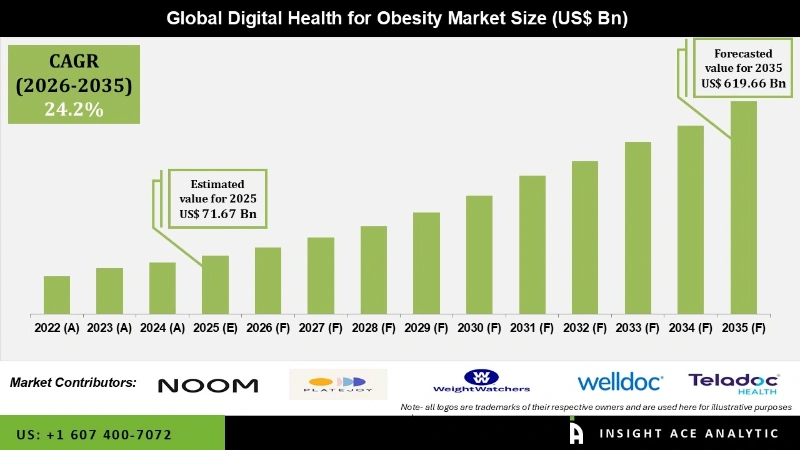

Global Digital Health for Obesity Market Size Was valued at USD 71.67 Bn in 2025 and is predicted to reach USD 619.66 Bn by 2035 at a 24.2% CAGR during the forecast period for 2026 to 2035.

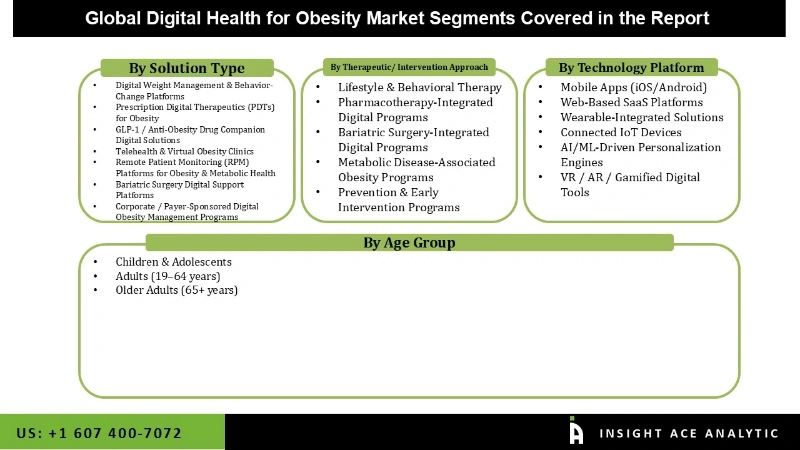

Digital Health for Obesity Market Size, Share & Trends Analysis Report By Solution Type (Digital Weight Management & Behaviour-Change Platforms, Prescription Digital Therapeutics (PDTs) for Obesity, GLP-1 / Anti-Obesity Drug, Companion Digital Solutions, Telehealth & Virtual Obesity Clinics, Remote Patient Monitoring (RPM) Platforms for Obesity & Metabolic Health, Bariatric Surgery Digital Support Platforms, Corporate / Payer-Sponsored Digital Obesity Management Programs) By Therapeutic / Intervention Approach (Lifestyle & Behavioural Therapy, Pharmacotherapy-Integrated Digital Programs, Bariatric Surgery-Integrated Digital Programs, Metabolic Disease-Associated Obesity Programs, Prevention & Early Intervention Programs), By Technology Platform, By Age Group and By Region, Segments Forecasts, 2026 to 2035.

The goal of digital health for obesity is to prevent, manage, and treat obesity and related medical disorders by utilizing digital technologies such as wearable technology, telemedicine platforms, smartphone apps, and internet resources. It includes a range of digital tools and treatments designed to promote healthy habits, assess body weight and activity levels, track eating patterns, provide educational materials, and facilitate online consultations with medical professionals. With the help of digital health for obesity solutions, people can set realistic goals, adopt healthier lifestyles, and get individualized support and assistance to reach and stay at a healthy weight.

The global obesity epidemic and the health problems that come with it, such as diabetes, heart disease, and some types of cancer, are fueling the demand for digital health for obesity. As wearable technology, smartphone apps, and connected health technologies become more widely used, real-time monitoring and feedback are made possible, which improves accountability and participation in obesity management initiatives. Additionally, the digital health for obesity market is growing and being adopted due to government initiatives and healthcare policies that focus on controlling and preventing chronic diseases, including obesity. These policies also encourage investment in digital health solutions and payment for virtual care services.

