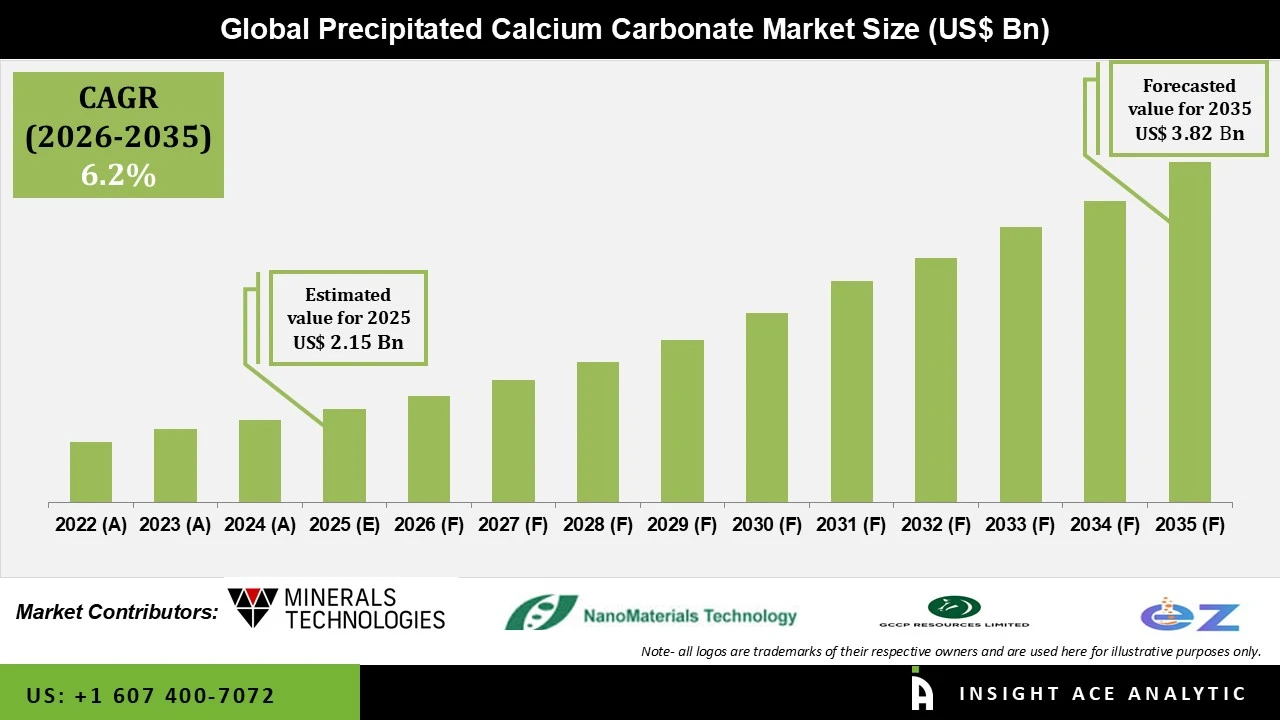

Precipitated Calcium Carbonate Market Size is valued at USD 2.15 Bn in 2025 and is predicted to reach USD 3.82 Bn by the year 2035 at a 6.2% CAGR during the forecast period for 2026 to 2035.

Precipitated Calcium Carbonate Market Size, Share & Trends Analysis Distribution by Grade (Pharmaceutical, Food, Cosmetic, and Reagent), and Segment Forecasts, 2026 to 2035

The reaction of calcium hydroxide with carbon dioxide produces precipitated calcium carbonate (PCC), a highly purified chemical product. PCC has excellent purity and a small particle size due to its stringent production requirements, making it suitable for a wide range of industrial applications. In papermaking, PCC is used as a coating pigment and filler to improve paper smoothness and brightness. In the pharmaceutical sector, it is used as a disintegrant, filler, and binder in tablet formulations. The expansion of the PCC market is being driven by its rising adoption in various industries such as paints, plastics, paper, and pharmaceuticals, where it outperforms naturally occurring calcium carbonate in terms of whiteness, purity, and process control.

The robust demand for precipitated calcium carbonate (PCC) in the paper industry is a primary market driver, as PCC is widely utilised as a filler and printing pigment to enhance brightness, opacity, and print quality. The rapid growth of the e-commerce sector, along with consumer preference for paper-based packaging, is expected to further boost demand for PCC in the packaging industry. This trend is expected to persist as the printing and packaging sectors increasingly prioritise sustainability. Additionally, PCC's stability, controlled particle size, and purity make it a necessary component in personal care and pharmaceutical applications. It is widely used as an excipient in pharmaceutical formulations, as an active ingredient in antacids, and as a calcium supplement.

