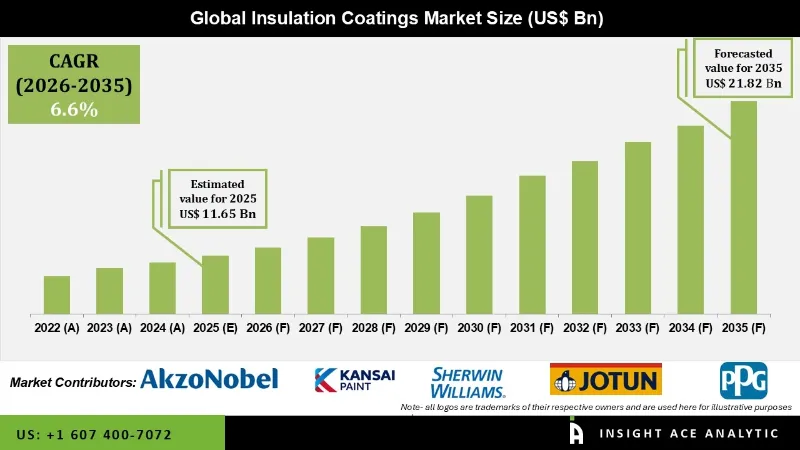

Insulation Coatings Market Size is valued at USD 11.65 Bn in 2025 and is predicted to reach USD 21.82 Bn by the year 2035 at a 6.6% CAGR during the forecast period for 2026 to 2035.

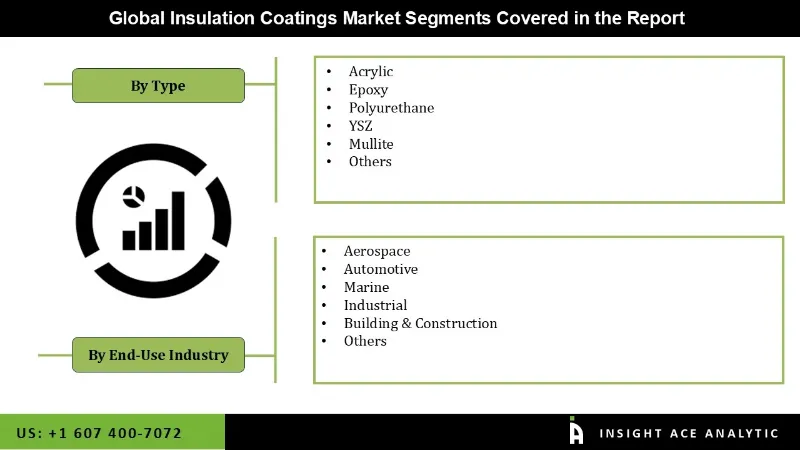

Insulation Coatings Market Size, Share & Trends Analysis Report By Type (Acrylic, Polyurethane, Epoxy, Mullite, YSZ), End-Use Industry (Aerospace, Automotive, Marine, Industrial, Building & Construction), By Region, And By Segment Forecasts, 2026 to 2035

Key Industry Insights & Findings from the Report:

Insulation coatings specialize in thermal insulation, moisture protection, and corrosion resistance to various surfaces and substrates. These coatings are applied to surfaces to create a barrier that prevents heat transfer, reduces energy consumption, and maintains temperature stability within a structure or system.

The worldwide market for insulation coatings is expected to expand due to the developing demand for energy efficiency in the current era, characterized by soaring energy consumption. This demand is poised to grow further with regions' rapid industrialization and urbanization. The increasing global population and a surge in commercial and residential establishments will further fuel the need for a continuous and sufficient energy supply. Many countries currently rely on non-renewable energy sources to meet these requirements. There is a growing awareness among consumers about the sustainability of future energy availability, given the alarming pace at which it is consumed. This awareness has increased interest in exploring various avenues to enhance energy efficiency and curtail energy wastage. Insulation Coatings have emerged as highly effective means of regulating heat energy according to specific needs and are actively promoted in various regions, resulting in an expanding consumer base.

