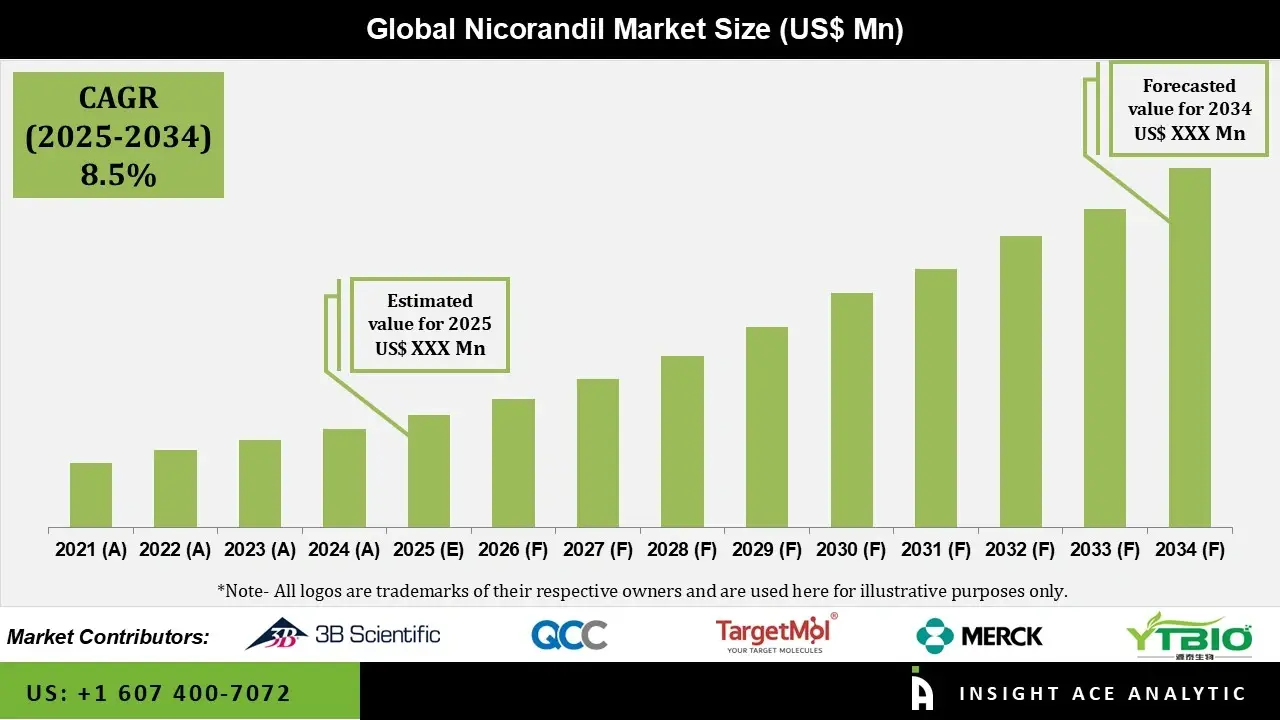

Global Nicorandil Market is estimated to grow with a CAGR of 8.5% during the forecast period of 2025 to 2034.

Nicorandil Market Size, Share & Trends Analysis Distribution by Dosage Form (Oral Solutions, Tablets, Injectables, and Extended-Release Formulations), Therapeutic Application (Hypertension, Ischemic Heart Disease, Heart Failure, and Chronic Stable Angina), Patient Demographics, End User, Distribution Channel and Segment Forecasts, 2025 to 2034

Nicorandil is a dual-action vasodilator and the only clinically approved potassium-channel activator with nitrate-like properties. It treats chronic stable angina pectoris by opening ATP-sensitive potassium channels in vascular smooth muscle and donating nitric oxide, resulting in both arterial and venous dilation.

This mechanism rapidly increases coronary blood flow, boosts oxygen delivery to the heart, and reduces cardiac preload and afterload, effectively relieving and preventing angina symptoms. Administered orally (typically 10–20 mg twice daily), it is indicated when beta-blockers or calcium-channel blockers are contraindicated or insufficient, and remains a standard therapy in Europe, Japan, and many Asia-Pacific and Middle East markets.

The Nicorandil market is growing steadily due to the rising number of people with heart disease worldwide. Aging populations, more sedentary lifestyles, and increasing rates of diabetes, high blood pressure, and Obesity are driving up angina cases. The growing elderly population – who are most at risk – is a major factor boosting demand. Better healthcare systems in developing countries, higher patient awareness, and increased spending on cardiovascular medicines also support market growth.

