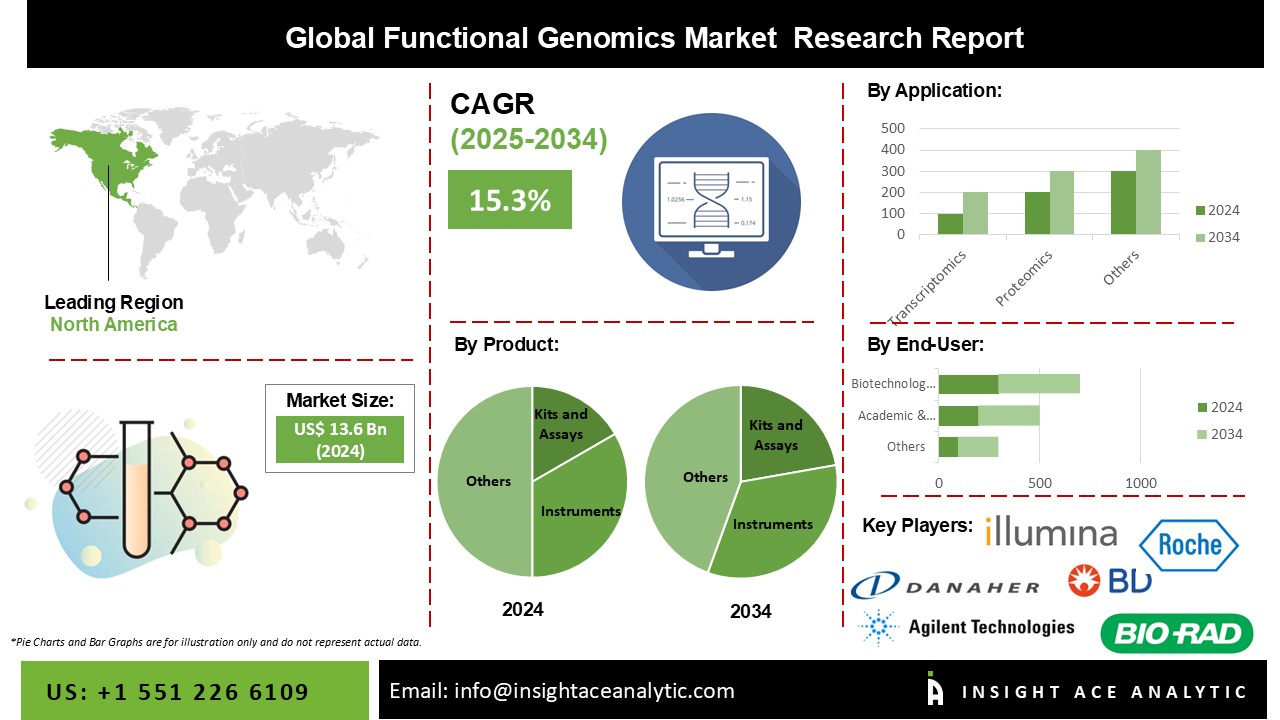

Global Functional Genomics Market Size is valued at USD 13.6 billion in 2024 and is predicted to reach USD 55.5 billion by the year 2034 at a 15.3% CAGR during the forecast period for 2025 to 2034.

Functional Genomics Market Size, Share & Trends Analysis Report by Product (Kits & Assays and Instruments), Technology (Next-Generation Sequencing (NGS), Polymerase Chain Reaction (PCR), Microarray), Application (Transcriptomics, Epigenomics, Proteomics, And Metabolomics), And End-User, Region And Segment Forecasts, 2026 to 2035

Key Industry Insights & Findings from the Report:

Understanding the roles and interconnections of the genes inside an organism's genome is the goal of the biological area known as functional genomics. In order to discover an organism's phenotype or observable traits entails researching how genes are expressed, controlled, and interact with one another and their environment.

The rising demand for gene therapy, personalized medicine, drug development, rising cancer incidence, and a notable rise in consumer genomics demand in recent years are the factors expanding the genomics market's expansion. Additionally, market participants' increased use of joint ventures and partnerships is anticipated to affect the genomics market's growth positively. The use of artificial intelligence in genomics has grown during the past few years. Artificial intelligence algorithms assess the data produced by sequencing technology, allowing for rapid and accurate identification of the genetic variants causing a particular disease.

