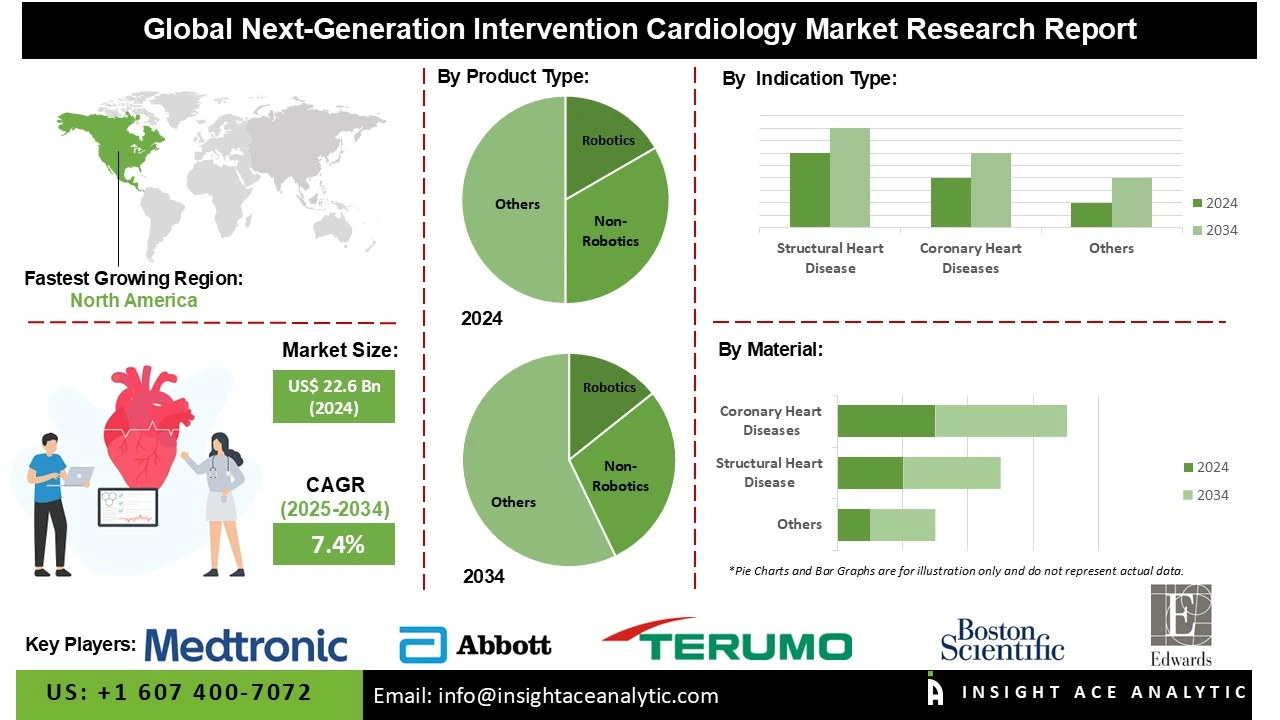

Next-Generation Intervention Cardiology Market Size is valued at US$ 22.6 Bn in 2024 and is predicted to reach US$ 45.5 Bn by the year 2034 at an 7.4% CAGR during the forecast period for 2025-2034.

Next-generation interventional cardiology is transforming cardiovascular care by advancing from conventional stents to adopt minimally invasive, precision-guided therapies. This evolution is marked by the structural heart revolution, with techniques such as TAVR and MitraClip that repair or replace valves without the need for open-heart surgery, alongside improved coronary therapies informed by intravascular imaging and physiology to guarantee optimal outcomes. The next-generation interventional cardiology market is rising rapidly due to rising cardiovascular disease prevalence and the rising need for minimally invasive procedures.

Advancements in technology, such as bioresorbable stents, drug-coated balloons, robotic-assisted interventions, and imaging-guided catheter systems, are improving procedural precision, safety, and patient outcomes. Innovations in wearable monitoring and AI-driven diagnostics allow personalized treatment planning and real-time intervention feedback. These technological improvements decrease recovery times, complications, and hospital stays, driving adoption among healthcare providers. Rising awareness, supportive reimbursement policies, and ongoing R&D further fuel market expansion globally.

The next-generation interventional cardiology industry is rapidly expanding because to the growing older population predisposed to cardiovascular illnesses. Advanced techniques, including minimally invasive stenting, transcatheter valve replacements, and bioresorbable scaffolds, offer safer and more effective treatment options.

