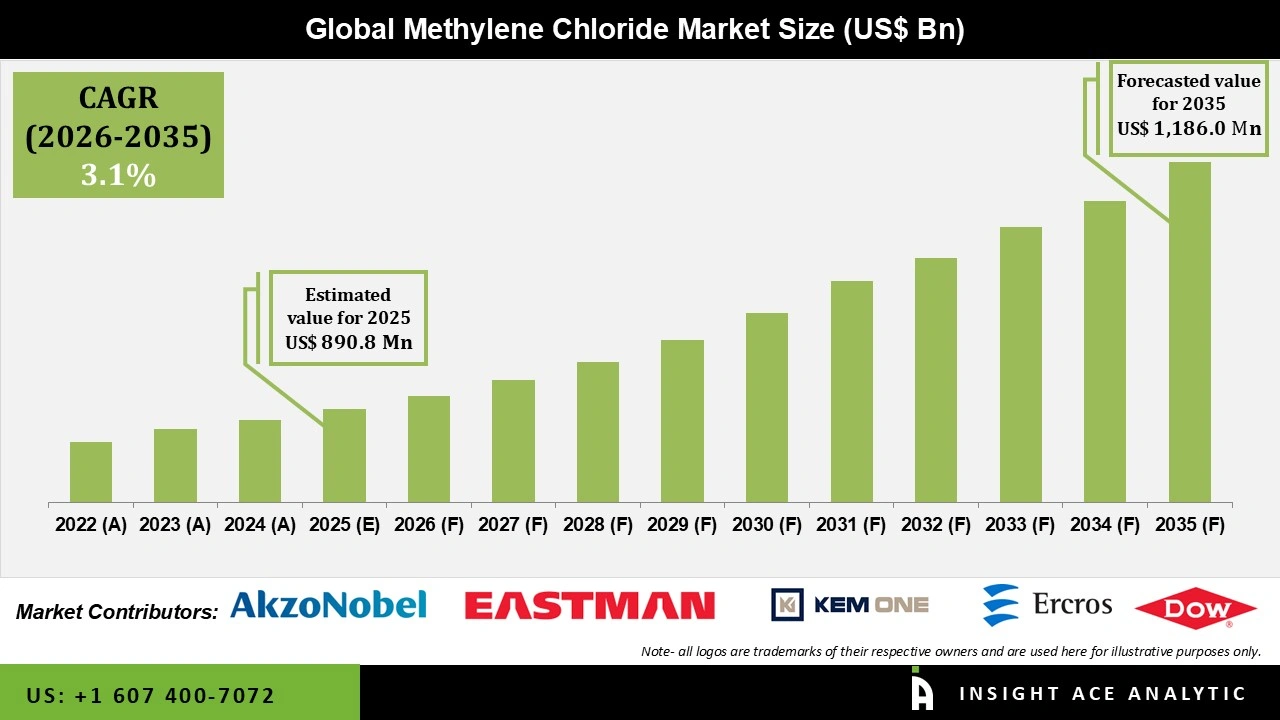

Global Methylene Chloride Market Size is valued at USD 890.8 Mn in 2025 and is predicted to reach USD 1,186.0 Mn by the year 2035 at a 3.1% CAGR during the forecast period for 2026 to 2035.

