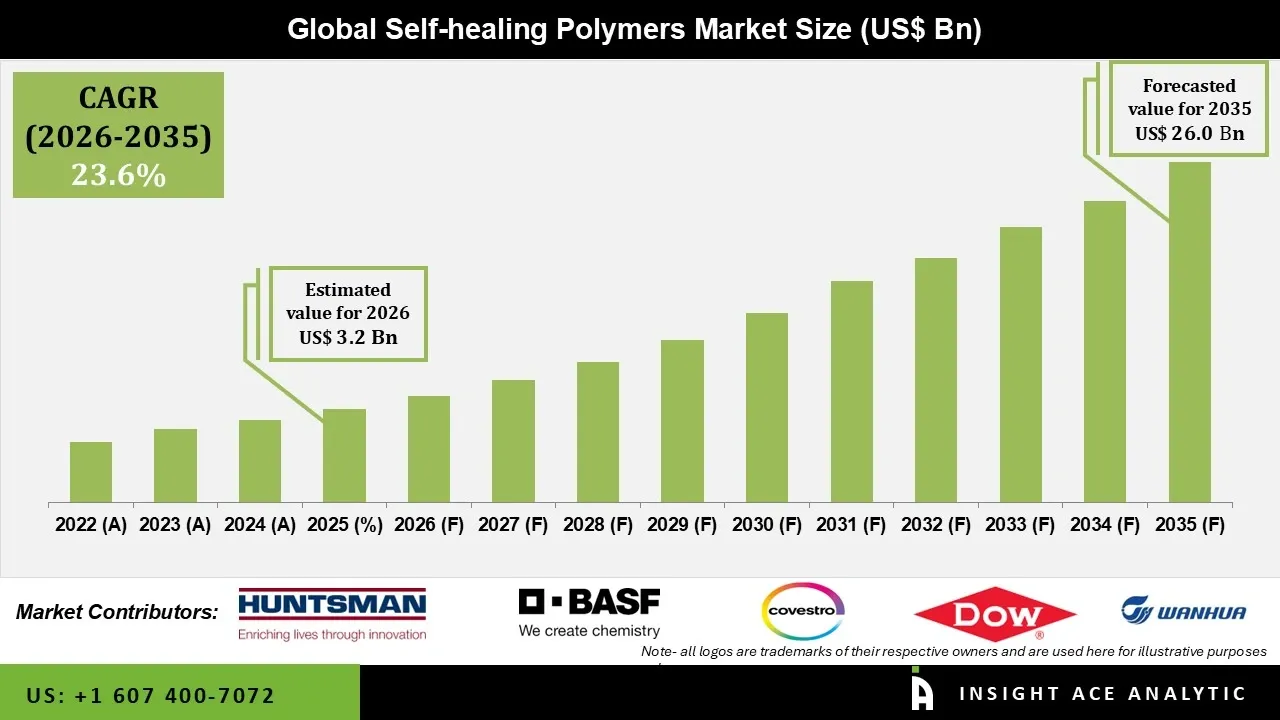

Self-healing Polymers Market Size is valued at USD 3.2 Bn in 2025 and is predicted to reach USD 26.0 Bn by the year 2035 at a 23.6% CAGR during the forecast period for 2026 to 2035.