Side effects such as headaches, dizziness, and rare but serious mouth or gut ulcers can limit patient acceptance. Newer angina treatments and generic competition are additional challenges. However, ongoing research into improved formulations (e.g., sustained-release versions) and expanding use in emerging markets offer strong growth potential. As heart disease remains a majorcause of death globally, Nicorandil continues to play an important role in affordable, effective angina management.

• Nanjing Luomeimei Biotechnology Co. LTD

• Merck

• Shanghai Myrell Chemical Technology Co. LTD

• Shanghai Yuanye Bio-Technology Co. Ltd

• J&K Scientific

• Shenzhen Feisi Biological Technology Co. LTD

• Yunnan Xili Biotechnology Co. LTD

• Shanghai Aladdin Biochemical Technology Co. LTD

• Nanjing Shenglide Biotechnology Co. LTD

• Biorbyt

• Biosynth Carbosynth

• ApexBio Technology

• Santa Cruz BiotechnologyInc.

• Combi-Blocks Inc

• AdooQ BioScience

• Wuhan Belka Biomedicine

• Alfa Chemistry

• Toronto Research Chemicals Inc

• Apollo Scientific Ltd

• 3B Scientific

• Carbone Scientific

• Cayman Chemical

• TCI

• Targetmol

• QCC

• A&A Life Science Inc

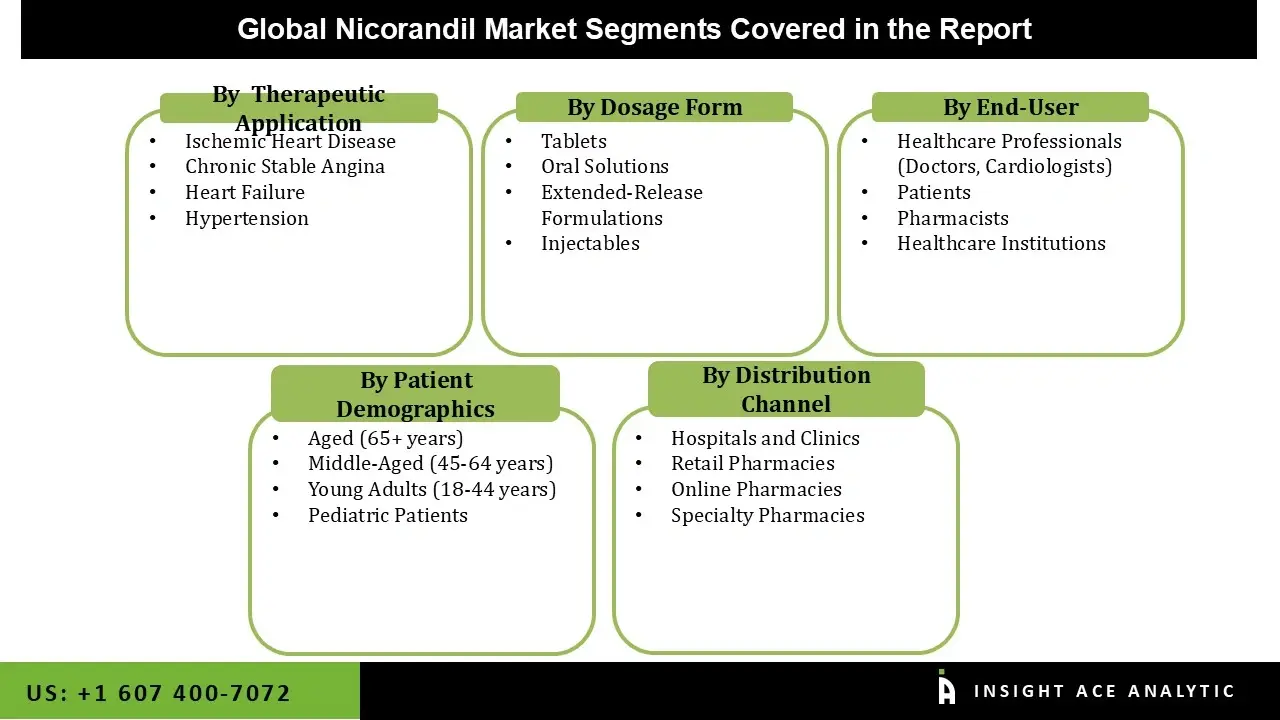

The nicorandil market is segmented by dosage form, therapeutic application, patient demographics, end user, and distribution channel. By dosage form, the market is segmented into oral solutions, tablets, injectables, and extended-release formulations. As per the therapeutic application, the market is segmented into hypertension, ischemic heart disease, heart failure, and chronic stable angina.