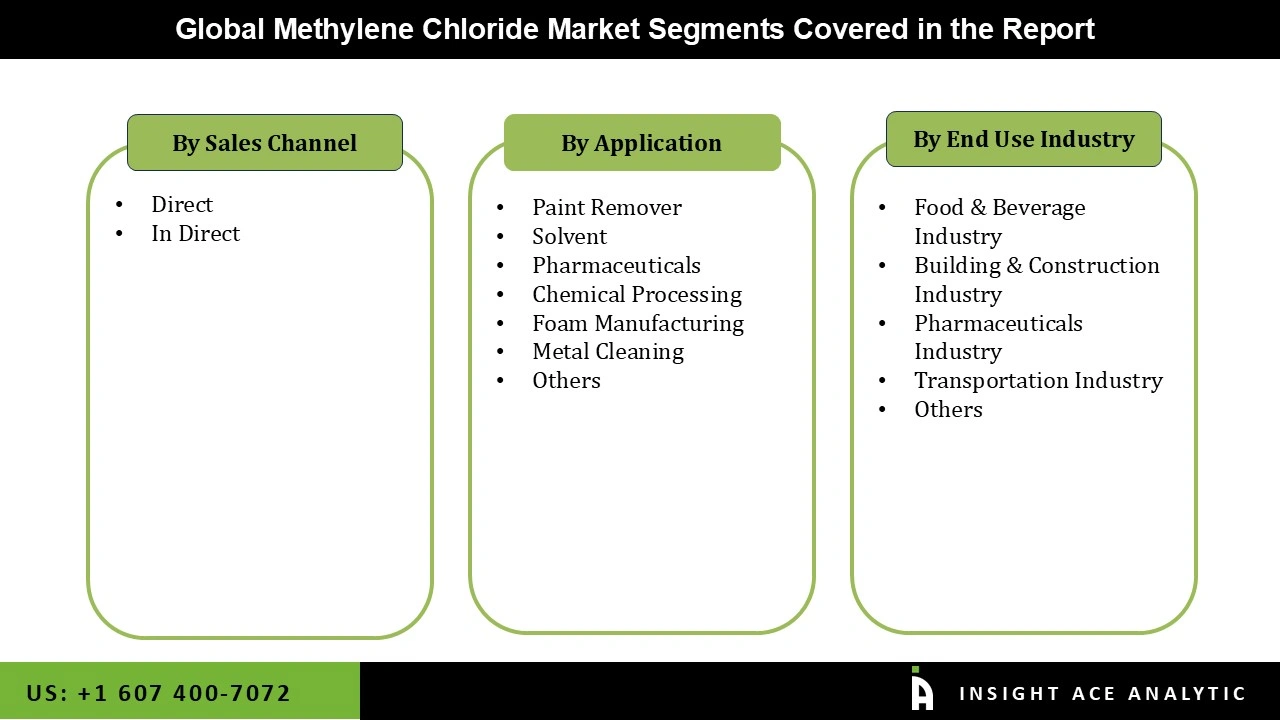

Methylene Chloride Market Size, Share & Trends Analysis Distribution by Application (Metal Cleaning, Paint Remover, Solvent, Foam Manufacturing, Pharmaceuticals, Chemical Processing, and Others), End-user (Pharmaceuticals Industry, Food & Beverage Industry, Transportation Industry, Building & Construction Industry, Others), Distribution Channel (Direct and In Direct), and Segment Forecasts, 2026 to 2035.

It is one of the most powerful and versatile organic solvents available, capable of dissolving a wide range of organic compounds quickly and effectively. Thanks to its low boiling point (~40 °C), high vapor pressure, and excellent solvency, it is widely used in many industries for tasks that require rapid cleaning, extraction, or dissolution without leaving residue. The pharmaceutical industry, which uses it as a crucial reaction and purification solvent in the production of antibiotics, steroids, and vitamins, is the main driver of the global market. The chemical processing industry also plays a major role in growth, using methylene chloride as a key raw material to produce hydrofluorocarbon (HFC) refrigerants like HFC-32, which are becoming more and more popular due to their lower potential for global warming than legacy alternatives. Additionally, the product's low flammability, rapid dissolving ability, and quick drying characteristic will guide its penetration in the various industries worldwide. Over the course of the projection period, an increase in construction activities, such as building and bridge construction, will fuel the methylene chloride market demand.

In addition, the main factors driving the methylene chloride market are rising demand for cleaning products and its usage as a crucial solvent in paint and adhesive compositions. It is utilized as a principal solvent in paint and adhesive formulations because of its high dissolving capacity, low flammability, and quick drying qualities. The construction and automobile sectors are the primary end users of paint and adhesives. The massive expansion of building projects, including bridges, residences, and manufacturing facilities, across the globe has led to a notable increase in the demand for paints and adhesives. However, because of the chemical's toxicity and carcinogenic nature, the market is severely hampered by strict environmental and safety restrictions.

Driver

Growing Need for Pharmaceutical Solvents

The growing need for pharmaceutical solvents due to the growing worldwide pharmaceutical sector is a major factor propelling the methylene chloride market. Methylene chloride is a favoured solvent for medication production and formulation because of its capacity to dissolve a wide variety of organic compounds and promote accurate chemical reactions. The need for effective and stable solvents like methylene chloride is increasing as pharmaceutical companies increase production to meet the growing demand for drugs, especially in emerging nations. Additionally, methylene chloride's function in pharmaceutical research and production processes is being strengthened by the rise in complicated drug compositions and the creation of novel medications. The market's responsiveness to changing pharmaceutical needs and the industry's continuous need for dependable solvents are both reflected in this development.

Restrain/Challenge

Growing Health and Environmental Hazards

The health and environmental hazards posed by methylene chloride are among the main factors limiting the market. As a volatile organic compound (VOC), methylene chloride, also known as dichloromethane, can be harmful to human health if inhaled or absorbed through the skin. Respiratory problems, impacts on the brain system, and even long-term health hazards might result from exposure. Because of these worries, regulatory bodies like the European Chemicals Agency (ECHA) and the US Environmental Protection Agency (EPA) have placed stringent limitations on the use of methylene chloride, especially in consumer products like paint removers. The market expansion for methylene chloride may be constrained by businesses' growing search for substitute solvents as environmental and safety concerns rise.

The Pharmaceuticals Industry category held the largest share in the Methylene Chloride market in 2025, driven by the fact that it is an essential solvent in the production of several medications. In the production of pharmaceuticals, methylene chloride is very helpful due to its broad range of organic molecule dissolution. Active pharmaceutical ingredients (APIs) are extracted and purified using this process, which helps produce high-purity drugs. Pharmaceutical companies can save money by using this molecule because of its low boiling point and volatility, which enable quick recovery and recycling in production operations. Additionally, the manufacture of vitamins, steroids, and antibiotics all of which are in high demand worldwide requires the solvent properties of methylene chloride.