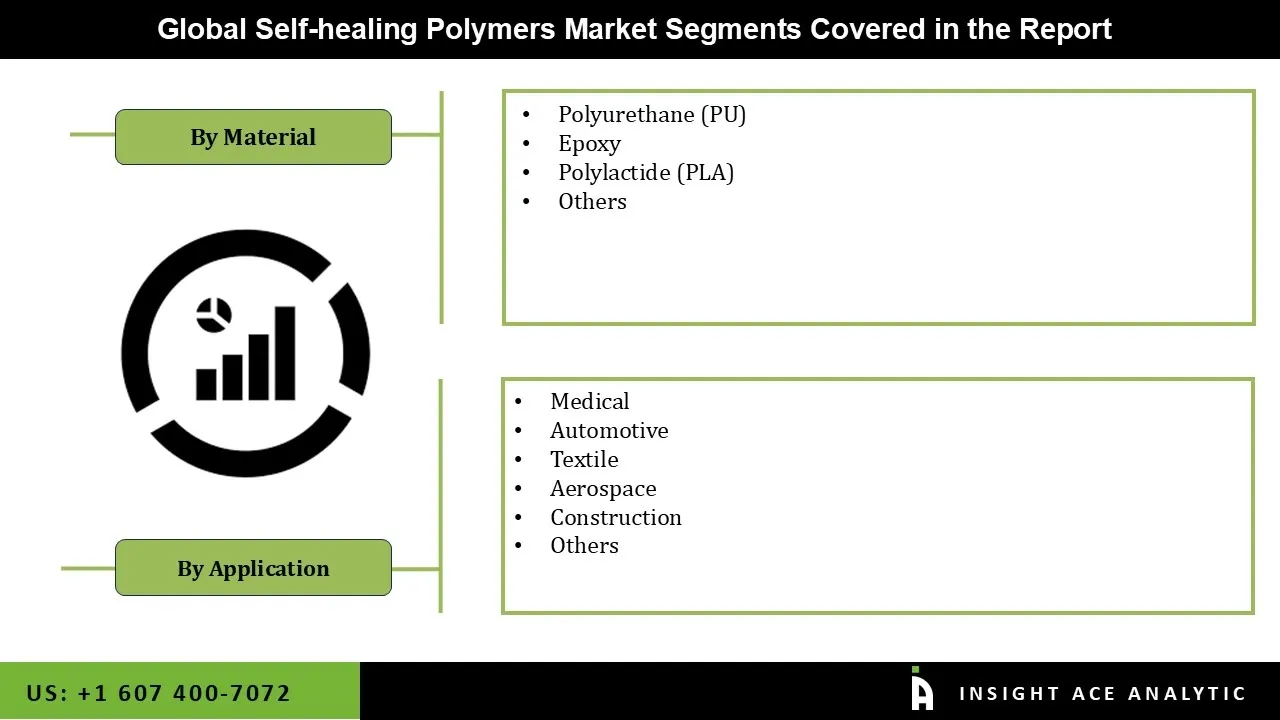

Self-healing Polymers Market Size, Share & Trends Analysis Distribution by Material (Epoxy, Polyurethane (PU), Polylactide (PLA), and Others), Application (Automotive, Construction, Medical, Textile, Aerospace, and Others), and Segment Forecasts, 2026 to 2035

Self-healing polymers are advanced materials engineered to autonomously repair mechanical damage such as cracks, scratches, or fractures extending their service life and reducing maintenance needs. Inspired by biological healing, they restore structural integrity and functionality without external intervention.

The market distinguishes two main types: intrinsic self-healing, which relies on reversible chemical bonds (e.g., hydrogen bonds, ionic interactions, or dynamic covalent bonds like Diels-Alder or disulfide linkages) for repeated healing; and extrinsic self-healing, which embeds healing agents (monomers, catalysts) in microcapsules or vascular networks that release upon damage to polymerize and seal cracks. These materials are gaining traction in high-value applications where durability and reliability are critical.

The need for long-lasting and environmentally friendly products is driving rapid growth in the global self-healing polymer market. Furthermore, self-healing polymers are being used in an increasing number of industrial applications. These polymers improve medical implants and gadgets, improving patient outcomes and lowering healthcare expenses. The self-healing polymers market is expanding due to technological developments in material science and nanotechnology. Polymers with better mechanical characteristics and quicker healing times are the result of innovations. These developments include the creation of multifunctional self-healing polymers that react to mechanical stress, heat, and light, providing adaptable solutions that improve the longevity and performance of products.

Additionally, on the other hand, the self-healing polymers market has a number of obstacles that hinder its expansion. Large-scale production of these materials is challenging due in large part to the intricate manufacturing process. The availability of self-healing polymers may be restricted, and production prices may rise as a result of this complexity. There are also technical obstacles to overcome. However, the self-healing polymers innovation is fueled by ongoing developments in material science, chemistry, and engineering.

To improve healing potential, durability, and adaptability, researchers are creating novel methods and compositions. The development of self-healing polymers with enhanced functionality and performance is made possible by advances in microencapsulation, shape memory polymers, and nanotechnology, increasing their use in a variety of industries. Thus, it is anticipated to provide future expansion and prosperity in the self-healing polymers market.

