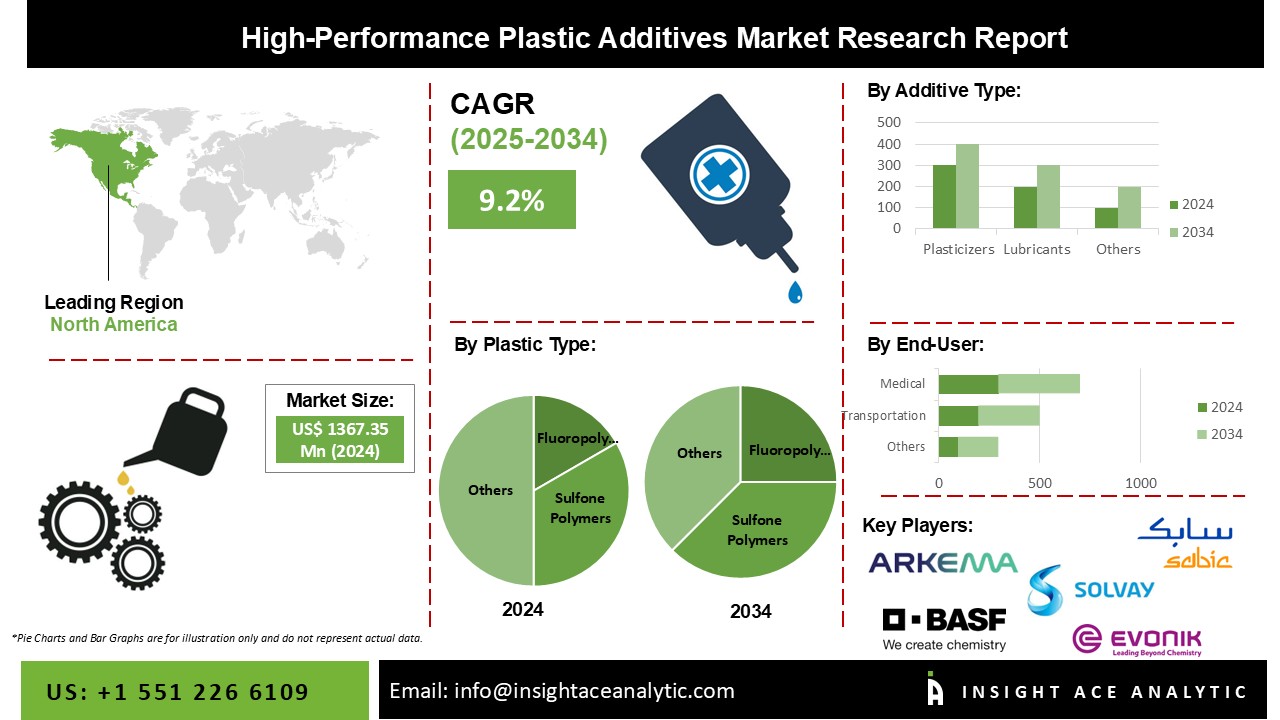

High-Performance Plastic Additives Market Size is valued at 1367.35 million in 2024 and is predicted to reach 3266.38 million by the year 2034 at a 9.2% CAGR during the forecast period for 2025-2034.

Performance additives are compounds added to modern-day automobile gasoline and other propelling fuels to stabilize and raise its octane level, reduce the likelihood of pre-ignition, and allow for more power to be created through higher compression and advanced ignition timing. High-performance adhesives are widely utilized in the automation, construction, medical, transportation, aerospace and defense industries. High-performance adhesives are light in weight, which is why they are commonly used in the automobile industry to manufacture lightweight vehicles.

However, COVID-19 has significantly impacted the global market. Numerous government limitations have hampered the production and supply of commodities, raw materials, and finished goods. Because of the epidemic, most chemical manufacturers in China have been compelled to temporarily close their doors. China is the primary market for these additives and their raw materials, and their impact on the worldwide market is expected to be significant. The supply of raw materials was hampered during the shutdown, affecting the production of various additives and derivatives. Moreover, labor shortages are impacting the market throughout the outbreak.