Additionally, the increasing use of these coatings in the space sector, essential in controlling the high heat produced during space shuttle re-entry into the Earth's atmosphere, is also anticipated to be advantageous for the global market. However, significant difficulties might be in store. The availability of inferior or dishonest items on the market is a significant element that may impact the industry's growth trajectory. Some businesses have deceived customers by erroneously marketing paints or coatings as insulating materials.

The insulation coatings market is segmented based on type and End-Use Industry. The Type Segment consists of Acrylic, Polyurethane, Epoxy, Mullite, and YSZ. Lastly, the End-Use Industry segment comprises Aerospace, Automotive, Marine, Industrial, Building & Construction.

Acrylic-based insulation coatings, which are liquid acrylic insulation coatings, make up most of the insulation coatings market. People prefer these coatings to standard ones because they don't need as much upkeep and can stop CUI. Insulation coatings help protect these components and ensure their performance. The demand for insulation coatings is also driven by ongoing research and development activities in lighting and laser technology. Researchers require reliable coatings to test and develop new products.

The Industrial segment is projected to grow rapidly in the global Insulation Coatings market. Government incentives, subsidies, and energy efficiency programs encourage the adoption of insulation coatings in both public and private sectors. The industrial segment uses insulation coatings in various applications, including the energy sector.

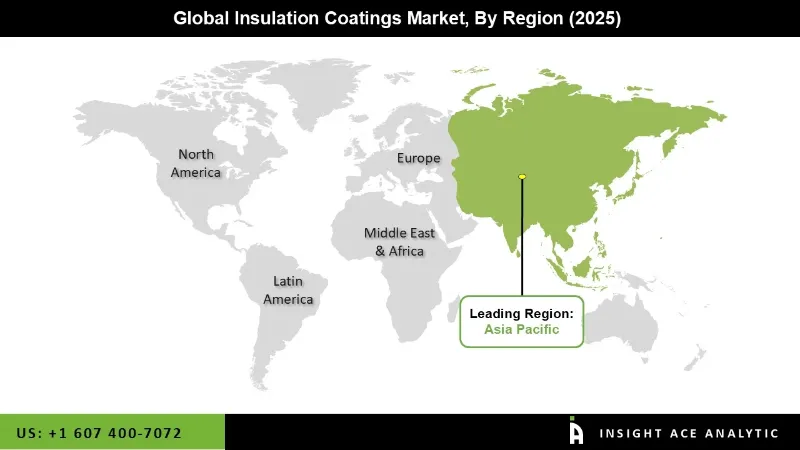

The Asia Pacific Insulation Coatings market is expected to register a tremendous market share. Asia Pacific hosts a significant aerospace and defence sector, where insulation coatings protect critical equipment and components from extreme temperatures and environmental factors. Aerospace advancements and military modernization efforts drive the demand for these coatings. There is a developing awareness among consumers and businesses about the importance of energy efficiency and environmental responsibility.

This awareness increases demand for insulation coatings to reduce energy consumption and greenhouse gas emissions. Ongoing advancements in insulation coating technologies, including the development of eco-friendly and high-performance coatings, are influencing market growth. Furthermore, the rapid pace of industrialization and urban development is anticipated to be a primary catalyst for regional market expansion.

| Report Attribute | Specifications |

| Market Size Value In 2025 | USD 11.65 Bn |

| Revenue Forecast In 2035 | USD 21.82 Bn |

| Growth Rate CAGR | CAGR of 6.6 from 2026 to 2035 |

| Quantitative Units | Representation of revenue in US$ Bn, Volume (KT) and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2024 |

| Forecast Year | 2026-2035 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | Type, End-Use Industry |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico ;The UK; France; Italy; Spain; China; Japan; India; South Korea; South East Asia; South Korea; South East Asia |

| Competitive Landscape | AkzoNobel (Netherland), PPG (US), Sherwin-Williams Company (US), Kansai Paint Co., Ltd. (Japan), Jotun Group (Norway), Nippon Paint Holdings Co., Ltd. (Japan), Axalta Coating System (US), Hempel (Denmark), Seal For Life Industries (US), Carboline (US), and Sharpshell Engineering (South Africa) and Others. |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing And Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

Insulation Coatings Market By Type

Insulation Coatings Market By End-Use Industry

Insulation Coatings Market By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.