• BASF SE

• Wanhua Chemical Group Co., Ltd.

• NEI Corporation

• Huntsman International Corporation

• CompPair Technologies SA

• Covestro AG

• Dow Inc.

• Autonomic Materials, Inc.

• Arkema S.A.

• The Lubrizol Corporation

• The Goodyear Tire & Rubber Company

• Sika AG

The self-healing polymers have seen significant growth due to the increased focus on material sustainability and environmental impact reduction. Due to their short service life and low recyclability, conventional polymers frequently lead to waste accumulation. Self-healing polymers, on the other hand, prolong product lifecycles by decreasing early disposal and lowering the frequency of replacements. Because they reduce dependency on virgin raw materials, industries including consumer electronics and construction see these materials as enabling circular economy initiatives.

Reversible chemical systems are used in self-healing polymers to increase recyclability, which further promotes environmentally friendly material management. In line with larger international initiatives to lower carbon footprints and advance resource-efficient technologies, this sustainability component is boosting corporate and regulatory interest in the commercialization of these polymers.

Over the course of the projection period, the self-healing polymers market's growth will be constrained by the regulatory obstacles associated with the use of self-healing polymers in regulated industries. Strict regulations and a lack of standardized testing procedures make it difficult to integrate self-healing polymers in regulated industries like healthcare and aerospace. For broad commercial adoption, adherence to performance and safety standards is crucial. However, the validation process is made more difficult by the lack of well-recognized testing procedures. In order to overcome these obstacles and enable the integration of self-healing polymers into highly regulated industries, coordinated efforts are required to create uniform testing frameworks and clear regulatory channels.

The Polyurethane (PU) category held the largest share in the Self-healing Polymers market in 2025, driven by the construction and automotive industries' increasing need for high-performance materials. These sectors are looking more and more for ways to make products more resilient and long-lasting, especially in challenging environments. PU-based self-healing polymers are a great option for coatings, sealants, and adhesives because of their exceptional flexibility, mechanical strength, and resilience to weather. Their capacity to automatically fix surface flaws like scratches and cracks prolongs the life of materials and lessens the need for regular maintenance, which lowers costs and increases product effectiveness.

In 2025, the automotive category dominated the Self-healing Polymers market, driven by OEM requirements for enhanced surface protection, reduced maintenance intervals, and longevity. This trend extends from paint films and protective coatings on the outside to interior components, lightweight structural parts, and electric vehicle housings, where the capacity for self-healing greatly improves overall lifespan performance.

Additionally, the automotive manufacturers are beginning to see self-healing polymers as a useful solution for improving reliability and lowering the total cost of ownership as the trend towards electrification, weight reduction, and advanced material integration picks up speed. As a result, the self-healing polymers market is the largest and fastest-growing in the world for end-use applications.