By patient demographics, the market is segmented into pediatric patients, young adults (18-44 years), middle-aged (45-64 years), and aged (65+ years). By end user, the market is segmented into healthcare professionals (doctors, cardiologists), pharmacists, patients, and healthcare institutions. The distribution channel segment comprises into hospitals and clinics, retail pharmacies, specialty pharmacies, and online pharmacies.

The oral solutions category held the largest share in the Nicorandil market in 2024. Oral dose forms are the most widely recognized and usually recommended manner of delivering Nicorandil, with tablets being the prevalent type. This simplicity and patient compliance elevate the oral route's attractiveness, allowing for stable therapeutic levels without the requirement for expert administration, making it ideal for long-term maintenance. In order to improve absorption and maintain therapeutic benefits over time, oral versions are frequently made using a controlled-release mechanism.

In 2024, the Ischemic Heart Disease category dominated the Nicorandil market. Ischemic heart disease, which includes a variety of disorders marked by decreased blood flow to the heart muscle, makes up the greatest portion of the therapeutic application category. Due to the increased occurence of ischemic heart diseases worldwide, which are caused by risk factors such as diabetes, hypertension, and lifestyle decisions, this category is leading.

According to the World Health Organization, ischemic heart disease accounts for 16% of all fatalities globally, making it the leading cause of mortality. The need for Nicorandil as a treatment option is anticipated to increase as medical professionals become more aware of the significance of efficient management techniques for ischemic heart disease.

