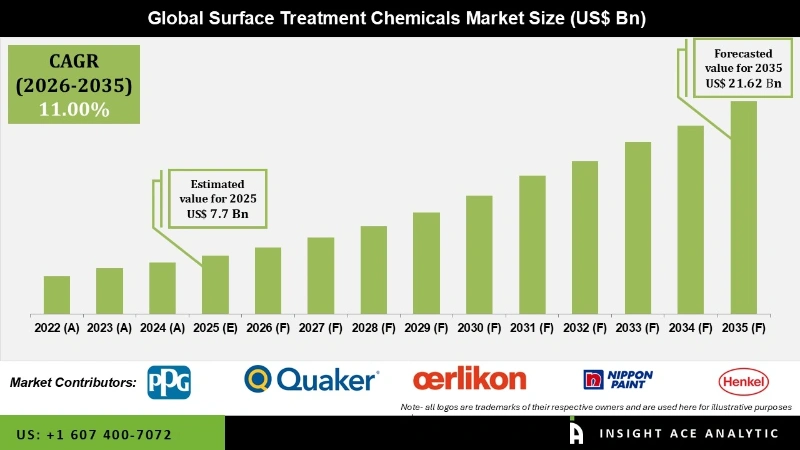

Surface Treatment Chemicals Market Size is valued at 7.7 billion in 2025 and is predicted to reach 21.62 billion by the year 2035 at a 11.00% CAGR during the forecast period for 2026 to 2035.

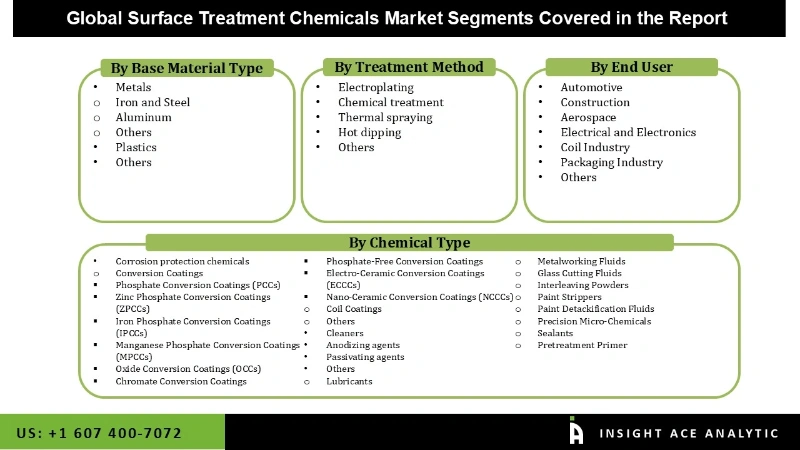

Surface Treatment Chemicals Market Size, Share & Trends Analysis Report By Chemical Type (Cleaners, Plating Chemicals, Conversion Coatings, and Others), Base Material (Metals, Plastics, And Others), By End Users Industry, By Treatment Method, By Region, And Segment Forecasts, 2026 to 2035.

Key Industry Insights & Findings from the Report:

The practice of altering a previously created product's surface attributes in order to obtain desired characteristics is known as surface treatment. It is a mechanical or chemical technique used to enhance solderability, adhesion or wettability, corrosion resistance, tarnish resistance, resistance to toxic chemicals, and wear and tear resistance.

Additionally, it adds hardness, changes heat conductivity and electrical conductivity, smoothest out surface defects, and controls surface friction and attrition. Also, chemical-based surface finishing activities, including photosensitivity improvement or reduction, paint and another tough stain stripping, corrosion curing, and, most critically, metal surface electroplating, are performed using surface treatment chemicals. They are used in a variety of industrial metals and machinery to increase performance and durability. They are also extensively employed in the electrical, construction, and automotive sectors.

Moreover, aluminium corrosion is encouraged by chemical treatment, which is predicted to speed up market expansion. The potential of surface treatment chemicals to lessen the effects of infections and to promote the adoption of the plating technique in the metal industry are additionally essential elements influencing the market expansion.

The rapid development of several end-use industries across significant regions, including North America, Asia Pacific, and others, is another crucial factor for market growth. The need for surface treatment chemicals is predicted to rise as a result of increased end-user demand. It is projected that sectors including automotive, construction, electrical and electronics, aerospace, and others will continue to drive market demand in the years to come.