However, research and therapeutic uses of genome technology have been complicated by the COVID-19 pandemic outbreak. But during the COVID-19 pandemic, a few specialized applications were beneficial to humanity in facilitating quick attention for developing efficient diagnostics, efficient therapies, and efforts to stop COVID-19 from spreading.

The Functional genomics market is segmented on the basis of product, technology, application, and end-user. Based on product, the market is segmented into kits & assays and instruments. The technology segment includes Next-Generation Sequencing (NGS), Polymerase Chain Reaction (PCR), and microarray. By application, the market is segmented into transcriptomics, epigenomics, proteomics, and metabolomics. The end-user segment includes academic & research institutions, biotechnology and biopharmaceutical companies, and other end users.

The biotechnology and biopharmaceutical companies’ category is expected to hold a significant share of the global Functional Genomics Market in 2024. The rising need for the use of genomes in drug discovery is to blame for this. Additionally, the market is being stimulated by the growing use of spatial genomics and transcriptomics technologies. Numerous studies are being conducted to develop innovative drugs utilizing genomics as a foundation. Firms are advancing drug development, target identification, biomarker discovery, and personalized medicine by leveraging functional genomics technology and methodologies.

The transcriptomics segment is projected to grow rapidly in the global functional genomics market. This is due to RNA analysis being easier than protein analysis, and this subject of functional genomics is one of the oldest in the field, with a wealth of research and practical tools already developed. Companies create and market cutting-edge systems and technology for transcriptome analysis. These techniques include single-cell RNA-seq, RNA sequencing (RNA-seq), and microarray-based gene expression profiling. These systems enable the investigation of non-coding RNAs, alternative splicing processes, gene expression patterns, and RNA alterations.

The North America Functional Genomics Market is expected to register the highest market share in terms of revenue in the near future. Due to the impact of genetic expression on human health, genomics has become an essential component of all disease research and therapy development. New advancements in the field of genomics application have resulted from collaborative efforts.

Functional genomics in North America is a key and quickly expanding area of the genomics industry. North America, which consists of the United States and Canada, is renowned for its sophisticated academic institutions and robust biotechnology and pharmaceutical industries. Genome projects receive much money from governmental organizations, such as the Canadian Institutes of Health Research (CIHR) in Canada and the National Institutes of Health (NIH) in the US. The Asia Pacific functional genomics market is a fast-expanding and dynamic segment of the genomics industry. The Asia Pacific region, encompassing China, Japan, India, South Korea, and Australia, is seeing substantial advances in genomics research and technology.

| Report Attribute | Specifications |

| Market size value in 2024 | USD 13.6 Bn |

| Revenue forecast in 2034 | USD 55.5 Bn |

| Growth rate CAGR | CAGR of 15.3% from 2025 to 2034 |

| Quantitative units | Representation of revenue in US$ Billion, and CAGR from 2025 to 2034 |

| Historic Year | 2021 to 2024 |

| Forecast Year | 2025-2034 |

| Report coverage | The forecast of revenue, the position of the company, the competitive market statistics, growth prospects, and trends |

| Segments covered | Product, Technology, Application, And End-User |

| Regional scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; The UK; France; Italy; Spain; South Korea; Southeast Asia |

| Competitive Landscape | Agilent Technologies, Inc., Becton, Dickinson and Company (BD), Bio-Rad Laboratories, Inc., and Danaher. (Integrated DNA Technologies, Inc.), Exact Sciences Corporation, F. Hoffmann-La Roche Ltd, Illumina, Inc., Merck KGaA, MRM Proteomics, Pacific Biosciences of California, Inc., Promega Corporation, QIAGEN, Thermo Fisher Scientific Inc. |

| Customization scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing and available payment methods | Explore pricing alternatives that are customized to your particular study requirements. |

Functional Genomics Market By Product-

Functional Genomics Market By Technology-

Functional Genomics Market By Application-

Functional Genomics Market By End-User-

Functional Genomics Market By Region-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.