Next-Generation Sequencing in Precision Medicine Market Size is valued at US$ 6.4 Bn in 2024 and is predicted to reach US$ 28.6 Bn by the year 2034 at an 16.4% CAGR during the forecast period for 2025 to 2034.

In the context of precision medicine, "next-generation sequencing" (NGS) refers to advanced DNA and RNA sequencing technologies that provide rapid, accurate, and comprehensive genetic material analysis. NGS may process millions of DNA fragments simultaneously, enabling researchers and clinicians to identify genetic variations, mutations, and biomarkers at a scale and speed never before achievable. NGS enables precision medicine by enhancing diagnosis, forecasting disease risk, and choosing the most effective treatments by tailoring medical interventions to each patient's distinct genomic profile. The market for next-generation sequencing in precision medicine is expected to grow significantly due to its revolutionary effects in providing precise, individualized diagnostics and treatments.

Additionally, the demand for genomic-based therapy customization to an individual's genetic composition is being driven by the rising prevalence of uncommon diseases, cancer, and genetic abnormalities. The industry is expanding more quickly due to the growing use of next-generation sequencing in pharmacogenomics, oncology, and rare illness diagnosis, as well as improved bioinformatics, falling sequencing prices, and supportive government regulations. Moreover, pharmaceutical companies use NGS to create targeted medications and find biomarkers. The next-generation sequencing in the precision medicine market is growing due to regulatory backing for companion diagnostics.

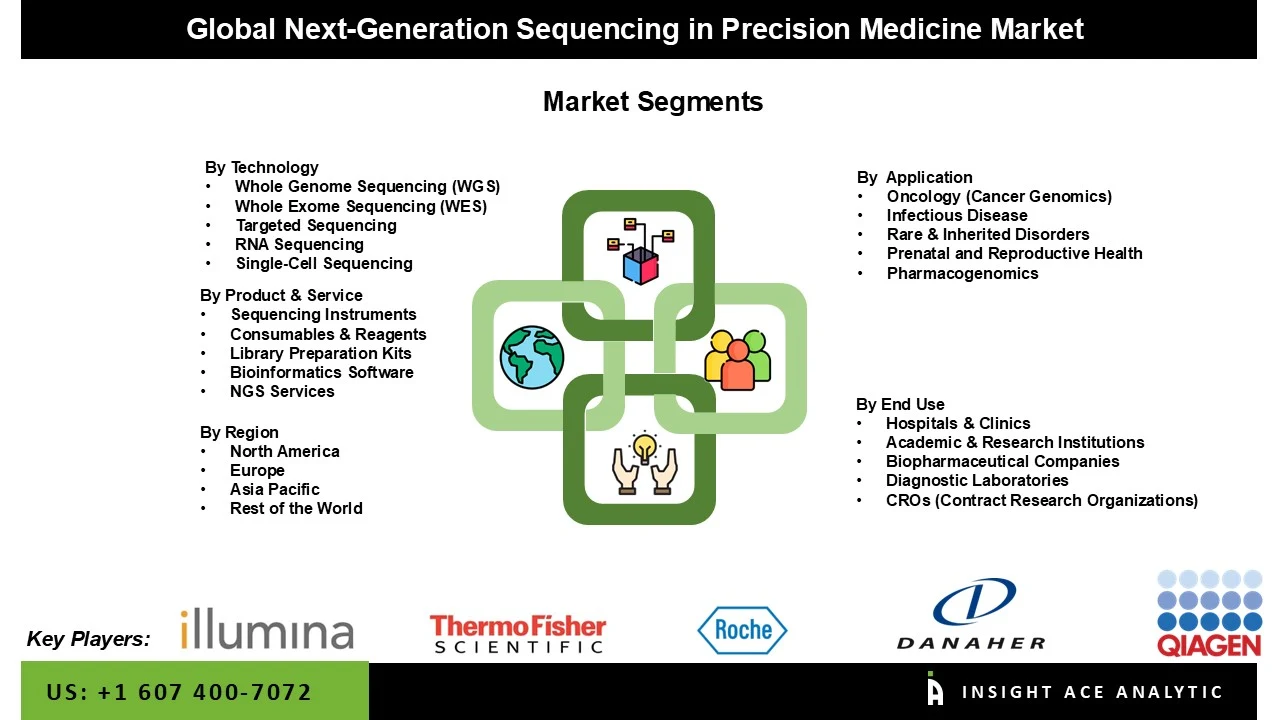

The next-generation sequencing in precision medicine market is segmented by product & service, technology, application, and end-use. By product & service, the market

