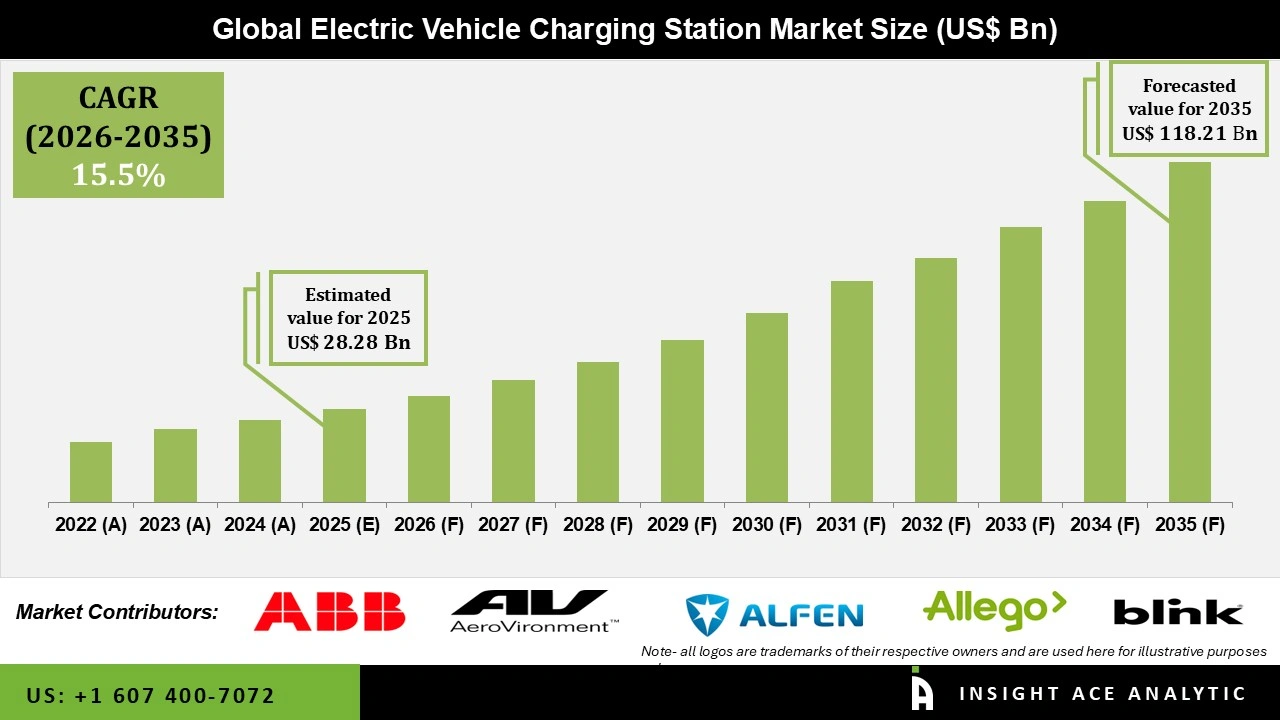

Global Electric Vehicle Charging Station Market size is valued at USD 28.28 Billion in 2025 and is predicted to reach USD 118.21 Billion by the year 2035 at an 15.5% CAGR during the forecast period for 2026 to 2035.