Increased awareness of cardiovascular health, technical innovations, and advantageous reimbursement policies further propel use. The elderly demographic, often with numerous comorbidities, demands precision therapies that reduce hospital stays and complications. As life expectancy rises, the market sees sustained expansion, with healthcare providers increasingly seeking next-generation cardiology solutions to expand patient outcomes and quality of life.

Some of the Key Players in the Next-generation Intervention Cardiology Market:

· Medtronic plc

· Boston Scientific Corporation

· Terumo Corporation

· Siemens Healthineers AG

· Edwards Lifesciences Corporation

· Braun SE

· Cordis

· Teleflex Incorporated

· Supira Medical, Inc.

· Intuitive Surgical Operations, Inc

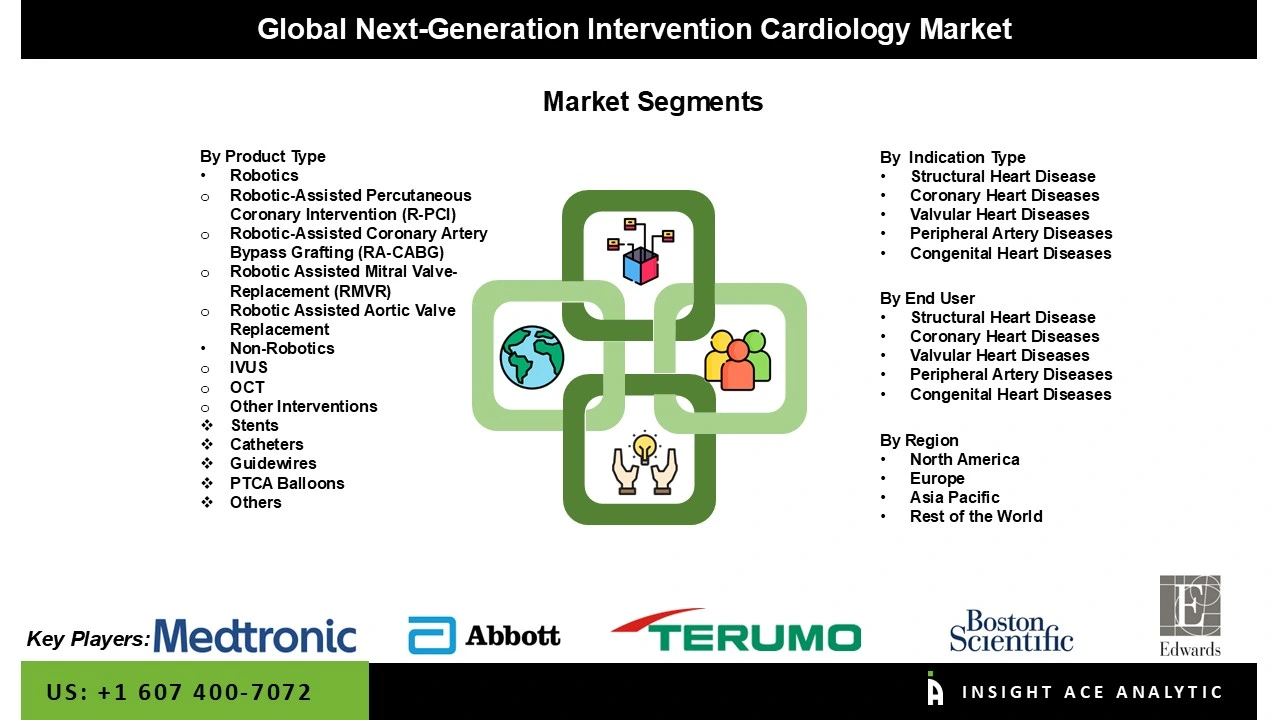

The next-generation intervention cardiology market is segmented by product type, indication, end-user and By Region. The product type segment comprises robotics (robotic-assisted percutaneous coronary intervention (R-PCI), robotic-assisted coronary artery bypass grafting (RA-CABG), robotic-assisted mitral valve repair (RMVR), and robotic-assisted valve replacement (RAVR)) and non-robotics (intravascular ultrasound, optical coherence tomography, and other interventions [stents, catheters, Ptca balloons, guidewires, and others]).

By indication type, the market is segmented into structural heart disease, valvular heart disease, peripheral artery disease, coronary heart disease, congenital heart disease. By end-user, the market is segmented into hospitals & clinics, cardiac centres, and ambulatory surgical centres.

