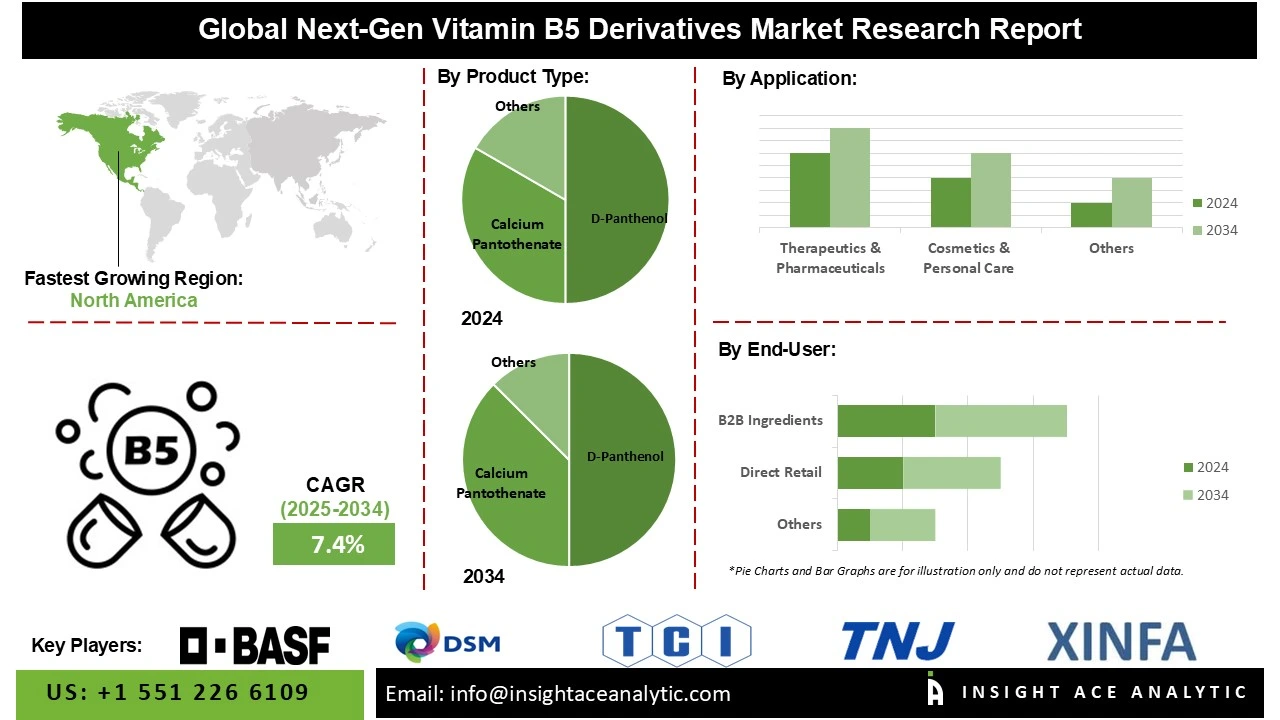

Global Next-Gen Vitamin B5 Derivatives Market Size is predicted to experience a 7.4% CAGR during the forecast period for 2025 to 2034.

