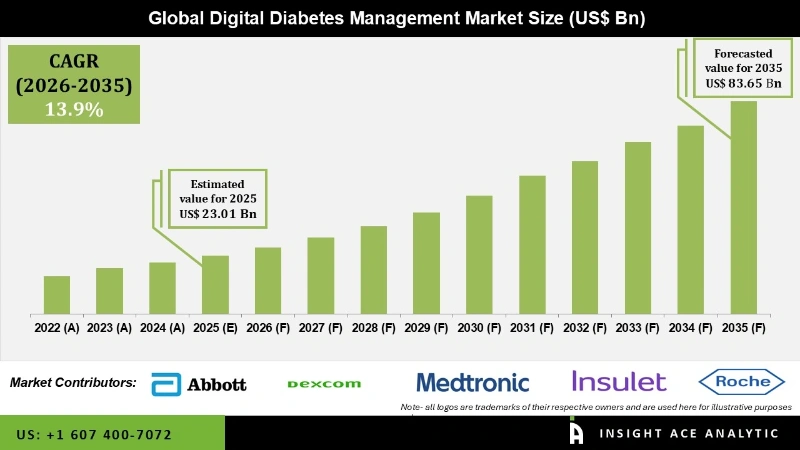

Global Digital Diabetes Management Market Size is valued at USD 23.01 Bn in 2025 and is predicted to reach USD 83.65 Bn by the year 2035 at a 13.9% CAGR during the forecast period for 2026 to 2035.

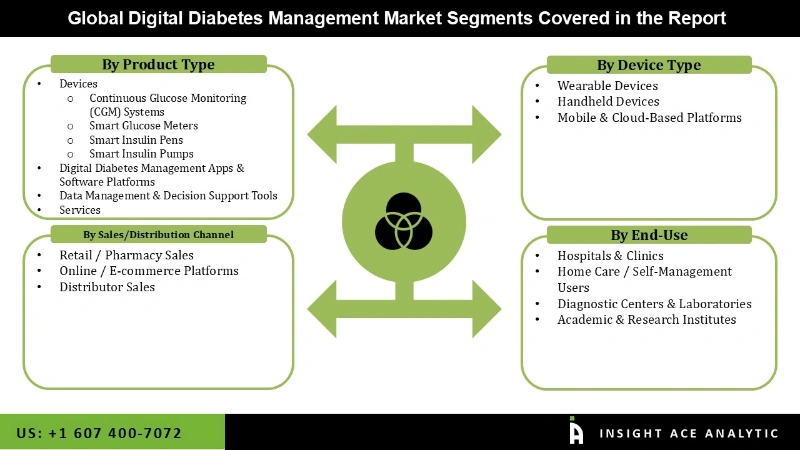

Digital Diabetes Management Market Size, Share & Trends Analysis Report By Product Type (Devices, Digital Diabetes Management Apps & Software Platforms, Data Management & Decision Support Tools, services), By End User (Hospitals & Clinics, Home Care / Self-Management Users, Diagnostic Centres & Laboratories, Academic & Research Institutes), By Device Type (Wearable Devices , Handheld Devices ,Mobile & Cloud-Based Platforms), By Sales / Distribution Channel, By Region and By Segments Forecasts, 2026 to 2035.

Key Industry Insights & Findings from the Report:

A collection of programs known as diabetes management software can assist patients and healthcare professionals track and monitor their diabetes. Diabetes management software is gaining popularity for various applications in the healthcare sector thanks to its multiple mobile and desktop apps, propelling growth in the diabetes management software market. To measure, monitor, and manage the degree of diabetes, diabetes management software is available for use on personal computers, mobile phones, tablets, and other digital assistants.

The market is expanding due to the adoption of diabetes awareness programs and other measures by various governments. These businesses' media efforts and initiatives for treating and preventing diabetes aid in raising public knowledge of the presence of multiple technologies in this industry. Diabetic patients have a high need for continuous blood glucose monitoring, which will significantly impact the growth of the global market over the forecast period. The market is estimated to face challenges in the future due to the growth in data security concerns and lower penetration in developing countries.

As there was a high risk of contracting COVID, the market for digital technologies for disease management among diabetes patients was growing. The product was created and planned to give patients a customized insight into how their blood sugar levels will respond to their diet, insulin dosage, and daily schedule. Therefore, the adoption and accessibility of such cutting-edge, rising, and unique technologies in the field of digital diabetes management would enhance market growth during the projection period.