| minimal residual disease |

is segmented into ngs services, sequencing instruments, consumables & reagents, bioinformatics software, and library preparation kits. By technology, the market is segmented into rna sequencing, whole genome sequencing (wgs), targeted sequencing, whole exome sequencing (wes), and single-cell sequencing. The application segment included infectious disease, rare & inherited disorders, pharmacogenomics, oncology (cancer genomics), prenatal and reproductive health. By end-use, the market is segmented into hospitals & clinics, diagnostic laboratories, biopharmaceutical companies, academic & research institutions, and cros (contract research organizations).

Technology breakthroughs, growing use of high-throughput platforms, and the growing need for customized treatments have all contributed to the sequencing instruments segment's greatest revenue share in the next-generation sequencing in precision medicine market in 2024. The ability to quickly, accurately, and economically sequence DNA and RNA is made possible by these tools, and it is crucial for customizing medical interventions to each patient's unique genetic profile. Additionally, major market participants' ongoing innovation to improve sequencing speed and lower operating costs is supporting the segment's growth.

In 2024, the next-generation sequencing in the precision medicine market was driven by the oncology segment. Since tumors are complicated and heterogeneous, NGS is widely employed in biomarker discovery, tailored treatment, and cancer diagnostics. Demand is further fueled by rising cancer prevalence. Additionally, through tumor profiling, actionable mutation discovery, minimal residual disease (MRD) detection, and continuous resistance evaluation, NGS technology has revolutionized oncology. NGS is being used in oncology pathways at academic institutions, hospitals, and CROs to improve patient care. The convergence of testing standards and reimbursement structures cements the relevance of genomics in contemporary cancer care.

North America held the largest share in the next-generation sequencing in precision medicine market because of the region's technologically advanced healthcare research framework and widespread use of NGS technology in precision medicine. The most advanced healthcare system in North America also comprises biotechnology companies, research hospitals, and esteemed academic institutions. Additionally, strong healthcare infrastructure, government support for precision medicine, and large investments in genomic research all contribute to the expansion of the next-generation sequencing in precision medicine market.

Furthermore, the market for next-generation sequencing in precision medicine in Asia-Pacific is being pushed by rising healthcare spending and the rise in non-communicable diseases (NCDs). Additionally, APAC governments—including those of China, India, and Japan—are actively assisting genomic programs to promote precision medicine. The region also gains from smart partnerships with world leaders, cost-effective manufacturing, and rapid technological advancements by regional firms. The market for next-generation sequencing in precision medicine is growing quickly in Asia due to rising pharmaceutical R&D spending and growing public awareness of genetic testing.

| Report Attribute | Specifications |

| Market Size Value In 2024 | USD 6.4 Bn |

| Revenue Forecast In 2034 | USD 28.6 Bn |

| Growth Rate CAGR | CAGR of 16.4% from 2025 to 2034 |

| Quantitative Units | Representation of revenue in US$ Bn and CAGR from 2025 to 2034 |

| Historic Year | 2021 to 2024 |

| Forecast Year | 2025-2034 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Product & Service , By Technology, By Application, By End-use, and By Region |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; Germany; The UK; France; Italy; Spain; Rest of Europe; China; Japan; India; South Korea; Southeast Asia; Rest of Asia Pacific; Brazil; Argentina; Mexico; Rest of Latin America; GCC Countries; South Africa; Rest of the Middle East and Africa |

| Competitive Landscape | Danaher, Thermo Fisher Scientific, Agilent Technologies, Eurofins Scientific, Pacific Biosciences (PacBio), Oxford Nanopore Technologies, Takara Bio, BGI Group (MGI Tech), QIAGEN, Illumina, Roche, Merck KgaA, BD (Becton, Dickinson and Company), 10x Genomics, New England Biolabs, Zymo Research, Novogene, Promega Corporation, Revvity (formerly PerkinElmer), and LGC Limited |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Geographic competitive landscape. |

| Pricing and Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

Next-Generation Sequencing in Precision Medicine Market by Product & Service-

Next-Generation Sequencing in Precision Medicine Market by Technology -

Next-Generation Sequencing in Precision Medicine Market by Application-

Next-Generation Sequencing in Precision Medicine Market by End-use-

Next-Generation Sequencing in Precision Medicine Market by Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.