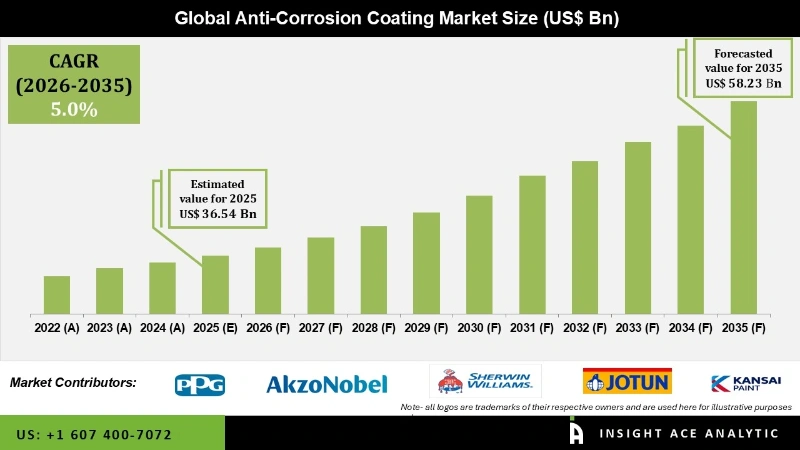

Global Anti-Corrosion Coating Market Size is valued at USD 36.54 Bn in 2025 and is predicted to reach USD 58.23 Bn by the year 2035 at a 5.00% CAGR during the forecast period for 2026 to 2035.

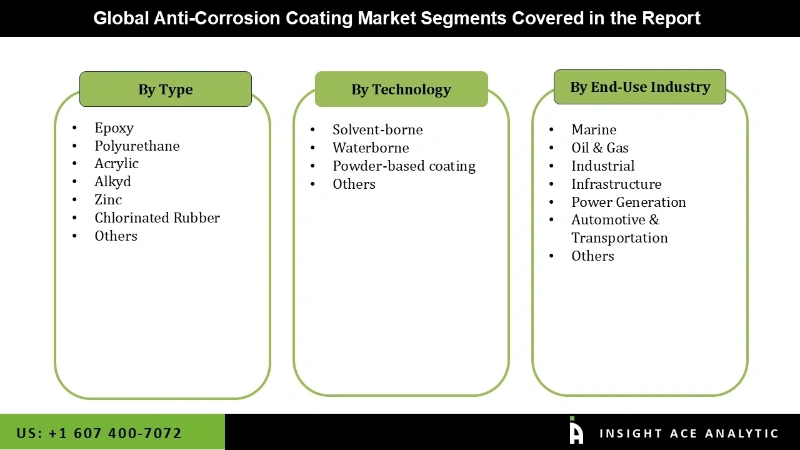

Anti-Corrosion Coating Market Size, Share & Trends Analysis Report By Type (Epoxy, Polyurethane, Acrylic, Alkyd, Zinc, Chlorinated Rubber, Others), By Technology (Solvent-borne, Waterborne, Powder-based coating, Others), By End-use Industry, By Region, And By Segment Forecasts, 2026 to 2035.

Anti-Corrosion Coating Market Key Takeaways:

|

Anti-corrosion coatings are applied to the metal to protect it against the effects of the environment, such as humidity and air temperature, which can cause rusting and pitting. Putting an anti-corrosion coating on a metal component is a great way to make it last longer in harsh environments. Coatings defend against corrosion and elements, mechanical damage, abrasion, and extreme temperatures. There will be a greater need for anti-corrosion coatings to shield materials from the damaging effects of water, chemicals, greases, and weather as the number of infrastructures grows.

In addition, one of the most frustrating issues in many final applications is corrosion. The jacketing, the insulating hardware, and even the underlying piping and equipment can all be attacked by corrosion. Corrosion can generate significant financial losses, endangering general property and human life. The government's increased spending on R&D for innovative coating solutions is also anticipated to push the prefabricated coating market soon, which is a major driver of the expansion of the anti-corrosion coating industry. As a result, demand for anti-corrosion coatings is expected to rise. In addition, key players increased focus on new product development and strategic collaborations led to the growth of the global anti-corrosion coating market. It drives expansion globally and is expected to boost market expansion in the coming years.

However, coatings' VOC emissions have been the focus of regulations regarding changeable prices and have slowed down the anti-corrosion coating market. Furthermore, increasing R&D activities and investments by prominent players are expected to create lucrative growth opportunities in revenue for players operating in the global anti-corrosion coating market over the forecast period.