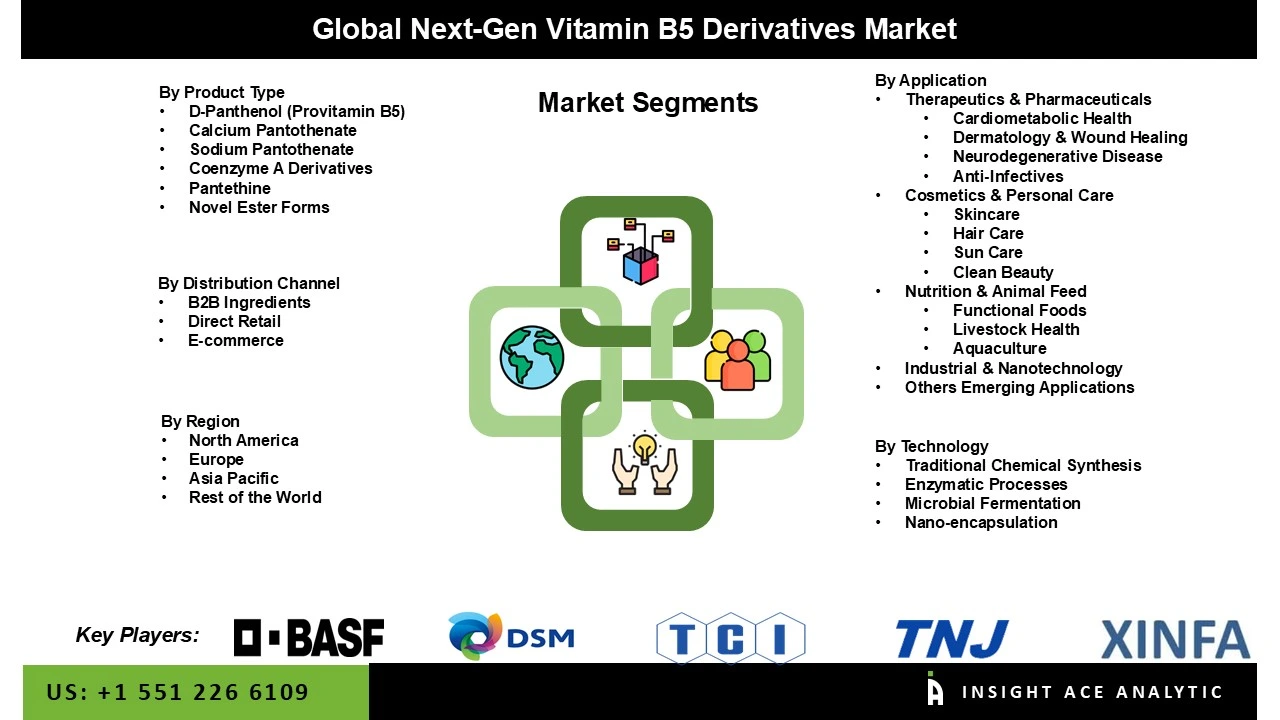

Next-Gen Vitamin B5 Derivatives Market, Share & Trends Analysis Report, By Product Type (D-Panthenol (Provitamin B5), Calcium Pantothenate, Sodium Pantothenate, Coenzyme A Derivatives, Pantethine, Novel Ester Forms), By Application (Therapeutics & Pharmaceuticals, Cosmetics & Personal Care, Nutrition & Animal Feed, Industrial & Nanotechnology, Others Emerging Applications), By Technology, By Distribution Channel, By Region, and Segment Forecasts, 2025 to 2034

Vitamin B5, or pantothenic acid, is a vital water-soluble B-complex vitamin that plays a central role in human and animal health as a precursor to coenzyme A (CoA), a molecule essential for energy production from fats, carbohydrates, and proteins, as well as the synthesis of hormones, cholesterol, and neurotransmitters.

Naturally present in foods such as meat, eggs, grains, and vegetables, pantothenic acid deficiencies are rare in balanced diets, but growing health awareness has spurred demand for enhanced, next-generation derivatives that offer superior stability, bioavailability, and targeted benefits. These “next-gen” derivatives are produced through advanced biotechnological methods like modular enzymatic cascade synthesis, which enables efficient, stereoselective production of highly pure enantiomers of vitamin B5 and its analogs from simple raw materials such as fumaric or mesaconic acid, while avoiding traditional multi-step chemical processes involving protecting groups and purifications.

Among these, Calcium Pantothenate has emerged as the dominant derivative across food, feed, and pharmaceutical applications, due to its water solubility, stability, and efficacy in CoA synthesis, making it indispensable for energy metabolism, hormone production, and wound healing. Its market share is strongly supported by its integration into animal nutrition, where it promotes livestock health, growth, and reproduction, with demand further fueled by rising global meat consumption and the expansion of aquaculture.

