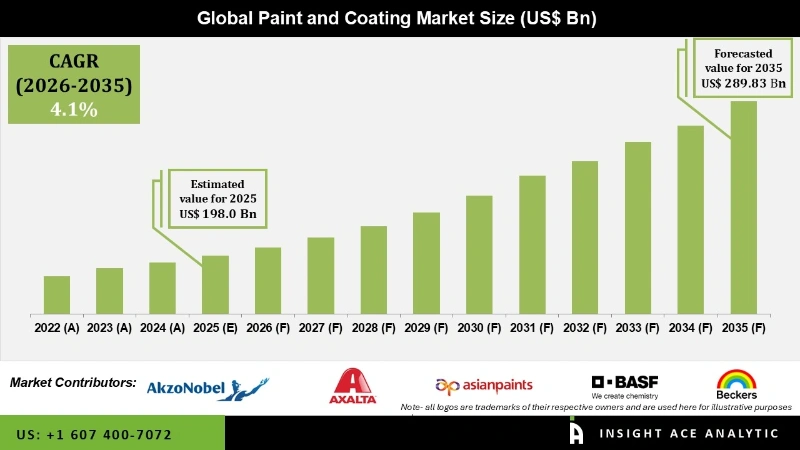

Paint and Coating Market Size is valued at USD 198.00 billion in 2025 and is predicted to reach USD 289.83 billion by the year 2035 at a 4.1% CAGR during the forecast period for 2026 to 2035.

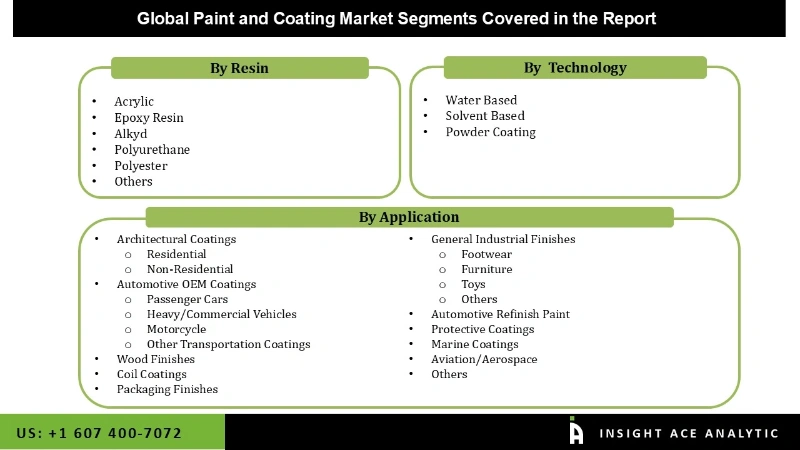

Paint and Coating Market Size, Share & Trends Analysis Report By Resin (Water-Based Coatings, Solvent-Based Coatings, Powder Coatings), Technology (Acrylic, Alkyd, Epoxy Resin, Polyester, Polyurethane), And By Application, By Region, And Segment Forecasts, 2026 to 2035.

Paints are substances intended to enhance the aesthetics of the surface on which they are placed. In contrast, coatings are primarily employed to stop substrate deterioration or to protect against corrosion. The worldwide paint and coating business is a sizable and expanding economic sector. The paint and coating market growth is driven by rising building activity, rising demand for environmentally friendly and sustainable coatings, and technological breakthroughs resulting in new product creation.

However, market expansion needs to be improved on volatile organic compounds' environmental and health risks (VOCs). Governments around the world are putting in place a variety of environmental and safety regulations, such as those from The Environmental Protection Agency (EPA), The Occupational Safety and Health Administration (OSHA)and the California Air Resource Board (CARB) to limit the negative effects of these compounds on human health and the environment.

The paint and coating market is segmented into resin, technology, and application. The market is segmented based on technology: water-based coatings, solvent-based coatings, powder coatings, and others. Based on resin, the market is fragmented into acrylic, alkyd, epoxy resin, polyester, polyurethane, and others. Depending on the application, it is fragmented into architectural, automotive OEM, wood finishes, coil coatings, packaging finishes, general industrial finishes, automotive refinish paint, protective coatings, marine coatings, aviation/aerospace and others.