The high-performance plastic additives market is segmented on the basis of end-user, plastic type, and additive type. Based on end-user, the market is segmented as transportation, medical, electrical and electronics, packaging, and others. By plastic type, the market is segregated into fluoropolymers, high-performance polyamides, sulfone polymers, liquid crystal polymers, polyimides, and others. The additive type segment includes plasticizers, flame retardants, lubricants, anti-oxidants, stabilizers, and others.

The plasticizers category is expected to hold a major share of the global high-performance plastic additives market in 2021. Polymer plasticity is changed to meet the needs of various application areas. They make it easier to handle raw materials during the manufacturing process and also change the frictional coefficient according to the application. The most widely utilized products are poly-carboxylic acid esters with aliphatic or branched alcohols with moderate-length chains. Ester plasticizers are chosen based on a cost-performance analysis, toxicity, non-volatility, processability, and compatibility with the host material. Yet, over 90% of all plasticizers are employed in the manufacture of flexible PVC. The category is predicted to grow due to the rising demand for flexible PVC polymer.

The packaging segment is projected to grow at a rapid rate in the global high-performance plastic additives market. Various types of items necessitate different types of packing materials. Transparent, food-grade, medical-grade, opaque, porous, moisture-resistant, heat-resistant, and other plastic materials are available on the market. Plastic is one of the most cost-effective alternatives to metals and alloys in packaging. Furthermore, convenience food is in high demand due to the hectic lifestyles of city dwellers. The market is predicted to be pushed by rising demand for plastic packaging from the food and beverage, medical, pharmaceutical, and other industries.

The Asia Pacific high-performance plastic additives market is expected to witness the highest market share in terms of revenue in the near future. The rapid rise of the e-commerce sector is boosting the growth of the regional packaging industry, resulting in the development of the regional market. Furthermore, increased disposable incomes encourage customers to spend more on home décor, ornamental products, and furniture, which has benefited the Indian and Chinese furniture markets.

The rising global demand for Chinese goods is likely to fuel the local plastics industry. Additionally, North America holds a large share of the worldwide market due to the rising use of plastics and polymers in the packaging, construction, aerospace & defense, food & beverages, general manufacturing, and car industries. Advancing investments in the aerospace and defense sectors for the development of improved materials are projected to provide an opportunity for the market in this area.

| Report Attribute | Specifications |

| Market size value in 2024 | USD 1367.35 Mn |

| Revenue forecast in 2034 | USD 3266.38 Mn |

| Growth rate CAGR | CAGR of 9.2% from 2025 to 2034 |

| Quantitative units | Representation of revenue in US$ Million, Volume (KT), and CAGR from 2025 to 2034 |

| Historic Year | 2021 to 2024 |

| Forecast Year | 2025-2034 |

| Report coverage | The forecast of revenue, the position of the company, the competitive market statistics, growth prospects, and trends |

| Segments covered | End-User, Plastic Type, And Additive Type |

| Regional scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; The UK; France; Italy; Spain; South Korea; Southeast Asia |

| Competitive Landscape | Solvay S.A., Evonik Industries AG., Colloids Ltd., SABIC, Ensinger, L.Brueggemann GmbH & Co. KG, Americhem, Inc., Colortech Inc., Tosaf Compounds Ltd., Arkema, BASF SE, 3M, SUQIAN UNITECH CORP., LTD., Nouryon, Avient Corporation, Kemipex, Advanced Polymer Solutions, LLC, NEWOS GmbH, Ceramer GmbH, and Karan Industrial Group. |

| Customization scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing and available payment methods | Explore pricing alternatives that are customized to your particular study requirements. |

High-Performance Plastic Additives Market By End-User-

High-Performance Plastic Additives Market By Plastic Type-

High-Performance Plastic Additives Market By Additive-Type-

High-Performance Plastic Additives Market By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.