This widespread use has also accelerated the development of next-gen bio-based formulations that contribute to sustainable farming practices. Beyond animal feed, calcium pantothenate is increasingly sought after in dietary supplements and fortified foods, especially among aging populations and vegan consumers looking to enhance energy metabolism, immune support, and overall wellness. In parallel, D-Panthenol, the biologically active form of panthenol, is gaining traction in cosmetics and personal care for its vegan-compatible, non-irritating profile and multifunctional properties as a humectant, emollient, and anti-inflammatory agent. It is widely used in skincare serums, moisturizers, and wound-healing creams, as well as in haircare products such as conditioners, where it boosts hydration, repair, and shine.

Technological advances, such as AI-driven formulation optimization, are enabling the development of smart cosmetics with improved bioavailability, exemplified by nano-encapsulated D-Panthenol serums. Meanwhile, IoT-enabled supply chains are enhancing traceability, quality assurance, and distribution efficiency. Together, these advancements highlight how both Calcium Pantothenate and D-Panthenol are at the forefront of next-gen Vitamin B5 derivative innovation, catering to the growing demands of health-conscious, sustainability-focused, and performance-driven global markets.

Some of the Major Key Players in the Next-Gen Vitamin B5 Derivatives Market are

· BASF SE

· DSM-Firmenich

· TRI-K Industries

· Yifan Pharmaceutical

· Xinfa Pharmaceutical

· TNJ Chemical

· Hayashibara

· Spec-Chem Industry

· Zhejiang NHU

· Kumar Organic Products

· Brother Enterprises Holding Co., Ltd

· Tokyo Chemical Industry Co., Ltd.

· Other prominent players

The next-gen vitamin B5 derivatives market is segmented into product type, application, technology, and distribution channel. Based on the product type, the market is segmented into D-panthenol (provitamin B5), calcium pantothenate, sodium pantothenate, coenzyme A derivatives, pantethine, and novel ester forms. Based on the application, the market is divided into therapeutics & pharmaceuticals, cosmetics & personal care, nutrition & Animal feed, industrial & nanotechnology, and other emerging applications.

Based on the technology, the market is divided into traditional chemical synthesis, enzymatic processes, microbial fermentation, nano-encapsulation. Based on the distribution channel, the market is divided into B2B ingredients, direct retail, and e-commerce.

D-Panthenol, also called dexpanthenol, is the physiologically active D-isomer of panthenol. It is a very powerful derivative of Vitamin B5 that is converted into pantothenic acid in the body, skin, and hair. D-Panthenol is the recommended option for sophisticated skincare and haircare formulations due to its better efficacy. It promotes cell growth, speeds up wound healing, and improves moisture retention without irritating skin. It is well-known for its humectant, emollient, and anti-inflammatory qualities.

Its acceptance has been further stimulated by the growing consumer desire for natural, vegan, and organic cosmetics due to increased knowledge of skin health, as D-Panthenol complies with "clean beauty" standards and regulatory preferences for safe, non-synthetic chemicals. As the need for preventive skincare and hair vitality increases due to rising pollution, stress, and lifestyle challenges, it has become a star ingredient in the global beauty and personal care market, commanding premium positioning and fostering strong customer loyalty because of its calming effects on sensitive skin.

The market for next-generation vitamin B5 derivatives is dominated by the cosmetics and personal care segment, which is bolstered by social media influence and beauty influencers, as well as rising consumer awareness of skin health. D-Panthenol's non-irritating, vegan-friendly, and sustainable qualities have made it a standout ingredient in response to consumer demand for clean-label, multipurpose compounds that work in both high-end and mass-market formulations.

Its adaptability in fostering hydration, repair, and calming effects has increased its use in personal hygiene, skincare, and haircare products. Smarter formulations, such as transdermal delivery systems and serums encapsulated in nanoparticles, are made possible by advancements like AI-driven research and development. These formulations greatly enhance bioavailability and performance. The segment's dominance in the global market is further cemented by IoT-enabled supply chains, which also guarantee traceability and consistent quality, in line with the strict safety and sustainability criteria of the cosmetics industry.