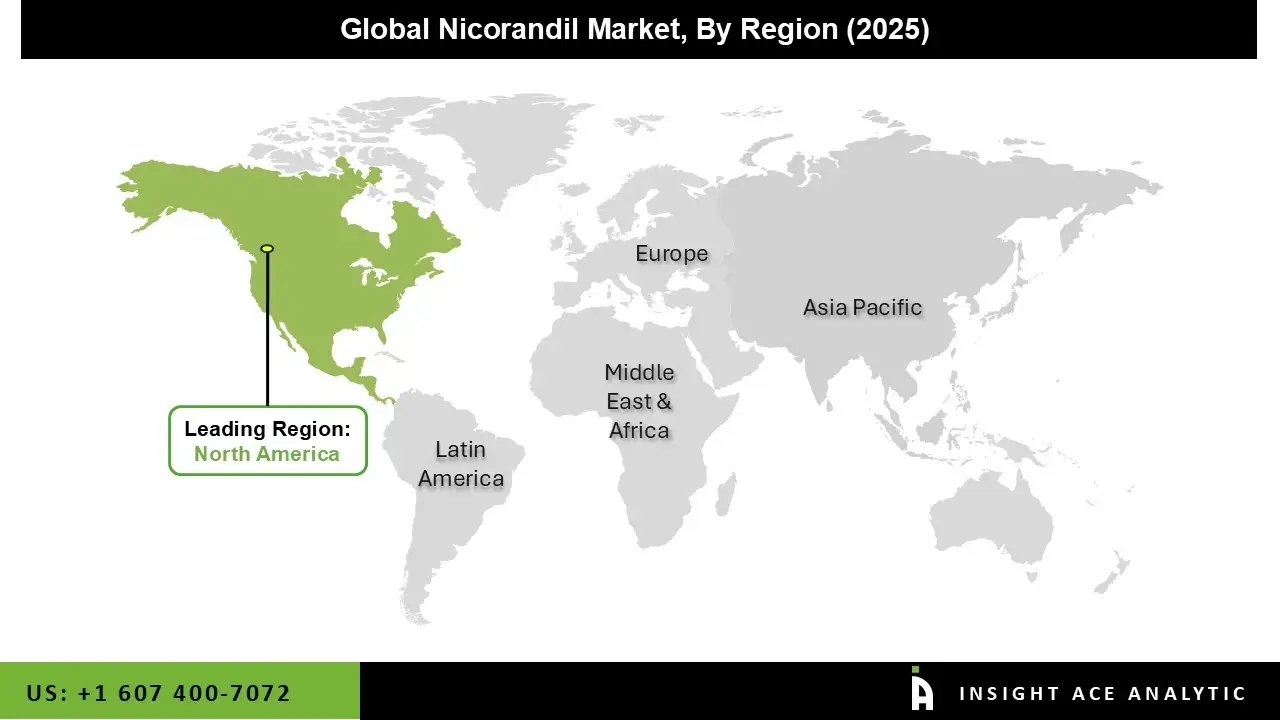

North America commands the leading market share in the global nicorandil landscape, characterized by its sophisticated and high-capacity healthcare ecosystem. The region’s dominance is underpinned by a significant patient population diagnosed with chronic stable angina and other ischemic heart conditions, supported by widespread diagnostic capabilities and a treatment culture that integrates both established and newer therapeutic options.

A mature pharmaceutical supply chain, combined with favorable reimbursement structures for cardiovascular medications, ensures consistent product availability and patient access. This established commercial footprint is reinforced by ongoing Cardiology research and clinical education that maintains physician awareness of nicorandil’s role in specific treatment algorithms, particularly for patients with refractory symptoms.

The Asia Pacific region is positioned for the most rapid expansion within the nicorandil market, representing the highest projected growth rate. This acceleration is driven by powerful demographic and systemic trends, including a sharply rising prevalence of hypertension, diabetes, and coronary artery disease across its vast and aging populations. Growth is further catalyzed by substantial governmental and private investment in healthcare infrastructure, which is improving diagnosis and treatment rates in both urban and emerging rural markets.

The region also benefits from the drug's established history and deep clinical familiarity in key markets like Japan and South Korea, while growth engines such as China and India contribute through scaling domestic pharmaceutical production, increasing physician adoption, and expanding insurance coverage for chronic disease management.

| Report Attribute | Specifications |

| Growth Rate CAGR | CAGR of 8.5% from 2025 to 2034 |

| Quantitative Units | Representation of revenue in US$ Bn and CAGR from 2025 to 2034 |

| Historic Year | 2021 to 2024 |

| Forecast Year | 2025-2034 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Dosage Form, By Therapeutic Application, By Patient Demographics, By End User, By Distribution Channel, and By Region |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; Germany; The UK; France; Italy; Spain; Rest of Europe; China; Japan; India; South Korea; Southeast Asia; Rest of Asia Pacific; Brazil; Argentina; Mexico; Rest of Latin America; GCC Countries; South Africa; Rest of the Middle East and Africa |

| Competitive Landscape | Nanjing Luomeimei Biotechnology Co. LTD, Merck, Shanghai Myrell Chemical Technology Co. LTD, Shanghai Yuanye Bio-Technology Co. Ltd, J&K Scientific, Shenzhen Feisi Biological Technology Co. LTD, Yunnan Xili Biotechnology Co. LTD, Shanghai Aladdin Biochemical Technology Co. LTD, Nanjing Shenglide Biotechnology Co. LTD, Biorbyt, Biosynth Carbosynth, ApexBio Technology, Santa Cruz BiotechnologyInc., Combi-Blocks Inc, AdooQ BioScience, Wuhan Belka Biomedicine, Alfa Chemistry, Toronto Research Chemicals Inc, Apollo Scientific Ltd, 3B Scientific, Carbone Scientific, Cayman Chemical, TCI, Targetmol, QCC, and A&A Life Science Inc |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Geographic competitive landscape. |

| Pricing and Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

• Oral Solutions

• Tablets

• Injectables

• Extended-Release Formulations

• Hypertension

• Ischemic Heart Disease

• Heart Failure

• Chronic Stable Angina

• Pediatric Patients

• Young Adults (18-44 Years)

• Middle-Aged (45-64 Years)

• Aged (65+ Years)

• Healthcare Professionals

o Doctors

o Cardiologists

• Pharmacists

• Patients

• Healthcare Institutions

• Hospitals and Clinics

• Retail Pharmacies

• Specialty Pharmacies

• Online Pharmacies

North America-

• The US

• Canada

Europe-

• Germany

• The UK

• France

• Italy

• Spain

• Rest of Europe

Asia-Pacific-

• China

• Japan

• India

• South Korea

• Southeast Asia

• Rest of Asia Pacific

Latin America-

• Brazil

• Argentina

• Mexico

• Rest of Latin America

Middle East & Africa-

• GCC Countries

• South Africa

• Rest of the Middle East and Africa

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.