one of the market's biggest obstacles. The high initial cost might be a considerable obstacle, especially for small- and medium-sized firms (SMEs) and industries running on narrow margins. Corporate budgets are strained by the costs associated with deploying these technologies, which include research and development, acquiring specialist equipment, upgrading existing facilities, and creating new supply chains.

Furthermore, compared to traditional fossil fuel-based processes, the operational expense related to maintaining and operating chemical decarbonization technology may be higher. Additionally, the price volatility in raw materials, renewable energy sources, and carbon pricing methods also affects the chemical decarbonization market. Financial planning and investment choices are impacted by unpredictability in the carbon credit markets and shifting subsidies. The businesses find it difficult to justify large-scale capital investments in areas with unpredictable or unsupportive legislative regimes, which causes chemical decarbonization projects to be delayed or cancelled.

The Carbon Capture, Utilization & Storage (CCUS) category held the largest share in the Chemical Decarbonization market in 2024 because of its vital function in mitigating the difficult-to-abate process emissions that come with the production of chemicals. CCUS is one of the few practical options for deep decarbonization because several chemical processes, like the generation of ethylene, ammonia, and methanol, inevitably produce CO2 emissions even when renewable energy is employed.

Additionally, in order to be cost-competitive and compliant, chemical manufacturers are being encouraged to invest in carbon capture systems by increasingly strict emission rules and carbon pricing mechanisms. Furthermore, the use of captured CO2 for chemicals, fuels, and polymers is generating new revenue streams, while technological developments are increasing capture efficiency and lowering prices.

In 2025, the Petrochemical Companies category dominated the Chemical Decarbonization market as significant manufacturers made a greater effort to lower the carbon intensity of large-scale, energy-intensive processes. Petrochemical companies are being forced to implement decarbonization strategies like energy efficiency improvements, process electrification, the use of low-carbon and recycled feedstocks, and the deployment of carbon capture technologies due to increased regulatory pressure, carbon taxes, and mandatory emission reporting. Additionally, in order to stay competitive in the market and land long-term supply contracts, petrochemical companies are being encouraged to invest in cleaner production pathways by the increased demand from downstream industries for sustainable polymers, fuels, and intermediates.

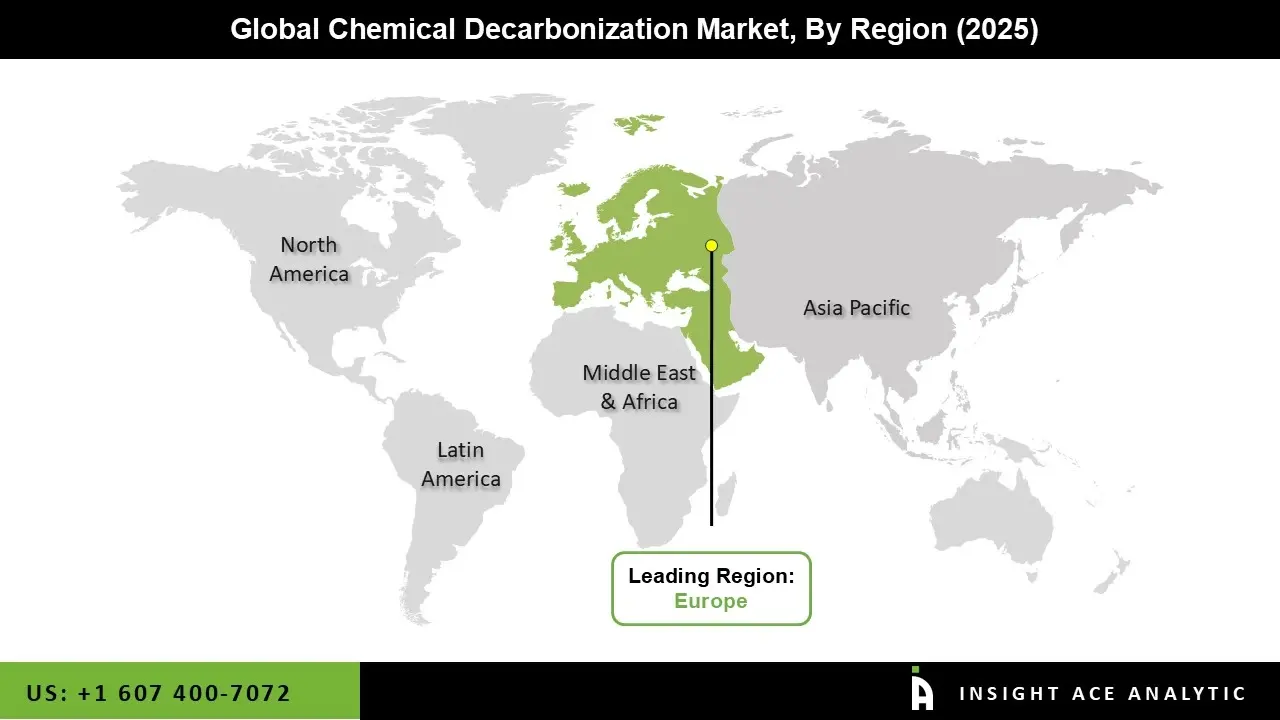

The Chemical Decarbonization market was dominated by the Europe region in 2025, fueled by substantial investments in clean technologies, aggressive climate targets, and robust regulatory frameworks. Chemical producers are being encouraged to switch to low-carbon processes by government programs like net-zero commitments, carbon pricing schemes, and incentives for clean hydrogen, carbon capture, utilization, and storage (CCUS), and renewable energy adoption.

Additionally, the area benefits from strong R&D spending, sophisticated industrial infrastructure, and the presence of significant chemical manufacturers who are aggressively incorporating digital optimization, green feedstocks, and electrification into their operations.

| Report Attribute | Specifications |

| Market size value in 2025 | USD 191.3 Bn |

| Revenue forecast in 2035 | USD 631.4 Bn |

| Growth Rate CAGR | CAGR of 13.1% from 2026 to 2035 |

| Quantitative Units | Representation of revenue in US$ Bn and CAGR from 2025 to 2035 |

| Historic Year | 2022 to 2025 |

| Forecast Year | 2026-2035 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | Type, Application, End-user, and By Region |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; The UK; France; Italy; Spain; China; Japan; India; South Korea; Southeast Asia; South Korea; Southeast Asia |

| Competitive Landscape | Carbon Clean, Twelve, Dioxide Materials, Monolith Inc., Aker Carbon Capture, LanzaTech, Siemens Energy, Topsoe, Terradot, Nextchem, ANDRITZ, and Carbon Engineering. |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Geographic competitive landscape. |

| Pricing and Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.