The global surface treatment chemical market is classified into four sections: end-user industry, base material, chemical type, and treatment method. Based on chemical Type, the market is segmented into Cleaners, Plating Chemicals, Conversion Coatings, and Others. Based on Base Material, the market is segmented into Metals, Plastics, and Others. Based on End-Use Industry, the market is segmented into transportation, construction, general industry, industrial machinery, packaging, and Others. Based on treatment method, the market is segmented into electroplating, chemical treatment, thermal spraying, hot dipping, plating chemicals and others

The plating chemicals segment held the largest market share. The market for plating chemicals has grown due to its versatility for usage in a variety of end-use industries, including transportation, manufacturing, and construction. The Surface Treatment Chemicals Market category for cleaning chemicals is anticipated to experience the quickest growth over the period of forecast.

The plastics segment is expected to dominate the market. Plastics' choice over metals in different end industries, including transportation and building, can be credited to the market's growth in this segment. Plastics are incredibly simple to manufacture because they can very easily be shaped and machined. They also require less finishing.

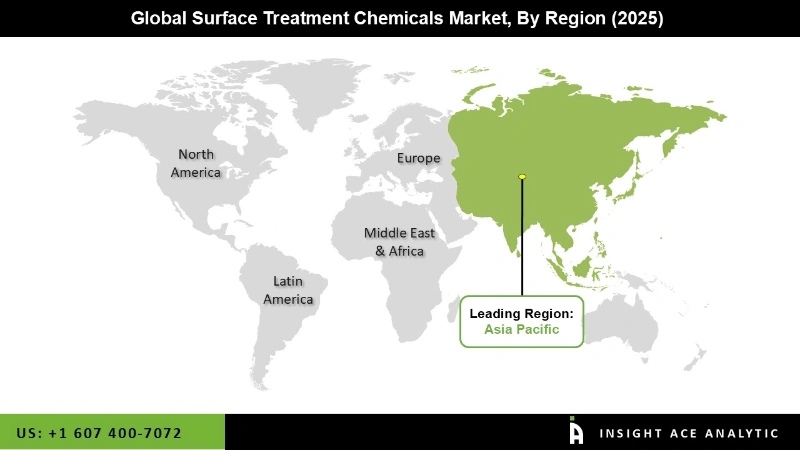

Asia Pacific is the largest and fastest growing market among them, owing to the region's growing construction industry, as well as its continuously growing automotive and marine industries. Because of increased government investment in the infrastructure sector, India, Japan, South Korea, and China are the region's largest markets. Following Asia Pacific, North America is the second largest shareholder in the Global Surface Treatment Chemicals Market. Because of increased demand for the product from diverse industries such as aerospace, marine, and defence, as well as significant reconstruction efforts in this country, the United States is the largest market in this region. Europe is another important area in the Global Surface Treatment Chemicals Market, with the United Kingdom, France, Germany, and Italy being the key contributors.

| Report Attribute | Specifications |

| Market size value in 2025 | USD 7.7 billion |

| Revenue forecast in 2035 | USD 21.62 billion |

| Growth rate CAGR | CAGR of 11.00% from 2026 to 2035 |

| Quantitative units | Representation of revenue in US$ Million, and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2025 |

| Forecast Year | 2026-2035 |

| Report coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments covered | Chemical Type, Base Material, End user Industry, Treatment Method |

| Regional scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country scope | U.S.; Canada; U.K.; Germany; China; Japan; Brazil; Mexico ;The UK; France; Italy; Spain; Japan; India; South Korea; South East Asia |

| Competitive Landscape | Element Solutions Inc. ,(U.S.), NOF Corporation (Japan), Atotech (Germany), Henkel AG & Co. KGaA (Germany), Chemetall, Inc. (Germany), Nihon Parkerizing Co., Ltd. (Japan), PPG Industries, Inc. (U.S.), Nippon Paint Holdings Co., Ltd. (Japan), Solvay (Belgium), OC Oerlikon Management AG (Switzerland), McGean-Rohco Inc. (U.S.), JCU CORPORATION (Japan), Platform Specialty Products Corporation (U.S.). Quaker Chemical Corporation (U.S.) |

| Customization scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing and available payment methods | Explore pricing alternatives that are customized to your particular study requirements. |

By End User

By Base Material Type

By Chemical Type

By Treatment Method

By Region scope

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.