Consequently, the growth of the PCC market is also supported by the expansion of the healthcare and cosmetics industries, notably in emerging economies.

The precipitated calcium carbonate (PCC) market is also expected to be driven by ongoing advances in production technologies and heightened emphasis on sustainability. Regulatory structures encouraging eco-friendly materials are also aiding market growth. Additionally, the market is shifting toward speciality PCC grades designed for specific applications, denoting a focus on high-performance products that meet end-user requirements. Increased awareness of PCC's benefits, such as enhanced opacity and brightness in paper products, is likely to further drive the market transition. However, the growth of the PCC market undergoes challenges from the availability of alternative fillers and additives, including talc, kaolin, and ground calcium carbonate (GCC), which can serve as substitutes due to their similar properties.

• EZ Chemicals Inc.

• Fujian Sanmu Nano Calcium Carbonate Co., Ltd.

• Minerals Technologies Inc.

• GCCP Resources Ltd.

• NanoMaterials Technology

• Guangdong Qiangda New Materials Technology Co.

• Nanoshel LLC

• Gulshan Polyols Ltd.

• Other Prominent Players

The precipitated calcium carbonate market is anticipated to increase in the future due to the expanding personal care and cosmetics industries. Emulsions and suspensions in personal care products are stabilized by precipitated calcium carbonate (PCC), guaranteeing a consistent texture and longer shelf life. Its cost-effectiveness and non-toxic, hypoallergenic qualities satisfy consumer demand for natural products while assisting producers in maintaining competitive pricing. For instance, retail sales of cosmetics and personal care products in Europe reached US$ 112 billion (€104 billion) in 2024, with Germany accounting for US$ 19.6 billion (€16.9 billion) and total European cosmetic product exports totaling US$ 34.1 billion (€29.4 billion), according to Cosmetics Europe, a trade association for the cosmetics and personal care industry based in Belgium. Thus, the precipitated calcium carbonate business is being driven by the expanding personal care and cosmetics sector.

The manufacturing of precipitated calcium carbonate (PCC) is subject to environmental laws, which present significant barriers to market growth over the forecast period. Strict environmental rules are being implemented globally as a result of the carbon emissions from the excavation and processing of limestone used in the production of precipitated calcium carbonate. Additionally, the manufacturers' operating expenses are raised by the strict emissions control regulations, waste disposal guidelines, and carbon tax rates enforced by governments and regulatory agencies. In order to reduce PCC usage over time and eventually control demand, industries are looking at sustainable and bio-based alternatives. To stay competitive in the market and adhere to rules, businesses must invest in carbon-neutral production techniques.

The pharmaceutical category held the largest share in the Precipitated Calcium Carbonate market in 2025. In pharmaceutical formulations, PCC serves as a prime excipient, serving as a binder, filler, or stabilizer during the tablet-making process. It is the perfect material for pharmaceutical applications that ensure the quality, potency, and consistency of medications due to its high purity and tiny particle size. The industry's high demand for PCC is a result of the general increase in pharmaceutical demand, which will greatly contribute to the market's expansion. Additionally, the aging population, rising rates of osteoporosis, and calcium deficiencies all contribute to the demand for calcium supplements, which in turn drives the precipitated calcium carbonate market. Furthermore, PCC's use in the healthcare sector is increased by its environmentally friendly processing and resemblance to pharmaceutical-grade standards.