The digital diabetes management market is divided into product & service, application, device type and end-use. Based on products & services, the market is segmented into devices (smart glucose meters, continuous glucose monitoring systems, and smart insulin pens, smart insulin pumps/ closed-loop pumps & smart insulin patches), application (diabetes & blood glucose tracking apps, obesity & diet management apps), data management software & platforms and services. The digital diabetes management market is segmented based on the device type into handheld and wearable devices. Based on end-use, the digital diabetes management market is divided into self/home healthcare, hospitals & speciality diabetes clinics and academic & research institutes.

The market's leading segment is self/home healthcare. The devices available on the market have an intuitive user interface coupled with cutting-edge digital gadgets. Adoption of these devices is becoming more necessary as patient awareness of diabetes management rises. This market is anticipated to grow due to the devices' use in exchanging crucial information with professionals via digital platforms. The market is anticipated to become less active due to widespread access to professionals in home healthcare. Due to the conditions, there was a high demand for digital diabetes management tools in the home settings market during the pandemic. During the pandemic, this sector received a significant boost from people using mobile applications and other connected devices at home.

Continuous glucose monitoring grabbed the highest revenue share, and it is anticipated that they will continue to hold that position during the anticipated time due to factors including ongoing technological development, rising product launches, greater incorporation of remote monitoring technologies into devices, rising availability of these gadgets, and increasing public awareness. Abbott established a freestyle libre system by enhancing its services in this industry. The use of this device will assist in tracking a patient's real-time blood glucose readings. Additionally, it gives a thorough picture of each person's glucose levels.

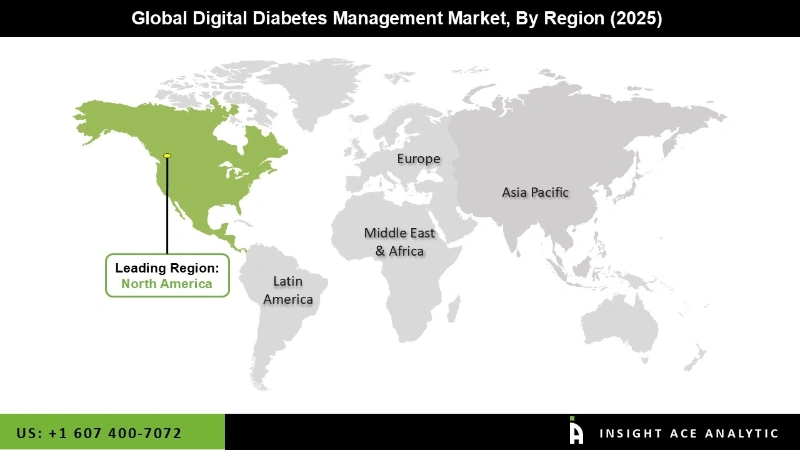

The North American digital diabetes management market is expected to register the highest market share. Numerous reasons, including the emphasis on ongoing technical breakthroughs, impending product launches with cutting-edge features, and the presence of significant market players in the North American region, have contributed to this region's success. The region's rising diabetic patient population provides growth prospects for the key market participants. Additionally, Asia Pacific is anticipated to increase quickly in the coming years. This market is expected to grow due to various factors, including an increase in the number of individuals with diabetes, growing healthcare costs, and an increasing number of market competitors in the area. It is also anticipated that rising disposable income and increased public knowledge of diabetes and other related health issues will promote the development of this industry.

| Report Attribute | Specifications |

| Market Size Value In 2025 | USD 23.01 Billion |

| Revenue Forecast In 2035 | USD 83.65 Billion |

| Growth Rate CAGR | CAGR of 13.9% from 2026 to 2035 |

| Quantitative Units | Representation of revenue in US$ Mn, and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2024 |

| Forecast Year | 2026-2035 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | Product Type, Device Type , End User and Sales / Distribution Channel. |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico ;The UK; France; Italy; Spain; China; Japan; India; South Korea; South East Asia; South Korea; South East Asia |

| Competitive Landscape | Abbott Laboratories, Dexcom, Inc., Medtronic plc, Insulet Corporation, Roche Diabetes Care (Roche Diagnostics), Ascensia Diabetes Care Holdings AG, Tandem Diabetes Care, Inc., Glooko, Inc., Novo Nordisk A/S, Senseonics Holdings, Inc., Sanofi S.A., B. Braun Melsungen AG, Bayer AG, LifeScan, Inc. (active but under financial restructuring), Omada Health, Inc., One Drop, Inc., Lark Health, Noom, Inc., Tidepool, Inc., HealthifyMe Wellness Pvt. Ltd., Virta Health Corp., Glytec, Inc., DreaMed Diabetes Ltd., DarioHealth Corp., Others |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing And Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

Digital Diabetes Management Market By Product Type-

Digital Diabetes Management Market By Device Type-

Digital Diabetes Management Market By End User-

Digital Diabetes Management Market By Sales / Distribution Channel-

Digital Diabetes Management Market By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.