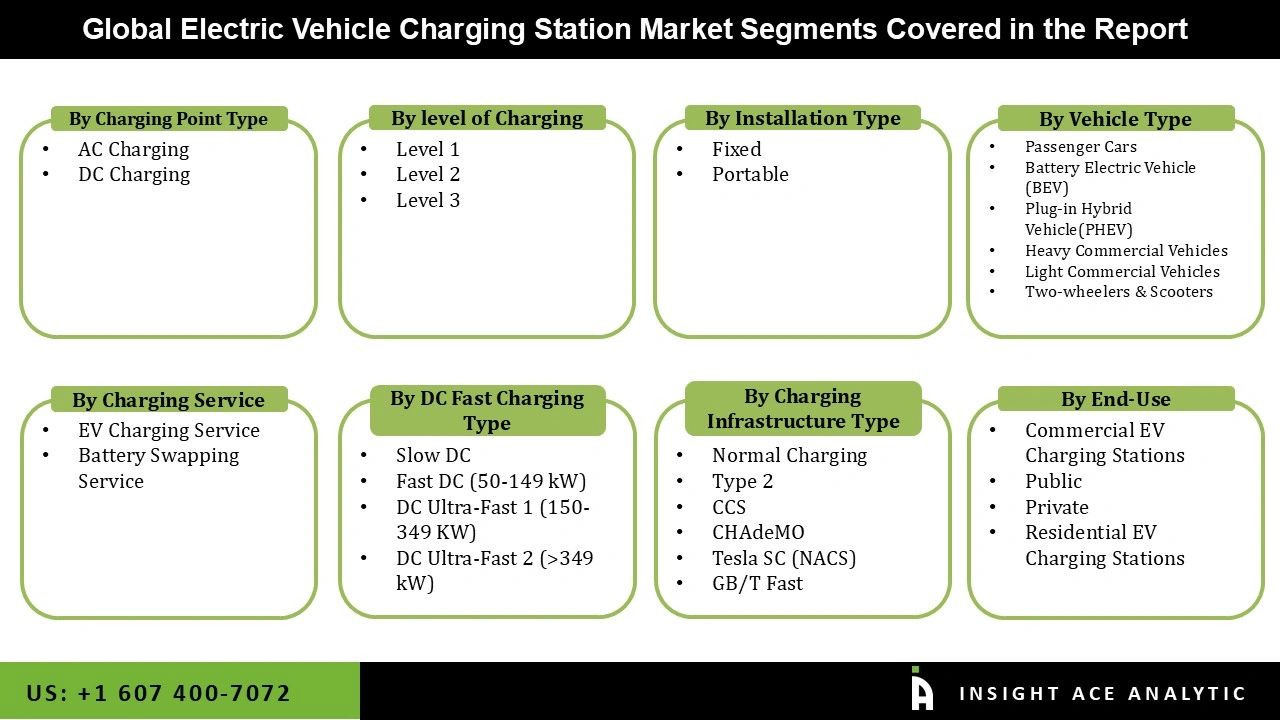

Electric Vehicle Charging Station Market Size, Share & Trends Analysis Report By Charger Type (Slow Charger And Fast Charger), Charging Type (AC, DC), Installation Type (Fixed, Portable), Connector Type (CHAdeMO, CCS, Others), Level of Charging (Level 1, Level 2, Level 3), Connectivity (Non-connected Charging Stations, Connected Charging Stations), Operation (Mode 1, Mode 2, Mode 3, Mode 4), Deployment (Private, Semi-Public, Public), Application (Commercial, Residential), By Region, And Segment Forecasts, 2026 to 2035.

The ever-increasing amounts of carbon emissions and other potentially harmful compounds that are caused by transportation are what pushed the government to mandate the use of electric vehicles. As a immediate consequence of this, there is a growing demand for an Station capable of charging electric vehicles (E.V.'s) in both commercial and residential contexts. It is projected that increased cooperation amongst manufacturers to supply charging stations utilizing a subscription model would fuel the rise of the sector. Green energy is also anticipated to be a significant factor in public and private electric vehicle charging stations. Carbon emissions are the main issue for E.V. owners.

The sales of electric vehicles have expanded exponentially in recent years, along with their improved performance, wider model availability, and longer range. The IEA's Global EV Outlook 2024 states that sales of electric vehicles approached 14 million in 2023, with the United States, China, and Europe accounting for 95% of these sales.

Companies are quickly developing their electric vehicle charging networks' charging technologies to solve these worries. Although they offer a more affordable and practical method of charging electric vehicles than commercial charging stations, E.V. chargers for domestic areas have huge growth potential.

The electric vehicle charging Station market is segregated based on the charger type, charging type, installation type, connector type, level of charging, connectivity, operation, deployment, application. Based on charger type, the market is segmented into slow charger and fast charger. based on charging type, the market is segmented into AC and DC. Based on installation type, electric vehicle charging Station market is segmented into fixed, portable. By connector type market is segmented into CHAdeMO, CCS, others. By level of charging market is segmented into level 1, level 2, level 3. By connectivity market is segmented into non-connected charging stations, connected charging stations. By operation market is segmented into mode 1, mode 2, mode 3, mode 4. by deployment market is segmented into commercial and residential. Commercial is subsegmented into destination charging stations, highway charging stations, bus charging stations, fleet charging stations, other charging stations. Residential is subsegmented into private houses, apartments/societies.

The fast charger category grabbed the highest revenue share, and it is anticipated that they will continue to hold that position during the anticipated time. Due to the fast charger's capacity to charge vehicles over the anticipated period, the fast charger market will experience exponential growth. Additionally, its capability to safeguard automobile batteries while charging would help the market expand. Besides, in 2020, the slow/moderate charger market will have low growth and limited penetration. In 2020, the sector of slow/moderate chargers held a market share of 16.24%. Due to the lengthy amount of time needed to charge EVs, the category will increase slowly during the anticipated period.

The commercial category is anticipated to grow at a significant rate over the forecast period. Public electric vehicle charging Station is in greater demand as a result of the historic move to electric automobiles. The development of a charging Station has not yet kept pace with the surge in sales of electric vehicles. The demand for public charging stations would only grow as the price of electric vehicles fluctuated and dropped, entering new markets, notably for inhabitants of multi-unit buildings. The ideal candidates for hosting electric vehicle charging stations would also be stores.