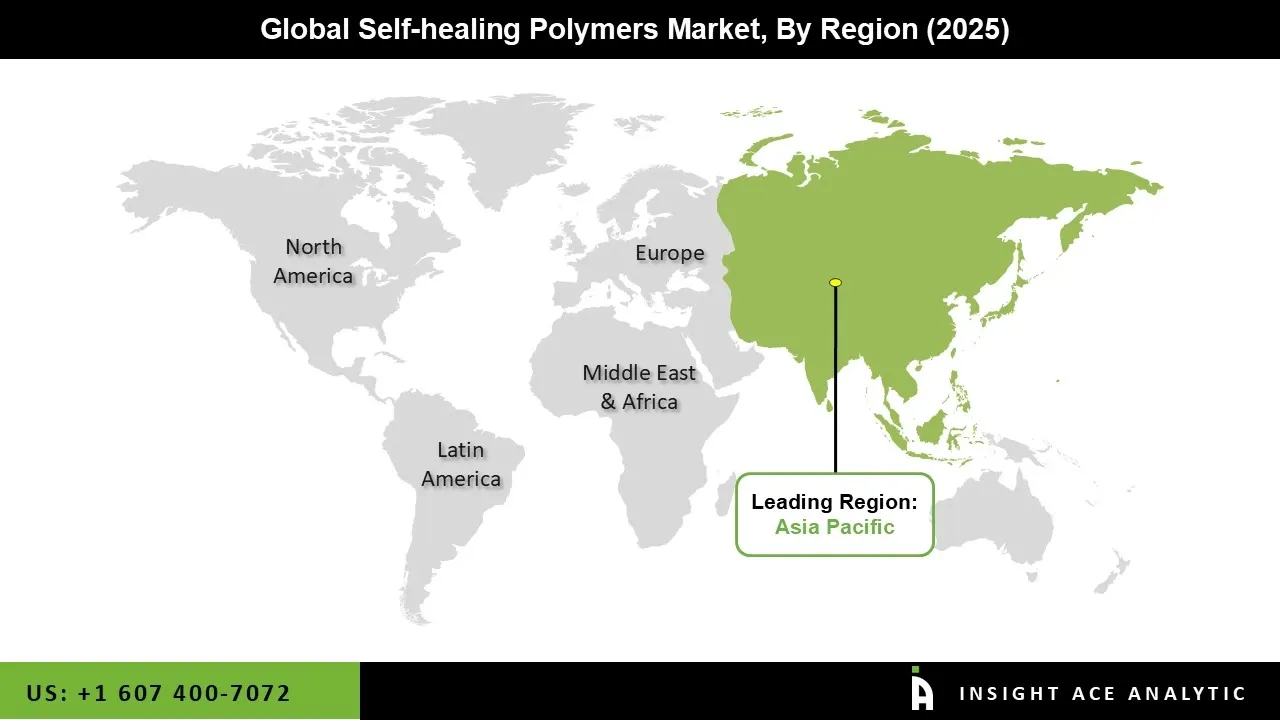

The Self-healing Polymers market was dominated by the North America region in 2025 due to the rapid industrialization and urbanization of South Korea, China, Japan, and India. Another factor anticipated to propel the growth of the self-healing polymers market in the Asia Pacific is the increasing use of these materials in electronics, vehicles, and architecture and construction to fix small fractures and damages.

The use of sophisticated materials is being encouraged by China's fast urbanization, growing construction industry, and government programs like Made in China 2025. Additionally, the nation's emphasis on sustainable materials and smart technology is driving the use of self-healing polymers in sectors like electronics, building, and healthcare, where creativity and economy are crucial.

• In June 2024, NEI Corporation received a Phase II SBIR grant from the U.S. Department of defense to further develop its NANOMYTE SHP (Self-Healing Polymer) coatings for military aerospace applications. The project focuses on enhancing the coating's ability to heal impact damage and corrosion on aircraft surfaces in harsh environments, utilizing a combination of shape-memory polymers and corrosion-inhibiting agents released upon damage.

| Report Attribute | Specifications |

| Market size value in 2025 | USD 3.2 Bn |

| Revenue forecast in 2035 | USD 26.0 Bn |

| Growth Rate CAGR | CAGR of 23.6% from 2026 to 2035 |

| Quantitative Units | Representation of revenue in US$ Bn and CAGR from 2025 to 2035 |

| Historic Year | 2022 to 2025 |

| Forecast Year | 2026-2035 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | Material, Application, and By Region |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; The UK; France; Italy; Spain; China; Japan; India; South Korea; Southeast Asia; South Korea; Southeast Asia |

| Competitive Landscape | BASF SE, Wanhua Chemical Group Co., Ltd., NEI Corporation, Huntsman International Corporation, CompPair Technologies SA, Covestro AG, Dow Inc., Autonomic Materials, Inc., Arkema S.A., The Lubrizol Corporation, The Goodyear Tire & Rubber Company, Sika AG |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Geographic competitive landscape. |

| Pricing and Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

Self-healing Polymers Market by Material-

• Epoxy

• Polyurethane (PU)

• Polylactide (PLA)

• Others

Self-healing Polymers Market by Application-

• Automotive

• Construction

• Medical

• Textile

• Aerospace

• Others

By Region-

North America-

• The US

• Canada

Europe-

• Germany

• The UK

• France

• Italy

• Spain

• Rest of Europe

Asia-Pacific-

• China

• Japan

• India

• South Korea

• South East Asia

• Rest of Asia Pacific

Latin America-

• Brazil

• Argentina

• Mexico

• Rest of Latin America

Middle East & Africa-

• GCC Countries

• South Africa

• Rest of Middle East and Africa

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.