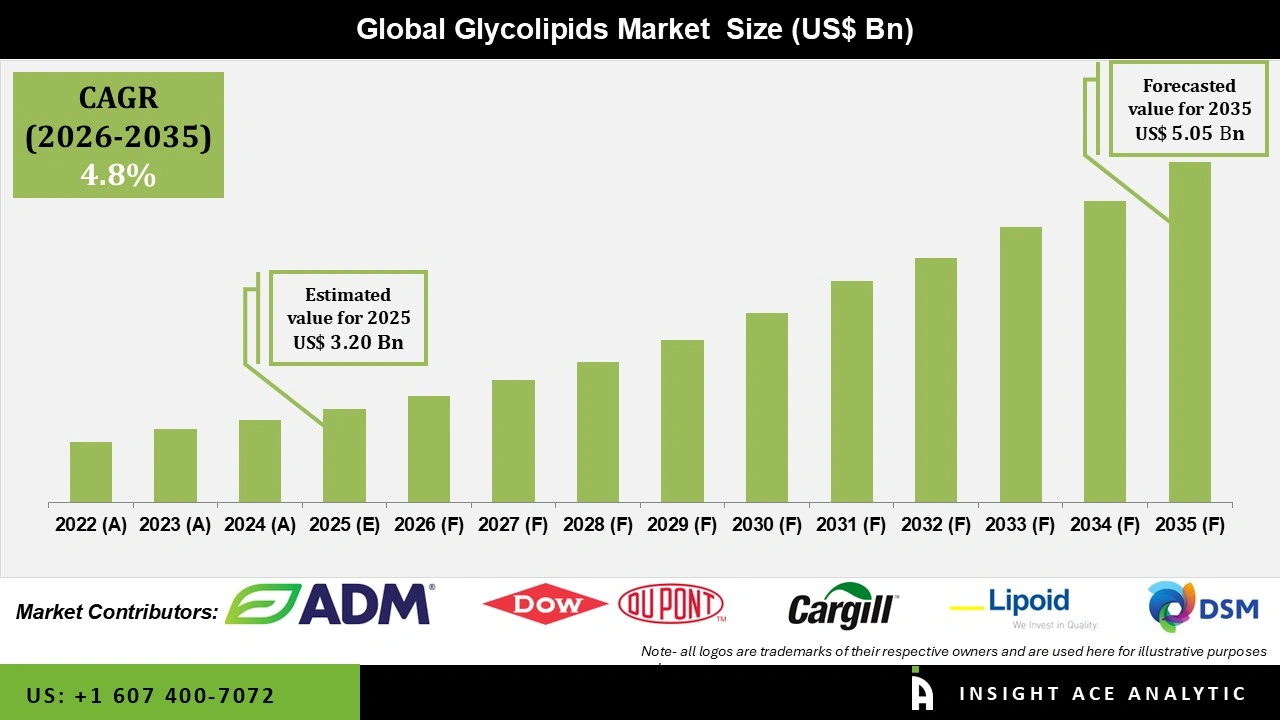

Global Glycolipids Market Size is valued at USD 3.20 Bn in 2025 and is predicted to reach USD 5.05 Bn by the year 2035 at a 4.8% CAGR during the forecast period for 2026 to 2035.

