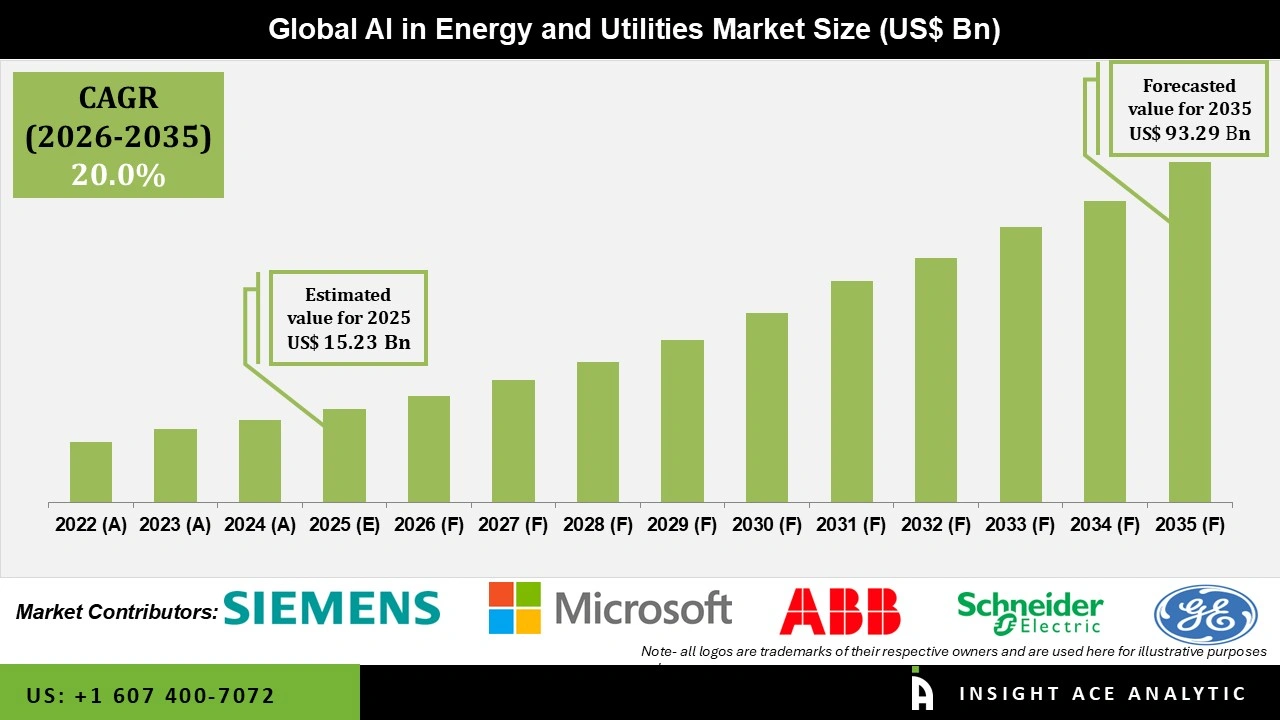

Global AI in Energy and Utilities Market Size is valued at USD 15.23 Billion in 2025 and is predicted to reach USD 93.29 Billion by the year 2035 at a 20.0% CAGR during the forecast period for 2026 to 2035.

