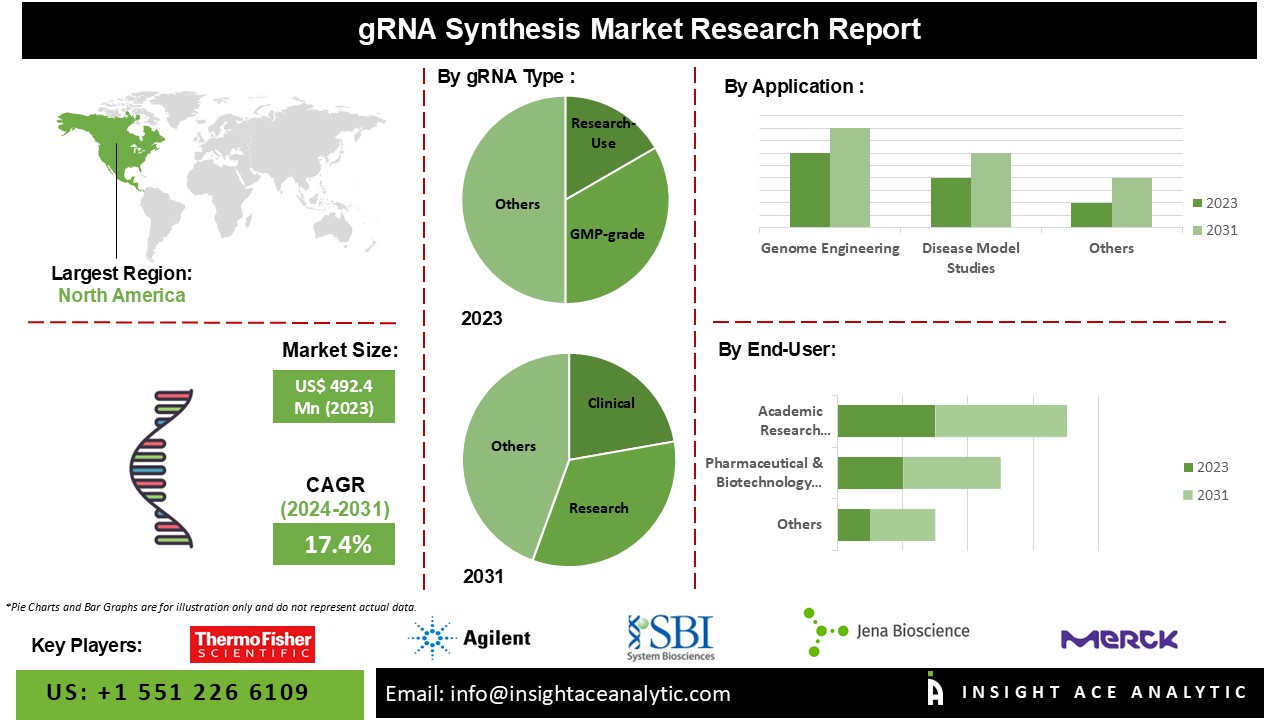

The gRNA Synthesis Market Size is valued at USD 492.4 Mn in 2023 and is predicted to reach USD 1,751.4 Mn by the year 2031 at an 17.4% CAGR during the forecast period for 2024 to 2031.