The rising prevalence of cardiovascular diseases, especially valvular disorders and congenital heart defects, drives the structural heart disease interventions segment and expands market growth. Technological innovations in minimally invasive therapies like transcatheter interventions shorten patient recovery times and procedural risk. Growth in the adoption of new devices, combined with expanding geriatric populations and the need for better clinical outcomes, drives market expansion, and hospitals and speciality centres increasingly turn to state-of-the-art interventions for structural heart disease.

The next-generation intervention cardiology market is dominated by hospitals & clinics due to rising cardiovascular disease prevalence and demand for minimally invasive procedures. Advanced technologies like bioresorbable stents, robotic-assisted interventions, and precision imaging improve patient outcomes and reduce recovery time. Hospitals prefer these innovations to enhance procedural efficiency, lower complications, and meet patient expectations. Increasing healthcare expenditure and adoption of digital cardiology solutions further drive market expansion in clinical settings.

The Asia Pacific region leads the market for next-generation interventional cardiology, driven by an increasing incidence of cardiovascular illnesses and a growing desire for minimally invasive procedures. Technological advancements in stents, catheters, and imaging devices enhance procedural safety and efficacy. Rising physician and patient awareness, positive reimbursement policies, and expanding healthcare infrastructure drive the adoption of innovative interventional cardiology products. This transformation toward accuracy, efficiency, and less recovery time is the driving force behind market expansion throughout the region.

Moreover, Europe's next-generation intervention cardiology market is also fueled by the region’s rising prevalence of cardiovascular diseases. Technological advancements in stents, catheters, and imaging devices improve patient outcomes and reduce recovery time. European healthcare systems are increasingly adopting innovative therapies to enhance efficiency and lower costs. Additionally, aging populations and supportive government initiatives for advanced cardiac care drive the uptake of next-generation interventional cardiology solutions, boosting investments and collaborations across hospitals and specialized medical device manufacturers.

| Report Attribute | Specifications |

| Market Size Value In 2024 | USD 22.6 Bn |

| Revenue Forecast In 2034 | USD 45.5 Bn |

| Growth Rate CAGR | CAGR of 7.4% from 2025 to 2034 |

| Quantitative Units | Representation of revenue in US$ Bn and CAGR from 2025 to 2034 |

| Historic Year | 2021 to 2024 |

| Forecast Year | 2025-2034 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Product Type, By Indication Type, By End-User and By Region |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; Germany; The UK; France; Italy; Spain; Rest of Europe; China; Japan; India; South Korea; Southeast Asia; Rest of Asia Pacific; Brazil; Argentina; Mexico; Rest of Latin America; GCC Countries; South Africa; Rest of the Middle East and Africa |

| Competitive Landscape | Medtronic plc, Boston Scientific Corporation, Terumo Corporation, Siemens Healthineers AG, Edwards Lifesciences Corporation, B. Braun SE, Cordis, Teleflex Incorporated, Supira Medical, Inc., Intuitive Surgical Operations, Inc |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Geographic competitive landscape. |

| Pricing and Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

Next-generation intervention cardiology Market by Product Type-

· Robotics

o Robotic-Assisted Percutaneous Coronary Intervention (R-PCI)

o Robotic-Assisted Coronary Artery Bypass Grafting (RA-CABG)

o Robotic Assisted Mitral Valve-Replacement (RMVR)

o Robotic Assisted Aortic Valve Replacement

· Non-Robotics

o IVUS

o OCT

o Other Interventions

§ Stents

§ Catheters

§ Guidewires

§ PTCA Balloons

§ Others

Next-generation intervention cardiology Market by Indication Type-

· Structural Heart Disease

· Coronary Heart Diseases

· Valvular Heart Diseases

· Peripheral Artery Diseases

· Congenital Heart Diseases

Next-generation intervention cardiology Market by End-User-

· Hospitals and Clinics

· Cardiac Centers

· Ambulatory Surgical Centers

Next-generation intervention cardiology Market by Region-

North America-

· The US

· Canada

Europe-

· Germany

· The UK

· France

· Italy

· Spain

· Rest of Europe

Asia-Pacific-

· China

· Japan

· India

· South Korea

· Southeast Asia

· Rest of Asia Pacific

Latin America-

· Brazil

· Argentina

· Mexico

· Rest of Latin America

Middle East & Africa-

· GCC Countries

· South Africa

Rest of the Middle East and Africa

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.