However, obstacles, including interoperability problems, data privacy difficulties, and the requirement for large infrastructure and training investments, stand in the way of the broad use of operational analytics solutions. The digital health for obesity market is anticipated to increase in the next few years, despite these obstacles, due to ongoing technological advancements and the growing importance of data-driven decision-making.

Some of the Major Key Players in the Digital Health for Obesity Market are:

The digital health for obesity market is segmented based on components and end-users. Based on components, the market is segmented into hardware, software, and services. By end-user, the market is segmented into patients, payers, providers, and others.

The services category is expected to hold a major global market share in 2024. The rising demand for installation, upkeep, training, and other services is accountable for this expansion. Additionally, the service sector is expanding due to the rising demand for sophisticated software platforms and solutions like Electronic Medical Records (EMRs) and Electronic Health Records (EHRs), as well as the growing requirement for training and upgrades to operate these software programs. Key players offer a broad range of services before and after installation, including resource allocation and optimization, project planning, training, and execution.

The patients segment generated the most market share in 2024 due to the growing need for individualized and easily accessible healthcare solutions, which is the primary driver of this dominance. As the primary consumers of digital health, patients actively utilise wearables, smartphone applications, and other devices to track and manage diseases such as obesity. Further propelling the use of digital health technologies is the convenience of self-management coupled with growing self-awareness of wellness and health. The segment dominance during the forecast period is a result of these factors taken together.

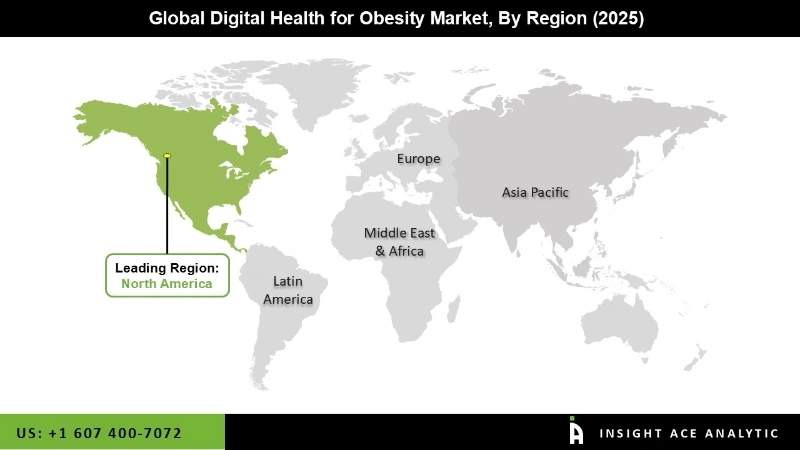

The North American digital health for obesity market is expected to register the highest market share in revenue in the near future because of its high rates of obesity, sophisticated healthcare system, and robust digital technology use. The area is home to many tech-savvy people who frequently utilize health apps, fitness trackers, and cell phones. The need is also fueled by high healthcare costs and government backing for digital health projects. Additionally, the region has grown due to the presence of top health tech businesses and research institutions, which have stimulated innovation in tailored obesity care.

In addition, Asia Pacific is projected to grow rapidly in the global digital health for obesity market. The region's obesity rates are rapidly increasing as a result of dietary modifications, urbanization, and shifting lifestyles. As obesity becomes a more significant health issue, there is a great demand for numerous useful solutions, including digital health technologies. Governments and healthcare organizations in the area are increasingly realizing the potential of digital health to address public health concerns like obesity. Investments in healthcare infrastructure and laws that encourage the use of digital health are driving the market's growth.

| Report Attribute | Specifications |

| Market Size Value In 2025 | USD 71.67 Bn |

| Revenue Forecast In 2035 | USD 619.66 Bn |

| Growth Rate CAGR | CAGR of 24.2 % from 2026 to 2035 |

| Quantitative Units | Representation of revenue in US$ Bn and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2025 |

| Forecast Year | 2026-2035 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | Solution Type, Therapeutic / Intervention Approach, Technology Platform and Age Group |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; France; Italy; Spain; South East Asia; South Korea |

| Competitive Landscape | Noom, PlateJoy HEALTH, WW International, WellDoc, Teladoc Health, Inc., MyFitnessPal, Healthify (My Diet Coach), Fitbit, Inc., Tempus, Fitnesskeeper Inc., Sidekick Health, BioAge Labs, and others. |

| Customization Scope | Free customization report with the procurement of the report and modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing And Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.