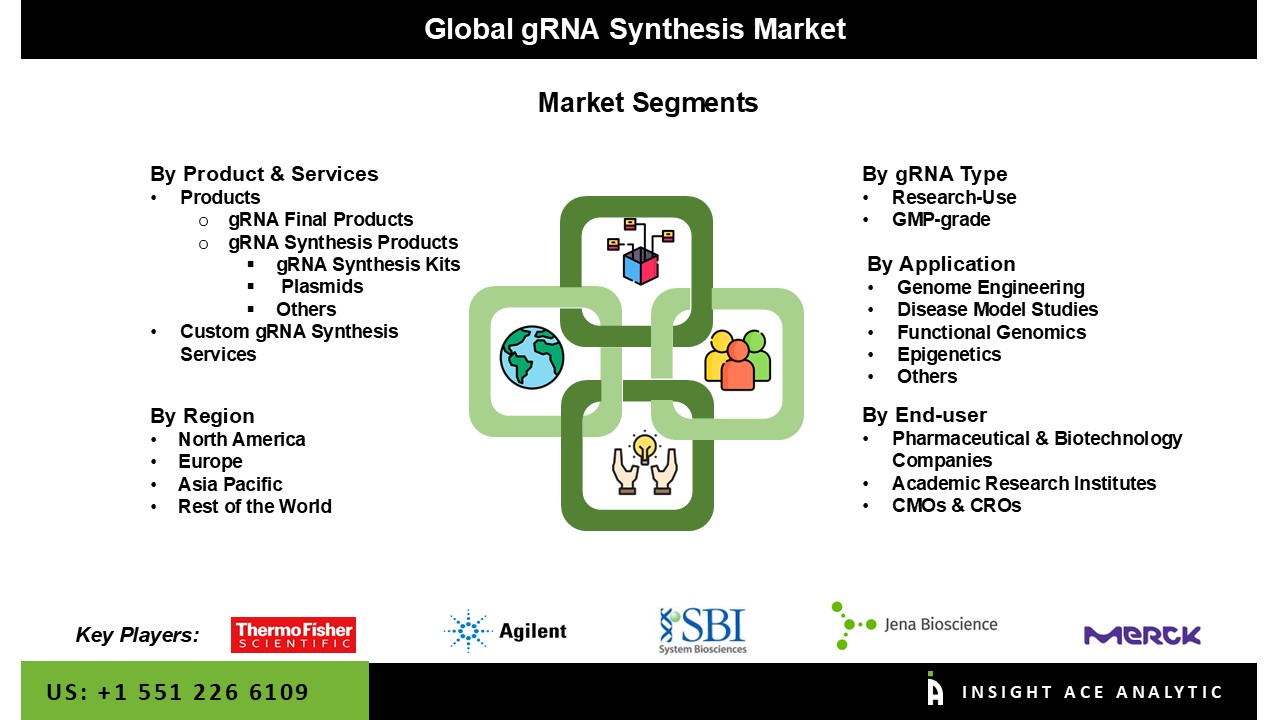

gRNA Synthesis Market Size, Share & Trends Analysis Distribution by Product & Services (Products, Custom gRNA Synthesis Services), gRNA Type (Research-Use, GMP-grade), Application (Genome Engineering, Disease Model Studies, Functional Genomics, Epigenetics), End-use (Pharmaceutical & Biotechnology Companies, Academic Research Institutes, CMOs & CROs) and Segment Forecasts, 2024-2031

The synthesis of guide RNA (gRNA) comprises the design and production of RNA molecules that direct CRISPR-associated (Cas) nucleases to specific genomic targets through complementary base pairing. This mechanism is essential for accurate gene editing in CRISPR technologies, facilitating applications in medicines, biomedical research, agriculture, and diagnostics. This technology has transformed fields such as medicine, agriculture, and biotechnology, becoming a crucial tool for researchers aiming to modify genes with high accuracy. In medicine, gRNA is used to develop gene therapies for genetic disorders, while in agriculture, it benefits in creating GMOs that resist pests and environmental stresses. It also plays a key role in next-generation sequencing (NGS) technologies, broadening its impact in genomic research and diagnostics.

A major factor driving the gRNA Synthesis market's growth is the increasing demand for personalized medicine. As healthcare moves towards modified treatments, the need for precise genetic modifications grows, boosting demand for gRNA-based technologies. This trend is further supported by significant investments in research and development, particularly in the biomedical sector, which is expected to fuel the market's expansion in the coming years.

The gRNA Synthesis market is product & services, gRNA type, application, and end-use. By product & services the market is segmented into products, custom gRNA synthesis services, products is sub segmented into gRNA final products, gRNA Synthesis Products. gRNA synthesis products is sub segmented into gRNA Synthesis Kits, Plasmids, Others. By gRNA type market is categorized into research-use, GMP-grade. By application market is categorized into genome engineering, disease model studies, functional genomics, epigenetics, and others. By end-use the market is categorized into pharmaceutical & biotechnology companies, academic research institutes, CMOs & CROs.

The custom gRNA synthesis services segment is set to experience the highest growth in the gRNA Synthesis market due to increasing demand for precision in gene editing, advancements in biotechnology, and diverse applications. Researchers require custom gRNAs to achieve greater accuracy, reduce off-target effects, and improve the efficiency of the CRISPR/Cas9 system, driving demand for these services. Biotechnology advancements have made gRNA synthesis more accessible and cost-effective, allowing researchers at all levels to obtain high-quality custom gRNAs. Additionally, the broad applicability of custom gRNAs in areas like functional genomics, disease models, and therapeutic interventions further expands their market potential.

The GMP-grade segment of the gRNA market is expected to see significant growth due to the rising demand for high-quality, regulatory-compliant products, particularly in clinical applications. GMP-grade gRNA is produced under strict quality control standards, ensuring safety and efficacy, which is essential as gene editing technologies like CRISPR advance toward therapeutic use. The growing focus on gene therapy for treating genetic disorders also drives demand, with pharmaceutical and biotech companies investing in novel therapies requiring GMP-grade gRNA for effective and safe gene editing in clinical trials and personalized medicine.

North America, particularly the U.S., is a key driver of the gRNA Synthesis market due to the presence of major players like Thermo Fisher Scientific, Merck KGaA, and Synthego, who are heavily investing in R&D for innovative gRNA products. The region benefits from substantial R&D investments in genomic research, alongside strong government support, including a 2023 Biden executive order aimed at enhancing gRNA manufacturing capabilities. Additionally, NIH-funded research has played a pivotal role in advancing genetic engineering and establishing the $40 billion biotech industry.

| Report Attribute | Specifications |

| Market Size Value In 2023 | USD 492.4 Mn |

| Revenue Forecast In 2031 | USD 1,751.4 Mn |

| Growth Rate CAGR | CAGR of 17.4% from 2024 to 2031 |

| Quantitative Units | Representation of revenue in US$ Mn and CAGR from 2024 to 2031 |

| Historic Year | 2019 to 2023 |

| Forecast Year | 2024-2031 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Product & Services, gRNA Type, Application, End-use and By Region |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; The UK; France; Italy; Spain; China; Japan; India; South Korea; Southeast Asia; South Korea; Southeast Asia |

| Competitive Landscape | Thermo Fisher Scientific Inc., Agilent Technologies Inc., System Biosciences, LLC., Jena Bioscience GmbH, Merck KGaA, GENEWIZ (Azenta Life Sciences), Takara Bio Inc., Synbio Technologies, Horizon Discovery Ltd., Synthego |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Geographic competitive landscape. |

| Pricing and Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

gRNA Synthesis Market by Product & Services -

gRNA Synthesis Market by gRNA Type -

gRNA Synthesis Market by Application -

gRNA Synthesis Market by End-use -

gRNA Synthesis Market by Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.