In 2025, the direct category dominated the methylene chloride market because large-scale industrial buyers are increasingly choosing streamlined procurement. In order to cut out middlemen and guarantee supply chain dependability, major end users in the chemical processing and pharmaceutical industries are moving toward direct interaction with producers. This method enables purchasers to strictly monitor product quality while securing consistent, high-purity volumes that are necessary for sensitive activities. Moreover, direct sourcing helps businesses comply with strict safety regulations established by organisations like the US Environmental Protection Agency (EPA).

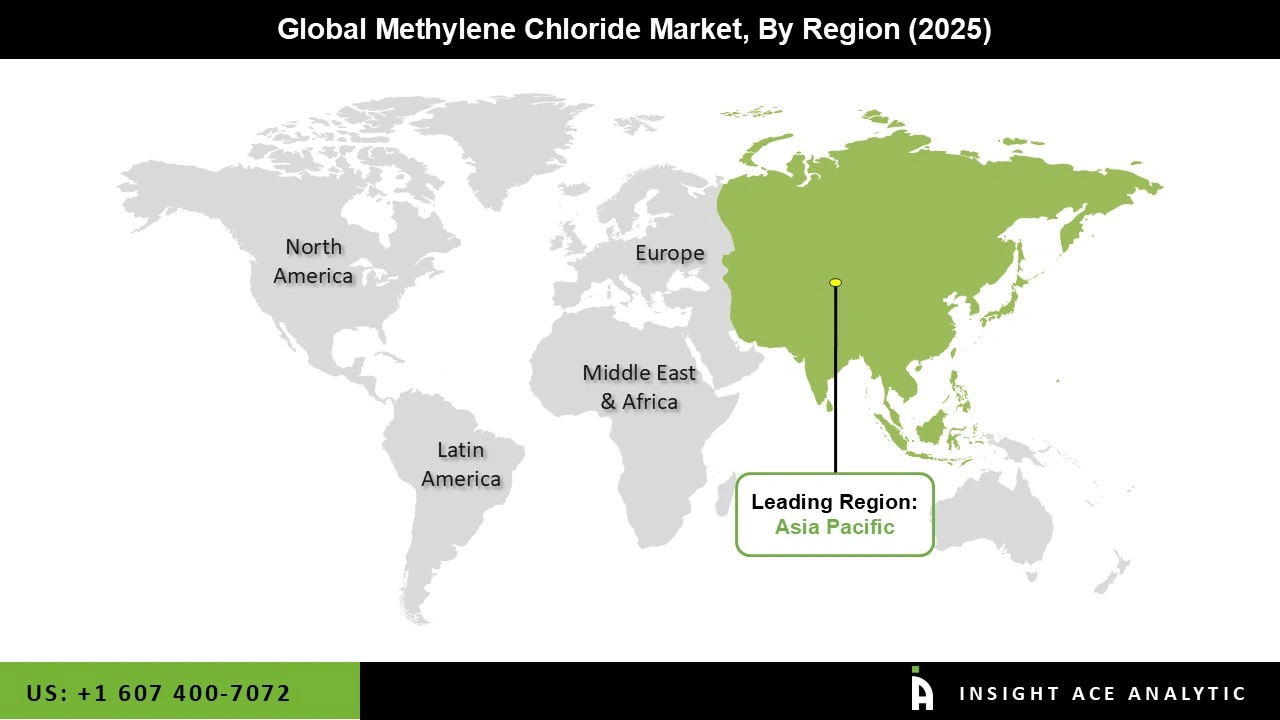

The methylene chloride market was dominated by Asia Pacific region in 2025 driven mainly by concentrated supply, strong demand, strategic trade positioning, and substantial regulatory factors. The region is a hub to the methylene chloride manufacturing base, supported by a well-developed chlor-alkali and chlorinated solvents infrastructure in China, India, and Southeast Asia.

This efficient production base aligns with high downstream demand, as APAC is a hub for key industries such as pharmaceutical API and intermediate manufacturing, chemical processing, polyurethane foam production, and metal cleaning.

| Report Attribute | Specifications |

| Market size value in 2025 | USD 890.8 Mn |

| Revenue forecast in 2035 | USD 1,186.0 Mn |

| Growth Rate CAGR | CAGR of 3.1% from 2026 to 2035 |

| Quantitative Units | Representation of revenue in US$ Mn, Volume (Kilotons) and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2025 |

| Forecast Year | 2026-2035 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Application, End-user, Distribution Channel, and By Region |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; The UK; France; Italy; Spain; China; Japan; India; South Korea; Southeast Asia; South Korea; Southeast Asia |

| Competitive Landscape | AkzoNobel N.V., Solvay S.A., Eastman Chemical Company, Gujarat Alkalies & Chemicals Ltd., Ineos Group, Dow Chemical Company, LOTTE Fine chemical, Occidental Petroleum Corporation, Ercros S.A., MC Chemicals Ltd, Olin Corporation, PPG industries Inc., Shin-Etsu Chemical Co. Ltd., KEM ONE, Tokuyama Corporation, and Others |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Geographic competitive landscape. |

| Pricing and Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.