Anti-Corrosion Coating Market is segmented into Type, Technology, End-User. The anti-corrosion coating market based on type is segmented as epoxy, polyurethane, acrylic, alkyd, zinc, chlorinated rubber, and others. The technology segment comprises solvent-borne, waterborne, powder-based coating, and others. By end-use industry, the market is segmented into marine, oil & gas, industrial, infrastructure, power generation, automotive & transportation, and others.

The acrylic anti-corrosion coating category is expected to hold a significant global market share due to the weatherproofing and oxidation resistance of acrylic materials contributing to their widespread use. Acrylic coatings, which are typically water-based, offer exceptional performance in various applications, including wall coating and roof coating, and are inexpensive compared to other materials.

The segment oil & gas is projected to grow rapidly in the global anti-corrosion coating market because the widespread application of corrosion protection coating in this industry is largely responsible for this significant market share. The microorganism risk is reduced, and the anti-corrosion coating enhances the abrasion resistance and surface finish. The anti-corrosion coating is used on the floors, handles, beds, walls, and ceilings of hospitals, care homes, and drop-in centers, especially in countries like the US, Germany, the UK, China, and India.

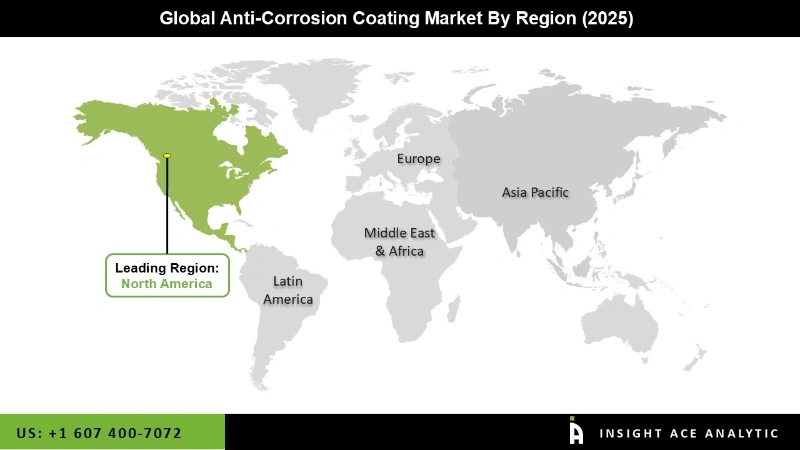

The Asia Pacific anti-corrosion coating market is expected to record the maximum market share in revenue in the near future. The rising demand for anti-corrosion coating in sectors like as construction, energy production, and the oil and gas industry might be ascribed to this phenomenon. The increasing requirement for renewable energy sources in the region also contributes to the Asia Pacific region's rapid development. In addition, the presence of key market competitors and improvements in anti-corrosion coating technology fuel expansion in the region's industries.

| Report Attribute | Specifications |

| Market Size Value In 2025 | USD 36.54 Bn |

| Revenue Forecast In 2035 | USD 58.23 Bn |

| Growth Rate CAGR | CAGR of 5.00% from 2026 to 2035 |

| Quantitative Units | Representation of revenue in US$ Bn and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2025 |

| Forecast Year | 2026-2035 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Type, Technology, End-User |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; France; Italy; Spain; South Korea; South East Asia |

| Competitive Landscape | PPG Industries, Inc., Akzonobel N.V., The Sherwin-Williams Company, Jotun, Kansai Paint Co., Ltd., Axalta Coating Systems Ltd., BASF SE, Hempel A/S, RPM International Inc., Nippon Paint Holdings Co., Ltd., Nycote Laboratories, Inc., Diamond Vogel, Eoncoat, Llc, The Dow Chemical Company, Advanced Nanotech Lab, 3M, Heubach Color, The Magni Group, Inc., Wacker Chemie Ag, 10 SK Formulations India Pvt. Ltd., Noroo Paints & Coatings, Ancatt Inc., Greenkote Plc, Renner Herrmann SA, Secoa Metal Finishing, Others |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing And Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

Anti-Corrosion Coating Market By Type -

Anti-Corrosion Coating Market By Technology -

Anti-Corrosion Coating Market By End-use Industry -

Anti-Corrosion Coating Market By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.