Global Resilient Supply Chains Market Size is predicted to grow at a 12.7% CAGR during the forecast period for 2025-2034.

A resilient supply chain is the capability of an organization to tactfully resist and recover supply chain disruptions within its supply chain network. Hence, the adoption of resilient supply chains is expected to increase in the near future as concerns grow over the rapid change in market trends, unexpected challenges, economic crises, natural disasters, and geopolitical conflicts. The growing adoption of technologies owing to their predictive analytics, real-time monitoring, and efficient resource management is expected to drive the growth of the global resilient supply chains market.

The rising need for resilient supply chains in organizations to adapt to interruptions and maintain continuity in various industries are other factors expected to augment the target market growth. The increasing adoption of resilient supply chains among several organizations and industries to control unexpected events and reduce operational downtime globally is expected to boost market expansion in the coming years.

However, the high cost of resilient supply chains and complexities with new technologies, coupled with the COVID-19 outbreak, may limit the target market's growth during the forecast period. Furthermore, increasing R&D activities, government initiatives to use sustainable components for production, and investments by prominent players are expected to create lucrative growth opportunities in revenue for players operating in the global resilient supply chains market over the forecast period.

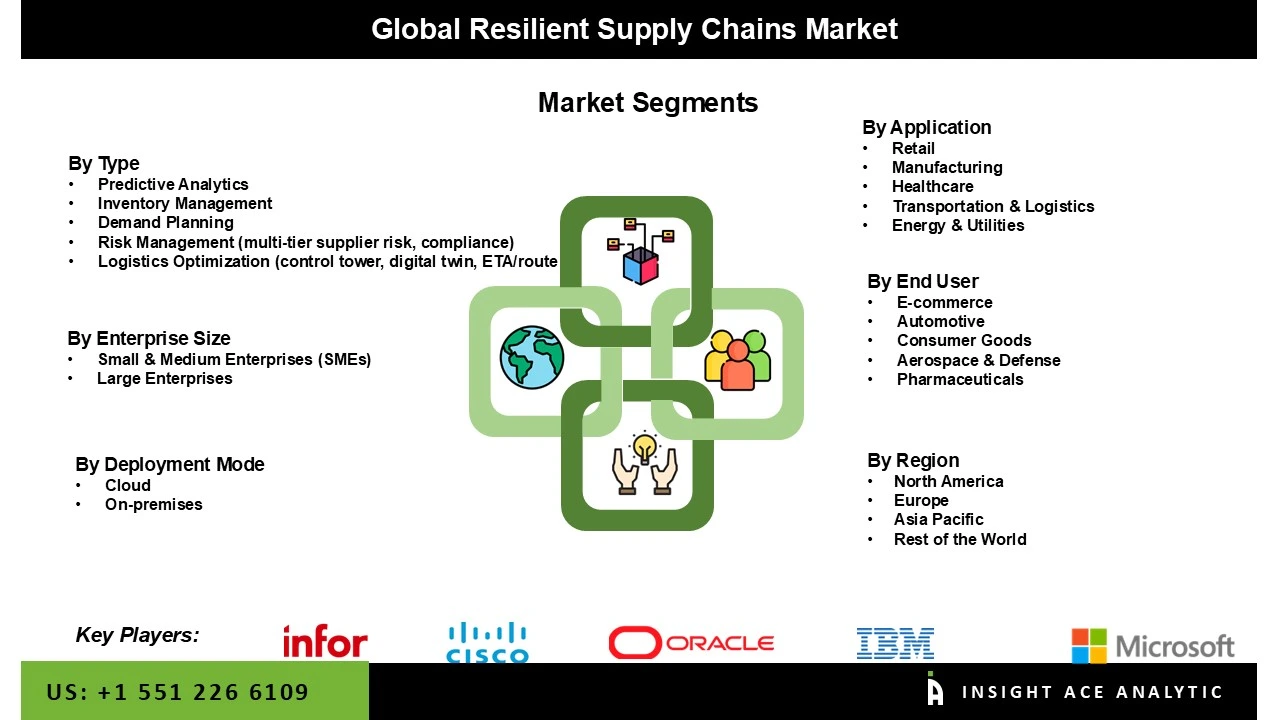

The resilient supply chain market is segmented based on type, application, component, enterprise size, deployment mode, and end-user. The market is segmented based on type as predictive analytics, inventory management, demand planning, risk management, and logistics optimization. The market is segmented by application into retail, manufacturing, healthcare, transportation & logistics, and energy & utilities. The market is segmented by component into software, hardware, and services. The market is segmented by enterprise size into small and medium enterprises and large enterprises. By deployment mode, the market is segmented into on-premises and cloud-based. By end user, the market is segmented into e-commerce, automotive, consumer goods, aerospace & defense, and pharmaceuticals.

The predictive analytics category is expected to hold a major share of the global resilient supply chains market in 2023. This is attributed to predicting possible disruptions and empowering proactive measures—additionally, there is increasing demand for predictive analytics to manage inventory effectively, demand shifts, and mitigate risks.

The retail sector segment is projected to grow at a rapid rate in the global resilient supply chains market owing to meet consumer demands and safeguard product availability. Hence, with the growing technological advancement and data analytics to reduce disruptions and streamline operations, there is an increase in demand for resilient supply chains in the retail sector, especially in countries such as the US, Germany, the UK, China, and India.

The North America resilient supply chains market is expected to register the highest market share in terms of revenue in the near future. This can be attributed to the strong focus on robust systems and advanced technology in the region, with the increasing adoption of resilient supply chains in different sectors, including retail, manufacturing, healthcare, and logistics. In addition, the region is focusing on investment in risk management and predictive analytics to mitigate disruptions and manage operational efficiency. The region pays attention to optimizing logistics to help with complexities in industrial and consumer needs. In addition, Asia Pacific is projected to grow at a rapid rate in the global resilient supply chains market due to the integration of innovative technologies to boost supply chains in various industries.

| Report Attribute | Specifications |

| Growth Rate CAGR | CAGR of 12.7% from 2025 to 2034 |

| Quantitative Units | Representation of revenue in US$ Mn,and CAGR from 2025 to 2034 |

| Historic Year | 2021 to 2024 |

| Forecast Year | 2025-2034 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Type, By Application, By Component, By Enterprise Size, By Deployment Mode, By End-User and By Region |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; France; Italy; Spain; South East Asia; South Korea |

| Competitive Landscape | SAP, Oracle, IBM, Microsoft, Amazon Web Services (AWS), Google Cloud, Siemens (Incl. Mendix), Dassault Systèmes (DELMIA), Infor, Manhattan Associates, Blue Yonder, Kinaxis, o9 Solutions, E2open, Coupa, project44, FourKites, Resilinc, Everstream Analytics, Interos, Exiger, Dun & Bradstreet, ServiceNow, Cisco, Schneider Electric, Zebra Technologies, Accenture, Capgemini, Tata Consultancy Services (TCS), Infosys, Wipro, Genpact, DHL Supply Chain, A.P. Moller – Maersk, Kuehne+Nagel, DB Schenker, GEODIS, XPO and Flexport |

| Customization Scope | Free customization report with the procurement of the report and modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing And Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

Resilient Supply Chains Market- By Type

Resilient Supply Chains Market- By Application

Resilient Supply Chains Market- By Component

Resilient Supply Chains Market- By Enterprise Size

Resilient Supply Chains Market- By Deployment Mode

Resilient Supply Chains Market- By End-User

Resilient Supply Chains Market- By Region

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.