Acrylic resin is anticipated to dominate the market. Due to its fast drying time, adhesion, flexibility, and relatively resistant qualities, acrylic resin has the most substantial market share and is ideal for paints and coatings. The primary factor driving the demand for the product is the expanding usage of acrylic for architectural coatings on interior and external walls, windows, and panels. Acrylic paints and coatings can be used on various surfaces, including wood, metal, and concrete, making them appropriate for indoor and outdoor usage. Many consumers favor acrylic paints and varnishes because of their dependability, resilience to the elements, and capacity to maintain color over time.

Water Based is anticipated to dominate the market. Due to rising utilization in the furniture, printing inks, plastic, wood, and vehicle industries, Water Based coatings currently have the biggest market share. The advantages of Water Based coatings, which include low VOC emissions, quick drying, and simpler application, are driving paint and coating market expansion. Water Based coatings are more environmentally friendly than conventional solvent-based coatings since they emit less volatile organic compounds (VOCs). Since traditional solvent-based coatings can no longer match Water Based technology's performance, industrial and consumer applications are increasingly turning to it. When opposed to solvent-based coatings, Water Based coatings are often less expensive to create, giving consumers a more affordable choice.

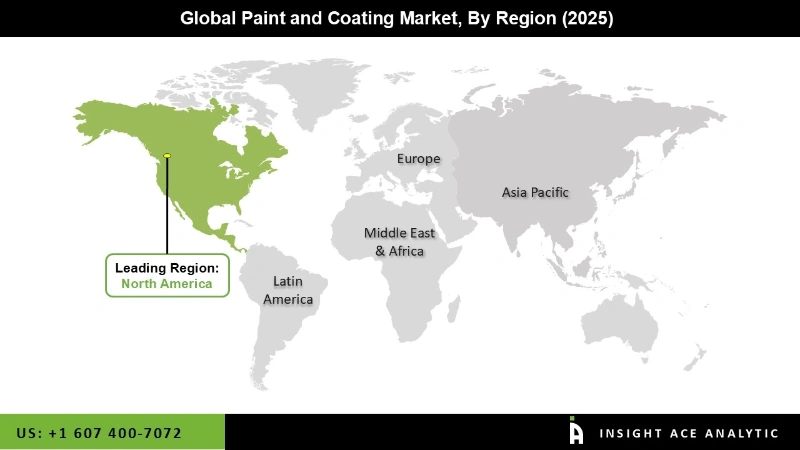

Asia Pacific, which includes China and Southeast Asia, dominated the market in 2019 and contributed significant of worldwide sales. Throughout the projected period, the market is anticipated to be driven by increasing building activities and rising demand from the automobile industry in emerging nations like China, India, Japan, and Southeast Asia. Growing building activity and expanding automotive sector demand, particularly in emerging nations like India, China, Korea, and Southeast Asia, will drive market expansion in the following years. Additionally, there are tremendous development opportunities to spur the market in the coming years due to the simple availability of raw materials and less stringent VOC emission rules compared to other regions like Europe and North America.

| Report Attribute | Specifications |

| Market size value in 2025 | USD 198.00 Bn |

| Revenue forecast in 2035 | USD 289.83 Bn |

| Growth rate CAGR | CAGR of 4.1% from 2026 to 2035 |

| Quantitative units | Representation of revenue in US$ Billion, and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2025 |

| Forecast Year | 2026-2035 |

| Report coverage | The forecast of revenue, the position of the company, the competitive market statistics, growth prospects, and trends |

| Segments covered | Resin, Technology, And Application |

| Regional scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; The UK; France; Italy; Spain; China; Japan; India; South Korea; Southeast Asia; South Korea; Southeast Asia |

| Competitive Landscape | akzonobel n.v., ppg industries, sherwin-willams company, axalta coating systems llc, jotun a/s, nippon paint holdings co., ltd., asian paints limited, kansi paint co., ltd., rpm international inc., basf coatings gmbh, hempel a/s, berger paints india limited, shalimar paints, masco corporation, s.k. kaken co., ltd., beckers group, dunn-edwards corporation, tiger coatings gmbh & co.kg., sacal international group ltd., vista paints corporation, indigo paints pvt.ltd, kelly-moore paints, and DAW SE |

| Customization scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing and available payment methods | Explore pricing alternatives that are customized to your particular study requirements. |

Paint And Coating Market By Resin-

Paint And Coating Market By Technology

Paint And Coating Market By Application

Paint And Coating Market By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.