The market for next-gen vitamin B5 derivatives is expanding rapidly in the Asia Pacific region due to rising disposable incomes and increased demand for beauty and personal care products in nations like China, Japan, South Korea, and India, where derivatives like D-Panthenol are widely used in cosmetics and related applications. With fortified foods and calcium pantothenate-based products becoming more popular for promoting metabolism, skin health, and general well-being, the nutraceutical and dietary supplement industries are growing quickly at the same time.

The region's governments and regulatory bodies are accelerating this trend by advocating for health, wellness, and cosmetic safety guidelines that prioritize components that are traceable and clean. Additionally, APAC beauty markets have a strong innovation in advanced delivery systems, such as serums and nano-encapsulation technologies, which further solidifies the region's leadership in the adoption of next-generation vitamin B5 derivatives.

· In June 2025, DSM-Firmenich, the company that produces more than 40 vitamins and carotenoids for use in pharmaceutical applications, such as beta-carotene and vitamins A, B1, B2, B3, B5, B6, B7, B9, B12, C, D3, E, and K1, will now be sold by Brenntag. These vitamins are essential to the production of pharmaceuticals and aid in the development of high-quality drugs. Most of these products are used as active pharmaceutical ingredients (APIs) and have obtained a Certificate of Suitability (CEP) for all forms of pure vitamins.

| Report Attribute | Specifications |

| Growth Rate CAGR | CAGR of 7.4% from 2025 to 2034 |

| Quantitative Units | Representation of revenue in US$ Mn and CAGR from 2025 to 2034 |

| Historic Year | 2021 to 2024 |

| Forecast Year | 2025-2034 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Product Type, Application, Technology, Distribution Channel |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; The UK; France; Italy; Spain; China; Japan; India; South Korea; Southeast Asia; South Korea; South East Asia |

| Competitive Landscape | BASF SE, DSM-Firmenich, TRI-K Industries, Yifan Pharmaceutical, Xinfa Pharmaceutical, TNJ Chemical, Hayashibara, Spec-Chem Industry, Zhejiang NHU, Kumar Organic Products, Brother Enterprises Holding Co., Ltd, Tokyo Chemical Industry Co., Ltd, Other prominent players. |

| Customization Scope | Free customization report with the procurement of the report and modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing and Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

Global Next-Gen Vitamin B5 Derivatives Market- By Product Type

· D-Panthenol (Provitamin B5)

· Calcium Pantothenate

· Sodium Pantothenate

· Coenzyme A Derivatives

· Pantethine

· Novel Ester Forms

Global Next-Gen Vitamin B5 Derivatives Market – By Application

· Therapeutics & Pharmaceuticals

o Cardiometabolic Health

o Dermatology & Wound Healing

o Neurodegenerative Disease

o Anti-Infectives

· Cosmetics & Personal Care

o Skincare

o Hair Care

o Sun Care

o Clean Beauty

· Nutrition & Animal Feed

o Functional Foods

o Livestock Health

o Aquaculture

· Industrial & Nanotechnology

· Others Emerging Applications (Sports Nutrition, etc)

Global Next-Gen Vitamin B5 Derivatives Market – By Technology

· Traditional Chemical Synthesis

· Enzymatic Processes

· Microbial Fermentation

· Nano-encapsulation

Global Next-Gen Vitamin B5 Derivatives Market – By Distribution Channel

· B2B Ingredients

· Direct Retail

· E-commerce

Global Next-Gen Vitamin B5 Derivatives Market – By Region

North America-

· The US

· Canada

Europe-

· Germany

· The UK

· France

· Italy

· Spain

· Rest of Europe

Asia-Pacific-

· China

· Japan

· India

· South Korea

· Southeast Asia

· Rest of Asia Pacific

Latin America-

· Brazil

· Mexico

· Rest of Latin America

Middle East & Africa-

· GCC Countries

· South Africa

· Rest of the Middle East and Africa

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.