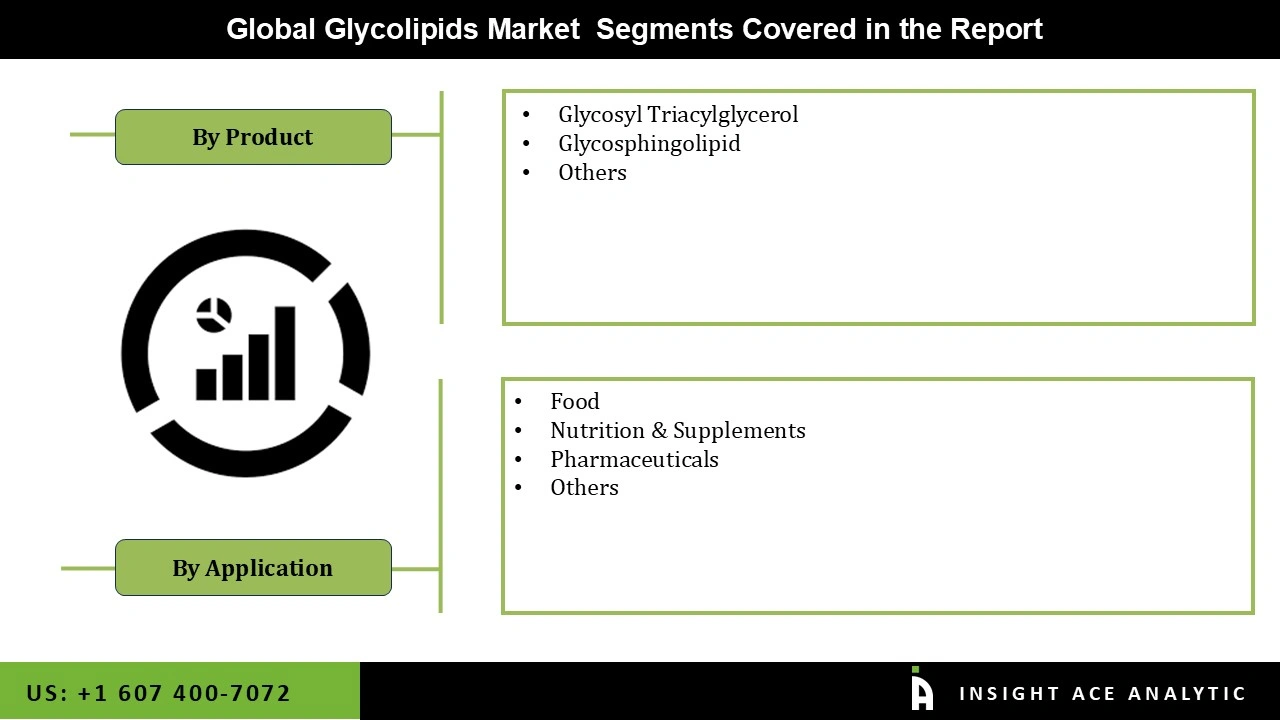

Glycolipids Market Size, Share & Trends Analysis Report By Type (Glycosyl Triacylglycerol, Glycosphingolipid, and Others), By Application (Food, Nutrition & Supplements, Pharmaceuticals, and Others), By Region and By Segment Forecasts, 2026 to 2035

Glycolipids consist of a carbohydrate (sugar) that is bonded to a lipid (fat) to form molecules. Cell membranes consist of these vital components, which are predominantly situated on the cell surface. Glycolipids are essential for the stability, communication, and recognition of cells. They support a multitude of biological processes, such as cellular interactions and immune responses. Glycolipids may be simple or complex, gangliosides containing multiple sugars, including sialic acid, or cerebrosides containing a single sugar.

Increasing consumer awareness of eco-friendly and sustainable microbial glycolipid-based green surfactants, coupled with the development of new production strategies for glycolipids and rising demand from the biomedical and cosmetic sectors, are significant drivers of market growth. Furthermore, the growing commercialization of glycolipids in various industries such as food, personal care, and oil fields further fuels market expansion. However, challenges such as expensive raw materials, purification costs, and lack of cost-efficiency have hindered the growth of glycolipid synthesis via microbial fermentation. The high costs associated with purification, including raw materials and fermentation, pose significant barriers to market growth. Consequently, the limited commercialization of glycolipids and escalating production expenses impede market expansion.

The Glycolipids market is segmented by product and application. Based on product, the Glycolipids market is segmented into Glycosyl Triacylglycerol, Glycosphingolipid, and Others. By application, the market share is broken down into Food, Nutrition & Supplements, Pharmaceuticals, and Others.

The foods category is expected to hold a major share of the global Glycolipids market in 2023. Glycolipids, being derived from natural sources such as plants and microorganisms, align with this trend and are perceived as healthier alternatives to synthetic additives and emulsifiers. Secondly, glycolipids offer functional benefits in food formulations, such as emulsifying, stabilizing, and foaming properties. They improve the texture, consistency, and mouthfeel of food products, enhancing their overall sensory appeal and quality.

The Glycosyl Triacylglycerols (TAGs) segment is projected to develop at a fast rate in the global Glycolipids market. Glycosyl Triacylglycerols (TAGs) represent a significant subclass of glycolipids that are widely recognized for their diverse range of applications and functional properties. TAGs are characterized by the presence of carbohydrate moieties attached to a glycerol backbone, making them valuable compounds in various industries such as food, pharmaceuticals, and cosmetics. One of the primary drivers of the dominance of the Glycosyl Triacylglycerol segment is the increasing usage of natural and sustainable ingredients in consumer products. TAGs derived from natural sources such as plants and algae are perceived as eco-friendly alternatives to synthetic additives, thus driving their adoption in food formulations, personal care products, and pharmaceuticals.