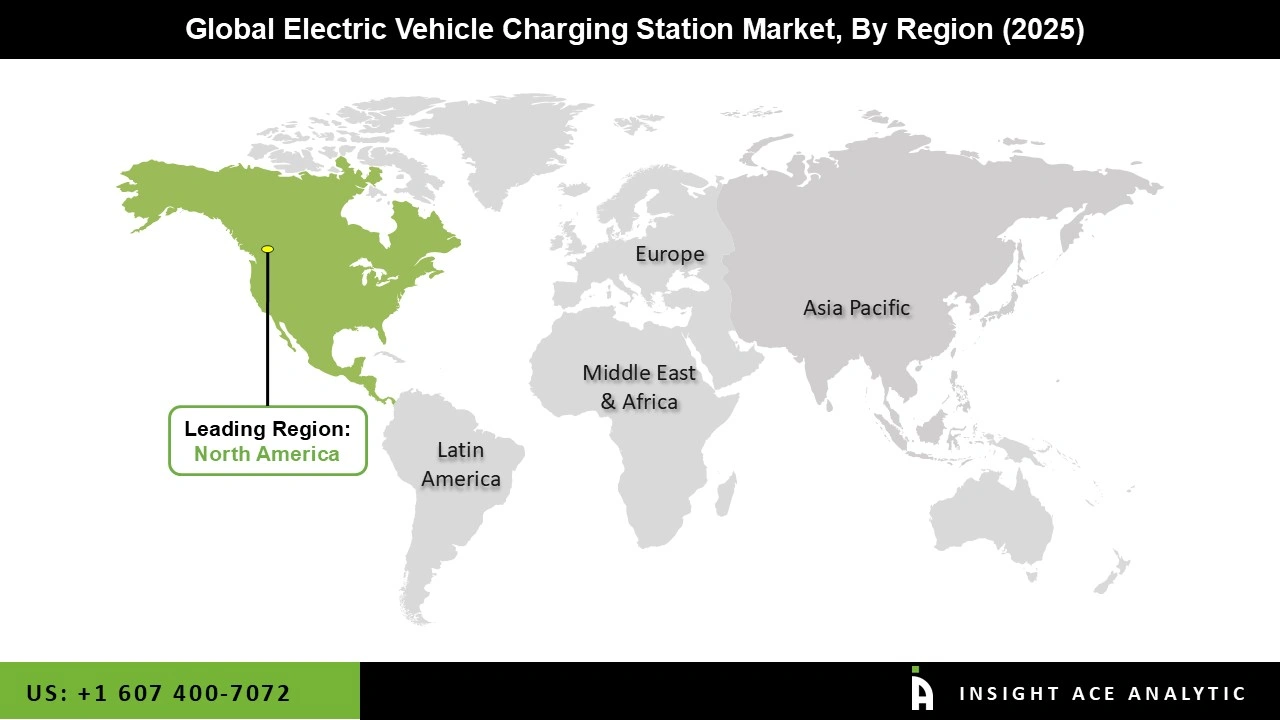

The Asia Pacific electric vehicle charging Station market is expected to report the highest market share in revenue in the near future. The Asia Pacific market is projected to be fueled by China's rapid expansion of EV charging Station , rising consumer demand for reasonably priced EVs for daily usage, and government-led EV promotion. The IEA projects that China is leading the way in the worldwide electric vehicle market in its annual Global EV Outlook. 2023 year witnessed 8.1 million new electric car registrations in China, a 35% rise from year 2022. Robust sales of electric vehicles is the primary factor driving regional growth in the EV charging Station market.

The nation's rapid economic growth will support the spread of cutting-edge technologies to enhance electrification in China during the predicted period. In addition, Europe is projected to grow at a rapid rate in the global electric vehicle charging Station market due to the location of important market participants. Market expansion in this region is probably going to be fueled by consumer adoption of EVs, driverless vehicles, and shared mobility. The market in this region is anticipated to be driven by factors including the tightening government regulations on car emissions, the quick adoption of new technologies, and the significant investment in product innovation.

| Report Attribute | Specifications |

| Market size value in 2025 | USD 28.28 Billion |

| Revenue Forecast in 2035 | USD 118.21 Billion |

| Growth rate CAGR | CAGR of 15.5% from 2026 to 2035 |

| Quantitative units | Representation of revenue in US$ Mn, Volume (Thousand Units) and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2025 |

| Forecast Year | 2026-2035 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market statistics, growth prospects, and trends |

| Segments Covered | Level Of Charging, Charging Point Type, Application, Charging Station Type, Installation Type, D.C. Fast Charging, IoT Connectivity, Charging Service And Electric Bus Charging Type |

| Regional scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; France; Italy; Spain; South Korea; Southeast Asia |

| Competitive Landscape | ABB Ltd., AeroViroment, Inc., Alfen N.V., Allego, Blink Charging Co., Chargemaster plc., ChargePoint, Inc., ClipperCreek, Denso Corporation, Efacec, Elix Wireless, Engie, Evatran Group, EVgo Services LLC., General Electric, HellaKGaAHueck& Co., Infineon Technologies AG and Others |

| Customization scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing and available payment methods | Explore pricing alternatives that are customized to your particular study requirements. |

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.