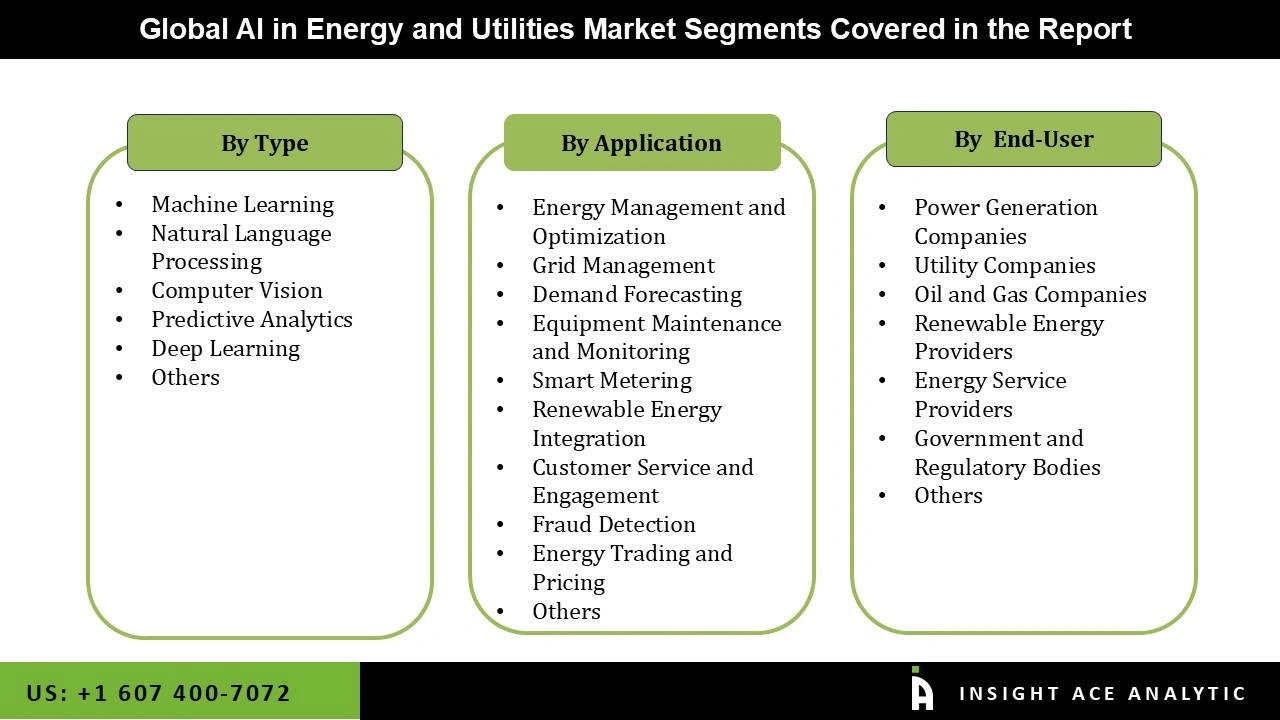

AI in Energy and Utilities Market Size, Share & Trends Analysis Report By Type (Machine Learning, Natural Language Processing, Computer Vision, Predictive Analytics, Deep Learning, Others), By Application, By End-User, By Region, and By Segment Forecasts, 2026 to 2035.

Artificial intelligence in the energy as well as utilities sector improves efficiency through the optimization of grid management, forecasting energy demand, and the integration of renewable energy sources. It facilitates smart grids, enabling predictive maintenance to avert equipment breakdowns, and assists in diminishing energy use. AI enhances demand responsiveness, equilibrates supply and demand, and aids in energy trading through market pattern analysis. These technologies enhance sustainability, decrease expenses, and facilitate the shift to cleaner energy alternatives.

Additionally, AI in energy and utilities makes it easier to manage and incorporate renewable energy sources into current systems. Advancements in protection and energy management have also enhanced the general efficiency and effectiveness of AI in energy and utility installations. Furthermore, AI in the energy and utilities sector enables data analysis and real-time monitoring, and the development of smart grids is enhanced, leading to more efficient and reliable grid operations.

However, the high cost of developing AI in the energy and utility sector is a significant market constraint. Additionally, market growth is further hindered by a need for more knowledge and familiarity with these technologies. A number of factors are creating opportunities for AI in the energy and utilities market. These include the increasing use of renewable energy sources, improvements in AI technologies, encouragement from government policies, and the necessity for more reliable grids and lower energy consumption across many industries.

The AI in energy & utilities market is segmented based on type, application, and end-user. Based on type, the market is segmented into machine learning, computer vision, natural language processing, predictive analytics, deep learning, and others. By application, the market is segmented into energy management and optimization, demand forecasting, equipment maintenance and monitoring, grid management, smart metering, customer service and engagement, renewable energy integration, fraud detection, energy trading and pricing, and others. By end-user, the market is segmented into power generation companies, utility companies, renewable energy providers, oil and gas companies, energy service providers, government and regulatory bodies, and others.

Predictive analytics is expected to hold a major global market share in 2023 in the AI in energy and utilities market because of its superior capacity to optimize resource allocation and precisely predict energy consumption. Predictive analytics, which analyzes both historical and real-time data, makes proactive maintenance possible. This helps to reduce operational expenses and downtime. For utilities aiming to achieve sustainability goals, predictive analytics is vital because of the role it plays in improving grid resilience and energy efficiency and aiding the integration of renewable energy sources.

The renewable energy integration segment is growing because artificial intelligence improves the dependability and efficiency of connecting renewable energy sources to the grid. With the help of artificial intelligence, utilities can maximize the utilization of replenishable energy sources and meet expanding sustainability goals and regulatory mandates. Artificial intelligence enhances grid stability, optimizes energy forecasts, and balances supply and demand.