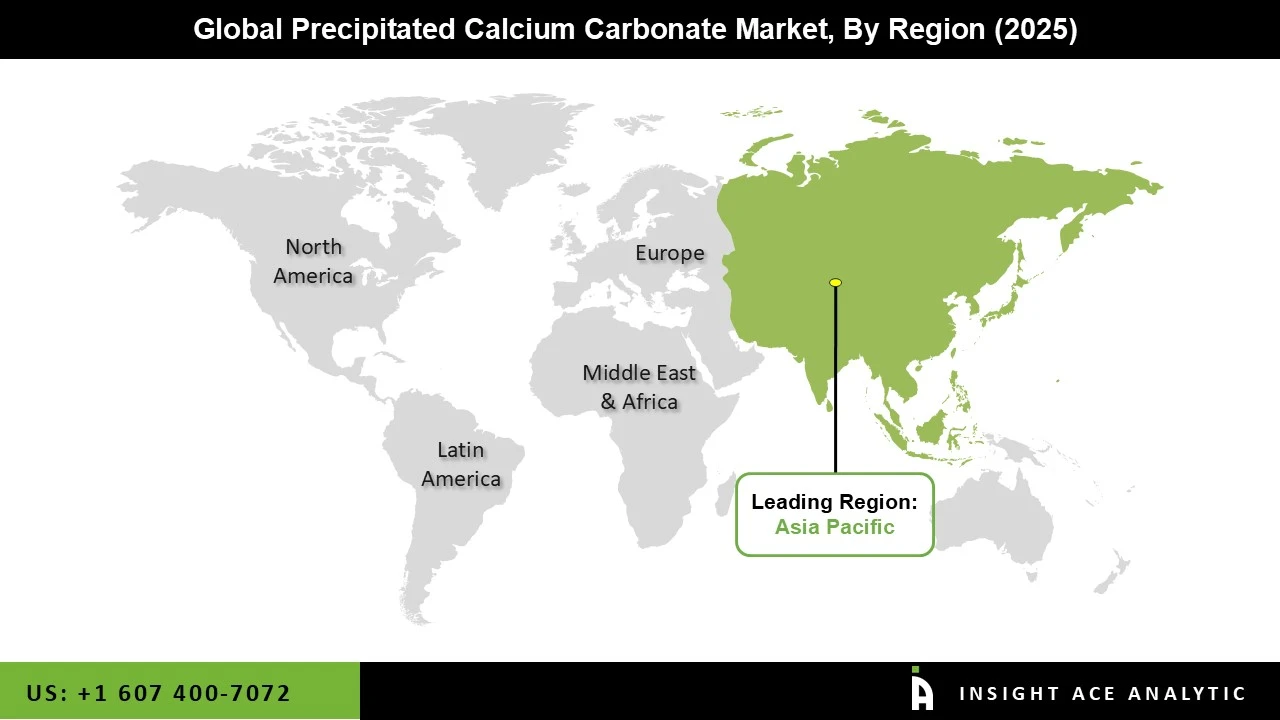

In 2025, the Asia Pacific region was the dominant market for precipitated calcium carbonate. The region's rapid industrialization, rising manufacturing base, and robust expansion in end-use sectors all contributed considerably to regional market demand. The pharmaceutical sector expanded as a result of improved healthcare infrastructure, rising population, and increased healthcare spending in nations such as China and India. Precipitated calcium carbonate was an important excipient in pharmaceutical formulations, helping in tablet manufacture and medication distribution. Rising demand for sustainable packaging solutions created new prospects for PCC as a filler and coating pigment, improving paper brightness, opacity, and printability. The trend toward lightweight, cost-effective packaging materials increased PCC use in the paper sector, prompting market participants to collaborate, consolidate, and expand capacity to strengthen their regional presence and meet expanding demand.

• March 2025: To strengthen its position in paper coatings and plastics, Omya AG announced that it had acquired a precipitated calcium carbonate production facility in North America from a strategic partner. This move increased the company's ability to produce PCC.

• July 2024: Artemyn was purchased by the Netherlands-based investment and diversified mining firm Flacks Group for US$ 400 million. Flacks Group sought to diversify its holdings and increase its presence in the mining industry by acquiring a reputable industrial-minerals operator. Precipitated calcium carbonate and other mineral-based solutions for the paper, board, coatings, and associated sectors are the specialty of Artemyn, an industrial-minerals company established in France.

• April 2023: In partnership with major paper and board manufacturers, Omya made significant investments to increase the production of calcium carbonate by building seven on-site plants throughout China and Indonesia. These facilities include two PCC plants in the provinces of Guangxi, Guangdong, Shandong, and Fujian, as well as three GCC facilities.

| Report Attribute | Specifications |

| Market size value in 2025 | USD 2.15 Bn |

| Revenue forecast in 2035 | USD 3.82 Bn |

| Growth Rate CAGR | CAGR of 6.2% from 2026 to 2035 |

| Quantitative Units | Representation of revenue in US$ Bn, Volume in Kilotons and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2025 |

| Forecast Year | 2026-2035 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | Grade, Age Group, Treatment Duration, End-user, Distribution Channel, and By Region |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; The UK; France; Italy; Spain; China; Japan; India; South Korea; Southeast Asia; South Korea; Southeast Asia |

| Competitive Landscape | EZ Chemicals Inc., Fujian Sanmu Nano Calcium Carbonate Co., Ltd., Minerals Technologies Inc., GCCP Resources Ltd., NanoMaterials Technology, Guangdong Qiangda New Materials Technology Co., Nanoshel LLC, and Gulshan Polyols Ltd. |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Geographic competitive landscape. |

| Pricing and Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

• Pharmaceutical

• Food

• Cosmetic

• Reagent

• North America-

o The US

o Canada

• Europe-

o Germany

o The UK

o France

o Italy

o Spain

o Rest of Europe

• Asia-Pacific-

o China

o Japan

o India

o South Korea

o South East Asia

o Rest of Asia Pacific

• Latin America-

o Brazil

o Argentina

o Mexico

o Rest of Latin America

• Middle East & Africa-

o GCC Countries

o South Africa

o Rest of Middle East and Africa

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.