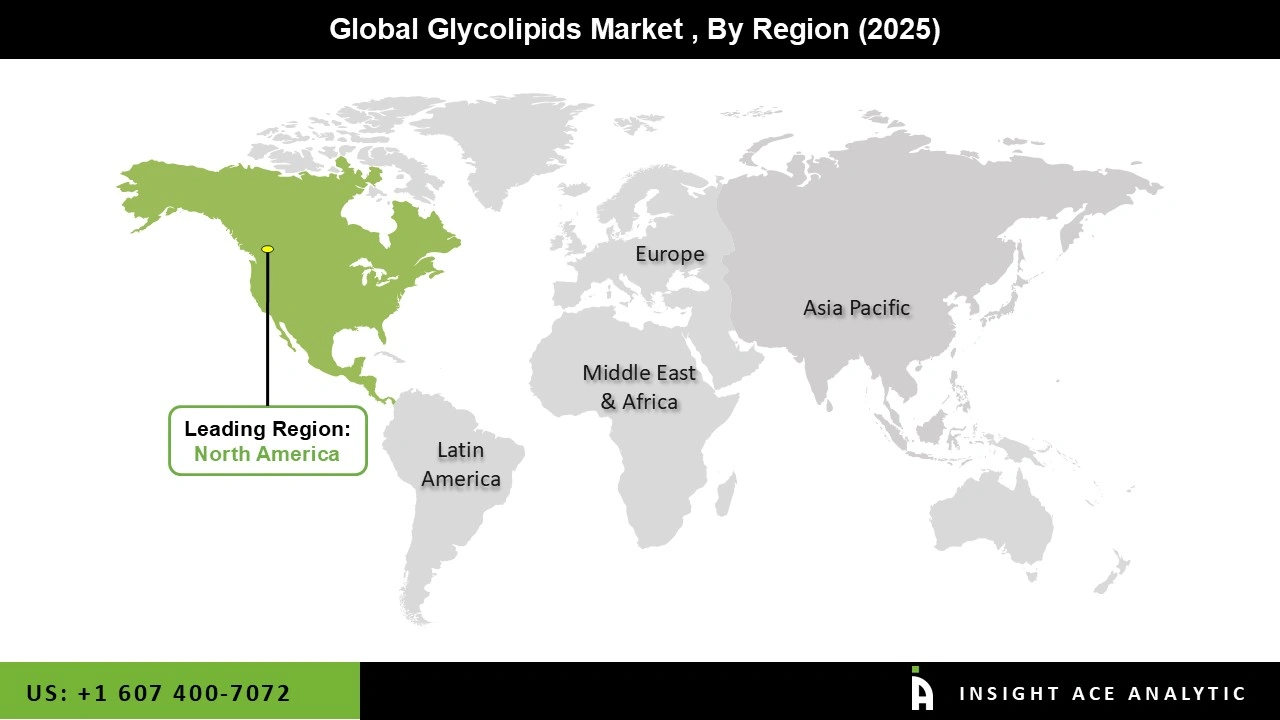

The North American Glycolipids market is expected to register the highest market share. Stringent regulatory standards, as well as quality control measures in North America, ensure product safety and efficacy, instilling confidence among consumers and facilitating market growth. The region's dynamic research and development ecosystem also fosters innovation in glycolipid-based products, leading to the introduction of novel formulations and applications that cater to evolving consumer preferences and market trends. In addition, Asia Pacific is projected to grow at a rapid rate in the global Glycolipids market.

The rising awareness of wellness and health among consumers in the APAC region is driving demand for natural and sustainable ingredients in products. Glycolipids, being derived from natural sources such as plants and microorganisms, are well-positioned to capitalize on this trend. Furthermore, the APAC region is witnessing significant investments in research and development, particularly in the pharmaceutical and biotechnology sectors.

| Report Attribute | Specifications |

| Market Size Value In 2025 | USD 3.20 Bn |

| Revenue Forecast In 2035 | USD 5.05 Bn |

| Growth Rate CAGR | CAGR of 4.8% from 2026 to 2035 |

| Quantitative Units | Representation of revenue in US$ Million and CAGR from 026 to 2035 |

| Historic Year | 2022 to 2024 |

| Forecast Year | 2026-2035 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Type, And Application |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; France; Italy; Spain; South East Asia; South Korea |

| Competitive Landscape | Archer Daniels Midland, Cargill Incorporated, DowDuPont, Royal DSM, LIPOID, Lasenor Emul, Avanti Polar Lipids, Lecico, Ruchi Soya Industries, Stern-Wywiol Gruppe, Unimills, Vav Life Sciences, Evonik Industries AG, BASF SE, Ecover, Jeneil Biotech, Inc., AkzoNobel N.V., Qualitas Health, Givaudan S.A., Croda International PLC., Biotensidon GmbH, Henkel Corporation, and Other Market Players |

| Customization Scope | Free customization report with the procurement of the report and modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing And Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.