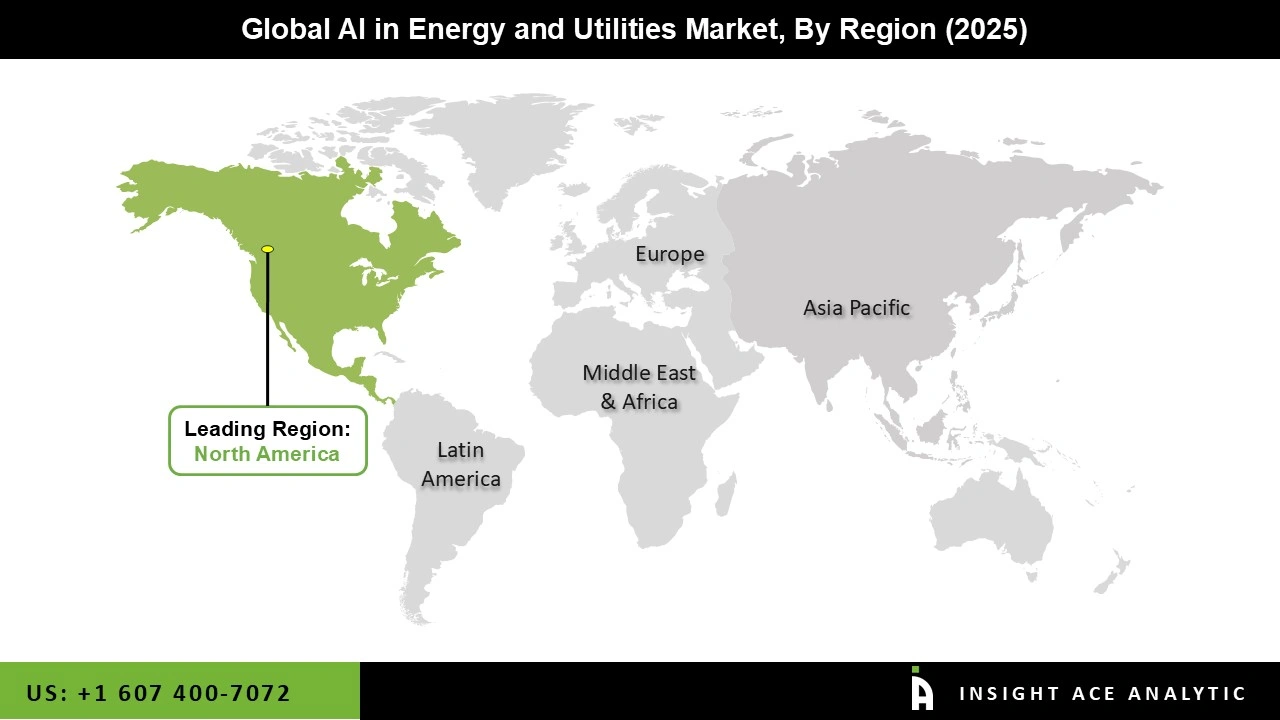

The North American AI in the energy and utilities market is expected to document the largest market share in revenue in the near future. This can be attributed to the emphasis on sustainability and energy efficiency in many different sectors, as well as substantial expenditures on renewable energy, cutting-edge technical infrastructure, and greater use of artificial intelligence is driving operational efficiencies and utility-wide optimization of energy distribution in response to the region’s push to reduce carbon emissions and increase energy efficiency.

In addition, the Europe is expected to grow rapidly in the AI in energy and utilities market because of the region’s growing urban population, increasing energy demand, smart grid development efforts, investments in replenishable energy, and improvements to the region’s infrastructure driven by artificial intelligence.

| Report Attribute | Specifications |

| Market Size Value In 2025 | USD 15.23 Billion |

| Revenue Forecast In 2035 | USD 93.29 Billion |

| Growth Rate CAGR | CAGR of 20.0% from 2026 to 2035 |

| Quantitative Units | Representation of revenue in US$ Bn and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2025 |

| Forecast Year | 2026 to 2035 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Type, Application, End-User |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; France; Italy; Spain; South East Asia; South Korea |

| Competitive Landscape | Siemens AG, General Electric Company, International Business Machines Corporation (IBM), Schneider Electric SE, ABB Ltd, Microsoft Corporation, Oracle Corporation, Honeywell International Inc., Cisco Systems, Inc., SAS Institute Inc., Intel Corporation, Siemens Energy AG, Enel X S.r.l., C3.ai, Inc., Tesla, Inc., Google LLC (subsidiary of Alphabet Inc.), Engie SA, Accenture plc, Hitachi, Ltd., Vestas Wind Systems A/S, Wärtsilä Oyj Abp, Électricité de France (EDF), Shell plc, and Nvidia Corporation, and Eaton Corporation plc. |

| Customization Scope | Free customization report with the procurement of the report and modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing And Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.